You might be interested in

News

Closing Bell: ASX inches closer to correction territory as traders move into defensive sectors

News

Lunch Wrap: ASX flashes red again as Trump says no exemption for Aussie steel, aluminium

Mining

News

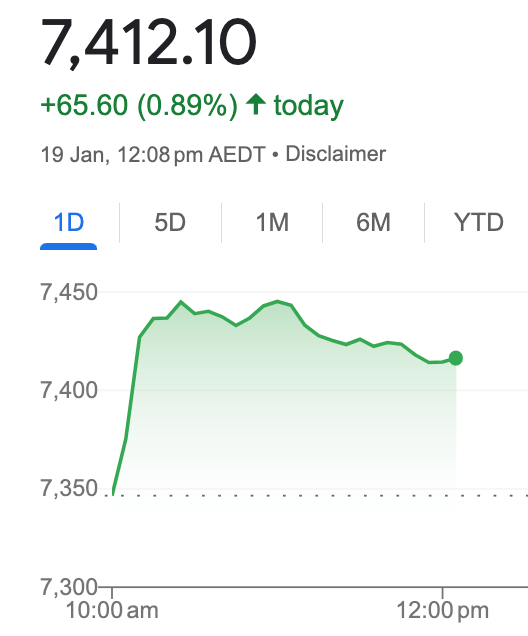

The local market has found some spunk on Friday morning, leaving the benchmark indices looking happier mid-morning than they have been in quite some time.

At midday, the S&P/ASX 200 Index was up by 65.5 points or 0.89% to above 7,4100.

On the last day of the week, out came the benchmark testicles so very absent over the last five sessions. Meanwhile, we have news from Canada that has put the nation at risk of being known as North Florida for generations to come.

Police in Caledon (just up the road from central Toronto) have told local media that a 25-year-old driver is on track to set an enviable record, losing his licence less than 20 minutes after passing his driving exam.

Officers say that they observed the man driving erratically, speeding and weaving through traffic, travelling (allegedly) at speeds of more than 50kph over the posted speed limit – and once they finally managed to pull the young fella over, police discovered open containers of alcohol inside the car.

He told police that he had been drinking and driving like a madman in celebration of his success in getting his driver’s permit less than half an hour prior to being pulled over – and a breath test showed that he was well over the legal limit.

The man, who hasn’t been named in local newspapers, was charged with careless driving, novice driver with BAC above zero, driving with open liquor and several other document related offences, police said.

“I can’t even begin to understand why someone would think that drinking a beer in their vehicle while driving is a smart idea, let alone a novice driver who should be well versed on the rules of the road,” Const. Ian Michel told reporters.

He’s also been charged with the incredibly exciting-sounding crime of “stunt driving” – similar in theory to the various hoon laws we have scattered around Australia, but only available to drivers in Canada who can provide clear footage of themselves parallel parking at high speed , before reversing through an entire moose without enraging the animal beyond its normal level of Massive Crankiness.

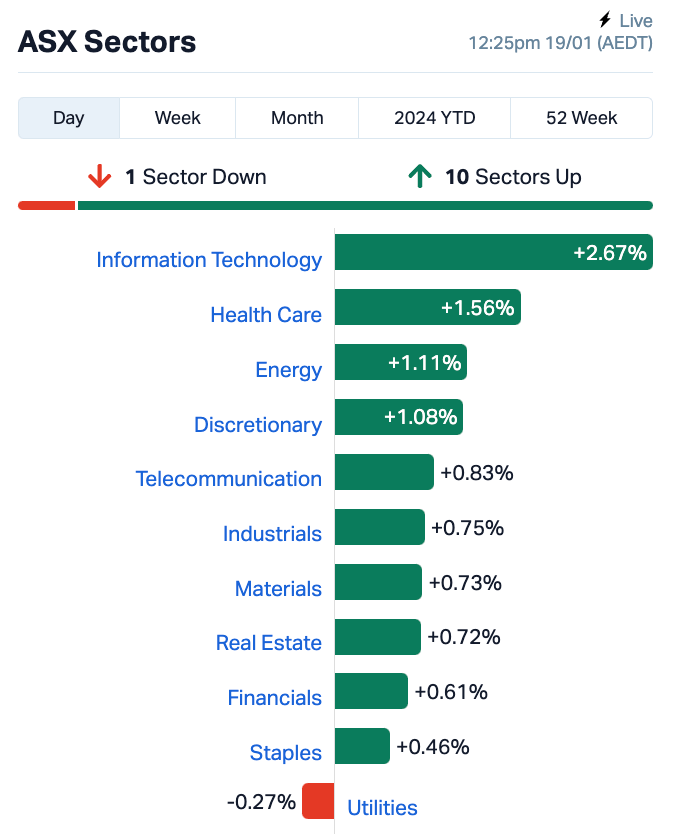

Local markets felt the positivity of some stonking tech-heavy Wall Street corporate earnings overnight.

