ASX Small Caps and IPO Weekly Wrap: ASX snaps a two-week downturn with a bold performance from banks and gold

Pic via Getty Images.

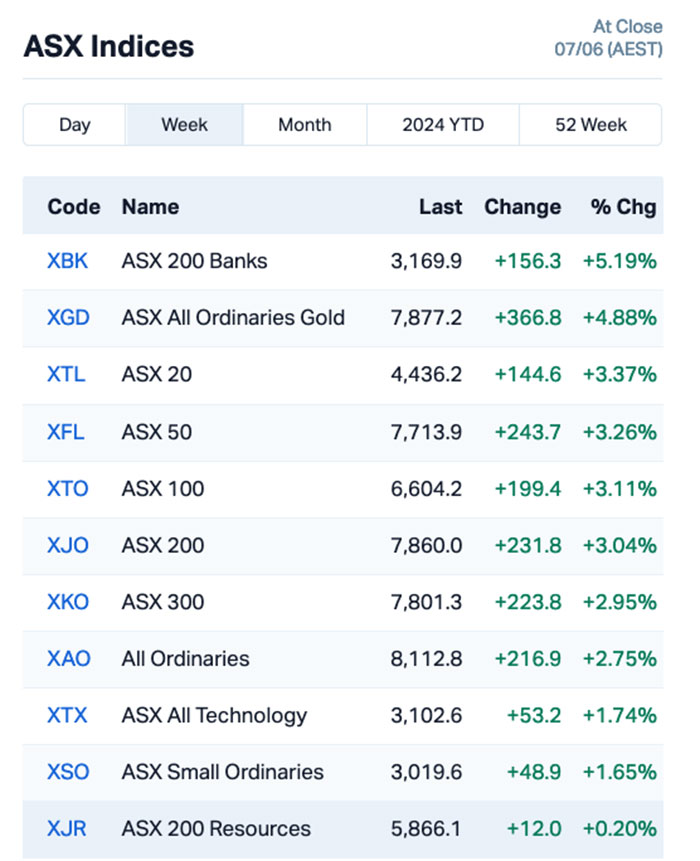

- The ASX 200 has banked a decent week, up +3.0%

- Banks, goldies and Staples had a monster week, all up around +5.0%

- Who won the Small Caps race? Read on to find out…

Local shares have snapped a two-week losing streak in style, finishing the past 5 sessions well ahead of the ballgame to get the final month of the financial year off to a cracking start.

You’re only going to get the banner headlines and barely fleshed out bullet points today, because I don’t even have time to explain to you why I don’t have time to explain anything else that’s happened this week.

Let’s just say “Thank Charles it’s a long weekend coming up”, and sprint for the Friday arvo finish that none of us want, or deserve.

This week was all about numbers and data, and the headlines for lovers of Australian-made numbers were one decent thing, and one that we could all take or leave, really.

The good news was word from the Fair Work Commission, which announced that the Australian minimum wage would be going up 3.75% – 25 basis points higher than the middle ground between the 5.0% the unions wanted, and the miserly 2% that business groups deemed appropriate.

As it turned out, almost everyone seems pretty happy with the result – the exception being those Small Business media tarts who aren’t happy unless there’s something to be miserable about.

The word from them was that the payrise is going to cause inflation, because Small Business Owners are just going to pass the cost of the pay rise for their staff directly to consumers, on the basis that the lease on their new Mercedes isn’t going to pay itself and one must always keep up appearances.

Unfortunately for the Small Business (m)owners, finding an economist who is on the same page about inflationary pressures turned out to be shockingly difficult, because – according to the vast majority of people whose livelihood depends on getting their economic facts right – it’s barely going to move the needle at all.

Which brings us to the iffy headline news for Australia, and that’s the shockingly low 0.1% GDP growth for the previous month, which has painted a picture of Australia as an aircraft that has all but stalled in the air.

It wasn’t what the doctor ordered, especially since the one thing pretty much everyone (aside from the big banks) is looking for is some kind of interest rate relief, which RBA Supremo Michele “with one L” Bullock says we’re all just gonna have to wait a while longer for.

Bullock was hard up against it in Senate Estimates during the week, and while she managed to weather a horrifying blizzard of vapid, woeful attempts to score points against her, she had to do so against the backdrop of interest rates news from overseas.

Canada became the first big economy to blink and lower the cash rate 25 basis points, followed in short order by all the bits of Europe that you’d trust to feed your cat while you’re away.

