Lunch Wrap: ASX flashes red again as Trump says no exemption for Aussie steel, aluminium

ASX flashed red after Australia not exempted from US tariffs. Picture via Getty Images

- ASX drops as Trump hits Aussie steel

- Australia not exempted from US tariffs

- Wall Street falls again, VIX spikes, gold rises

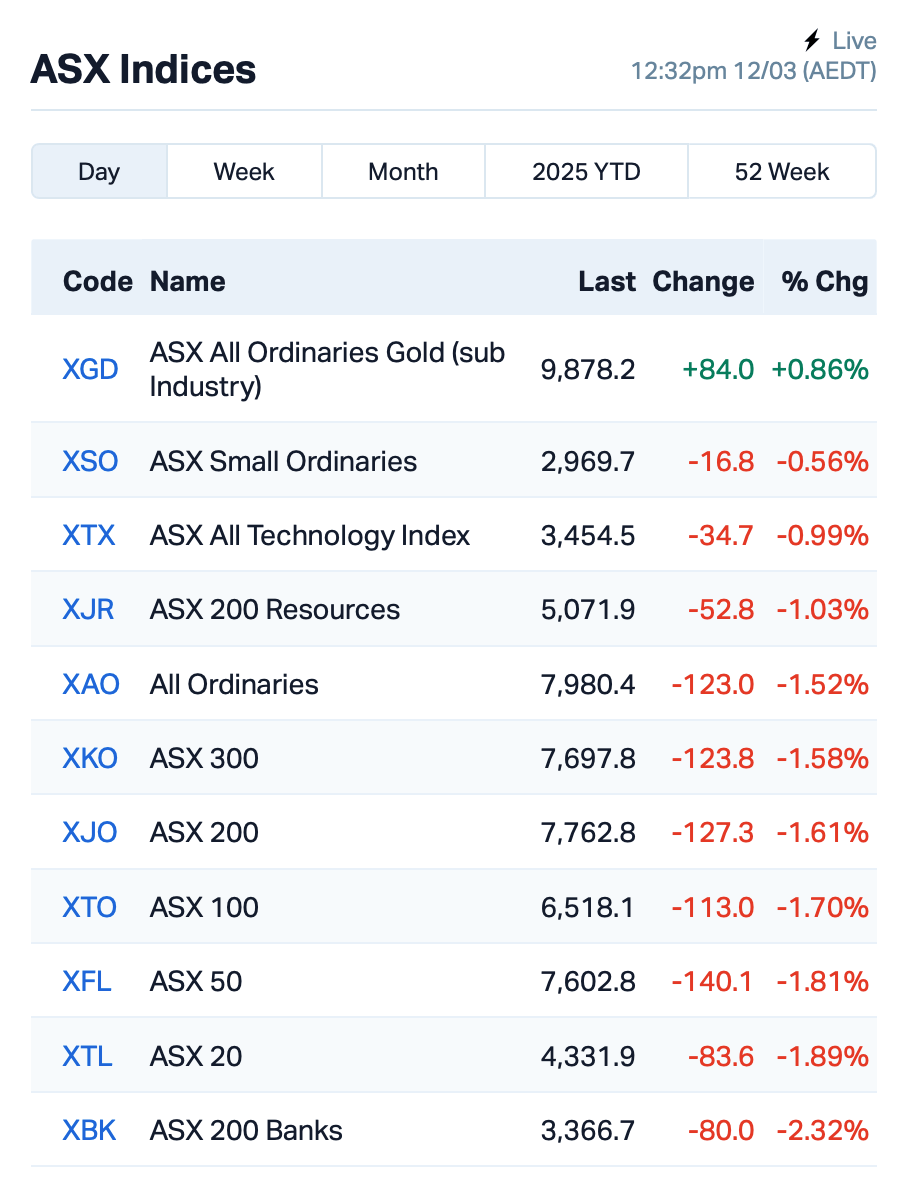

After falling nearly 1% yesterday, the ASX was in the red again on Wednesday, down by about 1.4% at lunch time (AEDT) after President Trump ruled out tariff exemptions for Australia.

This means the US will slap a 25% tariff on all Australian steel and aluminium exports, which will take effect this afternoon.

