ASX Small Caps and IPO Weekly Wrap: The ASX walked backwards again this week as investors battle tough conditions

I don't know what this 'sex' thing is that's waiting for us up the river, but it better be worth it. Pic via Getty Images.

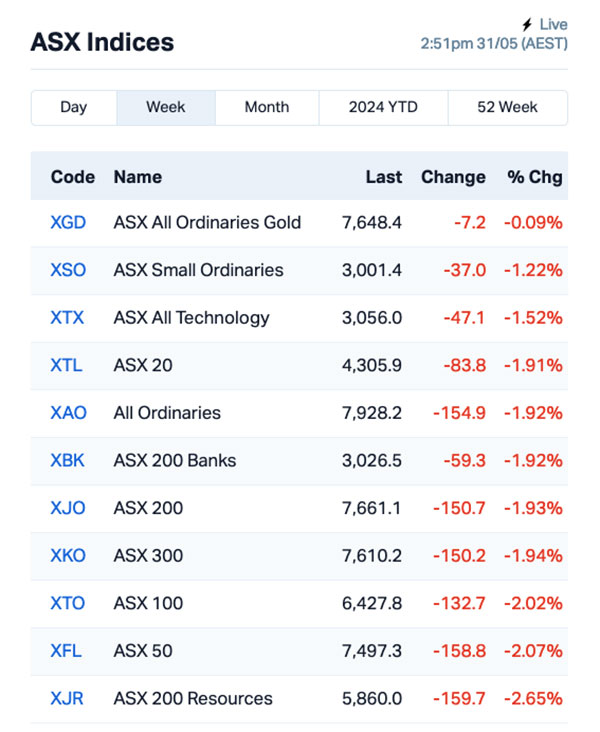

- The ASX 200 went backwards again this week, down -1.4pc

- Health Care fared best, “only” down -0.42pc

- Who won the Small Caps race? Read on to find out…

Aussie stocks went backwards again this week, with the benchmark down more than -1.0% for the second week running.

Broadly speaking, the reasons why the market lost ground are largely the same as they were last week – with the added bonus of looking fresher than they are, thanks to new data that spooked investors over a number of days.

The big banner figure was a bit of a shock from the month’s CPI data, when the ABS revealed the index is still growing, month to month, despite all the “lever pulling” and “hand wringing” the RBA Board says it’s been doing for the past nine months.

CPI was 3.4% in February, 3.5% in March and now it’s at 3.6% in April – clearly going the wrong way, and clearly not adding fuel to the fire underneath hopes of a rate cut any time soon.

That came on the heels of the nation’s monthly retail spending report, which clearly showed that we, as a nation, are getting worse at shopping.

Australian retail turnover rose by a pathetic 0.1% in April, and from the looks of things, that doesn’t seem to have made investors very happy at all.

It’s far too small to make up for the shellacking retail spending took in March (it fell -0.4% that month), and the failure to recover is yet another symptom of just how rocky the terrain that the Australian economy is trying to navigate really is.

It was also a bit of a dud week for the Big Australian this week, as BHP’s quest to get Even Bigger finally ground to a halt when the third (or was it fourth) offer it made to Anglo American was laughed out of the boardroom.

It was a bit of an embarrassment for BHP, which is now locked out of making any further plays for Anglo for six long months, thanks to UK laws designed to curtail unwanted corporate attention and harassment in the workplace.

And finally, it’s worth mentioning that the Amazing Metals-Go-Round has continued to spin like Torville and Dean, and the results for the week are once again all over the place.

