ASX Small Caps and IPO Weekly Wrap: Momma always told me ‘invest in real estate and gold’

Pic via Getty Images.

- Falling ASX 200 eyes hard-fought gain this week

- This was a great week to have your money in Real Estate and gold

- Who won the Small Caps race? Read on to find out…

It’s Friday afternoon again, and with the sun setting on another week on the ASX, it’s time to take a rapid look back at what went down for our beloved Small Caps, and the market in general.

This week has seen some profound movement among certain sectors, with the InfoTech sector the most broadly affected by pressures coming from Wall Street, where the quantity of love for Big Tech has been variable, at best.

The market, of course, has a lot of moving parts and there’s rarely ever one, single reason for anything that happens to a broad sector of shares – but, this week, there’s been a lot of newspaper ink (virtual or otherwise) sprayed about the place, covering the major market-shaking events of one man’s life.

And, as much as it pains me to do this… it’s Donald Trump.

Leaving politics at the door, and acknowledging that he’s actually incredibly lucky to be alive, Trump’s outsize influence on the market was on full display this week.

Even before he accepted the Republican nomination and formalised his latest run at the White House, Trump’s comments to potential voters spooked a lot of the horses that have been pulling the US tech sector to ever-increasing heights in recent weeks.

The Nasdaq had been on quite the run, with a string of all-time highs under its belt, and playing host to the biggest companies on the planet, including Nvidia and Apple and Meta and the rest of the so-called Magnificent Seven.

However, support for that sector has all but evaporated in the latter stages of this week, with US investors growing increasingly nervy about Trump’s often breathless rhetoric around his apparent desire to out China to the economic sword at the first, and every subsequent, opportunity he gets.

The talks of enormous, market shattering tariffs on everything that even smells a little bit like China could well be taken as pre-election bluster and posturing – but the US intention to suppress China’s march on the top of the technology hill is not exactly a secret.

Current president Joe Biden’s recent pitch to the sector, which included some very restrictive policy decisions (which he says are about national security, but most of the rest of us can spot a protectionist power play like that from 100 yards away) have put significant pressure on Big Tech in the US.

And that, it appears, has had a knock on effect on not just Aussie tech stocks, but our entire market as a whole that has any sort of exposure to US tech, be it stablemate stocks or our primary producers a little earlier in the food chain.

The end result is an ASX that could probably have enjoyed another week or two of bumper gains right across the board.

Instead, we got what we got: a mediocre rise for the benchmark, against a Materials sector that lost about 1.5% for the week, and a tech sector that did twice as bad.

It’s going to be a fascinating couple of months watching the market try to predict the politics of two men who have spent this week proving to be anything but predictable with their words and actions.

Strap in. The road to November is going to be a bumpy one.

