ASX Small Caps and IPO Weekly Wrap: The ASX retreated in the face of metal mayhem.

Pic via Getty Images.

- The ASX 200 went backwards this week, down -1.9pc

- Resources turned out to be best of a bad bunch on -0.18pc

- Who won the Small Caps race? Read on to find out…

Aussie stocks went backwards this week, in what can only be described as an egregious display of open defiance of the fauna that adorns our beloved national coat of arms.

Emus and kangaroos alike are reportedly massing on the outskirts of every major city, and with supply routes cut off in every direction, I strongly advise getting down to 7-11 and stockpiling as many of those weird Traveller pies they sell, because those things are grouse.

So… given that I wasn’t here on Monday or Tuesday, on account of having the flu.

No, really… I was 100% super-unwell, and it got pretty gross there for a while. Ask my neighbours – they had to listen to it. Even the deaf lady next door knocked on my door to complain, but I suspect that was more about the smell than the cry-screaming coming from my bathroom.

Anyhoo… I wasn’t paying attention on either of those days – but from what I can gather, it looks like the Big News of the Week was the volatility that seems to have gripped the commodities, particularly the metals.

I did a dive into this on Wednesday, using copper as the main example – but to save you injuring yourself by frantically clicking around the site trying to find it, it looked suspiciously like this:

According to Reuters analyst Andy Home, there’s a one-two punch happening on the copper market that’s driving the volatility levels that we’re seeing at the moment… and it’s not great news.

Firstly, there’s a “vicious short squeeze” underway in the US, where CME Group (which operates the US commodity exchange, or COMEX) is scrambling to ensure that there’s sufficient real-world copper on hand to cover a number of large short positions.

But the thing is that while US cupboards are looking a little bare, the pantries in London and China are anything but.

“Inventory registered with the Shanghai Futures Exchange (ShFE) stood at 291,020 metric tons at the end of last week, compared with London Metal Exchange (LME) stocks of 105,900 tons and CME stocks of just 18,244 tons,” Home says.

That’s largely due to a sharp increase over the past couple of years of copper imports into China, and that increased demand has led to two things: sky-rocketing copper prices and an overstocked warehouse.

The combination of those two things, Reuters says, has triggered a collapse in the Yangshan premium, which is “a closely-tracked indicator of China’s copper import appetite” – which, in turn, has effectively turned off the tap for Chinese interest in copper outside of existing annual import deals.

“The spot import door has just firmly closed,” Home says. “Metal will still flow into China under annual supply deals, which tend to be favoured by larger buyers, but arrivals will likely drop a couple of gears relative to the last few months.”

There were some very big swings in commodity prices since Monday, lots of ups and lots of downs and it all got a little too much to watch without that yawning sense of vertigo and vague nausea I get when the markets are being weird, or when something makes me imagine what Ed Sheeran’s fingers smell like.

(It’s pot pourri, damp earth and – of course – a powerful top note of ginger… and now I need to go and lie down.)

Anyway – even though these weekly numbers don’t really tell you much about both the ups and the downs, the commodities we love to watch looked like this for the week.

METAL MARKET PRICES as of FRIDAY ARVO, 24 MAY

Weekly % change

Gold: US$2,338.47 (-3.15%)

Silver: US$30.50 (-3.21%)

Nickel: US$20,178/t (+1.92%)

Copper: US$10,290/t (-4.77%)

Zinc: US$3,090/t (+1.81%)

Iron 62pc Fe: US$117.53/t (+0.58%)

So, as you can see, it’s been a bit all over the place this week – and that, coupled with the unending saga of investors wanting interest rates relief, and the US Fed (and our own RBA Board) hellbent on blue-balling us into a coma on the topic, the market’s had a rough trot over the past 5 sessions.

Best thing to do at this point is power down for the weekend, spend some time with the missus and the kids, maybe fire up the Xbox once the young ‘uns are asleep and spend a few quiet hours tormenting someone else’s kids on Fortnite.

The market will still be here on Monday – hopefully in a better mood, but.

