ASX Small Cap Lunch Wrap: Who are today’s pharaohs and who are the fan-bearers?

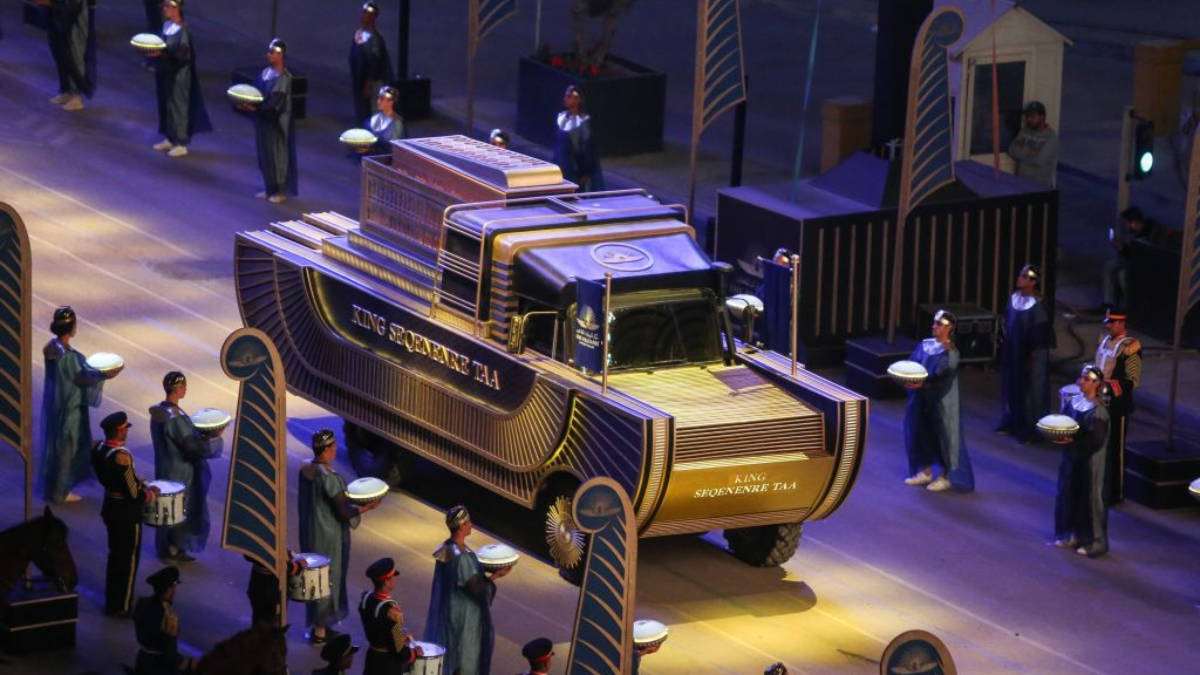

The Pharaohs' Golden Parade in Cairo featured 22 royal mummies. Image: Getty

It’s not every day you see 22 Egyptian mummies trundling along in a night-time convoy with a grand guard of honour in contemporary costume bearing Egyptian motifs.

The special event staged in Cairo over the Easter weekend was designed to draw tourists back to the land of the pyramids which, like many tourist meccas, has suffered over the past year.

The preserved remains of 18 kings and four queens in climate-controlled caskets were on their way to their new home at the National Museum of Egyptian Civilisation.

The specially-designed caskets were supposed to mimic the reed-based craft that carried pharaohs down the Nile to their final resting places in the Valley of the Kings.

The Pharaoh’s Golden Parade was broadcast live on Egyptian TV and around the world and was aimed at publicising Egypt’s ancient history to potential tourists.

While many people’s travel plans remain up in the air due to COVID-19, some analysts like Morgan Stanley are predicting a Golden Age of Travel in the 2020s once the pandemic eases.

“A Roaring 20s/Swinging 60s-like macro environment can drive traffic significantly higher than a 2019 baseline level,” said an analyst report on the travel industry from the bank.