White House spokeswoman Karoline Leavitt made it clear that there would be no exemptions, telling Australian media that Trump “considered it and considered against it”.

“If Australia wants to be exempted, they should consider moving steel manufacturing here,” Leavitt told the press.

The news came as Australia recorded a surprise trade surplus with the US for the first time in decades – according to ABS data released last week.

In January, Australia sold more goods to the US than it bought, thanks to a surge in gold exports.

While this surplus was a one-off anomaly, it weakened PM Albanese’s case that Australia should be granted an exemption from the tariffs.

But Trump not only confirmed the tariffs on Australia, he also threatened to double the levies on steel and aluminium exports from Canada, a move that sent shockwaves through markets globally.

Wall Street fell on the news, with all the three major indices losing ground. The US volatility index, also known as the VIX, spiked to as high as 29.5, which signals a surge in “extreme market fear”.

But gold edged higher, reclaiming a modest foothold above $US2,900/oz as traders flocked to the precious metal in search of safety.

Meanwhile back home, it’s also a sea of red with all 11 ASX sectors falling. Retailers, healthcare and industrials were the biggest laggards.

Australian companies affected by the US tariffs were obviously under the microscope this morning, with BHP (ASX:BHP), Rio Tinto (ASX:RIO) and Fortescue (ASX:FMG) all seeing downward pressure.

Bluescope Steel (ASX:BSL) and Champion Iron (ASX:CIA) also fell.

Goldies were the only sector showing signs of life. And analysts are already predicting tougher days ahead, with the ASX 200 now down 8% from its record high.

“If the 2018 trade war playbook repeats, our market could be sitting with a loss of perhaps 15%,” warned Moomoo’s Jessica Amir.

“To get you through, focus on stocks that are growing their earnings, despite the mayhem.”

In the large caps space, Insurance Australia (ASX:IAG) reported over 4000 claims relating to the damage caused by ex-tropical cyclone Alfred. The insurer has ramped up its response, increasing its property assessor team, even pulling in specialists from New Zealand to assist. Shares were down 1%.

On the retail front, NZ company Briscoe Group (ASX:BGP), which owns Rebel Sport, reported a 28% drop in full-year profits, mainly due to economic headwinds. The company’s net profit fell to NZ$60.6 million.

And, shipbuilder Austal (ASX:ASB) took a 16% hit after the company raised $200 million through an institutional placement at $3.80 per share, issuing 52.6 million new shares. This move was part of Austal’s plan to fund its US shipbuilding expansion, but it also means potential dilution for existing shareholders. On top of that, Austal’s former Chairman, John Rothwell, sold 13.2 million shares, adding more pressure to the stock price.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for March 12 [intraday]:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| MPW | Metal Powdworks Ltd | 0.370 | 155% | 6,102,542 | $14,784,092 |