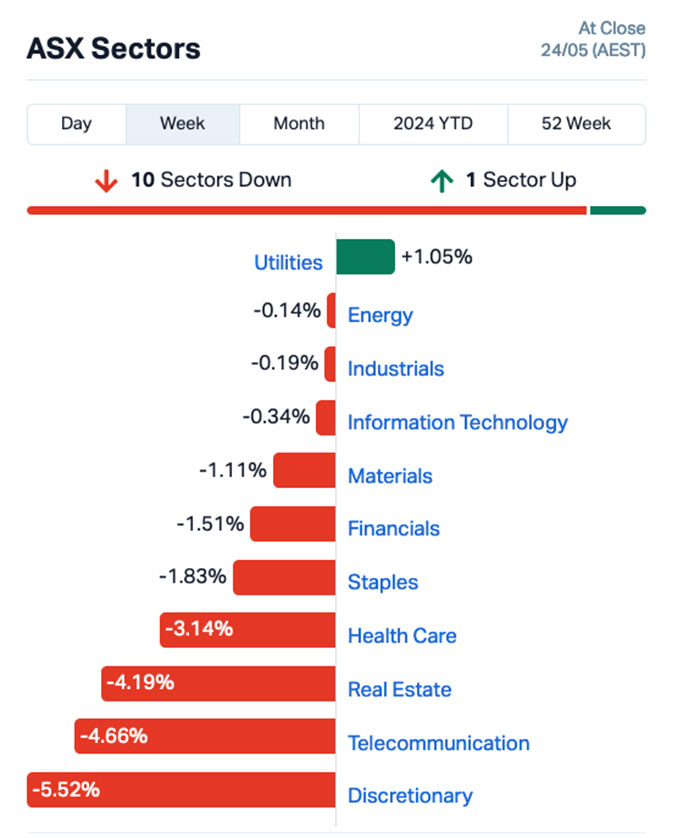

WHAT THE SECTORS DID

Having explained why metals are grinding everyone’s gears this week, a look at the sectors shows that it was the Utilities sector that performed the best – all lonely out in front of the pack, while the rest of the sectors wallowed in their own filth, sobbing like someone had just stolen all their toys.

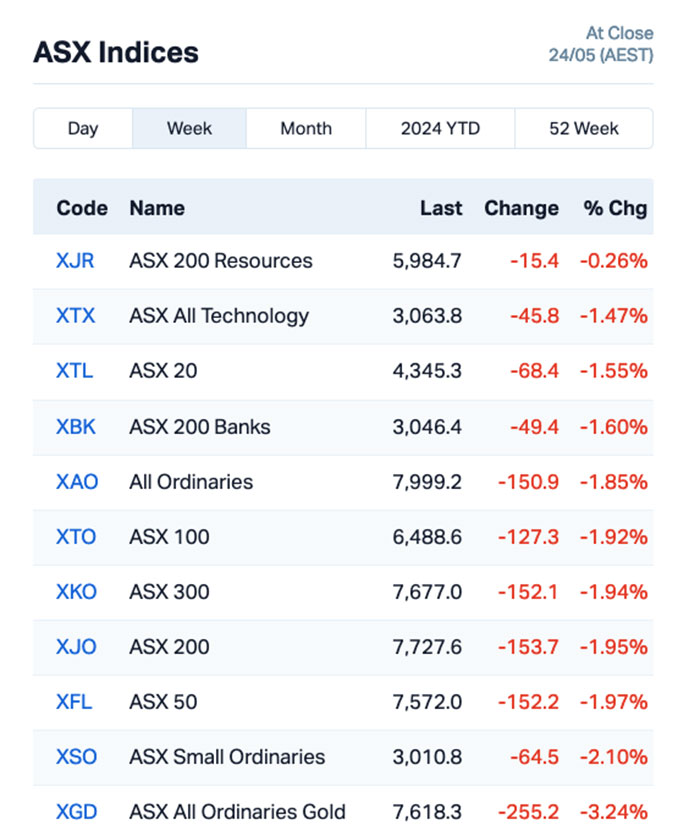

A look at the ASX indices for the week shows a similar, if even more depressing, sight – not a single one of them made headway this week.

But… there were a couple of Small Caps that banked some bangin’ results since Monday… and here they are…

SMALL CAP WINNERS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| SER | Strategic Energy | 0.028 | 115% | $7,773,042 |