Investors here (and in the US) found news of those cuts difficult to process, but the flow-on for local markets was a buoyancy that helped take the ASX 200 beyond +3.0% for the week.

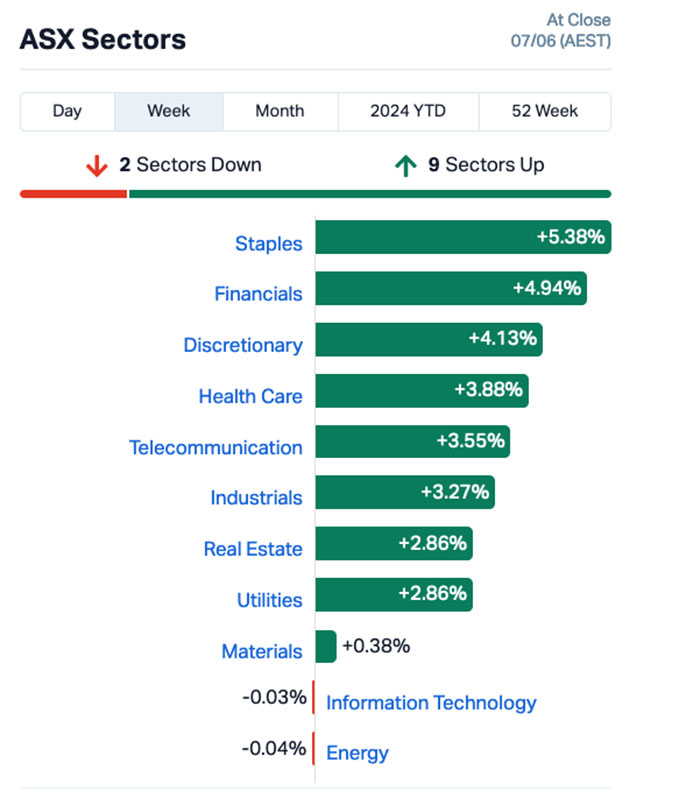

WHAT THE SECTORS DID

Here’s what the market sectors did

As you can see, everyone did rather well, with the exception of InfoTech, Energy and Materials… mostly because of some wild swings among key commodities that made a lot of people fairly nervy.

Except for the goldies. They did well… like, almost too well – easily outstripping the rest of their ASX stablemates among the diggers and explorers and whatnot.

Again, as you can see, it was the banks that came out on top for the week, with a late surge on Friday afternoon enough to push the big boys of the money biz into gold medal contention.

THIS WEEK’S ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| NRZ | Neurizer Ltd | 0.007 | 133% | $11,414,584 |

| VPR | Volt Power Group | 0.002 | 100% | $21,432,416 |

| WEL | Winchester Energy | 0.004 | 100% | $3,061,266 |

| FTL | Firetail Resources | 0.091 | 98% | $17,124,139 |

| 8VI | 8Vi Holdings Limited | 0.100 | 67% | $2,933,800 |

| SIX | Sprintex Ltd | 0.051 | 59% | $22,251,816 |

| GML | Gateway Mining | 0.034 | 55% | $13,050,161 |

| PKO | Peako Limited | 0.006 | 50% | $3,162,508 |

| REM | Remsensetechnologies | 0.025 | 47% | $3,791,773 |

| LPM | Lithium Plus | 0.140 | 46% | $16,542,500 |

| ASV | Assetvisonco | 0.020 | 43% | $12,339,222 |

| DXN | DXN Limited | 0.050 | 43% | $8,504,910 |

| GEN | Genmin | 0.150 | 43% | $102,784,415 |

| CCO | The Calmer Co Int | 0.009 | 40% | $11,045,767 |

| GGE | Grand Gulf Energy | 0.007 | 40% | $16,761,976 |

| KGD | Kula Gold Limited | 0.014 | 40% | $6,960,967 |

| VFX | Visionflex Group Ltd | 0.007 | 40% | $9,918,938 |

| NTU | Northern Min Ltd | 0.049 | 40% | $265,994,066 |

| EIQ | Echoiq Ltd | 0.180 | 38% | $91,401,244 |

| NIM | Nimyresourceslimited | 0.055 | 38% | $7,416,604 |

| LTP | Ltr Pharma Limited | 0.815 | 37% | $45,059,512 |

| MDX | Mindax Limited | 0.056 | 37% | $112,683,108 |

| CBH | Coolabah Metals Limi | 0.100 | 33% | $10,234,533 |

| GCM | Green Critical Min | 0.004 | 33% | $4,546,340 |

| JAY | Jayride Group | 0.012 | 33% | $1,890,473 |

| LSR | Lodestar Minerals | 0.002 | 33% | $4,046,795 |

| NAE | New Age Exploration | 0.004 | 33% | $7,175,596 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| MAY | Melbana Energy Ltd | 0.072 | 33% | $235,914,287 |

