ASX Small Caps and IPO Weekly Wrap: James Bay crowd enjoy a week of solid rock

Kids. Via Getty

- ASX 200 benchmark finds 0.2% as global markets wobble

- Lithium focus on Canada as ASX small caps reap rewards

- Leading Small Caps include Azure, Allkem and anyone near James Bay with a shovel

In Aussie small cap land last week, all the serious fun took place in Canada.

Allkem’s (ASX:AKE) James Bay lithium project is now officially one of the world’s largest lithium spodumene assets in the world – and apparently it’s going to get bigger.

A mega 173% increase in the James Bay mineral resource now weighs in at 110.2Mt @ 1.30% Li2O. This includes 54.3Mt @ 1/30% Li2O in the indicated category and 55.9Mt @ 1.29% Li2O in the inferred category.

“James Bay is now one of the largest spodumene lithium assets and clearly has the potential to grow even further as the boundaries of mineralisation are tested through an additional drilling program commencing later in the year,” AKE MD Martin Perez de Solay said, rather happily.

“The size and grade of this resource is amongst the best in the world and will underpin Allkem’s plans for future production and processing of lithium in Québec.”

As Stockhead’s Cameron Drummond says, “swimming around this resource is a slew of ASX juniors looking to turn James Bay into a mega-precinct.”

Get a pen, the list includes:

Kuniko (ASX:KNI), Recharge Metals (ASX:REC), Fin Resources (ASX:FIN), Oceana Lithium (ASX:OCN), Megado Gold (ASX:MEG), Sayona Mining (ASX:SYA), Rubix Resources (ASX:RB6), Cosmos Exploration (ASX:C1X), Resource Base (ASX:RBX), Summit Minerals (ASX:SUM), Winsome Resources (ASX:WR1), Lightning Minerals (ASX:L1M) and upcoming IPO newcomer Lithium Universe (ASX:LU7).

Patriot Battery Metals (ASX:PMT) also has its own huge resource in James Bay – the Corvette lithium project – with a resource of 109.2Mt @ 1.42% Li2O.

A huge day few days for our small cap lithium league.

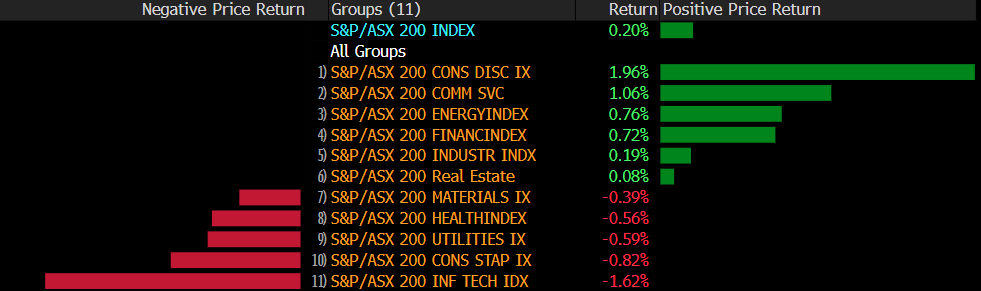

Here’s how the Aussie sectors ended last week:

TO MARKETS

Global equities were showing some old school volatility again last week, with watery numbers out of China, higher energy prices, upward pressure on bond yields and some thin US inflation data causing a few headaches.

For the week Wall Street fell 0.3%, the EU lost 0.4%.

Chinese shares were hammered, down 3.5% on both weak data and uncertainty around how officials will approach any stimmy.

At home the benchmark ASX 200 ended 0.2% higher led by consumer discretionary, energy and financial stocks, offset by losses in tech stocks, consumer stables and materials.

Oil prices continued to rise while gas prices surged, largely thanks to us and the real possibility of Aussies on strike which would hit global gas supplies. Metal prices fell last week, while iron ore price was abso flat.

Wall Street ended a mixed week with a well-mixed Friday – punters trying to digest the new inflation reads and so the future plans of the Federal Reserve’s cash rate cabal.