‘So much for solid US jobs data,’ they said. ‘That’s for your hawkish Fedspeak and we fart in the general direction of your geopolitical uncertainty.’

At 105/20 Bridge St, the resource-rich Aussie market found further reason to get jiggy on the back of some nicely rebounding commodity prices, which were enthused by thin smoke signals around some China stimmy.

Energy stocks were also among the first out the gate, after the Brent crude oil rise was close to 1.5% to about US$79 a barrel. Gold also climbed overnight by about up 0.9% to US$2,023.

All the blue chips you know and love — BHP (ASX:BHP) , Fortescue (ASX:FMG), Santos (ASX:STO) and Woodside Energy Group (ASX:WDS) — are doing their bit.

The morning’s other big winner on Blue Chip street is Whitehaven Coal (ASX:WHC) , up about 7% on juicy production numbers.

The banks and the tech stocks are dining out at lunch on Friday too.

Still, let’s not break out the champagne just yet, the benchmark index is on track to end the week well over 1% behind.

In local bond markets, the yield on Australian 2 Year government bonds was up at 3.93% while the 10 Year yield was up at 4.26%. US Treasury notes were mixed, with the 2 Year yield unchanged at 4.35% and the 10 Year yield up at 4.14%

US stock futures are mixed on Friday morning in Sydney after last night’s Nasdaq led rally on Wall Street during the previous session.

The Dow ended higher by about 0.55%, the S&P 500 gained 0.89% and the Nasdaq Composite climbed happily away by 1.35%,.

7 out of 11 S&P500 Sectors did the lifting led by Tech, Comms and Industrials.

Shares in the US-listed, Taiwanese chip giant TSMC led the advance, surging 9.8% after the chip producer reported solid fourth quarter numbers. Other chip firms including Nvidia (1.9%) and AMD (1.6%) also gained.

Out of favour lately after being dethroned by Microsoft as world’s fattest market capped company, shares in Apple jumped 3.3% following a buy rating upgrade from Bank of America.

Meanwhile, more of the hawkish signals from Fed officials and strong US data lifted Treasury yields and reduced expectations of a rate cut in March.

In extended trading, Super Micro Computer jumped 10% on stronger-than-expected quarterly results, while iRobot plunged 10% after the European Commission said it would likely reject Amazon’s bid to acquire the Roomba maker.

Here are the best performing ASX small cap stocks for 19 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CLE | Cyclone Metals | 0.0015 | 50% | 246,030 | $10,471,172 |

