ASX Small Cap Lunchtime Wrap: Who’s looking for a small piece of the action?

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

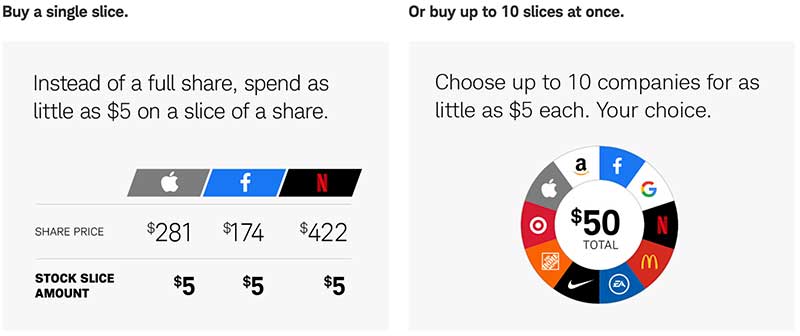

US brokerage Charles Schwab is moving ahead with plans to offer small ‘slices’ of large cap S&P 500 stocks for a little as $US5.

This successfully attracted a younger (and less affluent) demo to the stock market.

Similarly, Schwab says its new ‘stock slices’ are for punters who don’t want to spend thousands of dollars on a single company like Amazon ($US3,300/ share), Tesla ($US770/ share), or Alphabet ($US1350/ share):

The program — initially only for S&P 500 stocks — will be available as soon as June, the company says.

SMALL CAP WINNERS

Here are the best performing ASX small cap stocks at 12pm Wednesday May 6:

Swipe or scroll to reveal the full table. Click headings to sort.

CODE COMPANY PRICE CHANGE MARKET CAP E2M E2 Metals 0.21 133.33% $17.5M XTC Xantippe Resources 0.003 50.00% $10.0M DDD 3D Resources 0.003 50.00% $2.8M TPD Talon Petroleum 0.002 50.00% $1.8M FGO Flamingo 0.002 50.00% $1.1M VIC Victory Mines 0.002 50.00% $3.1M RDN Raiden Resources 0.008 33.33% $3.5M AEE Aura Energy 0.004 33.33% $8.0M RAG Ragnar Metals 0.005 25.00% $1.6M FPL Fremont Petroleum 0.005 25.00% $10.4M ARE Argonaut Resources N L 0.005 25.00% $7.9M POW Protean Energy 0.005 25.00% $1.6M TAR Taruga Gold 0.011 22.22% $3.6M CAP Carpentaria Exploration 0.023 21.05% $6.3M LAM Laramide Resources 0.35 20.69% $48.0M DCL Domacom Australia 0.053 20.45% $13.0M FIJ Fiji Kava 0.071 18.33% $6.8M IDZ Indoor Skydive AUS Group 0.006 20.00% $2.0M CE1 Calima Energy 0.006 20.00% $12.9M LSR Lodestar Minerals 0.006 20.00% $5.1M BAT Battery Minerals 0.006 20.00% $7.9M

Gold explorer E2 Metals (ASX:E2M) leads the winners column on some high-grade gold and silver drilling results at the Conserrat project in Argentina.

In March, five drill holes were completed at the early stage ‘Mia’ prospect before the program was interrupted by Argentina’s mandatory isolation measures to control the COVID-19 pandemic.

These holes have just returned hits like 16m at 3.9 grams per tonne (g/t) gold and 123g/t silver, including 8m at 7.64g/t gold and 216g/t silver, 76m from surface.

SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks at 12pm Wednesday May 6:

Swipe or scroll to reveal the full table. Click headings to sort.

| CODE | COMPANY | PRICE | CHANGE | MARKET CAP |

|---|---|---|---|---|

| VMG | Vdm Group | 0.001 | -50.00% | $10.4M |

| MAR | Malachite Resources | 0.06 | -40.00% | $833K |

| JPR | Jupiter Energy | 0.095 | -36.67% | $15.2M |

| CRO | Cirralto | 0.002 | -33.33% | $1.7M |

| ROG | Red Sky Energy | 0.001 | -33.33% | $2.4M |

| RFN | Reffind | 0.001 | -33.33% | $1.0M |

| CTO | Citigold Corporation | 0.003 | -25.00% | $7.3M |

| ADV | Ardiden | 0.003 | -25.00% | $5.4M |

| VAR | Variscan Mines | 0.012 | -20.00% | $1.9M |

| SUP | Superior Resources | 0.004 | -20.00% | $6.7M |

| DDT | DataDot Technology | 0.004 | -20.00% | $3.2M |

| ELT | Elementos | 0.002 | -20.00% | $5.1M |

| ZMI | Zinc Ireland | 0.029 | -17.14% | $3.1M |

| NVU | Nanoveu | 0.1 | -16.67% | $13.3M |

| EXR | Elixir Petroleum | 0.022 | -15.38% | $11.5M |

| LVH | LiveHire | 0.2 | -14.89% | $60.5M |

| TSC | Twenty Seven | 0.006 | -14.29% | $8.9M |

| CYM | Cyprium Metals | 0.125 | -13.79% | $7.0M |

Unremarkable Kazakhstan-focused oil and gas stock Jupiter Energy (ASX:JPR) is out of suspension, which was put in place after the share price spiked 0.5c to 34.5c on big volumes on April 22-23.

The stock has just released a statement to the ASX on the “irregular trading”, blaming “recommendation or recommendations in relation to Jupiter lodged via social media”.

The company didn’t explain why Gander had sold his shareholding, just that he had “held these shares for 10 years and was not in a ‘Black Out’ period or aware of any information concerning the company that was not already in the public domain”.

The share price is currently down just 36.6 per cent to 9.5c in morning trade.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.