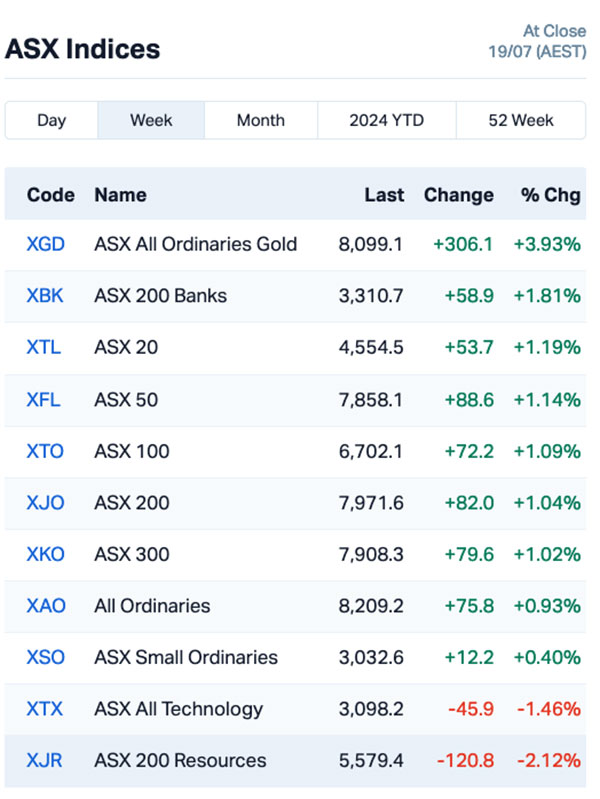

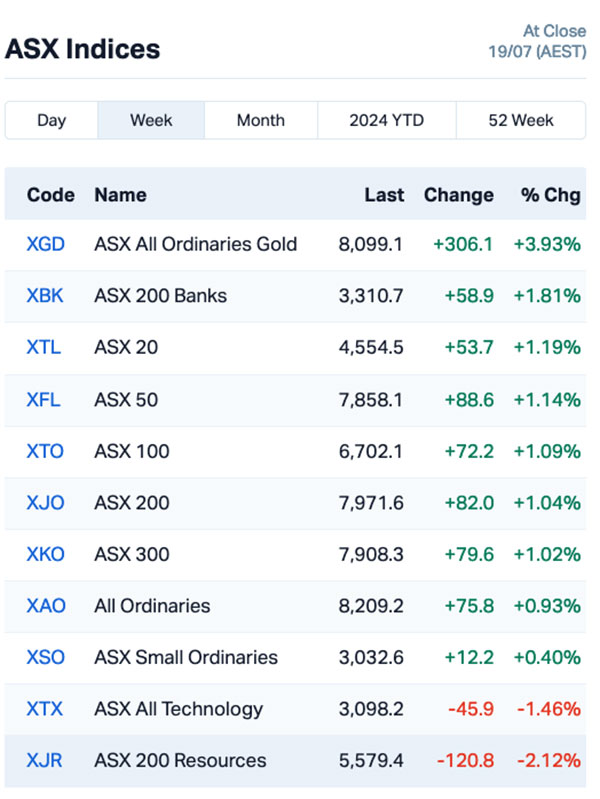

WHAT THE SECTORS DID

Here’s what the market sectors did:

Real Estate was the big winner this week, thanks to some solid movement for the nation’s retail space operators and despite a fairly broad sell-off throughout the session on Friday.

Stockland (ASX:SGP) in particular did well, up 3.4% for the week, Vicinity Centres (ASX:VCX) cranked out a 2.2% jump but it was Mirvac (ASX:MGR) that really shone bright, up 6.2% this week to a monthly gain of 9.9%.

Consumer Discretionary was helped into second place by its big players, with the gambling industry enjoying a sunny start to the week through Aristocrat Leisure (ASX:ALL) and The Lottery Corporation (ASX:TLC), which closed out the week on +2.2% and +1.2% respectively.

But hammered hard this week were the Materials players, with the likes of Rio Tinto (ASX:RIO) losing 4.8% and BHP (ASX:BHP) dropping 4.0%.

Even worse off were the Aussie tech stocks, at the mercy of a broad selloff in Big US Tech in the latter stages of the week, which put significant downward pressure on our homegrown techies.

A look at the ASX indices tells us a now-familiar story: the goldies were once again shining bright by the close of business on Friday, up close to 4.0% for the week and well out in front of the pack – despite a furious sell-off to end the week, which saw the XGD All Ords Gold index falter 2.0% on the nose in a single session.

THIS WEEK’S ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| MSG | MCS Services | 0.004 | 300% | $594,299 |