Air travel does seem to be taking off in the US, with 1.5 million domestic passengers taking flights each day in April, compared with a tenth of that number last April.

The US Global Jets ETF is up 27 per cent this year, already.

To markets:

At lunchtime in Sydney, the ASX All Ordinaries index had risen 1 per cent in early trade to 7,248 points.

US stock indexes were mostly flat at the end of overnight trading. The NASDAQ finished marginally lower at 13,688, while the Dow Jones index rose 16 points to 33,446.

The S&P 500 was up 6 points at 4,079 at Wednesday’s market close, and was enough to set a new record for the index which has gained 9 per cent since January 1.

“The S&P 500 and the Dow closed modestly higher and Treasury yields reversed slight losses after the Federal Reserve, in minutes of its latest meeting, said that the economic recovery remains far from complete despite showing signs of progress,” said stockbroker Argonaut in a note.

The price of gold was hovering around $US1,736 per ounce ($2,280/ounce), Thursday.

Ten-year bond rates were down from last week with the US yield trading at 1.67 per cent and Australia’s was at 1.69 per cent.

WINNERS

Here are the best performing ASX small cap stocks at 12pm Thursday April 8:

Swipe or scroll to reveal the full table. Click headings to sort.

Stocks highlighted in yellow made market moving announcements

| Code | Name | Price | % Change | Volume | Market cap |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.0285 | 30 | 335164294 | $ 275,474,989.48 |

| AO1 | Assetowl Limited | 0.009 | 29 | 11030468 | $ 3,461,535.74 |

| ROG | Red Sky Energy. | 0.0115 | 28 | 150772500 | $ 41,412,799.77 |

| MLS | Metals Australia | 0.0025 | 25 | 1250023 | $ 8,381,807.15 |

| XST | Xstate Resources | 0.005 | 25 | 12470635 | $ 10,758,350.06 |

| OEL | Otto Energy Limited | 0.017 | 21 | 68311418 | $ 67,130,136.82 |

| EVS | Envirosuite Ltd | 0.15 | 20 | 5532265 | $ 128,267,988.25 |

| MRD | Mount Ridley Mines | 0.006 | 20 | 50150739 | $ 21,120,728.14 |

| FFG | Fatfish Group | 0.125 | 19 | 6738133 | $ 98,579,273.10 |

| RIE | Riedel Resources Ltd | 0.0355 | 18 | 5799971 | $ 25,251,181.86 |

| SPA | Spacetalk Ltd | 0.165 | 18 | 552312 | $ 23,153,402.30 |

| NWC | New World Resources | 0.1 | 18 | 43933452 | $ 115,324,954.37 |

| FIJ | Fiji Kava Limited | 0.14 | 17 | 387684 | $ 15,594,747.84 |

| TPD | Talon Petroleum Ltd | 0.0105 | 17 | 62358786 | $ 52,500,168.23 |

| AFW | Applyflow Limited | 0.007 | 17 | 69000 | $ 10,871,122.43 |

| AZI | Alta Zinc Ltd | 0.007 | 17 | 134317578 | $ 26,044,195.06 |

| MCT | Metalicity Limited | 0.014 | 17 | 2680500 | $ 21,205,491.06 |

| MSR | Manas Res Ltd | 0.007 | 17 | 1000000 | $ 16,561,641.59 |

| OEX | Oilex Ltd | 0.007 | 17 | 19991675 | $ 26,528,513.29 |

| YPB | YPB Group Ltd | 0.0035 | 17 | 6665559 | $ 14,975,461.55 |

| ICT | Icollege Limited | 0.15 | 15 | 1176727 | $ 75,603,404.37 |

| LMG | Latrobe Magnesium | 0.023 | 15 | 645440 | $ 25,930,061.38 |

Alaskan oil explorer 88 Energy (ASX:88E) was Thursday’s top gaining stock with a ~40 per cent gain and the company has been on an upswing since mid-March. The company has posted a series of operational updates on work to advance its Peregrine project on the northern slopes of the US state of Alaska.