| CT1 | Constellation Technologies | 0.002 | 100% | $2,949,467 |

| AGC | AGC Ltd | 0.575 | 95% | $124,444,444 |

| SNX | Sierra Nevada Gold | 0.078 | 90% | $5,705,619 |

| GIB | Gibb River Diamonds | 0.045 | 80% | $10,363,963 |

| POS | Poseidon Nick Ltd | 0.007 | 75% | $25,994,743 |

| KED | Keypath Education | 0.825 | 65% | $114,861,657 |

| PH2 | Pure Hydrogen Corp | 0.235 | 62% | $73,488,568 |

| NMR | Native Mineral Resources | 0.035 | 59% | $7,134,917 |

| ASO | Aston Minerals Ltd | 0.019 | 58% | $23,311,157 |

| CAG | Caperange Ltd | 0.14 | 56% | $13,287,162 |

| BEX | Bikeexchange Ltd | 0.425 | 55% | $7,668,324 |

| FTZ | Fertoz Ltd | 0.04 | 54% | $7,507,466 |

| CAZ | Cazaly Resources | 0.026 | 53% | $13,184,453 |

| BM8 | Battery Age Minerals | 0.18 | 50% | $15,814,104 |

| GCR | Golden Cross | 0.003 | 50% | $3,291,768 |

| KP2 | Kore Potash PLC | 0.021 | 50% | $13,165,290 |

| NTM | Nt Minerals Limited | 0.006 | 50% | $6,104,417 |

| WEL | Winchester Energy | 0.003 | 50% | $3,061,266 |

| YPB | YPB Group Ltd | 0.003 | 50% | $2,423,884 |

| LGM | Legacy Minerals | 0.26 | 49% | $26,363,749 |

| NPM | Newpeak Metals | 0.031 | 48% | $3,832,170 |

| LPE | Locality Planning | 0.125 | 47% | $23,426,574 |

| CBH | Coolabah Metals | 0.072 | 47% | $7,086,196 |

| KNB | Koonenberrygold | 0.023 | 44% | $6,331,324 |

| NSX | NSX Limited | 0.023 | 44% | $9,451,422 |

| EQN | Equinox Resources | 0.38 | 43% | $45,077,501 |

| LTP | Ltr Pharma Limited | 0.47 | 40% | $33,442,607 |

| GNM | Great Northern | 0.014 | 40% | $2,164,807 |

| MTH | Mithril Resources | 0.28 | 40% | $24,949,985 |

| PPY | Papyrus Australia | 0.014 | 40% | $6,897,696 |

| CDD | Cardno Limited | 0.3375 | 40% | $13,671,623 |

| PLN | Pioneer Lithium | 0.18 | 38% | $4,832,250 |

| CUS | Copper Search | 0.13 | 38% | $12,919,957 |

| WNX | Wellnex Life Ltd | 0.029 | 38% | $36,107,277 |

| CHR | Charger Metals | 0.098 | 36% | $8,129,126 |

| TZL | TZ Limited | 0.023 | 35% | $5,901,412 |

| SUH | Southern Hem Mining | 0.05 | 35% | $28,345,236 |

| XF1 | Xref Limited | 0.175 | 35% | $33,089,572 |

| SUM | Summit Minerals | 0.215 | 34% | $10,246,282 |

| ADR | Adherium Ltd | 0.024 | 33% | $7,410,760 |

| CDX | Cardiex Limited | 0.072 | 33% | $21,180,569 |

| ICG | Inca Minerals Ltd | 0.008 | 33% | $6,437,911 |

| REE | Rarex Limited | 0.02 | 33% | $12,984,345 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| FND | Findi Limited | 3.83 | 33% | $181,540,542 |

| AUC | Ausgold Limited | 0.037 | 32% | $84,957,225 |

| COD | Coda Minerals Ltd | 0.165 | 32% | $28,844,481 |

| SVY | Stavely Minerals Ltd | 0.047 | 31% | $18,715,065 |

| KOB | Koba Resources | 0.15 | 30% | $23,784,242 |

Strategic Energy Resources won the week, on news that it has raised $2m via placement to explore the Achilles 1 polymetallic prospect in the South Cobar Basin. The placement, done at a small 8.3% discount to the last traded price, is cornerstoned by Datt Capital and Lowell Resources Fund (ASX:LRT).

Sierra Nevada Gold (ASX:SNX) says it will follow up a pre-IPO drill hole which returned up to 1270g/t silver at Endowment mine, part of its Blackhawk epithermal project in Nevada, US, which had investors excited all week.

Gibb River Diamonds (ASX:GIB) was also up, moving more than +50% on Tuesday’s news that the company has secured mining leases M04/475, M04/476 and M04/477 which are the three key licences at the heart of developing the Ellendale Diamond Project, 140km east of Derby in the West Kimberley region of Western Australia.

SMALL CAP LAGGARDS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| JTL | Jayex Technology Ltd | 0.001 | -50% | $281,279 |

| CGR | CGN Resources | 0.18 | -49% | $16,340,074 |

| AMS | Atomos | 0.023 | -43% | $26,685,627 |

| SHP | South Harz Potash | 0.0125 | -40% | $11,580,590 |

| IND | Industrial Minerals | 0.19 | -37% | $14,439,600 |

| VBS | Vectus Biosystems | 0.13 | -35% | $6,917,217 |

| AYM | Australia United Mining | 0.002 | -33% | $3,685,155 |

| CNJ | Conico Ltd | 0.001 | -33% | $1,805,095 |

| INP | Incentiapay Ltd | 0.004 | -33% | $4,975,720 |

| ME1 | Melodiol Global Health | 0.002 | -33% | $1,426,974 |

| MRD | Mount Ridley Mines | 0.001 | -33% | $7,784,883 |

| NRZ | Neurizer Ltd | 0.002 | -33% | $4,961,875 |

| SIH | Sihayo Gold Limited | 0.002 | -33% | $24,408,512 |

| VPR | Volt Power Group | 0.001 | -33% | $10,716,208 |

| MSI | Multistack International | 0.009 | -31% | $1,226,735 |

| AGD | Austral Gold | 0.021 | -30% | $12,858,538 |

| GLL | Galilee Energy Ltd | 0.026 | -30% | $10,192,339 |

| AMM | Armada Metals | 0.013 | -28% | $3,744,000 |

| AAU | Antilles Gold Ltd | 0.008 | -27% | $8,968,815 |

| CUF | Cufe Ltd | 0.014 | -26% | $16,045,573 |

| ENL | Enlitic Inc. | 0.295 | -26% | $24,401,535 |

| BEL | Bentley Capital Ltd | 0.029 | -26% | $2,968,989 |

| R8R | Regener8 Resources nl | 0.093 | -26% | $2,437,344 |

| BFC | Beston Global Ltd | 0.003 | -25% | $7,988,188 |

| ECT | Env Clean Tech Ltd | 0.003 | -25% | $12,687,242 |

| IMI | Infinity Mining | 0.045 | -25% | $5,937,670 |

| JAV | Javelin Minerals Ltd | 0.0015 | -25% | $4,352,462 |

| NKL | Nickelxltd | 0.021 | -25% | $1,844,119 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| AMD | Arrow Minerals | 0.003 | -25% | $40,557,460 |