| CSX | Cleanspace Holdings | 0.59 | 136% | $23,594,721 |

| DGR | DGR Global Ltd | 0.023 | 130% | $24,004,950 |

| LRL | Labyrinth Resources | 0.011 | 120% | $16,625,612 |

| KLI | Killi Resources | 0.1625 | 87% | $16,230,205 |

| NSM | Northstaw | 0.02 | 82% | $2,797,516 |

| PKO | Peako Limited | 0.004 | 73% | $2,846,152 |

| AUK | Aumake Limited | 0.005 | 67% | $5,743,220 |

| SIS | Simble Solutions | 0.005 | 67% | $2,260,352 |

| M2R | Miramar | 0.0115 | 64% | $2,566,067 |

| SNS | Sensen Networks Ltd | 0.034 | 62% | $28,782,623 |

| MMM | Marley Spoon Se | 0.03 | 58% | $2,119,039 |

| LM1 | Leeuwin Metals Ltd | 0.082 | 52% | $3,513,875 |

| AUH | Austchina Holdings | 0.003 | 50% | $6,301,151 |

| MCT | Metalicity Limited | 0.003 | 50% | $8,971,705 |

| SIT | Site Group Int Ltd | 0.003 | 50% | $7,807,471 |

| CY5 | Cygnus Metals Ltd | 0.063 | 47% | $17,601,548 |

| FEG | Far East Gold | 0.17 | 42% | $50,229,433 |

| AI1 | Adisyn Ltd | 0.038 | 41% | $7,775,544 |

| SKS | SKS Tech Group Ltd | 1.585 | 38% | $178,878,968 |

| OLH | Oldfields Holdings | 0.069 | 38% | $11,186,333 |

| ADN | Andromeda Metals Ltd | 0.022 | 38% | $71,536,231 |

| SRJ | SRJ Technologies | 0.096 | 37% | $14,973,677 |

| MLM | Metallica Minerals | 0.03 | 36% | $29,757,642 |

| MDI | Middle Island Res | 0.019 | 36% | $3,703,518 |

| OSL | Oncosil Medical | 0.0095 | 36% | $30,584,786 |

| MXO | Motio Ltd | 0.023 | 35% | $6,168,562 |

| JNO | Juno | 0.031 | 35% | $5,640,303 |

| 3DP | Pointerra Limited | 0.063 | 34% | $53,135,069 |

| BCT | Bluechiip Limited | 0.006 | 33% | $5,910,198 |

| DOU | Douugh Limited | 0.004 | 33% | $4,328,276 |

| HCD | Hydrocarbon Dynamic | 0.004 | 33% | $2,830,038 |

| INP | Incentiapay Ltd | 0.004 | 33% | $4,975,720 |

| RWD | Reward Minerals Ltd | 0.06 | 33% | $12,987,629 |

| SKN | Skin Elements Ltd | 0.004 | 33% | $2,357,944 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| TIG | Tigers Realm Coal | 0.004 | 33% | $52,266,809 |

| ASE | Astute Metals NL | 0.037 | 32% | $15,689,115 |

| FAL | Falcon Metals | 0.35 | 32% | $61,065,000 |

| TTT | Titomic Limited | 0.165 | 32% | $166,811,390 |

| FG1 | Flynngold | 0.034 | 31% | $6,618,162 |

| KNB | Koonenberry Gold | 0.017 | 31% | $4,892,387 |

| ASQ | Australian Silica | 0.026 | 30% | $7,046,509 |

| NXS | Next Science Limited | 0.29 | 29% | $81,674,629 |

| SNX | Sierra Nevada Gold | 0.042 | 27% | $3,818,217 |

| CMO | Cosmo Metals | 0.057 | 27% | $7,304,920 |

| DXB | Dimerix Ltd | 0.57 | 27% | $288,862,958 |

| DEL | Delorean Corporation | 0.043 | 26% | $9,275,999 |

| RAU | Resouro Strategic | 0.55 | 26% | $17,310,490 |

| BCK | Brockman Mining Ltd | 0.024 | 26% | $222,725,571 |

Super quickly, here’s how the Small Cap winners ended up where they were on the ladder.

MCS Services (ASX:MSG) s topped the ladder with an impressive-looking 300% jump. However, not even the WA-based uniformed security and traffic management services providor could come up with a reason why, even when the ASX issued a speeding ticket and demanded an explanation.

Sydney-based designer and manufacturer of respiratory protection equipment Cleanspace (ASX:CSX) was second best for the week, and managed it without so much as a blip on the radar before today.

Again, the ASX asked the hard question and put the stock into a Trading Halt, and again the company came back with a rock-solid “we don’t know either” – but it did point to its results announcement from three days ago, which looked pretty decent.

Sales are up 30% versus PCP to $15.3 (unaudited) millions – but as for why it took the market three days to notice that and send CSX flying up the ladder today is anyone’s guess.

And in third, DGR Global (ASX:DGR) l had a cracker of a week and climbing 130%, all thanks to its 6.8% stake in the once Aussie but now London/Canada-listed miner, SolGold – the latter of which revealed that is has been handed a US$750m cash injection for the development of its mega Cascabel copper-gold project in Ecuador.