88 Energy is getting ready to develop its Merlin-1 prospect which has delivered the best results of recent drilling by the company.

“Project Peregrine, in combination with the 100 per cent owned Umiat oil field, has the potential to deliver substantial returns for shareholders, in the form of a potentially large oil field development,” managing director, David Wall, said in a recent update.

AssetOwl (ASX:AO1) took off Thursday as the cloud-based software company servicing the real estate sector announced some top level personnel changes. The property management platform company has appointed a new CEO in Geoff Goldsmith who has developed AssetOwl’s commercial strategy and resourcing plans.

AssetOwl aims to commercialise its inspector360 photocentric tool for the real estate industry and to target the under-serviced self-management segment of the market.

Another winner early Thursday was Otto Energy (ASX:OEL) whose shares jumped before it was placed into a trading halt pending an update on its business. The company is going through a sales process for its Alaskan oil assets contained in its Borealis Alaska subsidiary to Pantheon Resources.

LOSERS

Here are the worst performing ASX small cap stocks at 12pm Thursday April 8:

Swipe or scroll to reveal the full table. Click headings to sort.

Stocks highlighted in yellow made market moving announcements

| Code | Name | Price | % Change | Volume | Market cap |

|---|---|---|---|---|---|

| GGG | Greenland Minerals | 0.089 | -44 | 25934083 | $ 214,648,375.36 |

| DTR | Dateline Resources | 0.004 | -20 | 17923522 | $ 43,700,390.38 |

| HNG | HGL Limited | 0.2 | -18 | 9763 | $ 32,490,419.47 |

| NPM | Newpeak Metals | 0.0025 | -17 | 5113332 | $ 17,022,483.89 |

| DLC | Delecta Limited | 0.006 | -14 | 155826 | $ 7,060,348.44 |

| VPR | Volt Power Group | 0.003 | -14 | 700000 | $ 32,093,367.45 |

| FTZ | Fertoz Ltd | 0.052 | -13 | 714038 | $ 9,319,297.68 |

| IDT | IDT Australia Ltd | 0.365 | -13 | 1937593 | $ 100,900,658.88 |

| AZY | Antipa Minerals Ltd | 0.045 | -12 | 28079558 | $ 127,553,071.52 |

| AUQ | Alara Resources Ltd | 0.016 | -11 | 29414 | $ 12,697,726.30 |

| CXM | Centrex Metals | 0.051 | -11 | 368248 | $ 20,913,305.13 |

| EQE | Equus Mining Ltd | 0.009 | -10 | 215000 | $ 18,190,227.06 |

| VAL | Valor Resources Ltd | 0.009 | -10 | 595000 | $ 28,338,314.18 |

| MBK | Metal Bank Ltd | 0.01 | -9 | 5870760 | $ 13,029,591.34 |

| DRX | Diatreme Resources | 0.021 | -9 | 816258 | $ 59,235,502.86 |

| MYG | Mayfield Group Ltd | 0.44 | -8 | 1581 | $ 40,975,623.84 |

| DTZ | Dotz Nano Ltd | 0.34 | -8 | 172471 | $ 139,261,479.86 |

| DCL | Domacom Limited | 0.081 | -8 | 21712 | $ 26,909,855.63 |

| ARD | Argent Minerals | 0.048 | -8 | 1430340 | $ 45,563,518.47 |

Greenland Minerals (ASX:GGG) was one of the largest casualties in early trading Thursday before its shares went into a trading halt as it prepared to update the market.

The exploration company is developing a rare earths project, Kvanefjeld, in Greenland which has been at the centre of an election campaign in the Denmark-ruled Arctic territory.

The opposition Community of the People party gained nearly 40 per cent of the popular vote in the election and had campaigned against the Kvanefjeld project and others.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.