ASX Small Caps and IPO Weekly Wrap: ASX closes up 1pc on a big, big week for Energy

"I took my kids to Mexico for dinner, and all I got was this massive explosion." Pic via Getty Images.

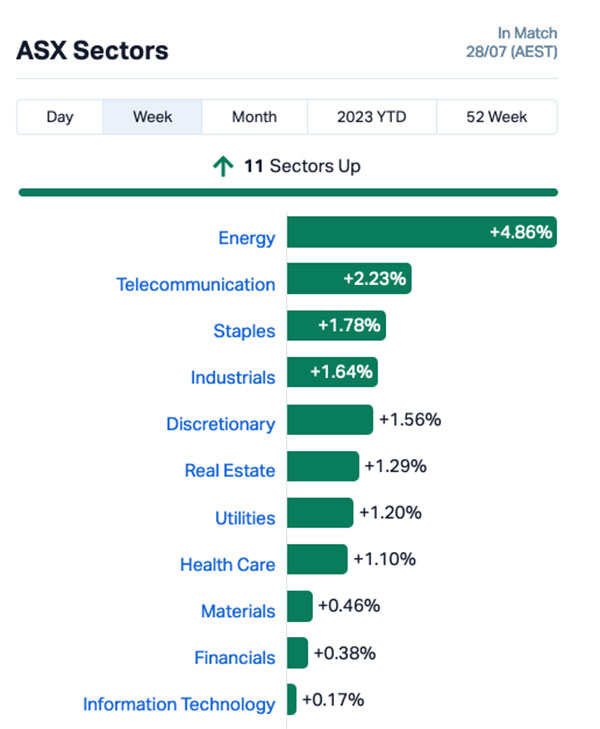

- ASX 200 benchmark falters on Friday to end the week up 1.0%

- Energy easily takes the market sector gong, banking a 4.8% win for the week

- Leading Small Capper Pointerra (ASX:3DP) shines with a +108% weekly gain

As far as weeks on the ASX go, the past five days have certainly added up to one, with the market pushed and pulled – like a reluctant fetus – until it landed with a soft, wet plop! to bellow a purple-faced welcome to the world.

(Leave me alone… it’s been a long week).

A slew of data from The Great National Beancounters at the ABS drove the market hither and thither this week, with the following headline digits giving investors, market analysts and the RBA hit-squad plenty of food for thought:

- Inflation fell to 6% in the June quarter, down from 7% in the March quarter.

- June quarter Export Price Index has fallen 8.5%, and is down 11.2% on an annual basis, the largest quarterly fall since the September quarter 2009.

- June retail trade figures showed a 0.8% drop, the inverse of May’s 0.8% rise.

If you’re in any doubt that the RBA board’s going to earn its keep next week when it pulls its head outta the public trough to consider what do to with rates on Tuesday, it’s a safe bet that unpicking that lot to reach a consensus will involve lengthy, robust and – dare I say it – tedious debate.

But, given that it’s one of Phillip “I’m actually feeling pretty” Lowe’s last rounds of discussions at the head of the table, I’ll bet you dollars to donuts the old rogue’s going to go down swingin’.

TO MARKETS

The past week undeniably belonged to the Energy sector, which ended the week so far out ahead of the rest of the market that it could barely be called a contest.

We’re still a short while before markets officially close for the week, but – being the brave market pundit I am – I’m pulling an Antony Green On Election Night special, and calling the Energy sector’s 2.7% lead over nearest rival (the Telcos) an unassailable margin.

At the time of writing, Energy’s up 4.65%, Telcos are up 1.95% – and it’s daylight again to the rest of the sectors from there.

Recent sector All-Star InfoTech is looking set to end the week at with the wooden spoon lodged firmly in its butt, adding just 0.18% since Monday morning.

Energy’s strong showing this week was enough to push it out in front for the month as well – something I thought to look up and report on after I pressed the wrong button while looking up the weekly results.