THIS WEEK’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| JTL | Jayex Technology Ltd | 0.001 | -50% | $281,279 |

| HT8 | Harris Technology Gl | 0.01 | -38% | $2,991,355 |

| PTL | Prestal Holdings Ltd | 0.105 | -36% | $17,898,247 |

| EWC | Energy World Corporation | 0.009 | -36% | $27,710,291 |

| TM1 | Terra Metals Limited | 0.068 | -35% | $25,142,130 |

| 1TT | Thrive Tribe Tech | 0.002 | -33% | $941,243 |

| AUG | Augustus Minerals | 0.062 | -33% | $5,122,200 |

| AYM | Australia United Min | 0.002 | -33% | $3,685,155 |

| BEZ | Besragoldinc | 0.066 | -33% | $27,594,660 |

| GCM | Green Critical Min | 0.003 | -33% | $4,159,755 |

| RML | Resolution Minerals | 0.002 | -33% | $3,220,044 |

| RNE | Renu Energy Ltd | 0.004 | -33% | $3,267,603 |

| ITM | Itech Minerals Ltd | 0.074 | -33% | $9,171,267 |

| CAQ | CAQ Holdings Ltd | 0.011 | -31% | $8,613,435 |

| FFF | Forbidden Foods | 0.009 | -31% | $2,499,458 |

| ACP | Audalia Res Ltd | 0.014 | -30% | $13,150,588 |

| AGH | Althea Group | 0.021 | -30% | $10,133,311 |

| AX8 | Accelerate Resources | 0.015 | -29% | $8,690,555 |

| BNL | Blue Star Helium Ltd | 0.005 | -29% | $11,669,312 |

| NOV | Novatti Group Ltd | 0.055 | -29% | $19,210,524 |

| OVT | Ovanti Limited | 0.005 | -29% | $4,960,422 |

| TYX | Tyranna Res Ltd | 0.005 | -29% | $19,727,552 |

| ESK | Etherstack PLC | 0.12 | -27% | $15,823,066 |

| PAM | Pan Asia Metals | 0.08 | -27% | $16,696,651 |

| GTG | Genetic Technologies | 0.05 | -26% | $7,270,862 |

| TGM | Theta Gold Mines Ltd | 0.13 | -26% | $92,500,179 |

| ENR | Encounter Resources | 0.63 | -25% | $297,546,516 |

| AD1 | AD1 Holdings Limited | 0.006 | -25% | $5,391,890 |

| ADG | Adelong Gold Limited | 0.0045 | -25% | $4,471,956 |

| BP8 | BPH Global Ltd | 0.003 | -25% | $1,189,924 |

| CTN | Catalina Resources | 0.003 | -25% | $3,715,461 |

| ENT | Enterprise Metals | 0.003 | -25% | $2,654,163 |

| FHS | Freehill Mining Ltd | 0.006 | -25% | $17,999,067 |

| JAV | Javelin Minerals Ltd | 0.0015 | -25% | $4,688,164 |

| MHC | Manhattan Corp Ltd | 0.0015 | -25% | $4,405,470 |

| RIE | Riedel Resources Ltd | 0.0015 | -25% | $3,335,753 |

| TKL | Traka Resources | 0.0015 | -25% | $2,625,988 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| YAR | Yari Minerals Ltd | 0.003 | -25% | $1,447,073 |

| LGM | Legacy Minerals | 0.25 | -24% | $24,781,924 |

| S66 | Star Combo | 0.11 | -24% | $14,859,128 |

| ATV | Activeportgroupltd | 0.038 | -24% | $12,717,661 |

| C7A | Clara Resources | 0.013 | -24% | $2,601,807 |

| LPM | Lithium Plus | 0.115 | -23% | $16,542,500 |

| MOV | Move Logistics Group | 0.23 | -23% | $26,768,580 |

| WMG | Western Mines | 0.24 | -23% | $20,225,269 |

| LM8 | Lunnon Metals | 0.155 | -23% | $33,765,722 |

| CYM | Cyprium Metals Ltd | 0.038 | -22% | $57,986,568 |

| NUC | Nuchev Limited | 0.21 | -22% | $30,731,254 |

| LIC | Lifestyle Communities | 9.61 | -22% | $1,345,227,597 |

HOW THE WEEK SHOOK OUT

Monday 15 July, 2024

Aldoro Resources (ASX:ARN) reportedfresh metallurgical test work has returned open cycle niobium recovery level of 62.4% “on a selected Kameelburg sample”. Those are numbers in line with recovery levels by developing mining explorers and producers in the global niobium space. Good news.