| MHJ | Michael Hill International | 0.475 | -24% | $182,696,382 |

| ERW | Errawarra Resources | 0.13 | -24% | $13,428,894 |

| LDX | Lumos Diagnostics | 0.036 | -23% | $18,289,662 |

| FTL | Firetail Resources | 0.046 | -23% | $7,296,372 |

| FXG | Felix Gold Limited | 0.055 | -23% | $12,432,907 |

| NXS | Next Science Limited | 0.26 | -22% | $72,923,776 |

| SP8 | Streamplay Studio | 0.007 | -22% | $8,054,366 |

| MKR | Manuka Resources | 0.046 | -22% | $34,190,528 |

| EQS | Equity Story Group | 0.025 | -22% | $2,724,837 |

| MEG | Megado Minerals Ltd | 0.011 | -21% | $2,799,011 |

| GLN | Galan Lithium Ltd | 0.23 | -21% | $91,545,940 |

| ICL | Iceni Gold | 0.067 | -20% | $17,729,468 |

| AUK | Aumake Limited | 0.002 | -20% | $5,743,220 |

| KPO | Kalina Power Limited | 0.004 | -20% | $9,945,576 |

| MCT | Metalicity Limited | 0.002 | -20% | $8,970,190 |

| PKO | Peako Limited | 0.004 | -20% | $2,108,339 |

| RAG | Ragnar Metals Ltd | 0.016 | -20% | $8,057,676 |

| RLG | Roolife Group Ltd | 0.004 | -20% | $3,129,527 |

| SHO | Sportshero Ltd | 0.004 | -20% | $2,471,331 |

| SIT | Site Group International | 0.002 | -20% | $5,204,980 |

HOW THE WEEK SHOOK OUT

Monday 20 May, 2024

Coolabah Metals (ASX:CBH) is back on the ASX. Last week Coolabah announced the application for quotation of a whole bunch of new securities on the ASX, including over 5 million options and 22 million ordinary shares in a move which signals a potential expansion and growth phase for the diversified explorer. This follows the acquisition of the Mundi Mundi project in NSW, which boasts x2 historical fluorite mines. Fluoride-ion batteries also have the potential to displace lithium-ion batteries as they have a potential eight-fold increase in energy density relative to lithium-ion batteries, according to CBH.

Still with the diggers – and a re-interpretation of historical data at Stavely Minerals’ (ASX:SVY) Junction Prospect has reportedly identified an immediate shallow discovery opportunity.

A new set of eyes apparently has seen copper-gold-silver lode-style mineralisation intersected previously at Junction including “chalcopyrite, bornite and covellite and is very similar to the mineralisation at the Cayley Lode (9.3Mt at 1.23% Cu, 0.23g/t Au, 7g/t Ag).” That news dropped late last week, with SVY saying drilling will start as soon as a rig can be mobilised.

Stocks in the ever-troubled software firm Nuix (ASX:NXL) have genuinely surged on what looks genuinely good news. NXL has lifted full year guidance by more than a full third this morning after “general positive trading into the second half” that includes a significant multi-year win. Nuix says it’ll likely beat its previously stated strategic target of growing statutory revenue by around 10%. Nuix says it expects statutory EBITDA to come in more than 35% on last year. Underlying EBITDA, which excludes non-operational legal costs, is likely to be in the range of $63m-$68m, up more than 36%.

Gold explorer Nagambie Resources (ASX:NAG)’ share price hasn’t enjoyed the best year to date, but today it rose on some welcome news. The company has announced a maiden JORC resource for the shallow, high-graded gold mineralisation at its namesake gold and antimony mine in central Victoria. Some specifics. The company’s talking an Inferred Resource here, of 415,000 tonnes averaging 11.5g/t gold equivalent and comprising 3.6g/t gold plus 4.3% antimony. It also notes that the in-ground metal content of 153,000 ounces gold equivalent, comprises 47,800 ounces gold plus 17,800 tonnes antimony and the average 11.5g/t gold equivalent resource grade is 230% of the mineable cut-off grade of 5.0g/t AuEq.

Here’s another, bigger, goldie faring well today. As Reubs highlighted earlier in Top 10 at 10, Ausgold (ASX:AUC) has appointed veteran company maker John Dorwood as exec chairman to drive towards first production from the 3Moz Katanning project in WA’s South West. “Ausgold’s growth potential and dominant ownership in the southwest Yilgarn Craton reminds me of Fronteer Gold, where I was VP-corporate development, which opened up a new frontier with its 2Moz Long Canyon gold project in under-explored eastern Nevada,” he says.