For those of you playing at home, the Energy sector’s up 10.8% for the month, which sounds like a lot because it is.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks for the week 24 – 28 July, 2023:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| 3DP | Pointerra Limited | 0.1875 | 108% | $64,391,589 |

| DXN | DXN Limited | 0.002 | 100% | $3,442,630 |

| GTE | Great Western Exp. | 0.062 | 77% | $11,371,415 |

| WNR | Wingara Ag Ltd | 0.044 | 69% | $7,548,328 |

| R3D | R3D Resources Ltd | 0.045 | 61% | $5,826,063 |

| AD1 | AD1 Holdings Limited | 0.008 | 60% | $5,757,983 |

| CPT | Cipherpoint Limited | 0.008 | 60% | $9,273,934 |

| PEC | Perpetual Res Ltd | 0.024 | 60% | $12,000,647 |

| TMB | Tambourahmetals | 0.31 | 57% | $11,624,031 |

| RBL | Redbubble Limited | 0.625 | 54% | $166,632,134 |

| CCO | The Calmer Co Int | 0.0045 | 50% | $2,256,310 |

| MEB | Medibio Limited | 0.0015 | 50% | $5,150,594 |

| RBR | RBR Group Ltd | 0.003 | 50% | $4,855,214 |

| CCX | City Chic Collective | 0.475 | 44% | $105,523,639 |

| YOW | Yowie Group | 0.037 | 42% | $8,087,012 |

| AUQ | Alara Resources Ltd | 0.034 | 42% | $22,260,714 |

| PAC | Pacific Grp Ltd | 10.53 | 40% | $531,725,198 |

| AMN | Agrimin Ltd | 0.3 | 40% | $86,505,746 |

| NXL | Nuix Limited | 1.53 | 37% | $475,194,459 |

| AN1 | Anagenics Limited | 0.019 | 36% | $6,215,539 |

| WHK | Whitehawk Limited | 0.042 | 36% | $10,005,863 |

| FNX | Finexia Financialgrp | 0.295 | 34% | $14,149,846 |

| AXP | AXP Energy Ltd | 0.002 | 33% | $11,649,361 |

| AYM | Australia United Min | 0.004 | 33% | $7,370,310 |

| GGX | Gas2Grid Limited | 0.002 | 33% | $8,154,204 |

| IS3 | I Synergy Group Ltd | 0.012 | 33% | $3,468,964 |

| ME1 | Melodiol Glb Health | 0.012 | 33% | $32,262,645 |

| ROG | Red Sky Energy. | 0.004 | 33% | $21,208,909 |

| SIS | Simble Solutions | 0.008 | 33% | $4,220,655 |

| OLY | Olympio Metals Ltd | 0.25 | 32% | $9,802,653 |

| CBR | Carbon Revolution | 0.23 | 31% | $44,552,026 |

| ASP | Aspermont Limited | 0.017 | 31% | $39,020,219 |

| RMI | Resource Mining Corp | 0.053 | 29% | $24,708,250 |

| FFT | Future First Tech | 0.009 | 29% | $5,718,693 |

| AND | Ansarada Group Ltd | 1.4 | 28% | $126,856,507 |

| GCY | Gascoyne Res Ltd | 0.25 | 28% | $223,638,342 |

| STK | Strickland Metals | 0.046 | 28% | $69,949,373 |

| FFF | Forbidden Foods | 0.023 | 28% | $3,374,803 |

| MCP | McPherson's Ltd | 0.53 | 28% | $74,853,553 |

| WSP | Whispir Limited | 0.395 | 27% | $46,687,274 |

| CHW | Chilwaminerals | 0.19 | 27% | $8,716,250 |

| PET | Phoslock Env Tec Ltd | 0.024 | 26% | $9,990,248 |

| EGY | Energy Tech Ltd | 0.054 | 26% | $18,233,631 |

| ASM | Ausstratmaterials | 1.51 | 25% | $233,387,318 |

| MOZ | Mosaic Brands Ltd | 0.2 | 25% | $35,669,547 |

| RVS | Revasum | 0.2225 | 24% | $23,831,247 |

| GLA | Gladiator Resources | 0.016 | 23% | $6,554,039 |

| CUL | Cullen Resources | 0.011 | 22% | $5,547,200 |

| EX1 | Exopharm Limited | 0.011 | 22% | $4,394,231 |

| CDR | Codrus Minerals Ltd | 0.085 | 21% | $6,411,550 |

Top of the Small Caps pops this week was Pointerra (ASX:3DP), which went through the roof earlier today on some great news out of the US.