ARN says the processes resulted in an upgrade of the head feed of 0.74% Nb2O5 to 5.5% Nb2O5, “a multiple of 10.6 times with a 62.4% recovery rate of Nb2O5.” The digger says recovery rate and upgrade values are considered encouraging in the initial test phase.

Metalicity (ASX:MCT) was out at the Yundamindra Gold Project, located 65 kms south east of Leonora and 65 kms east of Kookynie where assays from the recent RC drilling programme have been returned with multiple impressive gold intersections and high grades. Significant intercepts include: [email protected]/tAu from 28m, and [email protected]/t Au.

Adisyn (ASX:AI1) reported that it’s gone in for a binding collaboration agreement with 2D Generaton Ltd – is a global semiconductor IP business incorporated in Israel with close ties to – among others – NVIDIA.

The lithium hunter Dynamic Metals (ASX:DYM) farm-out JV of Widgiemooltha with Mineral Resources (ASX:MIN) started to bear fruit after pre-conditions were satisfied and the latter coughed up a $4m payment.

The deal, etched in March, gives MIN a 40% share in the lithium rights of the project (after a further $1m payment next year), which will bump up to 65% as long as it spends $15m on exploration within the next four years.

IT firm Attura (ASX:ATA) was rising as well after agreement to acquire Exent Holdings for $6mn in upfront consideration with earn-out/post-completion consideration of up to $2mn cash. ATA says it’s a strategically aligned acquisition which helps to extend ATA’s advisory and consulting network.

ATA also says FY24 revenue is expected to exceed $240 million, a 35% increase from the previous year. The company anticipates an underlying EBITDA of $25-$26 million, up 19% on pcp.

And finally, the local penny stock Middle Island Resources (ASX:MDI) announced on Friday a massive leg up from NT government – circa $300,000 for a drilling collab at its Barkly IOCG project near Tennant Creek.

Three diamond holes are being funded at the Wilma, Pebbles and Dino prospects which are targeted for copper, gold and base metals mineralisation from analysing geophysical data back in April.

Tuesday 16 July 2024

MCS Services (ASX:MSG) , went off on Tuesday morning and was up by some 300% by 11am. MSG provides uniformed security and traffic management services in Western Australia and – that’s about all the info we have at the moment, as the company has since gone into a trading halt to prep a reply to an ASX query.

Resources company creator DGR Global (ASX:DGR) was flying high very early on Wednesday, on news of SolGold’s monster US$750m cash injection for the development of its mega Cascabel copper-gold project in Ecuador. DGR has a 6.8% stake in the once Aussie but now London/Canada-listed miner.

Zelira Therapeutics (ASX:ZLD) this morning confirmed it’s secured patents for HOPE 1 and HOPE 2 formulations from the Ausssie Government’s Commission of Patents and the US Patent and Trademark Office (USPTO).

These are never easy and the purveyor of clinically validated cannabis therapies and meds says the patents cover drugs that are designed to treat cluster symptoms associated with Autism Spectrum Disorder (ASD), with the company saying “the broad patents fortify Zelira’s competitive edge in the central nervous system (CNS) therapeutic space and significantly enhance its patent portfolio.”

Now. Up a lazy 25% is Far East Gold (ASX:FEG) which just installed Aussie legend Justin Werner as its chairman… and also revealed the acquisition of a potentially multi-million-ounce gold project in Indonesia.

But take a bow Chairman Werner, who knows Indo like the back of his hand having been involved in the country’s mining industry for more than two decades. He’s been a non-executive director with FEG since its inception, and has been the MD of global top-10 nickel producer, Nickel Industries (ASX:NIC) since March 2008.

Meanwhile, FEG just signed a binding agreement with PT Iriana Mutiara Idenburg for exclusive rights to explore, develop, and operate the Idenburg Gold Project in Indonesia’s Papua Province.

The Idenburg project covers 95,280 hectares (952.8km2) and is known for high-grade lode gold occurrences characteristic of orogenic gold systems – similar to areas such as the 60Moz-plus Kalgoorlie Goldfields and the Mother Lode district of California.

It’s a region when combined with Papua New Guinea that hosts several multi-million-ounce gold and copper deposits including the world class Grasberg (+70Moz Au), where Werner once worked as a turnaround consultant, Porgera (+7Moz Au), Frieda River (20Moz Au) and Ok Tedi (20Moz Au).

