ASX Small Cap Lunch Wrap: What does a trillion dollars look like?

Pic: d3sign / Moment via Getty Images

European leaders have finally agreed a €750bn ($1.2 trillion) plan to spend their way out of the coronavirus crisis.

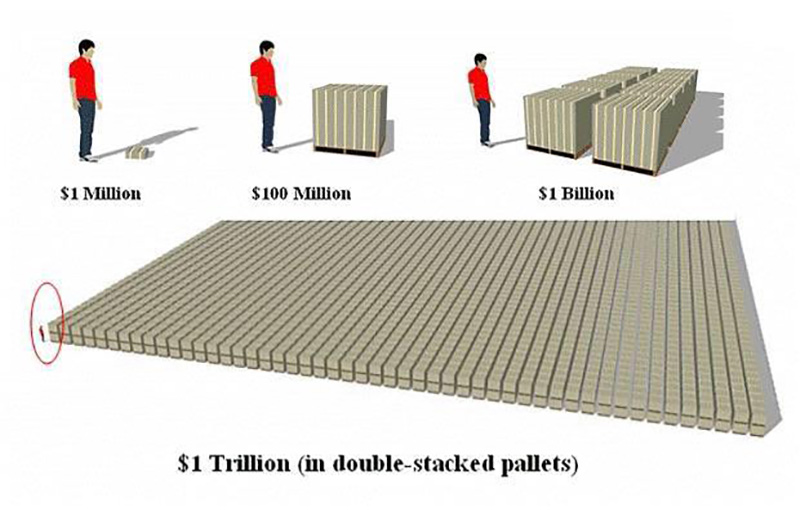

Every wondered what one trillion dollars (in $100 bills) might look like? Here you go:

Someone did the maths – if you (an immortal) spent $1m a day from the time Jesus was born, there would still be a few hundred billion left in that pile.

>>Scroll down for today’s best and worst performing ASX small cap stocks

The spending program will add between 0.5 percentage points (ppts) and 2ppts to individual EU countries’ GDP over the next few years, according to Oxford Economics.

“Consequently, we now expect the eurozone economy to return to pre-crisis levels by late-2021, instead of mid-2022 in our latest baseline,” head of Europe economics Angel Talavera says.

“The EU’s improved monetary and fiscal response to this crisis is now much stronger than in previous emergencies, confirming our view that further gradual integration rather than disintegration remains the more likely path forward.”

This proactive policy response and the boost in sentiment is likely to be reflected in an outperformance for European equities in the short-term, which Oxford Economics see as “relatively cheap” at the moment.

News of the EU stimulus fund saw European share markets close at four-month highs.

It is profit season in the US, where virus cases continue to soar.

So far 58 companies of the S&P 500 have reported earnings. Incredibly, 77.6 per cent of results have beaten forecasts, according to Refinitiv.

And the gold futures price is up $US26.50 (or 1.5 per cent) to $US1,843.90 an ounce — the highest level since September 2011.

WINNERS

Here are the best performing ASX small cap stocks at 12pm Wednesday July 22:

Swipe or scroll to reveal the full table. Click headings to sort.

| CODE | COMPANY | PRICE | CHANGE | MARKET CAP |

|---|---|---|---|---|

| LCY | Legacy Iron Ore | 0.006 | 50.00% | $37.5M |

| ICG | Inca Minerals | 0.003 | 50.00% | $8.1M |

| CZN | Corazon Mining | 0.002 | 33.33% | $5.5M |

| IBX | Imagion Biosystems | 0.06 | 25.00% | $45.7M |

| RFN | Reffind | 0.003 | 25.00% | $2.1M |

| SHO | SportsHero | 0.025 | 25.00% | $8.2M |

| AJJ | Asian American Medical Group | 0.03 | 25.00% | $10.4M |

| CAD | Caeneus Minerals | 0.005 | 25.00% | $17.4M |

| AAJ | Aruma Resources | 0.005 | 25.00% | $4.1M |

| RDM | Red Metal | 0.13 | 23.81% | $31.9M |

| FXL | Flexiroam | 0.016 | 23.08% | $528.5M |

| CLQ | Clean TeQ | 0.195 | 21.88% | $141.8M |

| BAT | Battery Minerals | 0.012 | 20.00% | $14.5M |

| IMS | Impelus | 0.006 | 20.00% | $4.8M |

| LML | Lincoln Minerals | 0.006 | 20.00% | $3.5M |

| CYM | Cyprium Metals | 0.21 | 16.67% | $11.8M |

| AO1 | Assetowl | 0.007 | 16.67% | $3.4M |

| CZR | Coziron Resources | 0.014 | 16.67% | $38.4M |

| SI6 | Six Sigma Metals | 0.007 | 16.67% | $5.6M |

| THR | Thor Mining DRC | 0.007 | 16.67% | $5.2M |

| SVL | Silver Mines | 0.158 | 16.67% | $158.6M |

| VLT | Vault Intelligence | 0.54 | 17.20% | $69.8M |

Legacy Iron Ore (ASX:LCY) leads the winners, up 50 per cent on some solid gold intersections at the Mt Celia project.

Almost every drill hole (27 out of 29 holes) intercepted significant mineralisation, the company says.

Explorer Corazon Mining (ASX:CZN) is restarting drilling at the compelling new Fraser Lake Complex (FLC) nickel-copper-cobalt target at the Lynn Lake project in the Manitoba Province, Canada.

The stock was up +33 per cent in morning trade.

New research indicates Imagion Biosystems’ (ASX:IBX) tech may allow the company to offer medical imaging for considerably cheaper rates than available today.

The biotech jumped 25 per cent to 6c per share.

And battery metals hopeful Clean TeQ (ASX:CLQ) is up on a new collaboration to develop scandium aluminium alloys for rockets.

LOSERS

Here are the worst performing ASX small cap stocks at 12pm Wednesday July 22:

Swipe or scroll to reveal the full table. Click headings to sort.

| CODE | COMPANY | PRICE | CHANGE | MARKET CAP |

|---|---|---|---|---|

| IMC | Immuron | 0.61 | -28.65% | $109.0M |

| SYA | Sayona Mining | 0.009 | -20.83% | $22.2M |

| DLC | Delecta | 0.005 | -16.67% | $4.0M |

| WRM | White Rock Minerals | 0.006 | -14.29% | $23.6M |

| IEC | Intra Energy Corporation | 0.006 | -14.29% | $2.3M |

| YPB | YPB Group | 0.006 | -14.29% | $11.4M |

| RVS | Revasum | 0.42 | -12.50% | $13.9M |

| QGL | Quantum Graphite | 0.029 | -12.12% | $6.4M |

| 9SP | 9 Spokes | 0.034 | -10.53% | $41.3M |

| DAU | Dampier Gold | 0.03 | -11.76% | $8.0M |

| FFG | Fatfish Internet Group | 0.009 | -10.00% | $7.3M |

| MGL | Magontec | 0.019 | -9.52% | $21.7M |

| TTI | Traffic Technologies | 0.019 | -9.52% | $9.2M |

| PIO | Pioneer Resources | 0.1 | -9.09% | $15.1M |

| AFL | AF Legal | 0.2 | -9.09% | $13.2M |

| QEM | QEM | 0.1 | -9.09% | $10.0M |

| PPC | Pro-Pac Packaging | 0.155 | -8.82% | $125.7M |

Diarrhoea company Immuron (ASX:IMC) dropped ~28 per cent after announcing a $US20m raise from institutional investors which it will use to fund R&D, preclinical and clinical programs, and marketing for its Delhi-belly pill Travelan.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.