ASX Small Cap Lunchtime Wrap: Recovery will be more ‘Nike Swoosh’ than ‘V shaped’, analysts say

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

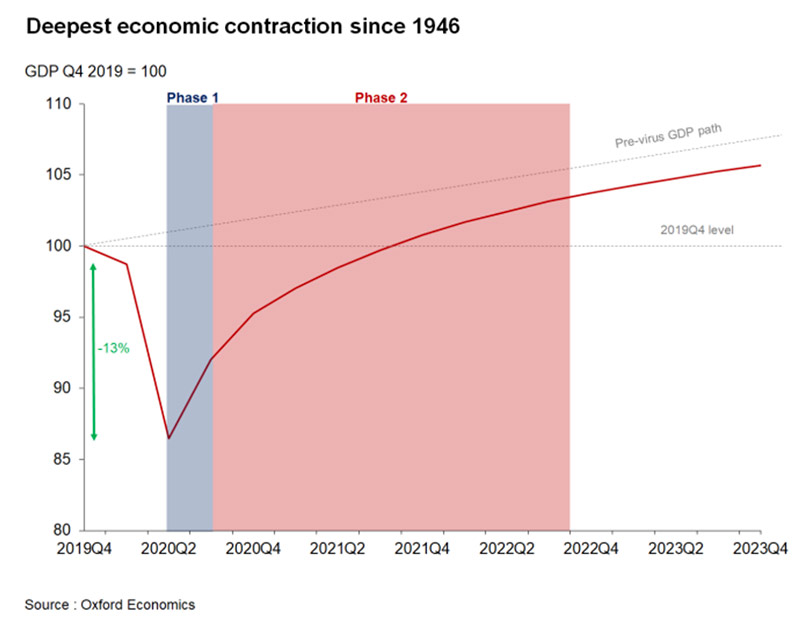

The US economic recovery will adopt more of a ‘Nike swoosh’ instead of the optimistic ‘quick bounce’ V shape, according to Oxford Economics.

And that’s barring any sharp resurgence of infections and hospitalisations — a real risk with Trump saying the US will not lock down again amid rising COVID-19 cases in California, Florida, Arizona and Texas.

“During the first phase, growth will be strong as employment, consumer spending, and business demand rebound from depressed levels,” says Gregory Daco, chief US economist at Oxford Economics.

“But during the second phase, lingering scars in the form of virus fear, bankruptcies, and regulated social distancing will limit growth.

“And while exceptional growth figures during the first phase will have a nearly irresistible attraction, we should constantly remind ourselves that the economy is only gradually emerging from a very deep hole.

“For example, while the 2.5 million payroll gain in May was the largest ever – and indeed encouraging news – it represents a return of only 10 per cent of the more than 20 million jobs lost in March and April.”

Short sellers take a big scalp

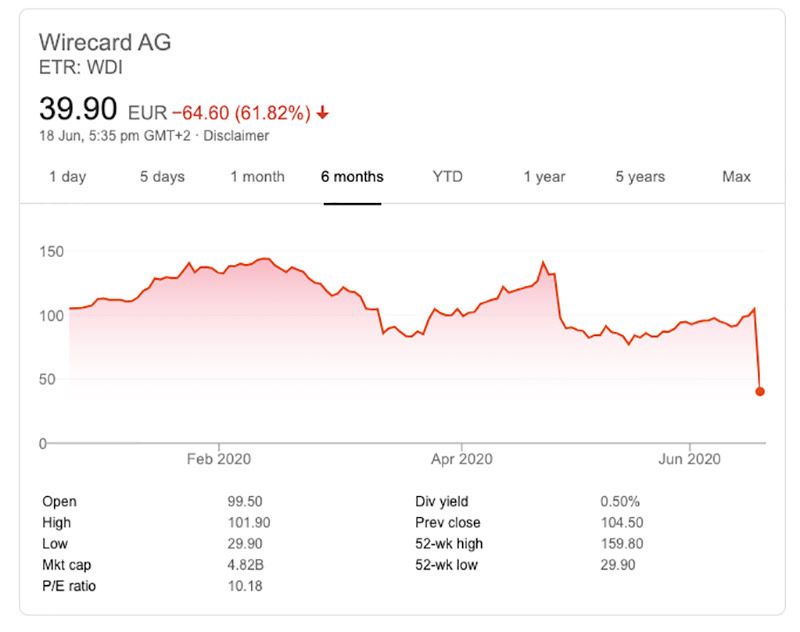

In Europe, a former star of the fintech sector crashed more than 60 per cent in a matter of minutes after auditors discovered that €1.9bn ($3.1bn) was missing from its accounts.