And Titomic (ASX:TTT) has risen today on news that it has hired a seasoned US Defence industry exec Dr Patricia Dare, a former Boeing and Lockheed exec and is on board to further push Titomic into the US Defence sector following some cracking recent contract wins.

Finally, there’s even more momentum than there was at the open and at lunch for ambitious little tech stock Adisyn (ASX:AI1). On Monday AI1 signed a binding thingy with 2D Generation, which is a global semiconductor IP business incorporated in Israel and which is reportedly pretty tight with Nvidia, with AI1 reporting the partnership aims to “generate transformational opportunities in the AI space”.

Wednesday 17 July, 2024

Labyrinth Resources (ASX:LRL), was the big little winner on Wednesday, after entering a 12-month option to acquire the remaining 49% of its Comet Vale gold project from Sand Queen Gold Mines for a cool $3m cash.

Comet Vale, 32km south of Menzies, is currently endowed with a resource of 96,000oz at 4.8g/t gold. It’s also snapping up the Vivien gold project by acquiring private company Distilled, whereby its vendors Alex Hewlett and Kelvin Flynn are expected to emerge with 12.3% and 10.2% voting power in LRL once transactions are finalised.

Vivien was famously mined by WA gold success story Ramelius Resources (ASX:RMS), generating $130m in net cash flow on a $10m purchase from Gold Fields.

It gives previously Canada-focused Labyrinth more exposure in the Goldfields and is part of its strategy to build ounces by consolidating and growing underexplored high-grade mines around the Menzies, Leinster and Leonora corridor.

And ahead by 40% is the local biotech with a penchant for targeting neurodegenerative diseases, Alterity Therapeutics (ASX:ATH), which climbed on positive interim data from the ATH434-202 open-label Phase 2 clinical trial in patients with multiple system atrophy (MSA), which has been shown to pre-clinically reduce α-synuclein pathology and preserve neuronal function by restoring normal iron balance in the brain. This is good news… trust me, I’m not a doctor.

Step One Clothing (ASX:STP), dropped a handsome uptick to forward guidance, which says – subject to final audit – the company now expects its FY24 financial results to be $84 million in FY24 revenue (vs FY23 $65 million), that’s circa 30% growth on the prior corresponding period (pcp), with $17 million in FY24 EBITDA (vs FY23 $12 million), an over 42% bump on pcp.

Titomic (ASX:TTT) continued to rise a day after the announcement it’d hired seasoned US Defence industry executive, Dr Patricia Dare. Dr Dare, (rumoured to be former Marvel villain now using her powers for good), and former Boeing and Lockheed executive is on board to further push TTT into the US Defence sector following its cracking headway into that lucrative sector on the top of recent contract wins.

And Andromeda Metals (ASX:ADN) was up, thanks to news of a binding with Traxys Europe for the sale and purchase of Andromeda’s kaolin products for the first 5 years of production, which the company says has helped it to meet the required support needed for its expanded Stage 1A+ production and further progress towards a final investment decision.

AusQuest (ASX:AQD) is up good this arvo after kicking off a detailed VTEM survey ( half paid for by the WA Government via its “Co-Funded Geophysics Program”) over itsMt Davis Base Metal Project, in WA’s Earaheedy Basin.

Acquired following the discovery by Rumble Resources (ASX:RTR) of extensive lead, zinc and copper mineralisation at the Chinook Prospect on the southern side of the Earaheedy Basin, MD Graeme Drew says detailed magnetics for the Mt Davis Project provide “strong evidence for the presence of either structurally disjointed Frere Iron Formation or extensive thick mafic intrusions, or both.”

Thursday 18 July, 2024

Dusk Group (ASX:DSK) reported sales surged during the last five weeks of the fiscal year following a website relaunch and a bunch of strategic initiatives which appear to have paid off. 2H24 total sales were 5.8% lower on pcp, compared to a fall of 9.7% in 1H FY24.

The fragrance trader says sales run rate numbers continued to improve with unaudited sales growth of 0.4% vs the same time last year.

Meanwhile, Noronex (ASX:NRX) rose on news it entered into an Earn-in Agreement and Strategic Alliance with a wholly-owned subsidiary of South32 Ltd (South32) to accelerate copper exploration in Namibia.

The agreement means South32 has committed to fund A$15 million of exploration expenditure over five years at Noronex’s Humpback-Damara Project in Namibia, giving South32 the right to subscribe for a 60% interest in Noronex’s wholly owned subsidiary Noronex Exploration and Mining Company.