| AHF | Aust Dairy Limited | 0.017 | 31% | $9,695,502 |

| FGH | Foresta Group | 0.013 | 30% | $28,264,549 |

| HOR | Horseshoe Metals Ltd | 0.013 | 30% | $8,421,123 |

| IS3 | I Synergy Group Ltd | 0.013 | 30% | $4,603,045 |

| YOJ | Yojee Limited | 0.052 | 30% | $14,080,598 |

| IDT | IDT Australia Ltd | 0.125 | 28% | $40,420,139 |

| COV | Cleo Diagnostics | 0.295 | 28% | $22,971,000 |

| T88 | Taitonresources | 0.120 | 26% | $6,184,073 |

| OIL | Optiscan Imaging | 0.145 | 26% | $116,947,712 |

| ZGL | Zicom Group Limited | 0.059 | 26% | $12,659,040 |

| DXB | Dimerix Ltd | 0.570 | 25% | $296,842,960 |

| ADG | Adelong Gold Limited | 0.005 | 25% | $5,589,945 |

| AUK | Aumake Limited | 0.003 | 25% | $5,743,220 |

| PNX | PNX Metals Limited | 0.005 | 25% | $29,851,074 |

| RLG | Roolife Group Ltd | 0.005 | 25% | $3,911,908 |

| SBW | Shekel Brainweigh | 0.050 | 25% | $10,539,287 |

| SRR | Saramaresourcesltd | 0.025 | 25% | $2,204,703 |

| TMR | Tempus Resources Ltd | 0.005 | 25% | $2,923,995 |

| YPB | YPB Group Ltd | 0.003 | 25% | $1,615,923 |

| CVB | Curvebeam Ai Limited | 0.225 | 25% | $43,715,878 |

| DRE | Dreadnought Resources Ltd | 0.020 | 25% | $59,722,240 |

There were a couple of Small Caps that banked some bangin’ results since Monday… including Firetail Resources (ASX:FTL) , which was the week’s clear winner, off the back of news that the company is set to acquire up to 80% of the York Harbour copper-zinc-silver project in Newfoundland, Canada via a staged earn-in agreement.

Visionflex also posted great numbers for the week, announcing that FY24 group revenue is projected to exceed $8.1 million, which is a very tidy 25% increase from FY23.

RemSense Technologies (ASX:REM) was the early leader on Friday morning and well in the mix for the best of the week, climbing nicely on news of a new contract with Chevron Australia to undertake virtualplant high-resolution photogrammetry scanning and image processing of Chevron’s Gorgon LNG Train 1 in northwestern Australia for a contract value of $534,195.33.

And LTR Pharma (ASX:LTP) was soaring late in the week, after positive news from trials of its signature erectile dysfunction medication showed that it works, and works fast, compared to oral doses of medications with similar intent that are already on the market.

THIS WEEK’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| ICU | Investor Centre Ltd | 0.002 | -71% | $913,534 |

