ASX Small Caps and IPO Weekly Wrap: Local markets have weathered the storm of global conflict and US data

Stroke... Stroke... Stroke... I think I'm having a Stroke... Stroke... Pic via Getty Images.

- Not a bad week for the ASX 200, up 1.8% for the week by the end of play Friday

- Health giant CSL heaved its considerable bulk to hold the market back

- Fin Resources won the week, after finding lithium pretty much where it expected to

Given the upheavals taking place around the world this week, the ASX has performed rather well, thanks in no small part to a surging gold price brought about by a desperate rush for safe haven, now that things have kicked off again in the Middle East.

It proved to be hard yards for a few of the other Israeli companies that are listed on the ASX at present, including a very difficult 10.5% slump for HeraMED (ASX:HMD) and a 13.3% fall for Way2VAT (ASX:W2V) .

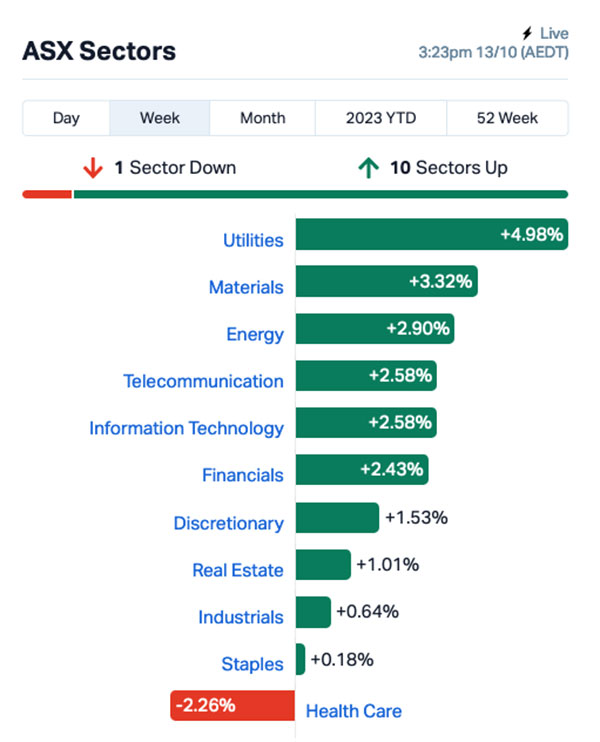

But overall, the market has behaved itself and turned in a decent showing – here’s what it looked like from a sector breakdown perspective.

As you’d expect in the face of global turmoil (above and beyond the usual pearl-clutching and hand-wringing over US CPI and jobs data), Utilities, Energy and Materials all did rather well, as oil and gold prices surged.

In fact, as the chart above shows, it was only really Health Care that shat the bed this week – and that can pretty much be directly attributed to CSL (ASX:CSL), which gave the bourse a collective heart attack with a dive for the basement that was as sudden as it was costly.

CSL is set to end the week down nearly 3.0%, which doesn’t sound like a horror show until you remember that it’s worth more than the rest of the Health Care sector combined – making it about as serious an anchor on the segment as you could possibly imagine.

While there’s no direct cause for the slump, theories about it abound, including news that major competitor Novo Nordisk’s Amazing Cure for Everything™ (aka Ozempic) could actually turn out to be useful in the fight against chronic kidney disease, as well as being excellent for diabetics and even more excellent for soccer mums who are struggling to fir into this season’s Lulu Lemons.

This week, CSL dove through a four-year low, and has been falling sharply since mid-June, when the company blamed “foreign currency headwinds” for a blowout – and it’s only today’s 1.6% rally that is keeping the Health Care sector off life support altogether.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks from 09-13 October:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| FIN | FIN Resources Ltd | 0.023 | 109% | $11,799,672 |