| IPB | IPB Petroleum Ltd | 0.011 | 38% | 5,950,606 | $4,520,980 |

| GES | Genesis Resources | 0.005 | 25% | 776,636 | $3,131,365 |

| MTB | Mount Burgess Mining | 0.003 | 20% | 6,077,489 | $2,612,034 |

| PVT | Pivotal Metals Ltd | 0.025 | 19% | 3,237,098 | $14,281,171 |

| LRL | Labyrinth Resources | 0.007 | 17% | 120,000 | $7,125,262 |

| MTL | Mantle Minerals Ltd | 0.0035 | 17% | 750,029 | $18,592,338 |

| TG6 | TG Metals | 0.29 | 16% | 313,363 | $13,521,542 |

| EME | Energy Metals Ltd | 0.185 | 16% | 4,000 | $33,549,330 |

| MSB | Mesoblast Limited | 0.305 | 15% | 13,008,908 | $269,065,693 |

| GGE | Grand Gulf Energy | 0.008 | 14% | 1,495,496 | $14,666,729 |

| GSR | Greenstone Resources | 0.008 | 14% | 69,000 | $9,576,794 |

| ZEU | Zeus Resources Ltd | 0.008 | 14% | 1,062,506 | $3,214,967 |

| BGE | Bridge SaaS | 0.08 | 14% | 96,321 | $8,357,794 |

| GAS | State GAS Limited | 0.165 | 14% | 208,936 | $39,762,884 |

| NC6 | Nanollose Limited | 0.025 | 14% | 542,308 | $3,495,500 |

| BBT | Bluebet Holdings Ltd | 0.255 | 13% | 107,048 | $45,248,927 |

| AZY | Antipa Minerals Ltd | 0.017 | 13% | 4,469,873 | $62,022,119 |

| LU7 | Lithium Universe Ltd | 0.027 | 13% | 669,822 | $9,324,526 |

| 88E | 88 Energy Ltd | 0.0045 | 13% | 11,225,923 | $98,901,682 |

| AUZ | Australian Mines Ltd | 0.009 | 13% | 101,099 | $7,560,394 |

| BUY | Bounty Oil & Gas NL | 0.009 | 13% | 701,706 | $11,988,008 |

| CAV | Carnavale Resources | 0.0045 | 13% | 710,166 | $13,694,207 |

| MHC | Manhattan Corp Ltd | 0.0045 | 13% | 5,572,369 | $11,747,919 |

| WCN | White Cliff Minerals | 0.018 | 13% | 9,915,395 | $20,429,749 |

IPB Petroleum (ASX:IPB) is nominally at the top of the Small Caps ladder today despite no news since it told the market about a signing an MoU with Australian oil and gas development tech company, Pivotree.

The MoU sets IPB up to use Pivotree technology for the potential future development within its WA-424-P Permit focussed on the proven Gwydion oil and gas discovery and potential Idris extension.

Meanwhile, the likes of Pivotal Metals (ASX:PVT), Mount Burgess Mining (ASX:MTB) and Genesis Resources (ASX:GES) are moving about quite a bit on decent volume, despite little or nothing in the way of news to the market today.

Labyrinth Resources (ASX:LRL) is moving nicely on a double-shot of happy news that has identified the company as the hottest ticket in town for anyone who loves great big steaming piles of cash in the bank.

Week before last, Labyrinth told the market that its sold off the Labyrinth and Denain gold projects in the Abitibi region of Quebec, Canada for US$3.5 million in cash money.

And this morning, the company was rolling in it again, after the Canadian tax office sent it a cheque for CAD $415,453, a rebate against expenditure incurred by Labyrinth hunting for resources last calendar year.

Lastly for the lead-up to lunch, market minnow Mantle Minerals (ASX:MTL) is moving quickly, after delivering a resource upgrade at the Highway nickel deposit, within the Pardoo Ni-Cu Project, located in the Pilbara region of northern Western Australia.

Here are the worst performing ASX small cap stocks for 19 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| RR1 | Reach Resources | 0.003 | -25% | 12,252,573 | $12,841,188 |

| CAZ | Cazaly Resources | 0.021 | -22% | 1,446,401 | $12,275,181 |

| S3N | Sensore Ltd | 0.074 | -22% | 1,686,578 | $3,457,358 |

| APS | Allup Silica Ltd | 0.035 | -19% | 360,441 | $1,654,515 |

| BMG | BMG Resources Ltd | 0.015 | -17% | 9,301,444 | $11,408,349 |

| ESR | Estrella Res Ltd | 0.005 | -17% | 5,804,303 | $10,556,231 |

| PAT | Patriot Lithium | 0.13 | -16% | 112,808 | $10,620,155 |

| AS2 | Askari Metals | 0.135 | -16% | 84,807 | $12,472,034 |

| T3D | 333D Limited | 0.018 | -14% | 189,333 | $2,508,344 |

| LSR | Lodestar Minerals | 0.003 | -14% | 47,276 | $7,081,891 |

| EQS | Equity Story Group | 0.031 | -14% | 13,000 | $1,534,133 |

| HTG | Harvest Tech Group | 0.013 | -13% | 130,688 | $10,589,450 |

| BRX | Belararox Ltd | 0.21 | -13% | 9,804 | $13,186,565 |

| PCL | Pancontinental Energy | 0.021 | -13% | 29,909,183 | $193,445,347 |

| AKM | Aspire Mining Ltd | 0.18 | -12% | 242,649 | $104,065,582 |

| AMM | Armada Metals | 0.022 | -12% | 100,000 | $5,200,000 |

| ATS | Australis Oil & Gas | 0.015 | -12% | 129,992 | $21,706,714 |

| CR9 | Corellares | 0.023 | -12% | 22,570 | $12,092,363 |

| ENX | Enegex Limited | 0.023 | -12% | 2,467 | $9,591,816 |

| MM1 | Midas Minerals | 0.115 | -12% | 137,028 | $11,277,142 |

| PRS | Prospech Limited | 0.039 | -11% | 518,258 | $11,886,544 |

| FOS | FOS Capital Ltd | 0.195 | -11% | 20,512 | $11,837,351 |

| ARV | Artemis Resources | 0.016 | -11% | 1,500,000 | $30,441,531 |

| MCL | Mighty Craft Ltd | 0.016 | -11% | 363 | $6,572,379 |

| VMS | Venture Minerals | 0.008 | -11% | 1,932,264 | $19,890,117 |