The announcements included a healthy quarterly report, but – in arguably more interesting news – existing Pointerra customer Entergy, a Fortune 500 company, has selected Pointerra’s US EPC partners for its 10-year, US$15 billion grid resilience CAPEX program.

That deal will see Pointerra’s AI-driven analytics platform used to identify and prioritise grid assets requiring remediation or replacement across the 10-year term of the program.

Pointerra closed out the week +108% ahead.

Great Western Exploration (ASX:GTE) capped off a solid week, finishing on +77%, mostly built slowly and steadily on Monday’s news that the company had kicked off RC drilling at the Firebird gold project, testing a large soil anomaly.

The large Ultrafine+ soil anomaly has an extent of 3.7km x 450m, with the current round of RC drilling designed to test below recent anomalous broad-spaced aircore drill results from highly weathered Archean Greenstone volcanic sediments and mafic units.

Wingara AG (ASX:WNR) has banked an unlikely third place this week, up 69% this week despite no market-sensitive news for nearly two months – not sure what’s happening there, but that might be one to keep an eye on next week.

ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks for the week 24 – 28 July, 2023:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| PAN | Panoramic Resources | 0.052 | -46% | $112,800,270 |

| ERW | Errawarra Resources | 0.1 | -41% | $7,865,520 |

| BNO | Bionomics Limited | 0.012 | -40% | $20,562,296 |

| BKY | Berkeley Energia Ltd | 0.42 | -39% | $196,150,555 |

| MVP | Medical Developments | 1.16 | -32% | $107,018,417 |

| MTM | MTM Critical Metals | 0.068 | -32% | $8,928,299 |

| OCT | Octava Minerals | 0.08 | -30% | $2,973,001 |

| LML | Lincoln Minerals | 0.007 | -30% | $9,944,983 |

| CXO | Core Lithium | 0.645 | -30% | $1,245,206,252 |

| LNR | Lanthanein Resources | 0.017 | -29% | $20,188,360 |

| WMG | Western Mines | 0.49 | -28% | $30,151,416 |

| BCB | Bowen Coal Limited | 0.11 | -27% | $277,678,164 |

| GPR | Geopacific Resources | 0.014 | -26% | $11,496,676 |

| PV1 | Provaris Energy Ltd | 0.061 | -26% | $34,055,394 |

| PEB | Pacific Edge | 0.135 | -25% | $129,658,435 |

| BCA | Black Canyon Limited | 0.15 | -25% | $8,926,109 |

| CLE | Cyclone Metals | 0.0015 | -25% | $10,264,505 |

| EEL | Enrg Elements Ltd | 0.009 | -25% | $11,101,577 |

| INP | Incentiapay Ltd | 0.006 | -25% | $8,855,445 |

| MTH | Mithril Resources | 0.0015 | -25% | $5,053,207 |

| OPN | Oppenneg | 0.006 | -25% | $6,700,078 |

| SGC | Sacgasco Ltd | 0.006 | -25% | $4,641,496 |

| BUB | Bubs Aust Ltd | 0.185 | -24% | $150,271,482 |

| APS | Allup Silica Ltd | 0.061 | -24% | $2,693,397 |

| TKM | Trek Metals Ltd | 0.084 | -24% | $40,323,928 |

| 8VI | 8Vi Holdings Limited | 0.23 | -23% | $9,010,956 |

| EPM | Eclipse Metals | 0.017 | -23% | $32,448,957 |

| GED | Golden Deeps | 0.0085 | -23% | $11,552,267 |

| BVR | Bellavistaresources | 0.155 | -23% | $6,265,464 |

| CRB | Carbine Resources | 0.007 | -22% | $3,862,164 |

| IPB | IPB Petroleum Ltd | 0.007 | -22% | $4,520,980 |

| RLG | Roolife Group Ltd | 0.007 | -22% | $5,756,465 |

| NOU | Noumi Limited | 0.125 | -22% | $36,024,211 |

| OM1 | Omnia Metals Group | 0.18 | -22% | $7,974,911 |

| SLM | Solismineralsltd | 0.47 | -22% | $31,827,031 |

| TOY | Toys R Us | 0.011 | -21% | $9,493,953 |

| AGR | Aguia Res Ltd | 0.019 | -21% | $9,544,794 |

| MDI | Middle Island Res | 0.023 | -21% | $3,094,481 |

| COB | Cobalt Blue Ltd | 0.37 | -20% | $142,472,149 |

| BEZ | Besragoldinc | 0.235 | -20% | $92,004,091 |

| AOA | Ausmon Resorces | 0.004 | -20% | $3,877,157 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | $11,494,636 |