Ironbark Zinc (ASX:IBG) was up today after the company revealed some key dates related to the financing and commencement of production at the project. The company notes that its licence for the Citronen project have been renewed with the Greenland government, and that plans are in place to essentially extend out financing until the end of the year for the project, with focus on a “much-revised asset investment plan in the second half of 2024″. Production, meanwhile, is earmarked to kick off by the end of 2026.

Bastion Minerals (ASX:BMO) said today that “widespread visible uranium” is present at Bastion’s Morrissey project in WA. Investors liked that news, and BMO is subsequently up a goodly amount (about 25% intraday) at the time of writing. This early-stage exploration minnow is also on the hunt for copper, gold, and various other green metals, and was in the news last week after providing updates on its hunt for high-grade rare earths and copper over in Sweden. Regarding the 15.58km2 Morrissey project in the Gascoyne region of WA, however, Bastion notes it’s completed initial mapping and sampling from which its determined the widespread uranium oxide sighting. The potential is there, says Bastion, for “economic surficial uranium, hosted at shallow depth in calcrete”.

Minerals exploration minnow, Athena Resources (ASX:AHN), was on the rise after releasing details from its Scoping Study for the company’s Bryo iron ore project and its FE1 resource. The study is suitably long and very detailed. We’ll give you the quick rundown of the exec summary of the project, based on the study. The project is deemed to be “economically robust”, with a Mineral Resource of 29.3Mt at 24.7% iron. A production target of 16.96 Mt at 26.1% iron from the MRE of 29.3Mt grading 24.7% iron has been noted, with a process rate of 2.4 Mtpa at an average grade of 26.1% Fe over an eight-year mine life “with significant potential to extend utilising additional resources”.

Memphasys (ASX:MEM) jumped on the back of news that its Felix System has outperformed a sperm preparation method comprising two of the most widely used processes, Density Gradient Centrifugation and Swim-Up (DGC+SU). The findings were from a recently completed Japanese clinical trial at the Reproduction Clinic Osaka, Japan.

The trial results showed that using the Felix System was superior to the DGC+SU methods for prepping sperm. Instead of going through the whole rigmarole of centrifugation and incubation like with the DGC+SU process, Felix is much simpler to use, with processing time taking a mere six to seven minutes.

Chimeric Therapeutics (ASX:CHM) climbed on news that it has received ethics approval for the initiation of its multi-site Phase 1/2 clinical trial of CHM CDH17 in patients with advanced gastrointestinal (GI) cancers. An ethics approval is a significant milestone in advancing the program toward study initiation under FDA regulations. CHM CDH17 is novel CAR T cell therapy that targets CDH17, a cancer target linked to some cancers like colorectal cancer, gastric cancer, and neuroendocrine tumours.

AML3D (ASX:AL3) said the US Navy’s submarine component manufacturing partner, Laser Welding Solutions, will lease additional ARCEMY metal 3D printing systems from AL3, with an option to purchase. The $0.7m order advances AML3D’s strategy to embed its ARCEMY technology in the wider US Navy supply chain.

Following a successful pilot phase, Hardi Aged Care is now moving forward with full site implementation at the Manly Vale facility. Hardi’s implementation of InteliCare Holdings (ASX:ICR)’s system in 42 rooms at Blacktown, Hardi’s second site, will now be brought forward to occur concurrently with the Manly Vale implementation. InteliCare and Hardi had entered into an agreement in February to deploy InteliCare into Hardi’s six residential aged care facilities, supporting almost 600 residents.

And… Gentrack (ASX:GTK) surged by over +20% today as the company reported its H1 update. For the first half, revenue was $102mm up 21% on pcp. EBITDA was $12.3m and tracking well against FY24 guidance. Growth is driven by recent and in-year new customers as well as upsells and upgrades for existing customers. The company’s growth in utilities meanwhile is a result of recent new customer wins alongside upselling new products to our existing customers.

Tuesday 21 May, 2024

Sierra Nevada Gold (ASX:SNX) surged after declaring its intentions to follow up drill hole BHD006 which returned up to 1270g/t silver at Endowment mine, part of its Blackhawk epithermal project in Nevada, US. SNX has previously identified a large and high-grade intermediate sulphidation epithermal Ag-Au-Pb-Zn vein system, likely related to a large porphyry system located immediately to the south.

Flynn Gold (ASX:FG1) has sampled up to 64g/t gold at the Link Zone prospect, part of the Golden Ridge project in Northeast Tasmania. It’s talking high-grade assays here from its underground grab sampling of mineralised veins, including 64.4g/t, 37.6g/t and 15.9g/t gold. The Link Zone prospect is located between the company’s Trafalgar and Brilliant prospects, with all three prospects now defining a corridor of high-grade gold mineralisation with a potential strike length of 2.5km and a vertical extent of at least 500m.

Bastion Minerals (ASX:BMO) says a recent mapping and sampling program uncovered “extensive new pegmatites and targets” at the Morrissey lithium project in WA.

Everest Metals (ASX:EMC) is hitting super grade gold up to 97g/t as part of a bulk sampling campaign at the Revere project in WA.

Western Australian focused explorer Golden Mile Resources (ASX:G88) announced the completion of Stage 3 metallurgical test work at its flagship Quicksilver nickel-cobalt project near Lake Grace, WA. That testing has outlined an initial “process beneficiation flowsheet”, which the company says has the potential to target 75% nickel recovery from the deposit.

