ASX Small Cap Lunch Wrap: Who’s up for a new ETF today?

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

2021 has given us an ASX crypto ETF, a semiconductor ETF and soon a private equity ETF will be added to the list.

This morning one of the Australian bourse’s major ETF providers VanEck announced it was launching the Global Listed Private Equity ETF (ASX:GPEQ).

Van Eck says, similar to the crypto and semiconductor ETFs, it is the first time Australian investors will had such direct access to this asset class, which accounts for 98% of the world’s companies (the other 2% being listed).

“Private equity offers investors long-term historical outperformance over public markets, yet traditionally it has only been accessible by institutional and ultra high net worth investors,” said Van Eck Asia-Pacific CEO Arian Neiron.

“GPEQ changes that and allows all investors to participate in private equity investments for the first time through a single trade on the ASX.

“As an alternative investment, private equity is important for investor’s portfolios as it displays a low correlation with equities and bonds as well as offering attractive risk and return characteristics.”

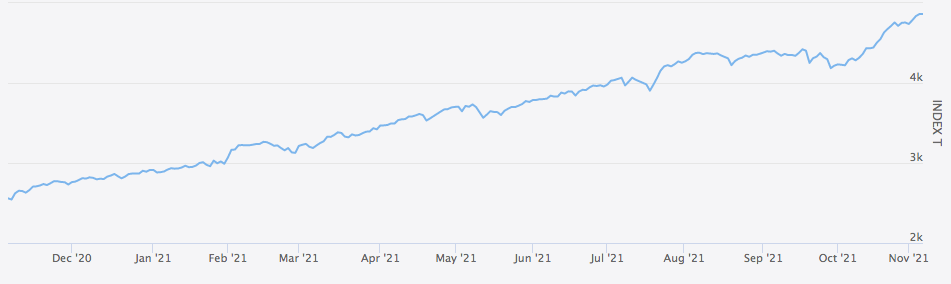

The VanEck Global Listed Private Equity ETF (GPEQ) will track the LPX50 Index which represents the global performance of the 50 most highly capitalised and liquid listed direct, indirect and private equity managers.

Some of these include 3i Group, Ares Capital, Onex Corp and Main Street Capital.

LPX50 Index chart

On local markets, the ASX has retreated slightly this morning down 0.12% to 7,444 points as at 11.45am (AEDT).

The resources sector is higher, but bank stocks are down. So far this week, the ASX has struggled to follow the lead from Wall Street, which continues to hit new record highs.

Meanwhile, the gold price continues to hold its gains after pushing above US$1,800/oz at the end of last week.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for November 9 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume |

|---|---|---|---|---|

| WOO | Wooboard Tech Ltd | 0.002 | 33 | 251527 |

| LMG | Latrobe Magnesium | 0.1375 | 31 | 36954873 |

| ANL | Amani Gold Ltd | 0.0025 | 25 | 2445515 |

| AYM | Australia United Min | 0.01 | 25 | 4500344 |

| PLG | Pearlgullironlimited | 0.135 | 23 | 87692 |

| RFT | Rectifier Technolog | 0.044 | 22 | 17420832 |

| CHN | Chalice Mining Ltd | 8.23 | 22 | 3178339 |

| PH2 | Pure Hydrogen Corp | 0.665 | 21 | 10235722 |

| LIO | Lion Energy Limited | 0.099 | 21 | 9141255 |

| ECT | Env Clean Tech Ltd. | 0.024 | 20 | 14444652 |

| DCC | Digitalx Limited | 0.1325 | 20 | 13358931 |

| AOA | Ausmon Resorces | 0.007 | 17 | 5143151 |

| KEY | KEY Petroleum | 0.0035 | 17 | 206750 |

| SBR | Sabre Resources | 0.007 | 17 | 153811 |

| MRL | Mayur Resources Ltd | 0.225 | 15 | 36500 |

| KOR | Korab Resources | 0.061 | 15 | 13063556 |

| DDD | 3D Resources Limited | 0.004 | 14 | 7923334 |

| MEB | Medibio Limited | 0.008 | 14 | 1748131 |

| RD1 | Registry Direct | 0.032 | 14 | 67397 |

| RDS | Redstone Resources | 0.016 | 14 | 570999 |

| HIQ | Hitiq Limited | 0.205 | 14 | 1454828 |

| PXS | Pharmaxis Ltd | 0.125 | 14 | 995427 |

| DOU | Douugh Limited | 0.077 | 13 | 7302627 |

Chalice (ASX:CHN) rose after unveiling its Maiden Mineral Resource for Julimar.

The company confirmed it was largest nickel sulphide discovery globally in at least 20 years, and the largest PGE discovery in Australian history.

Pearl Gull Iron (ASX:PG1) rose after drilling results

Douugh (ASX:DOU) updated shareholders on its customer numbers in the US.

And biotech Pharmaxis (ASX:PXS) got won FDA approval of its Investigational New Drug application to trial its PXS-5505 drug against liver cancer.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for November 9 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume |

|---|---|---|---|---|

| CAE | Cannindah Resources | 0.355 | -38 | 8044087 |

| YPB | YPB Group Ltd | 0.002 | -33 | 4895465 |

| GAP | Gale Pacific Limited | 0.305 | -28 | 2378102 |

| DME | Dome Gold Mines Ltd | 0.195 | -26 | 8535 |

| TZL | TZ Limited | 0.14 | -20 | 1029189 |

| CCE | Carnegie Cln Energy | 0.0025 | -17 | 1906875 |

| ACW | Actinogen Medical | 0.16 | -16 | 7775987 |

| TNG | TNG Limited | 0.1025 | -15 | 4365219 |

| GGX | Gas2Grid Limited | 0.003 | -14 | 969800 |

| MTB | Mount Burgess Mining | 0.006 | -14 | 80000 |

| GLA | Gladiator Resources | 0.033 | -13 | 6506953 |

| EGN | Engenco Limited | 0.47 | -13 | 28868 |

| CGB | Cann Global Limited | 0.0035 | -13 | 7597373 |

| EQX | Equatorial Res Ltd | 0.19 | -12 | 25520 |

| ZMI | Zinc of Ireland NL | 0.053 | -10 | 10000 |

| EQN | Equinoxresources | 0.225 | -10 | 292924 |

| NAG | Nagambie Resources | 0.072 | -10 | 5920 |

| TPD | Talon Energy Ltd | 0.009 | -10 | 3473357 |

| WMG | Western Mines | 0.185 | -10 | 135280 |

| AEV | Avenira Limited | 0.02 | -9 | 8489025 |

| TYM | Tymlez Group | 0.031 | -9 | 5465947 |

| IOD | Iodm Limited | 0.32 | -9 | 67478 |

| AZL | Arizona Lithium Ltd | 0.11 | -8 | 23613485 |

After posting big gains last week in connection with news from its ‘Mt Cannindah’ copper-gold-silver project, Cannindah (ASX:CAE) plunged this morning after its latest exploration update.

Gale Pacific (ASX:GAP) fell after a trading update in which it reported it had been hit by cost inflation greater than it had previously anticipated.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.