| ADS | Adslot Ltd. | 0.001 | -50% | $6,448,991 |

| FTC | Fintech Chain Ltd | 0.006 | -50% | $5,206,157 |

| SGC | Sacgasco Ltd | 0.004 | -43% | $3,898,435 |

| ENT | Enterprise Metals | 0.003 | -40% | $3,538,884 |

| VBS | Vectus Biosystems | 0.079 | -39% | $4,097,210 |

| IMI | Infinitymining | 0.028 | -38% | $3,325,095 |

| GRV | Greenvale Energy Ltd | 0.054 | -37% | $37,417,881 |

| 8IH | 8I Holdings Ltd | 0.010 | -33% | $3,481,609 |

| IEC | Intra Energy Corp | 0.002 | -33% | $3,381,563 |

| JAV | Javelin Minerals Ltd | 0.001 | -33% | $4,352,462 |

| MRD | Mount Ridley Mines | 0.001 | -33% | $7,784,883 |

| MRQ | Mrg Metals Limited | 0.001 | -33% | $3,787,678 |

| SNX | Sierra Nevada Gold | 0.050 | -33% | $4,754,683 |

| TKL | Traka Resources | 0.001 | -33% | $1,750,659 |

| 88E | 88 Energy Ltd | 0.002 | -33% | $72,231,680 |

| DY6 | Dy6Metalsltd | 0.075 | -32% | $3,434,921 |

| EV1 | Evolutionenergy | 0.040 | -31% | $9,142,600 |

| AGC | AGC Ltd | 0.335 | -29% | $74,872,656 |

| ASR | Asra Minerals Ltd | 0.005 | -29% | $8,319,979 |

| BDX | Bcaldiagnostics | 0.125 | -29% | $31,536,839 |

| BLU | Blue Energy Limited | 0.010 | -29% | $22,211,683 |

| CY5 | Cygnus Metals Ltd | 0.050 | -29% | $14,961,316 |

| W2V | Way2Vatltd | 0.010 | -29% | $8,738,673 |

| OLY | Olympio Metals Ltd | 0.033 | -28% | $3,162,629 |

| KP2 | Kore Potash PLC | 0.031 | -28% | $23,473,648 |

| SHP | South Harz Potash | 0.008 | -27% | $7,444,665 |

| 1TT | Thrive Tribe Tech | 0.009 | -25% | $3,389,594 |

| ASP | Aspermont Limited | 0.009 | -25% | $27,011,982 |

| AVE | Avecho Biotech Ltd | 0.003 | -25% | $9,507,891 |

| CLU | Cluey Ltd | 0.045 | -25% | $10,080,678 |

| CLZ | Classic Min Ltd | 0.003 | -25% | $1,366,324 |

| EEL | Enrg Elements Ltd | 0.003 | -25% | $3,029,895 |

| FCT | Firstwave Cloud Tech | 0.015 | -25% | $25,650,290 |

| GMN | Gold Mountain Ltd | 0.003 | -25% | $9,371,068 |

| HLX | Helix Resources | 0.003 | -25% | $9,792,581 |

| KPO | Kalina Power Limited | 0.003 | -25% | $8,702,379 |

| RIL | Redivium Limited | 0.003 | -25% | $8,192,564 |

| TD1 | Tali Digital Limited | 0.002 | -25% | $6,590,311 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| TIG | Tigers Realm Coal | 0.003 | -25% | $39,200,107 |