| ZAG | Zuleika Gold Ltd | 0.02 | 82% | $9,414,911 |

| KRR | King River Resources | 0.017 | 70% | $24,856,399 |

| DDT | DataDot Technology | 0.005 | 67% | $4,843,811 |

| PIL | Peppermint Inv Ltd | 0.014 | 56% | $28,529,996 |

| FGR | First Graphene Ltd | 0.105 | 50% | $64,984,167 |

| CCE | Carnegie Cln Energy | 0.0015 | 50% | $31,285,147 |

| MOB | Mobilicom Ltd | 0.009 | 50% | $13,266,767 |

| TG1 | Techgen Metals Ltd | 0.03 | 50% | $1,929,207 |

| MAUCA | Magnetic Resources | 0.4 | 48% | $8,167,545 |

| IPB | IPB Petroleum Ltd | 0.016 | 45% | $7,346,592 |

| STK | Strickland Metals | 0.1025 | 39% | $144,066,690 |

| MGT | Magnetite Mines | 0.395 | 34% | $24,948,641 |

| AXP | AXP Energy Ltd | 0.002 | 33% | $11,649,361 |

| HOR | Horseshoe Metals Ltd | 0.012 | 33% | $5,147,829 |

| MOH | Moho Resources | 0.008 | 33% | $2,720,355 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| ABY | Adore Beauty | 0.97 | 32% | $82,168,951 |

| BIT | Biotron Limited | 0.1 | 32% | $82,089,157 |

| AX8 | Accelerate Resources | 0.03 | 30% | $13,980,066 |

| PL3 | Patagonia Lithium | 0.15 | 30% | $7,350,525 |

| 5EA | 5Eadvanced | 0.455 | 30% | $155,337,677 |

| SPX | Spenda Limited | 0.013 | 30% | $47,804,024 |

| BPH | BPH Energy Ltd | 0.026 | 30% | $26,541,824 |

| NGL | Nightingale Intel | 0.065 | 30% | $6,638,386 |

| CRS | Caprice Resources | 0.04 | 29% | $4,670,277 |

| CZR | CZR Resources Ltd | 0.18 | 29% | $42,432,236 |

| NGY | Nuenergy Gas Ltd | 0.032 | 28% | $47,390,576 |

| VN8 | Vonex Limited. | 0.019 | 27% | $7,960,230 |

| CMD | Cassius Mining Ltd | 0.039 | 26% | $21,359,313 |

| AMD | Arrow Minerals | 0.0025 | 25% | $7,559,413 |

| LNU | Linius Tech Limited | 0.0025 | 25% | $10,574,477 |

| MTL | Mantle Minerals Ltd | 0.0025 | 25% | $15,368,615 |

| TOY | Toys R Us | 0.015 | 25% | $11,997,935 |

| AMA | AMA Group Limited | 0.046 | 24% | $81,525,758 |

| LPI | Lithium Pwr Int Ltd | 0.435 | 24% | $261,133,587 |

| A11 | Atlantic Lithium | 0.52 | 24% | $296,937,205 |

| AIS | Aeris Resources Ltd | 0.21 | 24% | $148,553,303 |

| JAT | Jatcorp Limited | 0.37 | 23% | $30,808,574 |

| CCA | Change Financial Ltd | 0.069 | 23% | $43,308,636 |

| BUY | Bounty Oil & Gas NL | 0.008 | 23% | $10,278,757 |

| M2M | Mtmalcolmminesnl | 0.032 | 23% | $3,274,992 |

| SER | Strategic Energy | 0.016 | 23% | $8,258,857 |

| HIO | Hawsons Iron Ltd | 0.059 | 23% | $52,387,050 |

| CTQ | Careteq Limited | 0.027 | 23% | $5,997,318 |

| PGY | Pilot Energy Ltd | 0.027 | 23% | $28,014,055 |

| FEG | Far East Gold | 0.19 | 23% | $34,315,180 |

| GT1 | Greentechnology | 0.495 | 22% | $100,099,436 |

| NHE | Nobleheliumlimited | 0.22 | 22% | $50,383,993 |

| RVS | Revasum | 0.165 | 22% | $19,064,998 |

The standout performer for the week was undoubtedly Fin Resources (ASX:FIN) , up handsomely thanks to some welcome news from the company’s maiden fieldwork program at Cancet West in James Bay, Canada.

The news is simple enough: the company’s had a solid look around the site, and identified “abundant spodumene crystals within a broad pegmatite outcrop” – which is music to the ears and eyes of anyone looking to get into the lithium game.

Mobilicom (ASX:MOB) has had a geopolitics-defying week, considering the massive upheavals in its home nation of Israel.