METAL MARKET PRICES as of FRIDAY ARVO, 31 MAY

Weekly % change

Gold US$2,343.40 +0.44%

Silver US$30.95 +2.03%

Nickel US$20,63/t -0.10%

Copper US$10,207/t -2.51%

Zinc US$3,042/t -0.43%

Iron 62pc Fe US$117.62/t +0.08%

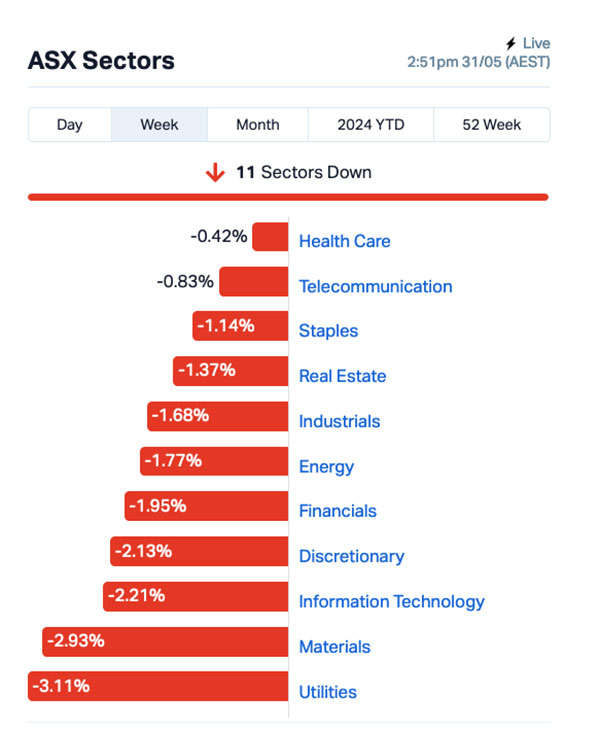

WHAT THE SECTORS DID

It was a resounding defeat across the board, with Consumer Discretionary, InfoTech, Materials and Utilities all giving up more than -2.0% as the week wore on, and even the best performing sector – Health Care – was below par on -0.42% since this time last Friday.

Tellingly, the one slice of the market that can usually be relied upon in times of trouble was also flailing about wildly all week. The safe-haven of gold turned out to be a bit of a false promise, as even the XGD All Ords Gold index was pointing to a loss by the end of play on Friday.

But… there were a couple of Small Caps that banked some bangin’ results since Monday… and here they are…

SMALL CAP WINNERS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| CAQ | CAQ Holdings Ltd | 0.065 | 333% | $46,656,108 |

| DY6 | DY6 Metals | 0.12 | 216% | $4,445,192 |

| FRS | Forrestania Resources | 0.048 | 153% | $8,089,287 |

| EDE | Eden Innovations | 0.0025 | 150% | $9,195,678 |

| GES | Genesis Resources | 0.008 | 100% | $5,479,889 |

| FAL | Falcon Metals | 0.31 | 100% | $47,790,000 |

| KP2 | Kore Potash PLC | 0.037 | 85% | $28,305,374 |

| MGA | Metals Grove Mining | 0.081 | 76% | $5,394,630 |

| IS3 | I Synergy Group Ltd | 0.014 | 75% | $3,540,804 |

| NVU | Nanoveu Limited | 0.031 | 63% | $13,816,564 |

| CR1 | Constellation Res | 0.24 | 60% | $13,533,027 |

| MHI | Merchant House | 0.056 | 60% | $5,278,924 |

| BDX | Bcal Diagnostics | 0.175 | 59% | $44,151,575 |

| KED | Keypath Education | 0.84 | 57% | $179,270,063 |

| KCC | Kincora Copper | 0.056 | 51% | $10,043,504 |

| 1MC | Morella Corporation | 0.003 | 50% | $15,446,999 |

| 8IH | 8I Holdings Ltd | 0.015 | 50% | $5,360,340 |

| CNJ | Conico Ltd | 0.0015 | 50% | $2,707,643 |

| MRQ | MRG Metals Limited | 0.0015 | 50% | $3,787,678 |

| VPR | Volt Power Group | 0.0015 | 50% | $16,074,312 |

| DXB | Dimerix Ltd | 0.495 | 46% | $250,101,958 |

| HHR | Hartshead Resources | 0.01 | 43% | $28,086,821 |

| TTM | Titan Minerals | 0.034 | 42% | $56,348,090 |

| COV | Cleo Diagnostics | 0.24 | 41% | $17,043,000 |

| VTI | Vision Tech Inc | 0.155 | 41% | $7,705,105 |

| T88 | Taitonresources | 0.1 | 39% | $5,108,582 |

| VN8 | Vonex Limited | 0.018 | 38% | $6,874,744 |

| NKL | Nickelx | 0.029 | 38% | $2,546,640 |

| HAL | Halo Technologies | 0.105 | 35% | $13,506,821 |

| FTZ | Fertoz Ltd | 0.044 | 33% | $11,010,950 |

| HCD | Hydrocarbon Dynamic | 0.004 | 33% | $2,425,747 |

| NRZ | Neurizer Ltd | 0.004 | 33% | $5,707,292 |

| RIL | Redivium Limited | 0.004 | 33% | $10,923,419 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| TX3 | Trinex Minerals Ltd | 0.004 | 33% | $6,400,283 |