| HRE | Heavy Rare Earths | 0.028 | -24% | $1,693,662 |

| IND | Industrialminerals | 0.190 | -24% | $14,095,800 |

| RCR | Rincon | 0.076 | -24% | $22,776,149 |

| BCK | Brockman Mining Ltd | 0.019 | -24% | $139,203,482 |

| CPM | Coopermetalslimited | 0.084 | -24% | $6,581,875 |

| STM | Sunstone Metals Ltd | 0.010 | -23% | $42,220,940 |

| BUX | Buxton Resources Ltd | 0.077 | -23% | $16,729,322 |

| A1G | African Gold Ltd. | 0.024 | -23% | $5,741,177 |

| REE | Rarex Limited | 0.014 | -22% | $11,061,842 |

| SPQ | Superior Resources | 0.007 | -22% | $16,009,763 |

| TGH | Terragen | 0.014 | -22% | $4,798,055 |

| AM7 | Arcadia Minerals | 0.055 | -21% | $6,437,756 |

| PXX | Polarx Limited | 0.011 | -21% | $24,605,790 |

| PSC | Prospect Res Ltd | 0.150 | -21% | $81,375,580 |

| WA1 | Wa1Resourcesltd | 16.630 | -21% | $1,021,863,824 |

| EVG | Evion Group NL | 0.019 | -21% | $7,957,061 |

| NKL | Nickelxltd | 0.023 | -21% | $2,019,749 |

| BGT | Bio-Gene Technology | 0.050 | -21% | $11,880,333 |

| PV1 | Provaris Energy Ltd | 0.031 | -21% | $19,787,139 |

| HAV | Havilah Resources | 0.175 | -20% | $60,161,450 |

| CXO | Core Lithium | 0.108 | -20% | $224,378,232 |

| A8G | Australasian Metals | 0.080 | -20% | $4,169,640 |

| ALR | Altairminerals | 0.004 | -20% | $17,186,310 |

| BUY | Bounty Oil & Gas NL | 0.004 | -20% | $6,743,254 |

| EXL | Elixinol Wellness | 0.004 | -20% | $5,945,320 |

| HHR | Hartshead Resources | 0.008 | -20% | $25,278,139 |

| MOM | Moab Minerals Ltd | 0.004 | -20% | $2,847,852 |

| MSG | Mcs Services Limited | 0.004 | -20% | $792,399 |

| NWM | Norwest Minerals | 0.028 | -20% | $11,255,466 |

| OKJ | Oakajee Corp Ltd | 0.012 | -20% | $1,188,798 |

| PUR | Pursuit Minerals | 0.004 | -20% | $14,719,857 |

| RON | Roninresourcesltd | 0.120 | -20% | $4,419,001 |

| TYX | Tyranna Res Ltd | 0.008 | -20% | $26,303,403 |

| WLD | Wellard Limited | 0.020 | -20% | $9,562,506 |

| YAR | Yari Minerals Ltd | 0.004 | -20% | $1,929,431 |

| RDN | Raiden Resources Ltd | 0.036 | -20% | $100,398,112 |

| TLM | Talisman Mining | 0.280 | -20% | $53,671,299 |

| NPM | Newpeak Metals | 0.020 | -20% | $3,214,078 |

| TKM | Trek Metals Ltd | 0.033 | -20% | $17,458,077 |

| SM1 | Synlait Milk Ltd | 0.355 | -19% | $77,596,490 |

| PAT | Patriot Lithium | 0.067 | -19% | $6,214,638 |

| ENV | Enova Mining Limited | 0.017 | -19% | $17,242,728 |

| FGL | Frugl Group Limited | 0.081 | -19% | $8,482,021 |

| CC9 | Chariot Corporation | 0.150 | -19% | $12,832,319 |

| SPD | Southernpalladium | 0.430 | -19% | $18,523,681 |

| CL8 | Carly Holdings Ltd | 0.013 | -19% | $3,488,815 |

| LLI | Loyal Lithium Ltd | 0.195 | -19% | $16,785,617 |

| ARN | Aldoro Resources | 0.061 | -19% | $9,154,415 |

| ILA | Island Pharma | 0.062 | -18% | $7,044,065 |

| CUS | Coppersearchlimited | 0.094 | -18% | $9,136,255 |

| CR1 | Constellation Res | 0.180 | -18% | $11,072,477 |

| DTI | DTI Group Ltd | 0.009 | -18% | $4,934,066 |

| M2R | Miramar | 0.009 | -18% | $1,860,869 |

| PLC | Premier1 Lithium Ltd | 0.027 | -18% | $4,713,501 |

| SCN | Scorpion Minerals | 0.018 | -18% | $7,370,211 |

| MHI | Merchant House | 0.046 | -18% | $4,336,259 |

| CR9 | Corellares | 0.014 | -18% | $6,976,386 |

| GW1 | Greenwing Resources | 0.056 | -18% | $10,875,089 |

| 14D | 1414 Degrees Limited | 0.062 | -17% | $14,766,448 |

| BSN | Basinenergylimited | 0.077 | -17% | $6,402,544 |

| M4M | Macro Metals Limited | 0.029 | -17% | $107,954,458 |

| 1AG | Alterra Limited | 0.005 | -17% | $3,448,586 |

| 1MC | Morella Corporation | 0.003 | -17% | $18,536,398 |

| AEV | Avenira Limited | 0.005 | -17% | $11,745,170 |

| ANR | Anatara Ls Ltd | 0.040 | -17% | $8,410,324 |

| AUH | Austchina Holdings | 0.003 | -17% | $5,250,959 |

| BPP | Babylon Pump & Power | 0.005 | -17% | $14,997,294 |

| CRB | Carbine Resources | 0.005 | -17% | $2,758,689 |

| CRR | Critical Resources | 0.010 | -17% | $17,803,503 |

| FIN | FIN Resources Ltd | 0.010 | -17% | $7,141,956 |

| FNR | Far Northern Res | 0.150 | -17% | $5,361,874 |

| GTR | Gti Energy Ltd | 0.005 | -17% | $10,249,735 |