Producer prices rose 0.3% on the month, raising bets the Fed will need to keep rates higher for longer, supported by the observations of San Francisco’s Fed Prez Mary Daly who thought her colleagues had ‘more work to do’ to bring US inflation to heel.

The Nasdaq lost nearly 0.7% following a quick chip firesale with AMD (-2.4%) and Nvidia (-3.6%) hardest hit.

The Dow Jones ended slightly higher, with Chevron and Merck & Co both up +1.9%. The S&P 500 on t’other hand moved lower by 0.1%.

For the week, the Dow lost -0.1%, while the S&P 500 gave away -0.7%. The Tech-Heavy starlets on the Nasdaq made it two losses straight after dropping -1.8%.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks for the week:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.002 | 100% | $8,737,021 |

| OAR | OAR Resources Ltd | 0.007 | 75% | $15,678,814 |

| ERW | Errawarra Resources | 0.135 | 67% | $7,865,520 |

| NGS | NGS Ltd | 0.02 | 67% | $3,768,411 |

| PEC | Perpetual Res Ltd | 0.031 | 63% | $14,182,583 |

| KNB | Koonenberrygold | 0.05 | 61% | $4,090,848 |

| RDN | Raiden Resources Ltd | 0.0125 | 56% | $26,718,496 |

| ID8 | Identitii Limited | 0.017 | 54% | $3,617,574 |

| MTL | Mantle Minerals Ltd | 0.0015 | 50% | $9,221,169 |

| OAK | Oakridge | 0.13 | 49% | $1,891,525 |

| LDX | Lumos Diagnostics | 0.076 | 49% | $26,223,595 |

| LIT | Lithium Australia | 0.049 | 48% | $57,396,009 |

| FTL | Firetail Resources | 0.135 | 48% | $13,475,000 |

| BIO | Biome Australia Ltd | 0.145 | 45% | $22,743,420 |

| ARV | Artemis Resources | 0.023 | 44% | $32,968,286 |

| OPN | Oppenneg | 0.01 | 43% | $11,166,796 |

| IR1 | Irismetals | 1.95 | 41% | $161,851,900 |

| TTT | Titomic Limited | 0.024 | 41% | $17,310,571 |

| FRE | Firebrickpharma | 0.26 | 41% | $27,243,408 |

| VMM | Viridismining | 0.645 | 40% | $20,597,939 |

| AW1 | Americanwestmetals | 0.32 | 39% | $116,452,200 |

| GMN | Gold Mountain Ltd | 0.011 | 38% | $27,228,943 |

| BCB | Bowen Coal Limited | 0.12 | 36% | $256,318,305 |

| BRX | Belararoxlimited | 0.405 | 35% | $19,575,328 |

| CCX | City Chic Collective | 0.645 | 34% | $147,269,255 |

| ENA | Ensurance Ltd | 0.2675 | 34% | $23,891,320 |

| EDE | Eden Inv Ltd | 0.004 | 33% | $8,990,911 |

| ENV | Enova Mining Limited | 0.008 | 33% | $3,127,435 |

| MTH | Mithril Resources | 0.002 | 33% | $6,737,609 |

| MPG | Manypeaksgoldlimited | 0.265 | 33% | $8,548,004 |

| BBT | Bluebet Holdings Ltd | 0.29 | 32% | $54,070,540 |

| AGR | Aguia Res Ltd | 0.025 | 32% | $10,412,502 |

| CRS | Caprice Resources | 0.05 | 32% | $5,837,847 |

| AYA | Artryalimited | 0.355 | 31% | $20,137,127 |

| WA8 | Warriedarresourltd | 0.105 | 31% | $38,795,293 |

| PPG | Pro-Pac Packaging | 0.34 | 31% | $58,140,068 |

| GSM | Golden State Mining | 0.048 | 30% | $8,981,149 |

| CZR | CZR Resources Ltd | 0.18 | 29% | $35,360,197 |

| 3DA | Amaero International | 0.18 | 29% | $70,863,686 |

| G1A | Galena Mining | 0.1075 | 28% | $86,545,399 |

| RHT | Resonance Health | 0.065 | 27% | $29,955,379 |

| TIG | Tigers Realm Coal | 0.007 | 27% | $78,400,214 |

| GPR | Geopacific Resources | 0.019 | 27% | $12,317,867 |

| UBI | Universal Biosensors | 0.29 | 26% | $65,834,525 |

| ADR | Adherium Ltd | 0.005 | 25% | $24,997,042 |

| AUK | Aumake Limited | 0.005 | 25% | $8,923,557 |

| BP8 | Bph Global Ltd | 0.0025 | 25% | $2,669,460 |