Quicksilver is an oxide clay-hosted deposit with a resource of 26.3Mt grading 0.64% nickel and 0.04% cobalt along with valuable by-products gold, rare earths and scandium.

Previous metallurgical test work by the company had improved its understanding of the unique mineralisation and demonstrated the potential to develop a low energy, multi-product beneficiation process.

Gibb River Diamonds (ASX:GIB) announced it’s been granted three mining leases on the project’s land and these are licences considered key to developing the project further with a view to re-establishing its production. The Ellendale Project has, in the past, been one of the world’s largest diamond producers, with previous operators reporting a combined market capitalisation of over $690 million in 2006 on leases now held by GIB.

A day after bursting on up on the sighting of “widespread visible uranium” at its Morrissey project in WA, Bastion Minerals (ASX:BMO) is surging again. BMO hinted at this yesterday in its uranium-based announcement actually, but it brings it front and centre today. It’s also discovered extensive new lithium-bearing pegmatites towards the north end of the Central pegmatite target and potential new pegmatite corridors prospective for lithium have been confirmed. Two hot commods for the price of one at Morrissey – uranium and lithium.

Importantly, says Bastion, the field program discovered outcropping and subcropping pegmatites showing similar characteristics to other areas of the regional ‘Ti Tree’ shear zone where advanced lithium pegmatite projects are located.

Pioneer Lithium (ASX:PLN) will commence a targeted exploratory drill campaign on major radiometric anomalies at their Verde Valor project in the rare earth-rich state of Bahia, Brazil. The initial 300m exploratory auger drilling campaign will focus on strategically selected location.

Kuniko (ASX:KNI) says a sampling campaign has commenced at Norway’s NGU national drill core archive, aiming to assay ~3,000m of unsampled historic drill core from 12 drill holes for the Ertelien Nickel-Copper-Cobalt Project. The current program aims to sample disseminated sulphide zones that were not previously been sampled.

And .. job candidates’ vetting company, Xref (ASX:XF1), said its Board has decided to conduct a strategic review of its business following interest expressed by a number of parties regarding a potential acquisition of the company. The inquiries and discussions are still preliminary in nature and there is no certainty that a transaction will result from the strategic review. Xref’s long-term corporate adviser, TMT Partners, has been asked to advise on the management and evaluation of this potential acquisition interest.

Wednesday 22 May, 2024

Charger Metals (ASX:CHR), was up on news that the company has defined new lithium and niobium soil anomalies at the Lake Johnston project in WA, which the company is running as a JV with mining giant Rio Tinto (ASX:RIO). An infill soil-sampling program revealed further delineated surface lithium anomalies at the prospect, and these have been discovered defined near historic drill-holes that have previously logged pegmatite intersections with “elevated lithium values”. Meanwhile, the newly discovered niobium target is big – 1.8km by 1.7km.

Gibb River Diamonds (ASX:GIB) was also up, moving more than +50% on Tuesday’s news that the company has secured mining leases M04/475, M04/476 and M04/477 which are the three key licences at the heart of developing the Ellendale Diamond Project, 140km east of Derby in the West Kimberley region of Western Australia.

Silver explorer Mithril Resources (ASX:MTH) was reinstated to the market after hours last night, following a lengthy absence from trading as the company worked towards meeting ASX requirements required to lift a trading suspension.Mithril recently held an AGM to ratify its recent financing efforts, which raised ~A$5m, and a share consolidation, and hit the market floor running on Wednesday to jump as high as +50% in brisk trade.

Aeon Metals (ASX:AML) rose on some land access news that certainly will encourage it, and its shareholders. The traditional owners of the Walford Creek region, the Waanyi PBC and Waanyi People have agreed terms for a new Cultural Heritage Protection Agreement (CHPA). And what that allows for is Aeon to recommence activities at Walford Creek, with pen being put to paper on relevant documents and signed by the necessary people, imminent. Business is business – this comes after a year of negotiations, the results of which will now enable Aeon to drill into the Fish River Fault and its surrounds and carry out “ongoing project development”

The Canadian-focused lithium hunter, Fin Resources (ASX:FIN), jumped after some fresh drilling news.Specifically, eight diamond drill holes have now been successfully completed at its White Bear prospect within the broader Cancet West project in James Bay, Quebec. They’re holes. Tick. And they’ve been successfully drilled. Double tick. But more than this, we know, too, that the drilling intersected the White Bear pegmatite, which has been confirmed as spodumene bearing, based on geological observations and LIBS data. Five holes have interesected visual megacrystic spodumene up to 15cm in length.

NewPeak Metals (ASX:NPM) noted it’s scheduled an “extraordinary” general meeting for June 28. (Extra)ordinary matter no. 1 on the meeting’s itinerary? “The ratification of prior issue of 13,666,667 shares to Gerhard Redelinghuys and Tania Redelinghuys as trustee for Redelinghuys Super Fund, at an issue price of $0.015 pursuant to the Placement…” For further context, about this time last month, NewPeak completed a $300,000 share placement at 1.5c/sh to Gerhard Redelinghuys, who is the founder of former small cap success story Bowen Coking Coal (ASX:BCB).