| TIG | Tigers Realm Coal | 0.004 | 33% | $52,266,809 |

| MDX | Mindax Limited | 0.041 | 32% | $84,000,135 |

| DES | Desoto Resources | 0.1 | 32% | $5,573,165 |

| SER | Strategic Energy | 0.021 | 31% | $12,557,936 |

| SRT | Strata Investment | 0.26 | 30% | $42,355,894 |

| CAT | Catapult Grp Int Ltd | 1.885 | 30% | $443,882,675 |

| SGQ | St George Mining | 0.022 | 29% | $21,747,890 |

| GUL | Gullewa Limited | 0.071 | 29% | $14,538,890 |

| SP8 | Streamplay Studio | 0.009 | 29% | $9,204,990 |

| LTP | LTR Pharma Limited | 0.61 | 28% | $41,891,265 |

| HYD | Hydrix Limited | 0.014 | 27% | $3,559,064 |

| TSL | Titanium Sands Ltd | 0.007 | 27% | $15,482,230 |

| AIV | Activex Limited | 0.005 | 25% | $1,077,513 |

| AL8 | Alderan Resource Ltd | 0.005 | 25% | $5,534,307 |

| ENT | Enterprise Metals | 0.005 | 25% | $4,423,605 |

SMALL CAP LAGGARDS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| HCT | Holista CollTech Ltd | 0.005 | -50% | $1,394,000 |

| TKL | Traka Resources | 0.001 | -50% | $1,750,659 |

| ICU | Investor Centre Ltd | 0.007 | -46% | $2,131,579 |

| FTC | Fintech Chain Ltd | 0.01 | -41% | $7,809,235 |

| BEL | Bentley Capital Ltd | 0.023 | -41% | $2,207,710 |

| RBR | RBR Group Ltd | 0.0015 | -40% | $3,268,809 |

| CTO | Citigold Corp Ltd | 0.005 | -38% | $15,000,000 |

| AUG | Augustus Minerals | 0.045 | -36% | $4,268,500 |

| 1AG | Alterra Limited | 0.004 | -33% | $5,172,879 |

| AUH | Austchina Holdings | 0.002 | -33% | $6,301,151 |

| CLZ | Classic Minerals | 0.004 | -33% | $1,634,340 |

| GCR | Golden Cross | 0.002 | -33% | $2,194,512 |

| RIE | Riedel Resources Ltd | 0.002 | -33% | $4,447,671 |

| RML | Resolution Minerals | 0.002 | -33% | $3,220,044 |

| WEL | Winchester Energy | 0.002 | -33% | $2,040,844 |

| YPB | YPB Group Ltd | 0.002 | -33% | $1,615,923 |

| NIS | Nickelsearch | 0.024 | -31% | $5,125,019 |

| EMS | Eastern Metals | 0.033 | -31% | $3,360,092 |

| TSI | Top Shelf | 0.0985 | -30% | $30,914,276 |

| ADY | Admiralty Resources | 0.007 | -30% | $14,665,265 |

| REM | Remsense Technologies | 0.017 | -29% | $2,802,615 |

| AMO | Ambertech Limited | 0.2275 | -29% | $21,704,588 |

| G11 | G11 Resources Ltd | 0.03 | -29% | $22,473,663 |

| SHP | South Harz Potash | 0.01 | -29% | $9,099,035 |

| MTH | Mithril Resources | 0.215 | -27% | $19,875,412 |

| TEE | Topend Energy | 0.115 | -26% | $11,314,063 |

| ODA | Orcoda Limited | 0.16 | -26% | $33,831,414 |

| AMD | Arrow Minerals | 0.003 | -25% | $30,418,095 |

| BFC | Beston Global Ltd | 0.003 | -25% | $7,988,188 |

| CTN | Catalina Resources | 0.003 | -25% | $3,715,461 |

| ECT | Environmental Clean Technologies | 0.003 | -25% | $12,687,242 |

| EFE | Eastern Resources | 0.006 | -25% | $7,451,679 |

| IRX | Inhalerx Limited | 0.03 | -25% | $5,693,009 |

| JAV | Javelin Minerals Ltd | 0.0015 | -25% | $3,264,346 |

| MCL | Mighty Craft Ltd | 0.006 | -25% | $2,213,456 |

| NGS | NGS Ltd | 0.003 | -25% | $753,682 |

| RFT | Rectifier Technolog | 0.009 | -25% | $13,819,839 |

| SI6 | SI6 Metals Limited | 0.003 | -25% | $7,106,578 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| CAZ | Cazaly Resources | 0.022 | -24% | $9,547,363 |