Despite the unfolding horrors there, the company still managed to put on around 67% for the week.

Zuleika Gold (ASX:ZAG) rounds out the top three performers for the week, up around 64% on news that super-investor Mark Creasy sunk $3 million into a subscription cash deal with Zuleika, via Yandal Investments.

All of those are covered in more detail down below, so do read on…

ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks from 18-22 September:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| PUA | Peak Minerals Ltd | 0.003 | -40% | $3,644,818 |

| RHY | Rhythm Biosciences | 0.195 | -39% | $40,911,379 |

| MHC | Manhattan Corp Ltd | 0.004 | -38% | $11,747,919 |

| KZA | Kazia Therapeutics | 0.099 | -38% | $25,998,431 |

| VTI | Vision Tech Inc | 0.26 | -35% | $7,589,138 |

| TMB | Tambourahmetals | 0.11 | -35% | $10,782,246 |

| VMT | Vmoto Limited | 0.15 | -33% | $47,889,648 |

| KNM | Kneomedia Limited | 0.002 | -33% | $4,514,356 |

| LVT | Livetiles Limited | 0.006 | -33% | $7,062,664 |

| MCM | Mc Mining Ltd | 0.1 | -33% | $37,968,194 |

| ZEU | Zeus Resources Ltd | 0.01 | -33% | $4,592,810 |

| FAU | First Au Ltd | 0.0025 | -29% | $4,355,980 |

| RML | Resolution Minerals | 0.005 | -29% | $6,286,459 |

| VAR | Variscan Mines Ltd | 0.01 | -29% | $3,566,147 |

| GRE | Greentechmetals | 0.28 | -27% | $16,978,667 |

| CR1 | Constellation Res | 0.11 | -27% | $5,988,651 |

| IBX | Imagion Biosys Ltd | 0.0125 | -26% | $20,892,265 |

| EWC | Energy World Corpor. | 0.028 | -26% | $86,209,795 |

| AVW | Avira Resources Ltd | 0.0015 | -25% | $3,200,685 |

| BP8 | Bph Global Ltd | 0.0015 | -25% | $2,002,095 |

| G50 | Gold50Limited | 0.105 | -25% | $12,840,086 |

| IS3 | I Synergy Group Ltd | 0.009 | -25% | $2,601,723 |

| KEY | KEY Petroleum | 0.0015 | -25% | $2,951,892 |

| LBT | LBT Innovations | 0.009 | -25% | $3,914,904 |

| MRD | Mount Ridley Mines | 0.0015 | -25% | $15,569,766 |

| SIX | Sprintex Ltd | 0.015 | -25% | $5,022,595 |

| TSO | Tesoro Gold Ltd | 0.015 | -25% | $15,804,189 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| YPB | YPB Group Ltd | 0.003 | -25% | $2,230,384 |