| CTN | Catalina Resources | 0.005 | 25% | $6,192,434 |

| FGL | Frugl Group Limited | 0.02 | 25% | $17,209,116 |

| GES | Genesis Resources | 0.005 | 25% | $3,914,206 |

Errawarra Resources (ASX:ERW) gained about 60% last week thanks to a bonus-round of continued nearology-driven investment, because next door neighbour Azure Minerals (ASX:AZS) can’t stop hitting lithium.

Canaccord’s Tim Hoff told Stockhead last week Azure Minerals (ASX:AZS) is exciting analysts, brokers and investors alike.

AZS has risen more than 1100% this year after hitting massive pegmatite-hosted lithium at its Andover project in the Pilbara.

Some analysts have said they expect drilling to date already points to an economic resource of 60-70Mt. The company formally posted an exploration target of 100-240Mt at 1-1.5% Li2O on Monday, something that could be, MD Tony Rovira told delegates at Diggers & Dealers, as good as a top 5 hard rock lithium resource globally.

Hoff says the response to Azure shows the market will still reward Tier 1 discoveries.

“Looking at it and the connection between results and where people interpret value, that gap has closed. It’s happening very quickly these days,” he said.

Perpetual Resources (ASX:PEC) ended a huge week 63% ahead on news that the company has entered into an additional binding option agreement to acquire a further three highly prospective exploration permits, covering approximately 5,000ha in Brazil’s “Lithium Valley” region, within Brazil’s mining-friendly state of Minas Gerais.

On top of that big news, PEC has also revealed that it’s received firm commitments from professional and sophisticated investors to raise $1.5 million (before costs) through a placement of shares at $0.022 per share.

PEC closed out the week at $0.031.

ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks for the week:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| MSB | Mesoblast Limited | 0.3675 | -66% | $301,255,785 |

| CLA | Celsius Resource Ltd | 0.012 | -48% | $29,198,672 |

| ICG | Inca Minerals Ltd | 0.019 | -39% | $14,550,299 |

| HPC | Thehydration | 0.036 | -38% | $5,290,021 |

| TMB | Tambourahmetals | 0.21 | -37% | $11,110,576 |

| CLE | Cyclone Metals | 0.001 | -33% | $10,264,505 |

| DXN | DXN Limited | 0.001 | -33% | $1,721,315 |

| EMU | EMU NL | 0.002 | -33% | $2,900,043 |

| MEB | Medibio Limited | 0.001 | -33% | $5,150,594 |

| TD1 | Tali Digital Limited | 0.001 | -33% | $3,295,156 |

| PNR | Pantoro Limited | 0.052 | -32% | $263,425,709 |

| GBE | Globe Metals &Mining | 0.044 | -32% | $21,942,983 |

| DMM | Dmcmininglimited | 0.058 | -31% | $1,737,100 |

| KFM | Kingfisher Mining | 0.22 | -30% | $12,085,875 |

| INP | Incentiapay Ltd | 0.005 | -29% | $6,325,318 |

| IVX | Invion Ltd | 0.005 | -29% | $32,108,161 |

| 8VI | 8Vi Holdings Limited | 0.135 | -27% | $5,448,485 |

| NYR | Nyrada Inc. | 0.03 | -27% | $4,680,261 |

| EPX | Ept Global Limited | 0.023 | -26% | $10,256,015 |

| AMD | Arrow Minerals | 0.003 | -25% | $9,071,295 |

| CCE | Carnegie Cln Energy | 0.0015 | -25% | $15,642,574 |

| GCR | Golden Cross | 0.003 | -25% | $4,389,024 |

| ME1 | Melodiol Glb Health | 0.0075 | -25% | $21,778,430 |

| MSI | Multistack Internat. | 0.006 | -25% | $817,824 |

| SI6 | SI6 Metals Limited | 0.006 | -25% | $11,963,157 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| YPB | YPB Group Ltd | 0.003 | -25% | $2,230,384 |