| BCK | Brockman Mining Ltd | 0.019 | -24% | $232,005,803 |

| FRE | Firebrick Pharma | 0.055 | -24% | $10,937,177 |

| COD | Coda Minerals Ltd | 0.13 | -24% | $23,600,030 |

| PHO | Phosco Ltd | 0.046 | -23% | $12,868,416 |

| NXM | Nexus Minerals Ltd | 0.047 | -23% | $18,285,826 |

| ATV | Activeport Group | 0.054 | -23% | $17,443,133 |

| GHY | Gold Hydrogen | 1.52 | -23% | $117,677,740 |

| AAU | Antilles Gold Ltd | 0.007 | -22% | $6,975,745 |

| ASO | Aston Minerals Ltd | 0.014 | -22% | $16,835,835 |

| MPR | Mpower Group Limited | 0.014 | -22% | $5,327,401 |

HOW THE WEEK SHOOK OUT

Monday 27 May, 2024

Explorer DY6 Metals (ASX:DY6) was soaring on Monday morning, after revealing that the company has taken a closer look at historic drill samples from the Tundulu project in southern Malawi, and found that the project is – apparently – absolutely riddled with Rare Earths.

This is worth explaining because it’s kind of an awesome story… like buying a second-hand wallet in an op-shop, and finding a winning lottery ticket tucked away inside when you brought it home.The project was initially explored in 1988 by Japanese International Cooperation Agency (JCIA), with the drill cores examined, catalogued and stuffed a in drawer somewhere – presumably because back in 1988, JCIA went to Malawi looking for something other than REEs.

There was some follow-up exploration work done at the site, which continued sporadically until 2014 – leaving a juicy tranche of samples to go over with a fresh set of eyes, which were focussed on finding the kind of Rare Earths that are super-fashionable at the moment. In steps DY6, and they’ve taken that historical data and some far more recent boots-on-the-ground exploration work – and the news there is good.

Drilling intercepts including 101m @ 1.02% TREO from surface, 109m @ 1.06% TREO from 53m and 97m @ 1.35% TREO from surface tell the story – there’s probably a lot of valuable stuff there, close to the surface – which DY6 says compares favourably to Lynas’ (ASX:LYC) Mt Weld deposit.

Anyway – DY6 was up more over +300% today, and that’s the reason why, according to our own Moon Landing, Gregor Stronach.

Also doing well was Armada Metals (ASX:AMM), on news that a binding agreement has been signed to acquire 100% of the issued capital of Midwest Lithium, an Australian company that currently holds, or has the right to acquire, a 100% interest in 1,098 unpatented lode mining claims covering approximately 93km2, located in the Black Hills of South Dakota, USA. On completion, Midwest shareholders will hold 50% of the enlarged post capital raising, issued share capital of Armada. The transaction is subject to various conditions, of course, “including execution of long form agreements and the completion of satisfactory legal, financial, tax and technical due diligence by Armada”

Hydrix (ASX:HYD) was also moving well on Monday morning, on news that its wholly-owned subsidiary Hydrix Services has entered into a $2.3m contract with leading European medical company Paul Hartmann, to provide a second round of services to assist with product development.

And Australasian Metals (ASX:A8G) was on the rise, after it announced it has entered into an Option Agreement with Verdant Minerals regarding the Dingo Hole high pure quartz project in the Northern Territory and Queensland. That operation is known as the Dingo Hole high pure quartz project and A8G has entered an agreement with Verdant Minerals regarding it.

High Pure Quartz HPQ is a rapidly growing minerals sector, and that’s largely due to the material’s high industrial usage in the tech and electronics industry (yes, AI), including for semiconductors, solar panels, optical glass, optical fibres and more.

Clinical-stage biopharmaceutical company Dimerix (ASX:DXB) soared almost +20% after saying Taiba has acquired the exclusive rights to register and commercialise DMX-200 for the treatment of focal segmental glomerulosclerosis (FSGS) kidney disease in the United Arab Emirates (UAE), Saudi Arabia, Oman, Kuwait, Qatar, Bahrain and Iraq. Under the deal DXB will receive up to US$80.4m (~A$120.5m) from Taiba in upfront and milestone payments on certain development and sales milestones being achieved.

The company will also receive tiered royalties starting at 30% on net sales.