| YAR | Yari Minerals Ltd | 0.013 | -24% | $6,753,009 |

| 1AE | Auroraenergymetals | 0.1 | -23% | $16,716,728 |

| DTR | Dateline Resources | 0.01 | -23% | $8,854,428 |

| ZNC | Zenith Minerals Ltd | 0.1 | -23% | $35,238,088 |

| MFG | Magellan Fin Grp Ltd | 6.81 | -23% | $1,277,280,569 |

| SOM | SomnoMed Limited | 0.55 | -23% | $64,068,924 |

| AVJ | AVJennings Limited | 0.275 | -22% | $140,334,142 |

| ERW | Errawarra Resources | 0.105 | -22% | $7,645,440 |

| RDS | Redstone Resources | 0.007 | -22% | $6,971,028 |

| XPN | Xpon Technologies | 0.042 | -21% | $6,895,947 |

| BRX | Belararoxlimited | 0.48 | -21% | $27,530,331 |

| SEG | Sports Ent Grp Ltd | 0.195 | -20% | $50,916,845 |

| AHK | Ark Mines Limited | 0.18 | -20% | $8,803,228 |

| CT1 | Constellation Tech | 0.002 | -20% | $2,942,401 |

| DCX | Discovex Res Ltd | 0.002 | -20% | $6,605,136 |

| EMU | EMU NL | 0.002 | -20% | $2,900,043 |

| ERL | Empire Resources | 0.004 | -20% | $4,451,740 |

| GTG | Genetic Technologies | 0.002 | -20% | $23,083,316 |

| KPO | Kalina Power Limited | 0.006 | -20% | $9,091,175 |

| MRQ | Mrg Metals Limited | 0.002 | -20% | $5,514,797 |

| NES | Nelson Resources. | 0.004 | -20% | $2,454,377 |

HOW THE WEEK SHOOK OUT

Monday October 09, 2023 – ASX up +0.23%

Fin Resources (ASX:FIN) was the day’s standout performer, up 64% at the close after its maiden fieldwork program identified abundant spodumene crystals within a broad pegmatite outcrop at Cancet West in James Bay, Canada.

King River Resources (ASX:KRR) secured itself a speeding ticket from the ASX, up 40% in the AM, up 20% in the arvo.

PainChek (ASX:PCK) was up 40% in the morning, but then lost 28%. Just like that.

Vonex (ASX:VN8) was up 33%, possibly due to cost cutting, or it could be a random gamble. VN8 does its thing on the cloud and provides the full gamut of traditional telecommunications products such as mobile and internet.

Mobilicom (ASX:MOB) came out the gate strongly, up circa 20% int the morn but the surge lacked urge and it closed up 16.7% – possibly because the company has requested an extension prior to an upcoming voluntary delisting to allow shareholders to complete converting their shares into American Depositary Shares.

The day’s late mover was Cleanspace (ASX:CSX), which designs, makes, and flogs “premium respiratory protection equipment for industrial and healthcare markets” – it rose 10% in short order before the close.

Tuesday October 10, 2023 – ASX up +1.0%

Mobilicom (ASX:MOB), not long for this bourse, jumped circa 40% yesterday, after receiving ‘a number of inquiries from shareholders in Australia requesting additional time to complete the conversion process of ordinary shares into American Depositary Shares (ADSs)’.

That’s because last month MOB broke the news that it’ll be removed from the official list of ASX shares and make its forever home on the Nasdaq.

“In an effort to accommodate its shareholders, the Company has decided to extend the proposed Delisting date to 19 October 2023 to allow current shareholders the ability and time to be able to transfer their fully paid ordinary shares to ADSs if they wish to do so,” MOB says.

Nightingale Intelligent Systems (ASX:NGL) finalised an expanded contract with the San Pablo Police Department (SPPD), which invested in two additional AI-powered Blackbird Robotic Aerial Security (RAS) systems, bringing their total to five.

Here’s the kicker and why the share price was topping out on Tuesday: as part of the expansion with SPPD, Nightingale obtained Tactical Beyond Visual Line of Sight (TBVLOS) approval for its Blackbird drones from the US Federal Aviation Administration, which holds the keys to the US drone kingdom.

CZR Resources (ASX:CZR) jumped early and stayed high on news the Definitive Feasibility Study (DFS) at the Robe Mesa iron ore project in the Pilbara looks “set to generate exceptional financial returns”.

The main talking points of the announcement included increased ore reserves at the project, from 8.2Mt in the pre-feasibility study (PFS), to 33.4Mt and production rates have increased from 2Mtpa in the PFS to 3.5-5Mtpa in the DFS.

Pure Resources (ASX:PR1) up on news it’s staked 13.5km2 of exploration claims in the Crystal Mountain Pegmatite District, Colorado, and Atlantic Lithium (ASX:A11) is higher on word Ghana’s first lithium mine has been boosted by government acquiescence in diverting two transmission lines that run right across A11’s planned mining area.

And DomaCom (ASX:DCL) was up Up 38% to 0.022 cents after it started a capital raise of up to $6 million via convertible notes, the company saying the cash infusion ‘fortifies the company’s financial position enabling further expansion.

Wednesday October 11, 2023 – ASX up +0.6%

Kalgoorlie-focused Zuleika Gold (ASX:ZAG) with four gold projects in the post topped the charts Wednesday courtesy of a late Tuesday Mark Creasy flavoured revelation. The company revealed a subscription cash deal with one of the legendary West Aussie prospector/investor’s various toys – Yandal Investments – for the raising of $3m.

The subscription price was at a 28% premium. Handy.