| DCX | Discovex Res Ltd | 0.002 | -20% | $6,605,136 |

| ENT | Enterprise Metals | 0.004 | -20% | $2,997,884 |

| IEC | Intra Energy Corp | 0.004 | -20% | $6,483,126 |

| KOB | Kobaresourceslimited | 0.14 | -20% | $14,758,333 |

| MTB | Mount Burgess Mining | 0.004 | -20% | $3,532,684 |

| RRL | Regis Resources | 1.715 | -20% | $1,408,231,399 |

| 5EA | 5Eadvanced | 0.485 | -20% | $153,529,319 |

| DYM | Dynamicmetalslimited | 0.23 | -19% | $7,700,000 |

HOW THE WEEK PLAYED OUT

Monday, July 24 – ASX 200 Down -0.10%

It’s been a while since it was Monday, and I’ll admit that I’ve kinda spaced on what happened at the start of the week, but I’m smiling in all the photos so it can’t have been that bad of a day.

From what I can see, however, it was mostly a case of the market holding its breath ahead of the world’s central banks playing the old Too Much Data Is Never Enough game, which is probably why the ASX needle didn’t move all that much.

Standouts:

- Melodiol Global Health (ASX:ME1): +26% > The Aussie-based cannabis company, which acquired subsidiary Health House International in May, has delivered strong revenue results during H1, according to a new report.

- Global Health (ASX:GLH): +27% > The digital healthcare solutions provider has also just posted a healthy report, noting its Australian operations return to positive cashflow; overseas cashflow deficit reduced and total cashflow deficit reduced by 64%.

Tuesday, July 25 – ASX 200 Up +0.46%

Tuesday was a day for the Materials sector to shine, landing a solid win alongside the week’s booming Energy sector to help lift the nation’s diggers out of a form slump caused by iffy commodity prices and a niggling groin injury that no amount of vigorous rubbing by the physios seems to be able to fix.

Standouts:

- DXN (ASX:DXN): +50% > The Aussie techie, a data centre designer, builder and operator, has revealed a very positive quarterly report, with a highlight: modular data centre contracts in the latest quarter totalling $3.9m.

- Si6 Metals (ASX:SI6): +33% > A strong investor presentation has investors in the Botswana-focused (nickel, copper, PGE) metal heads upbeat. Strategic targeting of critical minerals sites and investor propositions a-go-go. More here.

- Strickland Metals (ASX:STK) : +14% on news that the sale of its Millrose project to gold major Northern Star Resources (ASX:NST) has reached a stage of transactional completion.

Wednesday, July 26 – ASX 200 Up +0.85%

The benchmark got a solid shot of Vitamin D-flation on Wednesday, when the ABS delivered the June quarter results showing a drop to 6%, against the previous quarter’s figure of 7%.

There was a near-instant surge for the overall market, and investors held strong for the rest of the day to land a +0.85% result – not bad in the overall market climate this week.

Materials put in another good day, up 1.83% ahead of InfoTech’s +1.15%, with the week’s winner Energy quietly chipping in from just off the green for a +0.57% birdie as well.

Standouts:

- Xantippe Resources (ASX:XTC): +67% > Big gainz, but no fresh news today for the WA (Southern Cross) focused precious metals explorer. The other day, though, it announced some capital raising to fund strategic growth.

- AD1 Holdings (ASX:AD1): +40% > The recruitment tech and utilities-software-billing firm announced strong quarterly financial/activities results today.

- Melodiol Global Health (ASX:ME1): 20% > The Aussie cannabis company’s wholly owned subsidiary Mernova Medicinal Inc. has made strong progress on the EU GMP licence process to fast-track cannabis exports to Australia and Europe. And for some reason, we’re craving pizza.

- BirdDog Technology (ASX:BDT) +17% > The global video tech company reports not-too-bad quarterly results, with customer cash receipts of A$7.5 million, +3.6% quarter-on-quarter (-7.5% versus pcp).