Polymetals Resources (ASX:POL) and Metals Acquisition (ASX:MAC) have formed a non-exclusive strategic alliance to extract greater value from both the Endeavor and CSA copper mines in the Cobar Basin of NSW. MAC will also invest up to $5m @ $0.35/share in POL.

Polymetals is surging on the news, by the way, up more than 20% at the time of writing, while Metals Acquisition’s share price is also faring well, up a more modest 4% or so – but still significant considering the size of the company’s market cap, which is in excess of $1.46b.

It’s a very big deal for POL, this, and will see the joint operation treat high-grade zinc ore at Endeavor. POL will also provide MAC with excess water offtake to enhance CSA ore treatment capacity.

And, EMvision Medical Devices (ASX:EMV) has shared an update from its ongoing clinical trials focusing on improving EMVision’s AI algorithms for diagnosing strokes caused by bleeding or blockages in the brain. The interim results from the Stage 2 of the trial showed that the AI algorithm is working well in figuring out if a patient has ischaemia stroke or not (clot or not).

The algorithm was able to spot patterns and features in complex patient data, even in cases of early-onset severe ischaemic stroke, which can be hard to detect on standard brain scans.

This analysis builds on previous positive findings that showed EMV’s AI model performs strongly in identifying if there’s bleeding in the brain (haemorrhage).

Tuesday 28 May, 2024

Gold, lithium and nickel hunter, Forrestania Resources (ASX:FRS), surged today on news related to iron ore, in the Yilgarn region, sending it triple-bagging upwards, about 200%.

The company has announced it’s entered into an option agreement with shareholders of Netley Minerals to acquire 100% of issued shares in Netley, which is the holder of highly prospective iron ore tenements right next to Mineral Resources’ (ASX:MIN) Koolyanobbing operations.

It’s potentially big for FRS, that, which enters into a three-month option period, in which the company will drill test several iron ore targets identified by Netley and its advisors. The potential is there, with surveys and rock chip sampling correlating with the geophysical trends, indicating mineralisation potential. All else, including infrastructure – road, rail, port and service centres – lines up well.

Falcon Metals (ASX:FAL) soared after receiving high-grade results for its 91-hole aircore (AC) drilling program at its Farrelly mineral sands prospect in Victoria, which is a follow-up on high-grade reconnaissance drilling results announced in early March.

The new results confirm Farrelly as a high-grade mineral sands discovery with a thick zone of mineralisation (Main Zone) now defined covering an area of about 1,200 metres by 600 metres and remaining open in several directions.

Significant drill intercepts include: 26m at 8.9% THM (total heavy mineral concentrate) from 6m, with 15m at 12.9% THM from 13m; and 22m at 9.2% THM from 8m, including 12m at 15.1% THM from 16m as well as 3m at 20.3% THM from 21m.

Papyrus Australia (ASX:PPY), which makes fibre, fertiliser and food packaging out of banana waste, made tidy gains on news that it has signed two contracts worth US$1.7m with the Egyptian Government’s National Authority for Military Production (MP).

Kincora Copper (ASX:KCC) has signed itself a $50m earn-in and joint venture agreement with a unit of the NYSE-listed AngloGold Ashanti for KCC’s Northern Junee-Narromine Belt (NJNB) copper and gold project in New South Wales. This is located in the near-unexplored undercover extension of a porphyry-related, rich gold and copper mineralised zone known as the Macquarie Arc. The company notes that a “wide range of virgin, large intrusive-related copper-gold targets will be drill tested” under the new agreement.

AngloGold will have the right to spend up to $50 million to earn a 80% interest through:

- $25 million of exploration expenditure to earn a 70% joint venture interest (Phase I) including a minimum A$2 million expenditure obligation, with Kincora the initial operator for a 10% management fee.

- Completion of a Pre-Feasibility Study (PFS) or funding of a further $25 million of expenditure to earn a 80% joint venture interest (Phase II).

Battery metals and precious metals hunter, Marquee Resources (ASX:MQR), has inked an option agreement with two parties to buy a gold and silver project in Sardinia, Italy, called Sa Pedra Bianca. Shareholders are enjoying the 30% rise in MQR that’s come on the back of the news today.

The Sa Pedra Bianca project covers a large portion of the old Osilo project, which contained a non-JORC resource of 1.65Mt at 7.06g/t gold and 29.7g/t silver for a total of 376,140oz gold and 1.58Moz silver. Timothy Spencer is named as one of the two parties and is the ex-MD of Essential Metals, which was acquired by Develop Global (ASX:DVP) in November last year.