| HFY | Hubify Ltd | 0.010 | -17% | $4,961,363 |

| ME1DE | Deferred Settlement | 0.025 | -17% | $606,139 |

| NAG | Nagambie Resources | 0.010 | -17% | $7,169,721 |

| PGY | Pilot Energy Ltd | 0.020 | -17% | $24,972,675 |

| SIH | Sihayo Gold Limited | 0.003 | -17% | $24,408,512 |

| CAN | Cann Group Ltd | 0.052 | -16% | $20,999,141 |

| DEL | Delorean Corporation | 0.042 | -16% | $10,786,046 |

| LDR | Lode Resources | 0.105 | -16% | $10,678,415 |

| LIO | Lion Energy Limited | 0.021 | -16% | $9,613,511 |

| UVA | Uvrelimited | 0.105 | -16% | $4,464,939 |

| CNB | Carnaby Resource Ltd | 0.530 | -16% | $88,547,682 |

| MAG | Magmatic Resrce Ltd | 0.069 | -16% | $30,444,702 |

| EG1 | Evergreenlithium | 0.080 | -16% | $5,060,700 |

| PPG | Pro-Pac Packaging | 0.135 | -16% | $27,253,157 |

| UNT | Unith Ltd | 0.014 | -16% | $15,904,686 |

| BKG | Booktopia Group | 0.049 | -16% | $11,182,050 |

| CHL | Camplifyholdings | 1.260 | -15% | $91,162,945 |

| AVM | Advance Metals Ltd | 0.022 | -15% | $1,003,149 |

| DGR | DGR Global Ltd | 0.011 | -15% | $12,524,322 |

| GSR | Greenstone Resources | 0.011 | -15% | $15,105,830 |

| HPC | Thehydration | 0.011 | -15% | $3,354,044 |

| PSL | Paterson Resources | 0.011 | -15% | $5,472,455 |

| VEN | Vintage Energy | 0.011 | -15% | $16,695,313 |

| MZZ | Matador Mining Ltd | 0.061 | -15% | $33,581,598 |

| VMM | Viridismining | 1.395 | -15% | $91,807,633 |

| AQI | Alicanto Min Ltd | 0.017 | -15% | $10,464,976 |

| RAS | Ragusa Minerals Ltd | 0.017 | -15% | $2,566,778 |

| SFX | Sheffield Res Ltd | 0.340 | -15% | $131,711,919 |

| DUN | Dundasminerals | 0.023 | -15% | $1,946,445 |

| TG6 | Tgmetalslimited | 0.230 | -15% | $17,065,810 |

| TG1 | Techgen Metals Ltd | 0.035 | -15% | $4,740,905 |

HOW THE WEEK SHOOK OUT

Monday 03 June, 2024

Galileo Mining (ASX:GAL) was the best performing small cap on Monday morning, surging on news that the company has signed a farm-in and joint venture agreement with the excitingly-named ACN 654 242 690 Pty Ltd, which is a 100% owned subsidiary of Mineral Resources (ASX:MIN) .Under the agreement, Galileo will initially sell off 30% of the lithium rights at its Norseman project to Minres for $7.5 million in cash, with Minres able to increase that to a 55% stake by sole funding an additional $15m of exploration over the next four years, and then up to 70% by sole funding expenditure through to a Decision to Mine.

Eastern Metals (ASX:EMS) performed well on Monday morning on news that the company has identified new zones of anomalous base metal mineralisation in the northern portion of its Browns Reef project in NSW’s southern Cobar Basin. The company says that mapping and pXRF traverses along the Woorara Faul – a regional-scale structure related to known mineralisation at the high-grade Pineview and Evergreen zones – have identified new anomalous zones north and south of Evergreen, which the company has named ‘Kelpie Hill’ and ‘Windmill Dam’ respectively.

Big news from health tech player Inoviq (ASX:IIQ), which said it has created specialised exosomes (EEVs) designed to target and destroy breast cancer cells in a lab setting.

In the study, IIQ inserted a cancer targeting protein, chimeric antigen receptor (or CAR), into immune cells, which released the modified/engineered exosomes.

This protein acts like a homing device, guiding the exosomes to the breast cancer cells. Overall, the study found that these engineered exosomes were successful in finding and killing breast cancer cells in their experiments conducted in vitro. The modified exosomes were isolated and concentrated using INOVIQ’s proprietary EXO-ACE technology, which recovered more than 80% of exosomes with over 95% purity. In the tests, 75% of breast cancer cells treated with these exosomes experienced cell death within 72 hours.

Falcon Metals (ASX:FAL) continued its climb up the charts on Monday, still gaining on last week’s news of a high-grade mineral sands discovery over a ~1,200m x ~600m area at Falcon’s 100% owned Farrelly Prospect.