- Oneview Healthcare (ASX:ONE): +15% > The healthtech software solutions outfit has just delivered a positive cash flow report. Which is nice.

Thursday, July 27 – ASX 200 Up +0.73%

The overnight news from the US was a heavily-tipped 25bp rate hike by The Fed, which Wall Street had already priced in well in advance, so it caused barely a ripple for local investors.

In fact, the biggest news out of the US that day was the fact that the Dow had equalled it’s best-ever record of 13 straight wins on the trot – a feat not seen since 1987, the same year Kylie Minogue urged the world to “Do the Locomotion”, permanently damaging the eyesight of a generation of schoolboys in the process.

And this happened on Thursday as well, marking the exact moment that healthcare suddenly became important again for Republican lawmakers in the US.

Locally, InfoTech and Real Estate outshone the rest of the market, while Energy stocks took a modest step back – barely putting a dent in the week’s barnstorming effort, though.

Standouts:

- R3D Resources (ASX:R3D): +60% > The small miner has announced it has completed the refurbishment of a solvent-extraction crystallisation process plant at its 45,000t Tartana copper heap leach project in Queensland. It’s charging the circuits for imminent first copper sulphate pentahydrate production. That’s expected to begin in the coming week.

- Pacific Current Group (ASX:PAC): +30% > The asset manager has a non-binding indicative proposal ready for submission that would see CQC Partners acquire all of the issued ordinary shares in PAC. This is a good thing for PAC investors, apparently, which you can read more about here.

- The Original Juice Co. (ASX:OJC): +21% > The high-quality juicer and wellness beverage company is up on a positive quarterly cash flow report.

Friday, July 27 – ASX 200 Down -0.75%

A soggy end to the week for the benchmark, after a piss-weak lead-in from Wall Street overnight left local investors wondering where all the love had gone.

There was barely a positive sector in the house by the end of the session, with the Energy sector doing everything it could to be best on the bourse, edging just above zero by the time we all got to knock off for the weekend.

The worst of the performers, by a sizeable margin, was Real Estate – it shed 3.0% as yet another home builder scandal unfolded thanks to the nation’s largest purveyor of suburban McMansions was busted (allegedly) shaking down its fixed-price contract customers for outrageous sums of money.

Last time I checked, media reports suggested that at least 60 of Metricon’s customers had filed complaints about it, and the NSW government has been forced to “open an inquiry” into whatever the hell’s going on.

The other big news for the day was the Victorian government’s announcement that 2024 will be the last year in that state for new homes to be built with natural gas connections, which knocked some of the Energy sector’s renewable winds from its all-hemp sails.

Standouts:

- Pointerra (ASX:3DP): +100% > The SaaS tech company shot up today on news out of the US that existing Pointerra customer Entergy, a Fortune 500 company, has selected Pointerra’s US EPC partners for its 10-year, US$15 billion grid resilience CAPEX program. That deal will see Pointerra’s AI-driven analytics platform used to identify and prioritise grid assets requiring remediation or replacement across the 10-year term of the program.

- Phoslock (ASX:PET): +50% > Phoslock delivered its June quarterly today, revealing a net cash outflow from operating activities of $0.62 million – much better than the prior quarter, which recorded approximately $3.2 million in operating cash outflow.

- Great Western Exploration (ASX:GTE): +37.8% > GTE’s been climbing this week on Monday’s news that the company had kicked off RC drilling at the Firebird gold project, testing a large soil anomaly. The large Ultrafine+ soil anomaly has an extent of 3.7km x 450m, with the current round of RC drilling designed to test below recent anomalous broad-spaced aircore drill results from highly weathered Archean Greenstone volcanic sediments and mafic units.

PO listings this week

There were none this week – but, I can almost guarantee that there will be at least one by this time next week (he says, almost guaranteeing that he’s jinxed it by almost guaranteeing it’ll happen).

So, please – I’m begging you – hold on for just a little while longer, and let the sweet, sweet release of your IPO fluid backlog be even sweeter, in the knowledge that your patience in this matter will eventually be rewarded.

… and that’s the week that was. I hope you enjoyed as much (if not more) than I did, and we’ll see you here bright and early on Monday for the next thrilling instalment of Who Wants to Be a Former Millionaire?

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.