Spencer will be appointed as a consultant of the company and will join the Marquee board on exercise of the option agreement.

Based on its due diligence so far, Marquee believes the Sardinian project to have “exceptional upside with real potential to become a 1Moz+ gold district”.

AusQuest (ASX:AQD) has news today from its Peruvian operations – it’s now begun drilling at its new copper-gold target at the Cerro de Fierro project.

The company believes their “is room for a sizeable deposit to be found”, affirmed by historic drilling returning multiple copper-gold intersections at the prospect.

The RC drilling program will test a structural target close to a drill hole that intersected multiple zones of copper-gold mineralisation, including 30m at 0.43% Cu, 0.16g/t Au; 43m at 0.43% Cu, 0.35g/t Au; 28m at 0.42% Cu, 0.15g/t Au and 33m at 0.24% Cu, 0.13g/t Au.

The project is located at the southern end of a recognised IOCG metallogenic belt in southern Peru and is within ~150km of the Mina Justa deposit (~337Mt @ 0.76% Cu) – being developed by the Marcobre JV. Assay results are expected within four weeks of this drilling program.

Matador Mining (ASX:MZZ) reported assay results from the final 110 drillholes of the 157 hole reverse circulation (RC) drill program at the Malachite Project in Newfoundland, Canada. New gold-in-bedrock anomalism has been identified, including drillhole CRC0142 which graded 127 parts per billion gold from 6 to 7m.

Playside Studios (ASX:PLY), the games maker, provided an update to its FY24 revenue and earnings guidance announced in February. Based on year-to-date trading, PLY now expects FY24 revenue to come in between $63m-$65m (previously $60-$65m). FY24 EBITDA is to come in between $16-$18m (previous guidance $11-$13m).

Wednesday 29 May, 2024

Winning on Wednesday was Desoto Resources (ASX:DES), soaring early on news that the company is all set to buy a rare earths project in the Northern Territory called Spectrum, where previous drilling pulled up a highlight 6m @ 6.55% total rare earths (TREO) from 248m.

The details are as follows: DeSoto has signed a binding term sheet to acquire 70% of Copperoz’ Spectrum REE project via a two stage minimum exploration spend of $5m over the next 39 months, with a right to acquire up to 100% of the project.

During the first 15 months, DeSoto agrees to spend a minimum of $2m, including a minimum 3500m worth of RC/DD drilling, while Stage 2 requires a minimum $3m expenditure during the following 24 months, and upon completion of a positive feasibility study, DeSoto has an option to buy out the remaining 30%.

Oar Resources (ASX:OAR) has announced the expansion of its Brazilian assets by the pegging of an additional 650km2 of prospective ground in the states of Rio Grande Do Sul and Goiás. This is an increase of 283% and brings the total Brazilian landholding to 880km2.

The acquired tenements are considered prospective for sandstone and sedimentary hosted uranium mineralisation. Both projects are located within 10km of historic uranium occurrences identified by the Industrias Nucleares do Brasil (INB), which is a Brazilian state-run company engaged in the prospection, exploration and extraction of uranium and other heavy metals.

OD6 Metals (ASX:OD6) has doubled the resource at its rare earths Splinter Rock project – to 682Mt at 1,338ppm TREO.

“This mineral resource estimate sets OD6 apart from any other clay-hosted rare earth project in Australia, and highlights Splinter Rock to be one of the largest and highest-grade projects globally,” MD Brett Hazelden says.

Splinter Rock is located in the Esperance-Goldfields region of Western Australia – about 30 to 150km northeast of the major port and town of Esperance.

Cleo Diagnostic’s (ASX:COV) made gains after revealing that its ovarian cancer blood test outperforms the current clinical benchmark, correctly detecting 90% of early-stage cancers compared to only 50% using standard workflows.

Pursuit Minerals (ASX:PUR) was celebrating some early success, with results from Drill Hole 1 at its Maria Magdelena tenement in the Rio Grande Sur project delivering “significant high grade intercepts of lithium brine at shallow depths of ~131m”.

Milk company Fonterra (ASX:FSF) provided its Q3 business update, announcing profit after tax from continuing operations of $1,013 million, up $20 million on pcp or equivalent to 61c per share. CEO Miles Hurrell says the Foodservice and Consumer channels in particular had a strong third quarter with a lift in earnings compared to the same time last year.