| AAJ | Aruma Resources Ltd | 0.016 | 60% | 9,551,255 | $2,220,582 |

| NWM | Norwest Minerals | 0.011 | 22% | 1,093,405 | $4,366,076 |

| BCB | Bowen Coal Limited | 0.006 | 20% | 1,706,163 | $53,878,201 |

| 8CO | 8Common Limited | 0.025 | 19% | 382,374 | $4,705,993 |

| PIL | Peppermint Inv Ltd | 0.004 | 17% | 778,039 | $6,634,438 |

| SKK | Stakk Limited | 0.007 | 17% | 388,924 | $12,450,478 |

| TMK | TMK Energy Limited | 0.004 | 17% | 8,225,616 | $28,090,995 |

| BNL | Blue Star Helium Ltd | 0.008 | 14% | 650,508 | $18,864,197 |

| CCG | Comms Group Ltd | 0.057 | 14% | 1,003,000 | $19,493,427 |

| PNT | Panthermetalsltd | 0.017 | 13% | 10,806,510 | $3,722,561 |

| AJL | AJ Lucas Group | 0.009 | 13% | 662,345 | $11,005,837 |

| HAW | Hawthorn Resources | 0.049 | 11% | 16,179 | $14,740,687 |

| AON | Apollo Minerals Ltd | 0.020 | 11% | 250,000 | $16,712,224 |

| GES | Genesis Resources | 0.011 | 10% | 188,880 | $7,828,413 |

| LYK | Lykosmetalslimited | 0.011 | 10% | 1,910 | $1,883,556 |

| GT1 | Greentechnology | 0.055 | 10% | 238,590 | $19,437,605 |

| IND | Industrialminerals | 0.175 | 9% | 3,100 | $12,851,600 |

| NMG | New Murchison Gold | 0.013 | 8% | 57,775,346 | $97,636,796 |

| BVR | Bellavistaresources | 0.335 | 8% | 2,985 | $31,273,592 |

| GC1 | Glennon SML Co Ltd | 0.500 | 8% | 1,900 | $22,361,001 |

| AMI | Aurelia Metals Ltd | 0.220 | 7% | 7,554,273 | $346,770,739 |

| MAU | Magnetic Resources | 1.480 | 7% | 779,177 | $368,130,387 |

| IPT | Impact Minerals | 0.008 | 7% | 30,000 | $21,416,036 |

Forrestania Resources (ASX:FRS) has successfully secured $500,910 through a placement of 20,036,400 shares at $0.025 each. The placement was made at a 29.7% premium to the recent 10-day average share price, showing strong backing from existing shareholders, directors, and staff. The funds will go toward drilling at the Lady Lila prospect, where there’s an estimated resource of 24,000 ounces of gold, and further exploration at the Ada Ann prospect.

Ovanti (ASX:OVT) has scored a big win, securing a 20-year License Agreement with BNPLPay Protocol, a blockchain-based platform for Buy Now, Pay Later (BNPL) financing. This deal gives Ovanti preferential access to cheaper, decentralised debt funding, without the usual first-loss capital requirements, and at rates well below traditional lenders – saving OVT 30-40% on financing costs.

In return, Ovanti will earn a sweet 50% share of BNPLPay’s revenues, creating a long-term income stream. OVT said the partnership not only boosts its funding, but also aligns the company with BNPLPay’s growth, especially as OVT looks to expand into the US market.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for March 12 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -33% | 88,888 | $9,862,021 |

| NTM | Nt Minerals Limited | 0.002 | -33% | 15,001 | $3,632,709 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 1,247,860 | $57,867,624 |

| CDT | Castle Minerals | 0.002 | -25% | 112,523 | $3,793,628 |

| NRZ | Neurizer Ltd | 0.002 | -25% | 2,311,110 | $6,716,008 |

| QXR | Qx Resources Limited | 0.003 | -25% | 34,500 | $5,240,311 |

| SIS | Simble Solutions | 0.003 | -25% | 5,000 | $3,345,321 |

| PKD | Parkd Ltd | 0.030 | -23% | 150,086 | $4,056,541 |

| NIC | Nickel Industries | 0.590 | -22% | 235,791,362 | $3,238,806,459 |

| BXN | Bioxyne Ltd | 0.023 | -21% | 3,601,950 | $59,427,633 |

| AUK | Aumake Limited | 0.004 | -20% | 3,747,996 | $15,053,461 |

| PAB | Patrys Limited | 0.002 | -20% | 536,075 | $5,143,618 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 58,200 | $7,937,639 |

| SP3 | Specturltd | 0.013 | -19% | 541,158 | $4,930,402 |

| LMS | Litchfield Minerals | 0.160 | -18% | 729,062 | $5,501,212 |

| ION | Iondrive Limited | 0.018 | -17% | 5,690,833 | $24,839,563 |

| PEB | Pacific Edge | 0.100 | -17% | 9,181 | $97,429,917 |

| AKN | Auking Mining Ltd | 0.005 | -17% | 102,391 | $3,448,673 |

| EPM | Eclipse Metals | 0.005 | -17% | 3,511,600 | $17,158,914 |

| MRD | Mount Ridley Mines | 0.003 | -17% | 47,434 | $2,335,467 |

| RDN | Raiden Resources Ltd | 0.005 | -17% | 1,175,242 | $20,705,349 |

| CUE | CUE Energy Resource | 0.105 | -16% | 73,961 | $87,386,578 |

| HMY | Harmoney Corp Ltd | 0.460 | -16% | 29,686 | $55,570,460 |

| COB | Cobalt Blue Ltd | 0.049 | -16% | 2,046,520 | $25,489,451 |

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.