Germany-based Wirecard has delayed publishing its annual report and is working with the auditor “to clarify the situation”.

It’s the latest in a string of scandals surrounding the company. In October, the Financial Times reported that Wirecard staff appeared to be conspiring to fraudulently inflate sales and profit at its subsidiaries.

A number of high-profile short sellers were betting against the stock.

Barry Norris, manager of the Argonaut Absolute Return Fund, said Wirecard was his biggest short position.

“During our first-quarter conference call we previously described the company as ‘having more red flags than you would see at a communist rally’,” he said.

SMALL CAP WINNERS

Here are the best performing ASX small cap stocks at 12pm on Friday June 19:

Swipe or scroll to reveal the full table. Click headings to sort.

| CODE | COMPANY | PRICE | CHANGE | MARKET CAP |

|---|---|---|---|---|

| VPR | Volt Power Group | 0.002 | 100.00% | $9.2M |

| APG | Austpac Resources | 0.002 | 100.00% | $4.3M |

| AWN | AWN Holdings | 0.4 | 53.85% | $11.1M |

| RXH | Rewardle Holdings | 0.003 | 50.00% | $1.6M |

| PWN | Parkway Minerals | 0.003 | 50.00% | $13.7M |

| YPB | YPB Group | 0.003 | 50.00% | $3.4M |

| GMR | Golden Rim | 0.01 | 42.86% | $12.9M |

| SER | Strategic Energy Resources | 0.006 | 33.33% | $7.2M |

| ESE | Esense-Lab | 0.02 | 33.33% | $5.1M |

| CDV | Cardinal Resources | 0.59 | 26.88% | $297.5M |

| DTS | Dragontail Systems | 0.14 | 27.27% | $34.8M |

| TNT | Tesserent | 0.07 | 27.27% | $35.8M |

| MNW | Mint Payments | 0.024 | 26.32% | $21.9M |

| SPT | Splitit | 1.73 | 25.82% | $606.1M |

| SIH | Sihayo Gold | 0.03 | 25.00% | $57.3M |

| ICU | Isentric Ltd | 0.026 | 23.81% | $5.3M |

| IP1 | Integrated Payment Tech | 0.021 | 23.53% | $6.5M |

| OSP | Osprey Medical | 0.011 | 22.22% | $16.5M |

Some good news for WA’s beleaguered lithium sector as Altura (ASX:AJM) locks in a binding, multi-year offtake agreement with battery materials manufacturer and major shareholder Shanshan.

China-based Shanshan has market cap of ~$2.7bn and is one of the world’s largest suppliers of lithium-ion battery materials including cathodes, anodes and electrolytes.

Investors loved the news, sending the stock up +20 per cent in early trade.

Popular African gold play Cardinal Resources (ASX:CDV) has recommended a takeover offer from China’s Shandong Gold Mining that values it at about $300m.

The 60c all-cash offer represents a 39.9 per cent premium to the company’s 20-day volume weighted average price and a 31.1 per cent premium to Russian gold miner Nord Gold SE’s indicative proposal in March.

The stock was up +27 per cent.

SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks at 12pm on Friday June 19:

Swipe or scroll to reveal the full table. Click headings to sort.

| CODE | COMPANY | PRICE | CHANGE | MARKET CAP |

|---|---|---|---|---|

| EGY | Energy Tech | 0.105 | -43.24% | $9.0M |

| TMK | Tamaska Oil and Gas | 0.004 | -33.33% | $3.6M |

| SHK | Stone Resources Australia | 0.003 | -25.00% | $3.3M |

| ONX | Orminex | 0.032 | -20.00% | $17.3M |

| CE1 | Calima Energy | 0.004 | -20.00% | $8.6M |

| CLQ | Clean TeQ | 0.145 | -17.14% | $112.0M |

| IMS | Impelus | 0.005 | -16.67% | $4.0M |

| SGO | Stream Group | 0.022 | -15.38% | $4.8M |

| LRT | Lowell Resources Fund | 0.81 | -14.21% | $22.3M |

| DAF | Discovery Africa | 0.02 | -13.04% | $4.0M |

| CXM | Centrex Metals | 0.035 | -12.50% | $11.1M |

| IVX | Invion | 0.007 | -12.50% | $38.5M |

| PUA | Pure Alumina | 0.016 | -11.11% | $4.1M |

| NVX | Novonix | 0.89 | -10.55% | $212.9M |

| EDE | Eden Energy | 0.028 | -9.68% | $53.4M |

| ALY | Alchemy Resources | 0.019 | -9.52% | $10.5M |

| MPP | Metro Performance Glass | 0.2 | -9.09% | $40.8M |

| WWI | West Wits Mining | 0.01 | -9.09% | $11.1M |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.