DY6 Metals (ASX:DY6) is still trading nicely off Monday’s news that saw it burst up more than 300% at one stage earlier this week. There’s nothing fresh to report, but in case you missed it: “Exceptional” high grade historical drill hits confirm the Tundulu rare earths project in Malawi as a significant asset, says the company.

And, Critical Resources (ASX:CRR said 31 new LCT pegmatites were discovered to the east of the Mavis Lake Main Zone, including multiple spodumene-bearing pegmatites. The discoveries were confirmed by the discovery of several new exposed rock formations, extending the known area of spodumene-containing rocks up to 250m in length.

Thursday 30 May, 2024

Nanoveu (ASX:NVU) climbed on news that the company has signed a binding deal giving Rahum Nanotech exclusive distribution rights in South Korea for the EyeFly3D product, which “allows users to experience 3D without the need for glasses on everyday handheld devices”. NVU says Rahum must receive orders of ~$30 million by the end of 2026 to maintain exclusivity.

Big news for Ora Gold (ASX:OAU), after the explorer revealed that it is set to team up with miner Westgold (ASX:WGX) to bring OAU’s high grade 240,000oz Crown Prince deposit into production, with WGX signing on to snap up $6 million worth of shares in the junior for a cornerstone stake of around 15%.

Merchant House (ASX:MHI) announced that it’s set to sell off its 33% shareholding in Tianjin Tianxing Kesheng Leather Products Company to Tianjin Wuxi International Trading Company, for the equivalent of a cool $8.3 million Aussie dollars.

Sports data and analytics company, Catapult Group (ASX:CAT) was up +9% after the company hit a milestone revenue mark of US$100m for FY24, up 20% on pcp.

Ark Mines (ASX:AHK) surged due to a significant increase in mineral estimates at its Sandy Mitchell rare earth and heavy mineral project in northern Queensland. The company has announced a Maiden Indicated Mineral Resource Estimate (MRE) of 21.7 million tonnes, surpassing expectations.

This includes a variety of valuable heavy minerals such as monazite, zircon, rutile, xenotime, and ilmenite. The company anticipates strong project economics from these findings, as they can be processed at a low cost. Additionally, this places Sandy Mitchell as the first surface-expressed Placer Rare Earth deposit with a JORC resource on the ASX.

Lord Resources (ASX:LRD) has confirmed the presence of significant lithium-caesium-tantalum geochemical anomalies at its Jingjing lithium project in WA’s Eastern Goldfields through infill soil sampling work.

The Jingjing project, acquired in May 2023, comprises two tenements located in an area known for lithium-caesium-tantalum deposits. This project is distinct from the company’s exploration activities at Horse Rocks, where Mineral Resources (ASX:MIN) is conducting exploration under a strategic partnership.

Falcon Metals (ASX:FAL) is continuing to soar after its recent announcement about a significant mineral sands discovery in Bendigo. The company’s 91-hole aircore (AC) drilling program at the Farrelly mineral sands prospect in Victoria has returned high-grade results. This confirms Farrelly as a substantial mineral sands find, with a thick zone of mineralization (Main Zone) covering an area of approximately 1,200 meters by 600 meters and still open in multiple directions.

And, Clarity Pharmaceuticals (ASX:CU6) has signed a Supply Agreement with SpectronRx for Cu-64 production. This adds a new Cu-64 manufacturer to Clarity’s network, addressing supply constraints and benefiting patients, especially in the US oncology market. Cu-64’s longer half-life overcomes limitations of other isotopes, providing broader access to PET imaging for cancer diagnosis.

Friday 31 May, 2024

Kula Gold (ASX:KGD) gained nicely through the morning on news that the company has decided to acquire the historic Mt Palmer Gold Mine, last commercially mined in 1944 down to only the 6th Level (~160m) at 15.9g/t Au. Kula says that the mine’s location, just 15km from the Marvel Loch gold processing plant and infrastructure, aligns with its strategy of exploring near to existing operations to fast track any discovery to monetary success.

Graphite producer and natural graphite anode developer Volt Resources (ASX:VRC) was also on the move Friday morning, after providing an update on a shipment of high purity graphite product.

Volt says its subsidiary, Zavalievsky Graphite, has commenced production of high purity micronized graphite for the 40-tonne customer order received in April 2024 and is targeting completion by July 2024. To-date, about 26 tonnes have been produced and shipped to the customer.

Papyrus Australia (ASX:PPY) continued to enjoy investor support on Friday morning, after the company clarified some of the structural elements of the contracts it recently signed with the Egyptian government, which – in a mildly convoluted way that I have run out of time trying to comprehend – “represents potential revenue of up to $2.7m USD per year from moulded product sales by Papyrus”.