LTR Pharma (ASX:LTP) was well up over +20% on no specific news.

And… MedAdvisor (ASX:MDR) jumped after providing guidance for the full year ending this June. Based on the strong start to Q4 FY24 and anticipated activity levels over the remainder of this quarter, the company expects to deliver positive revenue, EBITDA and NPAT for the full year. Revenue is set to come in between $120m-$123m, an all time record (versus $98m in the pcp) EBITDA is set to come in between $6.8m -$7.6m (versus loss of -$3m in the pcp) NPAT is set to come in between $0.5m -$0.8m, first ever profit for the firm, (versus loss of -$11.3m in the pcp).

Thursday 23 May, 2024

Strategic Energy Resources (ASX:SER) announced that it has raised $2m via placement to explore the Achilles 1 polymetallic prospect in the South Cobar Basin. The placement, done at a small 8.3% discount to the last traded price, is cornerstoned by Datt Capital and Lowell Resources Fund (ASX:LRT). The company notes that the funds raised will also be used to explore SER’s broader South Cobar Project along with advancing SER’s other exploration assets and general working capital. Another piece of news highlighted by the company is that Tony Gu, Datt Capital’s partner and head of research, has been appointed to the SER board as a non-executive director.

Niobium is having something of a moment this week, and RareX (ASX:REE) has acquired the district-scale Khaleesi project in WA’s Eastern Yilgarn region where historical drilling had returned elevated levels of niobium. It comes after the completion of successful $1.5m, internally brokered, capital raise. That news has pushed up the share price of the rare earths explorer/developer by an eye-catching 44% at time of writing. The acquisition has been dubbed the Khaleesi Project and is located along strike from the “highly endowed” Ponton Dyke deposit (most recently held by Galaxy Resources (ASX:GXY), since merged with Orocobre (ASX:ORE)), which has reportedly returned some of Australia’s best rare earth intersections – up to 28m at 10% total rare earth oxides (TREO) including 6m at 20.57% TREO.

Kalgoorlie Gold Mining (ASX:KAL) was up today on its fresh discovery of extensive, thick gold mineralisation and anomalism at its Wessex target at the Pinjin project, following the first pass aircore drill program. New intercepts include: 28m at 1.27g/t Au from 36m, and 12m at 1.17g/t Au from 52m. Pinjin is situated at the southern end of the Pinjin Goldfield and is about 140 km northeast of Kalgoorlie–Boulder.

Cazaly Resources (ASX:CAZ) was up on no news, but a hell of a lot of trading volume. Not sure entirely, or at all, actually, what’s going with CAZ today to back up this rise, however.

Strickland Metals (ASX:STK) is also enjoying gold’s glow today after drilling results – including a highlight 17m at 10.6g/t Au from 144.7m – at the Palomino prospect “exceeded expectations”. Palomino is a prospect at STK’s 100% owned Yandal Gold Project in WA. These latest assays have turned high grade at “significant width”, says the company, and in addition to the highlight above, results also included: 13.7m at 6.3g/t Au from 133.4m (incl 3m at 20g/t Au). Further Palomino assays are “due shortly”, along with IP survey results, notes the company, which remains very well funded with about $51.4m in cash at the time of writing.

Wisr (ASX:WZR) has secured a $50m facility from global financial services firm Nomura, which will accelerate the non-bank lender’s path to profitability. Wisr has maintained deliberate moderated loan volume settings in Q3 FY24 but intends to pivot to loan volume growth settings in Q4 FY24 and beyond. WZR says its margins are expanding with portfolio net interest margin (NIM) 5.24% in Q4 FY24, slightly up on pcp of 5.20%. Quarterly revenue was $23.1m, a 4% decrease on pcp, while EBITDA of $300k, was an improvement on pcp, which recorded a loss of $800k. The company’s quarterly net operating cash flow of $4.5m, was a 13% increase on pcp.

AFT Pharmaceuticals (ASX:AFP) has reported record profits and robust growth for the 12 months to March, driven by strong sales of over-the-counter medicines in Australasia and growing demand in international markets. Full-year operating revenue was up 25% to $195.4 million, driven by sales in International and Asian markets which grew by 70%. Record EBITDA of $26.2 million, up 22%, and NPAT increased 46% on pcp to $15.6 million.

Lefroy Exploration (ASX:LEX) announced the results from its Reverse Circulation (RC) drilling campaign targeting the Havelock and Lucky Strike gold targets, which commenced in April. Significant assays returned include: 5m @ 4.22g/t Au from 145m and 7m @ 2.04 g/t Au from 37m.

And… Sun Silver (ASX:SS1) is preparing to carry out drilling at its Maverick Springs project in Elko County, Nevada, with three local contractors tendering for the drill contract. The drilling will upgrade the classification of the current inferred resource of 292Moz at 72.4 g/t and test expansional opportunities.