And… small greenfields explorer AustChina Holdings (ASX:AUH) is on site and ready to drill four lithium targets at the Chenene project in Tanzania.

Tuesday 04 June, 2024

Little known med-tech player Opticomm (ASX:OPC) surged after announcing the launch of a “ground-breaking new microscopic medical imaging device” called InVue, which the company says has been designed “to enable precision surgery by putting real-time digital pathology access directly into the hands of surgeons”.

Condor Energy (ASX:CND) was moving well after providing an update on exploration progress at its Technical Evaluation Agreement (TEA) off the coast of Peru.

Condor is reporting that there is evidence of multiple petroleum systems at two large oil prospects (Raya and Bonito) and regional mapping shows that the primary source rock interval, the Oligocene/Miocene aged Heath Formation, is mature for oil generation over much of the TEA area.

Perpetual Resources (ASX:PEC) is flexing hard again. The reason? It’s rare earths this time. The company has announced the commencement of its exploration program at the Raptor REE project, which is situated in the prolific Caldeira REE complex in Minas Gerais, Brazil.

Specifically, this very initial stage of the operation represents the due diligence exploration phase. Raptor covers a strategic area of 380 hectares, and has some nearology chops as reason for the company to be excited. It’s located close to Meteoric Resources’ (ASX:MEI) Tier 1 Caldeira ionic clay REE project, which boasts a JORC Mineral Resource Estimate of 545 million tonnes at 2,561ppm TREO comprising 24.1% MREO.

G11 Resources (ASX:G11) surged after announcing strong new assay and down hole geophysics results from a recent reverse circulation (RC) drilling program at Wilandra Central. That’s a key target area within the 30km-long Wilandra Copper Corridor of the company’s wholly owned Koonenberry project.

Genetic Signatures (ASX: GSS), a company known for its molecular diagnostic solutions for infectious diseases, has just received clearance from the US FDA for its EasyScreen Gastrointestinal Parasite Detection Kit and GS1 automated workflow. This is a significant announcement in the world of clinical diagnostics, especially for expanded testing for gastrointestinal (GI) parasites.

The approval means that healthcare professionals now have a powerful new tool to accurately and quickly diagnose these kinds of infections.

Wednesday 05 June, 2024

The Calmer Co (ASX:CCO) was well above 100% after news retail sales of its kava-based relaxation beverage have risen dramatically.

Surely can’t be the same flava of Kava that this intrepid reporter once had, which is good news for everyone.

CCO says it’s pulling in some $16,000 a day in e-commerce sales for the month of May, an increase of 45%.

Total sales were reported to be up 28% and will exceed $610,000 in May, against April’s total of $470,000.

Group 6 Metals (ASX:G6M) also did well on Wednesday, climbing after the company released an update on how things are going at its wholly owned Dolphin tungsten mine on King Island, Tasmania.

Group 6 says the open pit has exceeded forecast volumes for ore tonnes and metric tonne units (mtu) of WO3 recovered up until the end of April, despite the operation falling behind schedule.

RemSense Technologies (ASX:REM) has jumped after adding some ballast to the board.

The company said in an update, there’d been some terrific cost-cutting delivering an operating cost savings of approximately $1 million over prior years.

And clinical stage biotech PharmAust (ASX:PAA) jumped by almost +20% this morning after sharing some exciting updates about its ongoing research into Motor Neurone Disease (MND), also called Amyotrophic Lateral Sclerosis (ALS).

PAA announced that enrollment for the Open-Label Extension (OLE) study has now been completed.

This study looks at the long-term safety, tolerability, and effectiveness of PAA’s lead drug, monepantel (MPL), for people with MND/ALS.

PAA says that new and updated data provided by Berry Consultants reveals some promising news — patients who took MPL had a 91% lower risk of death from MND/ALS compared to ‘untreated matched-controls’.

This is significant and suggests that MPL could be a really effective treatment for MND/ALS.

Thursday 06 June, 2024

Back in the headlines on Thursday with a near 140% explosion in share price is Firetail Resources (ASX:FTL).

FTL announced it’s set to acquire up to 80% of the York Harbour copper-zinc-silver project in Newfoundland, Canada via a staged earn-in agreement.

The company described York Harbour as a Cyprus-style volcanogenic massive sulphide (VMS) exploration project, located 180km west-south-west of FireFly Metals Ltd (ASX:FFM) Green Bay Copper Project.