Voltaic Strategic Resources (ASX:VSR) says that recent rock chip sampling at the Eldinero prospect, part of its Meekatharra project in WA, has shown visible signs of copper-gold minerals in quartz veins, extending the surface strike length to 200m.

This is a big step forward for the company’s exploration work, showing promise for more discoveries at the project.

The minerals seem to be connected to the Burnakura Shear Zone, which stretches over 10km and is made up of dolerites. And this zone is important because it holds several gold deposits.

The company notes that the Meekatharra tenement package is largely underexplored, despite its proximity to numerous historical and active open pits and underground mines, and geologically prospective structures.

Falcon Metals (ASX:FAL) was still well up on Tuesday’s news. Falcon is now up ~75% since announcing a high grade mineral sands discovery, called Farrelly, Tuesday this week.

“While it is early days in our understanding of Farrelly, with more drilling and test work required, it is shaping up to become a significant mineral sands deposit, in proximity to other major deposits, but at far higher grades,” MD Tim Markwell says.

Forrestania Resources (ASX:FRS) was also up on announcing it’s entered into an option agreement with shareholders of Netley Minerals to acquire 100% of issued shares in Netley, which is the holder of highly prospective iron ore tenements right next to Mineral Resources’ (ASX:MIN) Koolyanobbing operations.

Potentially big for FRS, that, which enters into a three-month option period, in which the company will drill test several iron ore targets identified by Netley and its advisors.

Spacetalk (ASX:SPA) has made a move back into the European market by teaming up with Elisa, a major mobile operator in Finland. This partnership means Spacetalk’s Adventurer 2 and Loop products will be sold in 67 Elisa stores and online starting in June. Elisa will have exclusive rights to sell Spacetalk products in Finland for 12 months. Initially, Elisa will stock 1600 Spacetalk devices, with an estimated annual sales of 5000 units

Wound care medical company, AVITA Medical ASX:AVH), surged +13% this morning after receiving an FDA approval for its latest product, the RECELL GO System. The RECELL GO system will launch in top burn treatment centres in the US initially, with plans for broader availability in the future. CEO Jim Corbett believes this FDA approval will revolutionise wound care, making treatment more accessible and effective.

EZZ Life Science (ASX:EZZ) has entered into a significant sales agreement with Pinehills (Hong Kong) Limited, spanning five years.

Under the terms, Pinehills has committed to procuring EZZ-branded products worth at least $15 million within the initial 12-month period. Over the duration of the agreement, the annual purchase volumes are set to escalate by a minimum of 10% each year.

EZZ says the deal represents a strategic move for EZZ, as it will facilitate the expansion of its product distribution into key markets such as China, Vietnam, and other Southeast Asian markets.

PharmAust (ASX:PAA) has made key changes to its leadership team, reappointing Dr Michael Thurn as managing director and CEO, and welcoming Dr Nicky Wallis as chief scientific officer.

Dr Wallis, a neuroscientist with extensive global experience, will lead the evaluation of monepantel for potential use in treating neurodegenerative diseases.

These appointments mark a significant shift for the company as it aims to become a global leader in this field.

IPOs that didn’t happen yet

Resouro Strategic Metals (ASX:RAU)

Proposed Listing: 04 June, 2024

IPO: $8 million at $0.50 per share

The Australian-led Resouro Strategic Metals is currently listed on the TSXV in Canada, with a focus on Brazil-focused rare earths plays. Its flagship Tiros project has potential to become an industry-leading rare earths and titanium mine as western countries race to develop diversified sources of critical minerals.

The IPO, as listed, will be managed by Taylor Collison Limited ( Lead Managers).

Piche Resources (ASX:PR2)

Proposed Listing: 07 June, 2024

IPO: $10 million at $0.10 per share

Blinklab describes itself as a mineral exploration company with multiple, drill ready uranium projects with the potential to host tier 1 mineral deposits.

The IPO, as listed, will be managed by Euroz Hartleys (Lead Manager).

Pengana Global Credit Private Trust (ASX:PCX)

Proposed Listing: 20 June, 2024

IPO: $250,000 at $2.00 per share

Pengana Global Credit Private Trust is a listed Investment Trust investing in global private debt.

The IPO, as listed, will be managed by Taylor Collison Limited, Morgans Financial Limited, Shaw and Partners Limited. (Joint Lead Managers).

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.