Friday 24 May, 2024

Strategic Energy Resources (ASX:SER) was once again at the top of the small caps heap on Friday morning, building on the previous day’s news that the company has raised a cool $2 million to explore the Achilles 1 polymetallic prospect in the South Cobar Basin. The placement, done at a small 8.3% discount to the last traded price, is cornerstoned by Datt Capital and Lowell Resources Fund (ASX:LRT).

Appen (ASX:APX) rose after telling investors at the AGM that generative AI will have a significant impact on its total addressable market. Appen also said it was aiming for breakeven on an operating basis sometime in FY24.

Keypath Education (ASX:KED) was up thanks to a merger and delisting deal signed with Sterling Partners, with an offer of $0.87 cash per share on the table that the Keypath board has grabbed firmly with both hands – it’s an 88.3% premium to the 6-month volume weighted average price (‘VWAP’) of Keypath CDIs prior to the announcement being made.

Adherium (ASX:ADR) jumped on Friday morning, on news that drug behemoth AstraZeneca has selected the company’s Hailie Smartinhaler platform for a clinical trial, with the contract valued at $1.1 million over the course of three years.

Lending platform Propell Holdings (ASX:PHL) was up in early trade, clearly enjoying significantly increased deal volumes in April and May that has seen average loan size continue to grow, reaching $82k quarter-to-date – a 20% uplift on Q3.

Greenhy2 (ASX:H2G) moved sharply on Friday in the wake of an investor presentation from the Chairman and Managing Director in Sydney.

And Paterson Resources (ASX:PSL) got a shot in the arm on Friday after announcing the strategic sale of 100% of the issued capital of its wholly owned subsidiaries Burraga Copper, BC Exploration and Old Lloyds Mine – which bolt together like Voltron to form the basis of the Burraga Project in NSW.

Bubalus Resources (ASX:BUS) – the critical minerals-exploring junior – is faring rather fine-to-fantastic on Friday. The company has been given the go-ahead to kick off its maiden drilling at its Nolans East REE project in the Northern Territory. And that comes after receiving a key Heritage Authority Certificate. Nolans East is 15km from Arafura Resources’ (ASX:ARU) Nolans Bore project where Australia’s next REE mine and refinery are under construction with $840m in government funding support.

Bubalus has defined 22 drill-ready targets at Nolans East from a sampling program that returned more than 500 parts per million (ppm) total rare earth oxides (TREO) with a peak value of 2053ppm TREO.Notably, valuable neodymium-praseodymium (NdPr), which is used to manufacture permanent magnets for electric vehicles and wind turbines average 22% of that total REE content.

Paterson Resources (ASX:PSL) has decided to make a “strategic sale” of its Burraga copper-gold project in NSW – to a company called Octo Mining Burraga for the goodly amount of $2.85 million. Paterson’s focus will now turn to its Grace gold-copper project in WA instead, and these funds, once all due diligence is completed by Octo and pen is put to final paperwork, will be pushed towards advancing that operation. The Grace project and its surrounding exploration licences cover roughly 350km2 and are located 25km to the southeast of the 32 Moz gold and 1mt copper Telfer gold copper mine – owned by big gun miner Newcrest Mining.

Gold Mountain (ASX:GMN) was up on no news. The gold price has taken a bit of a dip today, but there are still some golden gains being made by minnow goldies on the bourse. This one is at least sporting some high trading volume at the time of writing and a 33% gain. Not sure what’s up with that, but we can at least tell you that the company seems excited about its Wabag project over in Papua New Guinea. Earlier this month, GMN announced it had undertaken a “major review” of the project, gaining new insights into its promising porphyry systems.

Drug behemoth AstraZeneca selected Adherium’s (ASX:ADR) Hailie Smartinhaler platform for a clinical trial. This contract is valued at $1.1m over the course of three years, ADR says.

Nanoveu (ASX:NVU) and Chinese manufacturing partner Fulland entered into a joint venture for the exclusive manufacturing and marketing of 3D technologies.

Lending platform Propell Holdings (ASX:PHL) is enjoying significantly increased deal volumes in April and May. Average loan size continues to grow reaching $82k quarter-to-date – a 20% uplift on Q3.

Althea Group (ASX:AGH) announce that its wholly-owned subsidiary, Peak Processing, has signed a binding JV deal in the US with Flora Growth (NASDAQ:FLGC) to enter the thriving legal hemp derived delta-9-THC cannabis-infused beverages market. The US cannabis beverages market is valued at US$966.92 million in 2024, and projected to reach US$19.06 billion by 2028.

Oceania Healthcare (ASX:OCA) advised that Suzanne Dvorak has today been appointed as Chief Executive Officer. Dvorak has been in the Australian aged care and retirement living sectors for the past decade, which included leading the single largest residential aged care provider in Australia. She has most recently been an external advisor at Bain & Company in Melbourne.

And, PlaySide Studios (ASX:PLY) and Warner Bros have announced the development of a new “Game of Thrones” real time strategy game for the PC. Featuring multiple game modes, fans will be able to play on their own, team up with friends or engage in multiplayer skirmishes.

IPOs that happened

Nuthin’ happening around here. But that’s okay. It’s Friday arvo… go home.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.