Osteopore (ASX:OSX) was back in the news after revealing that its $18.7 million partnership with Singapore’s NDCS and A*STAR to develop next-generation dental implants has reached “significant milestones”.

The milestones include the successful development of a 3D-printed technology, which the company says “can combine patented biological additives and polymer compounds for dental implants that have the potential to accelerate bone healing”.

Structural Monitoring Systems (ASX:SMN) rose quickly after lifting its revenue forecast for the full year ahead of a likely maiden quarterly profit.

The avionics specialist says increased sales are expected to see the Group record a quarterly profit for the first time in the June quarter.

The stronger-than-anticipated results bolstered by the strong performance of the Group’s Contract Manufacturing segment.

By the end of this current financial year, SMN forecasts that annual gross revenue will have grown by 27% building on revenue growth of 43% in FY2023 with a figure of 28% revenue growth budgeted for in FY2025.

SMN have also forecasted Group EBITDA of $3.38 million for the current financial year which represents a significant turnaround on LBITDA of $0.27 million for FY2023.

And Top End Energy (ASX:TEE) made moves through the morning session, after announcing that it has been given a formal Ministerial grant of Exploration Permit, which the company says is the culmination of a multiple year application and approval process encompassing native title holder agreement and NT Ministerial approvals.

The permit the first EP to be granted in the NT since 2015, and sets TEE up for rapid deployment of a planned exploration program, looking for natural gas. The company is also in the process of finalising a deal for three additional granted permits from Hancock.

Friday 07 June, 2024

Killing it casually on Friday was Jayride (ASX:JAY) after providing a trading update on its airport transfer marketplace business that showed that “contribution profit continued to increase on a lower passenger trips base”, which the company says is a validation of its recently updated business strategy.

As mentioned earlier, LTR Pharma (ASX:LTP) had a firm grip on the winner’s list after the news from its recent primary and secondary clinical studies for its Spontan erectile dysfunction spray.

“Initial data showed that Spontan’s nasal spray reached the same Cmax (maximum concentration) level as an oral administration, despite being administered at a lower dose, with volunteers showing observable effects of the drug in as little as 9 minutes, with an average of 12 minutes across the study compared to 56 minutes (Tmax) in patients receiving oral treatment.”

RemSense Technologies (ASX:REM) was the early leader on Friday morning, climbing nicely on news of a new contract with Chevron Australia to undertake virtualplant high-resolution photogrammetry scanning and image processing of Chevron’s Gorgon LNG Train 1 in northwestern Australia for a contract value of $534,195.33.

Dreadnought Resources (ASX:DRE) was up early on news that mineralogical work at its Gifford Creek Carbonatite – part of DRE’s 100% owned Mangaroon Critical Minerals project – has confirmed that the dominant niobium mineral is pyrochlore, which is a high niobium mineral (>50%) from which ~95% of global niobium is produced.

Finally, the gold developer MetalsTech (ASX:MTC) says a key condition has been satisfied for its ~$120m (~A$0.639 per share) acquisition by Trans Metals Fund, following the granting of underground mining activity permit No. 2440-3935/2023 for the Sturec Gold Mine.

IPOs that didn’t happen yet

Resouro Strategic Metals (ASX:RAU)

Proposed Listing: 14 June, 2024

IPO: $8 million at $0.50 per share

The Australian-led Resouro Strategic Metals is currently listed on the TSXV in Canada, with a focus on Brazil-focused rare earths plays. Its flagship Tiros project has potential to become an industry-leading rare earths and titanium mine as western countries race to develop diversified sources of critical minerals.

The IPO, as listed, will be managed by Taylor Collison Limited ( Lead Managers).

Piche Resources (ASX:PR2)

Proposed Listing: 17 June, 2024

IPO: $10 million at $0.10 per share

Blinklab describes itself as a mineral exploration company with multiple, drill ready uranium projects with the potential to host tier 1 mineral deposits.

The IPO, as listed, will be managed by Euroz Hartleys (Lead Manager).

Pengana Global Credit Private Trust (ASX:PCX)

Proposed Listing: 20 June, 2024

IPO: $250,000 at $2.00 per share

Pengana Global Credit Private Trust is a listed Investment Trust investing in global private debt.

The IPO, as listed, will be managed by Taylor Collison Limited, Morgans Financial Limited, Shaw and Partners Limited. (Joint Lead Managers).

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.