5E Advanced Materials (ASX:5EA) was up more than 25% on news the step-rate testing is underway and should quickly ID the porosity of the boron-loving small cap’s ore body and form a base-line parameter at Fort Cady Borate project in California, which hosts a multi-generational borate resource where boric acid, borate specialty materials, gypsum, and potassium sulphate will be produced.

Easy for them to say.

And Besra Gold (ASX:BEZ) was up well over 20% after getting paid US$10m from Quantum Metal Recovery, as per conditions set by a US$300 million Gold Purchase Agreement back in May.

Thursday October 12, 2023 – ASX up +0.3%

Taking the Thursday meat tray home was Redbubble (ASX:RBL) – the online marketplace connecting independent artists with customers that we don’t often hear from, but which dropped news of a remarkable turnaround and jumped +25%.

According to RBL, it’s turned to a positive underlying cash flow of $0.7 million, up $16.9 million on prior corresponding period (pcp) and up $5.5 million on the fourth quarter of FY23.

That’s allowed the company to build its cash balance to $39.9m, up $4.2m from 30 June 2023, which the company has attributed to “a number of recently-implemented initiatives”. These include: “the introduction of artist account tiers on the Redbubble and TeePublic marketplaces and a dynamic order routing system for the Redbubble marketplace in the US, as well as further optimisation of paid marketing spend”.

Lithium Power International (ASX:LPI) also climbed, up 18.5% in very short order on no news – which was enough to have the ASX push it into a trading pause just minutes after the market opened, and then into a complete halt. Rob Badman put on his journo hat (which is one of those multicoloured propellor caps kids from the 1950s wore) and sniffed out something takeover related, which you can read here.

Friday October 13, 2023 – ASX down -0.45%

Horseshoe Metals (ASX:HOR) staged a late surge to take top spot for Small Caps on Friday, jumping a very handy 50% in short order off the back of a happy and well-received half-year report.

There’s a bit to digest in there, but the nuts and bolts of it are a sizeable reduction in losses compared to the same period last year, down to $646,912 against 2022’s $1,596,059 drop, which corresponds to a diluted loss per share of $0.106 versus the $0.304 loss last year.

Fertoz (ASX:FTZ), climbing 40.3% early on Thursday’s news that its Fertify NPKS plant in Montana, USA has achieved nameplate capacity of 40,000 tons per annum after two months of operation, but eased to around +25% by close of play.

Fertoz has reached the milestone with the facility working at double-shift capacity, but says that 50,000 tons per year is “achievable with triple shift operation”, as it ramps up production of its regenerative and organic all-in-one NPKS pellets to farmers in time for Spring in the US.

Meanwhile, peer-to-peer investing solution provider SelfWealth (ASX:SWF) was up 22% after acknowledging there’s some truth behind recent media speculation of a potential transaction with Stakeshop.

However, that offer was knocked back in short order by Selfwealth as it “did not offer appropriate value to Selfwealth shareholders”, and as such there’s been very little in the way of negotiation on the topic thus far.

Fin Resources (ASX:FIN) resumed its recent climb, up 21% (+110% for the week) on Monday’s news about abundant spodumene crystals within a broad pegmatite outcrop at Cancet West, 45km west of Winsome Resources’ (ASX:WR1) Cancet lithium deposit and 100km west of Patriot Battery Metals’ (ASX:PMT) Corvette Lithium Deposit.

Upcoming ASX IPO listings

All dates are sourced from the ASX website. They can, and frequently do, change without notice.

Nido Education (ASX:NDO)

Expected listing: October 16, 2023

IPO: $99.2m at $1.00

CGN Resources (ASX:CGR)

Expected listing: October 18,2023

IPO: $10m at $0.20

Freedom Care Group (ASX:FCG)

Expected listing: October 19, 2023

IPO: $3.2m at $0.20

Golden Globe Resources (ASX:GGR)

Expected listing: October 20, 2023

IPO: $6m at $0.20

Far Northern Resources (ASX:FNR)

Expected listing: October 23, 2023

IPO: $6m at $0.20

Great Dirt Resources (ASX:GR8)

Expected listing: October 23, 2023

IPO: $5m at $0.20

Midwest Lithium (ASX:MWL)

Expected listing: November 08, 2023

IPO: $17m at $0.25

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.