| TGH | Terragen | 0.023 | -25% | $5,820,930 |

| AMM | Armada Metals | 0.025 | -24% | $1,714,202 |

| RAC | Race Oncology Ltd | 0.98 | -24% | $166,330,156 |

| BNZ | Benzmining | 0.42 | -24% | $46,563,499 |

| NYM | Narryermetalslimited | 0.13 | -24% | $5,404,750 |

| MXO | Motio Ltd | 0.036 | -23% | $9,411,648 |

| KP2 | Kore Potash PLC | 0.01 | -23% | $7,379,355 |

| W2V | Way2Vatltd | 0.017 | -23% | $10,045,964 |

| LRL | Labyrinth Resources | 0.007 | -22% | $8,312,806 |

| OLI | Oliver'S Real Food | 0.014 | -22% | $6,170,247 |

| RLG | Roolife Group Ltd | 0.007 | -22% | $5,043,907 |

| THR | Thor Energy PLC | 0.0035 | -22% | $6,566,812 |

| FRS | Forrestaniaresources | 0.078 | -22% | $7,356,670 |

| DLI | Delta Lithium | 0.68 | -22% | $357,963,661 |

| NUC | Nuchev Limited | 0.18 | -22% | $15,193,310 |

| SRZ | Stellar Resources | 0.011 | -21% | $12,071,571 |

| 1TT | Thrive Tribe Tech | 0.026 | -21% | $8,898,646 |

| BLU | Blue Energy Limited | 0.019 | -21% | $33,317,525 |

| BMO | Bastion Minerals | 0.023 | -21% | $3,986,457 |

| SLM | Solismineralsltd | 0.385 | -21% | $25,783,607 |

| ICI | Icandy Interactive | 0.039 | -20% | $53,688,227 |

| NWF | Newfield Resources | 0.195 | -20% | $149,929,821 |

| ETM | Energy Transition | 0.043 | -20% | $56,941,249 |

Upcoming ASX IPO listings

All dates are sourced from the ASX website. They could change without notice.

Cleo Diagnostics (ASX:COV)

Expected listing: August 17

IPO: $5m at $0.20

Cleo is a medical diagnostics and devices development company.

The company’s product makes early diagnosis of ovarian cancer a reality with a simple and accurate blood test.

Its flagship is the CleoDX platform, a test kit designed to detect a novel protein biomaker CXCL10 in the blood which is present very early and through all stages of ovarian cancer.

After blood is collected, risk evaluation is performed and an assessment is made by Cleo’s proprietary algorithm.

Curvebeam AI (ASX:CVB)

Expected listing: August 23

IPO: $25m at $0.48

CurveBeam AI develops and manufactures a range of specialised medical imaging (CT) scanners and supporting clinical assessment software.

Based in Melbourne, the company is said to be a a leader in cone beam CT imaging, paving new frontiers in artificial intelligence (AI)-based bone and joint analysis.

Curvebeam’s technology involves deep learning AI (DLAI) expertise, which it delivers across orthopedics and bone health (fragility fracture prevention).

Ashby Mining (ASX:AMG)

Expected listing: August 24

IPO: $15m at $0.20

AMG is developing a gold production business in the Charters Towers region in Northern Queensland, and has secured rights to a land package covering over 600km2 containing historical mines, mineral resources, highly prospective exploration potential and a gold processing plant.

The 340Ktpa Blackjack Processing Plant is a conventional Carbon in Pulp (CIP) plant, located 15 minutes from Charters Towers.

The Far Fanning gold project lies on a permitted Mining Lease with historical production of 47,200oz gold from 664,000t of ore at average 2.2g/t gold.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.