Miramar Resources (ASX:M2R), was up on news that it’s clocked up to 5.48% copper, 54.5% lead and 73.48g/t silver following the initial sampling program at its new Chain Pool project in the Gascoyne part of WA.

M2R executive chairman Allan Kelly reckons the Gascoyne region projects have the potential for all sorts of commodities but no-one’s had a really good look yet.

“For example, there has not been any modern and/or systematic exploration or drilling at the Joy Helen Prospect despite the presence of high-grade base metal mineralisation,” he said.

Macro Metals (ASX:M4M) which owns a portfolio of multiple iron ore projects situated within the well-established Pilbara and Midwest regions of WA says a field team at Goldsworthy East has completed a mapping and sampling program, 100km east of Port Hedland, while they were on site demarking the area to be covered by the heritage survey, which completed today.

Arizona Lithium (ASX:AZL) has announced that it has been conditionally approved for an investment incentive of up to $21.6m under the Saskatchewan government’s Oil & Gas Processing Investment Incentive Program. The funds are provided as transferable royalty credits, and can be claimed at a rate of 20% in the first calendar year of operations, 30% in the second calendar year, and 50% in the third calendar year against government royalties.

Easing off in the arvo, but still up was One Click Group (ASX:1CG) after the company hit the milestone of 150,000 users, with that figure representing a significant 57% up on the same time last year.

1CG says it has seen a major uptick in users through the start of this year’s tax season, with around 1,000 users per day signing up for its One Click Life fintech platform.

Friday 19 July, 2024

As mentioned earlier, Cleanspace cranked out a big win and copped a speeding ticket today, all off the back of a 3-day-old sales and revenue update. The company has told the ASX that might be the explanation for the movement.

Flynn Gold (ASX:FG1) was an early leader on Friday morning after delivering news of a new high-grade gold discovery in Northeastern Tasmania, at the company’s Golden Ridge project. Drilling has revealed a gold vein zone in trenching 250m north of the Trafalgar mine, with 17 out of 36 grab rock chip samples assayed at over 10g/t Au, including 99.4g/t Au, 76.6g/t Au and 67.1g/t Au.

Metalicity (ASX:MCT) was up on news that it’s appointed Argonaut PCF to seek indicative offers for its Admiral Bay Zinc Project, located in the Canning Basin, Kimberley Region of Western Australia, which the company says “hosts one of the largest zinc resources in the world, based on existing JORC 2012 compliant mineral resource (170mt @ 7.5% Zn eq)”.

Mayfield Group Holdings (ASX:MYG) climbed quickly at the opening bell on news of some boardroom largesse for shareholders. The company has declared a fully franked final dividend of $0.02 per share for the fiscal year ending on 30 June 2024, which is double the divvy the company paid out this time last year.

And Riversgold (ASX:RGL) dropped an investor presentation this morning that has done something fitting the company name, the price moving more than 7.6%, which isn’t terrible considering the rest of the market’s mood today.

IPOs that did happen

Ordell Minerals (ASX:ORD)

Listing Date: 19 July, 2024

IPO: $6 million at $2.00 per share

Market newbie Ordell made its debut on the ASX this morning, following a successful IPO that raised $6 million at $2.00 a pop, off the back of its priority drill ready Barimaia JV located next door to Ramelius at Mt Magnetic and the early stage Goodia Project in the southern Yilgarn that is just south of Develop’s Dome North project along with the Fisher South project that is along strike from Emerald Resources’ North Laverton Project.

It didn’t go well, and the latest numbers have it opening the day at a smidge over 10% of its $2.00 IPO price, and closing at around that same price to bank an 89.5% fall. There’s sure to be more news on what it all means next week.

IPOs that didn’t happen yet

Piche Resources (ASX:PR2)

Proposed Listing: 15 July, 2024

IPO: $10 million at $0.10 per share

Blinklab describes itself as a mineral exploration company with multiple, drill ready uranium projects with the potential to host tier 1 mineral deposits.

The IPO, as listed, will be managed by Euroz Hartleys (Lead Manager).

And that’s it from the newsroom for this week. Join us again next week, when all this will happen again, and I’ll be here to cover it all, unless my prayers are answered and I die in my sleep.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.