ASX Lunch Wrap: Volatile morning for stocks; gold soars and Bitcoin breaks $101k

ASX swings between gains and losses on Friday morning. Picture via Getty Images

- ASX seesaws after tech, banks stocks falter

- Gold soars and Bitcoin breaks $101k

- CC Capital ups takeover bid for Insignia

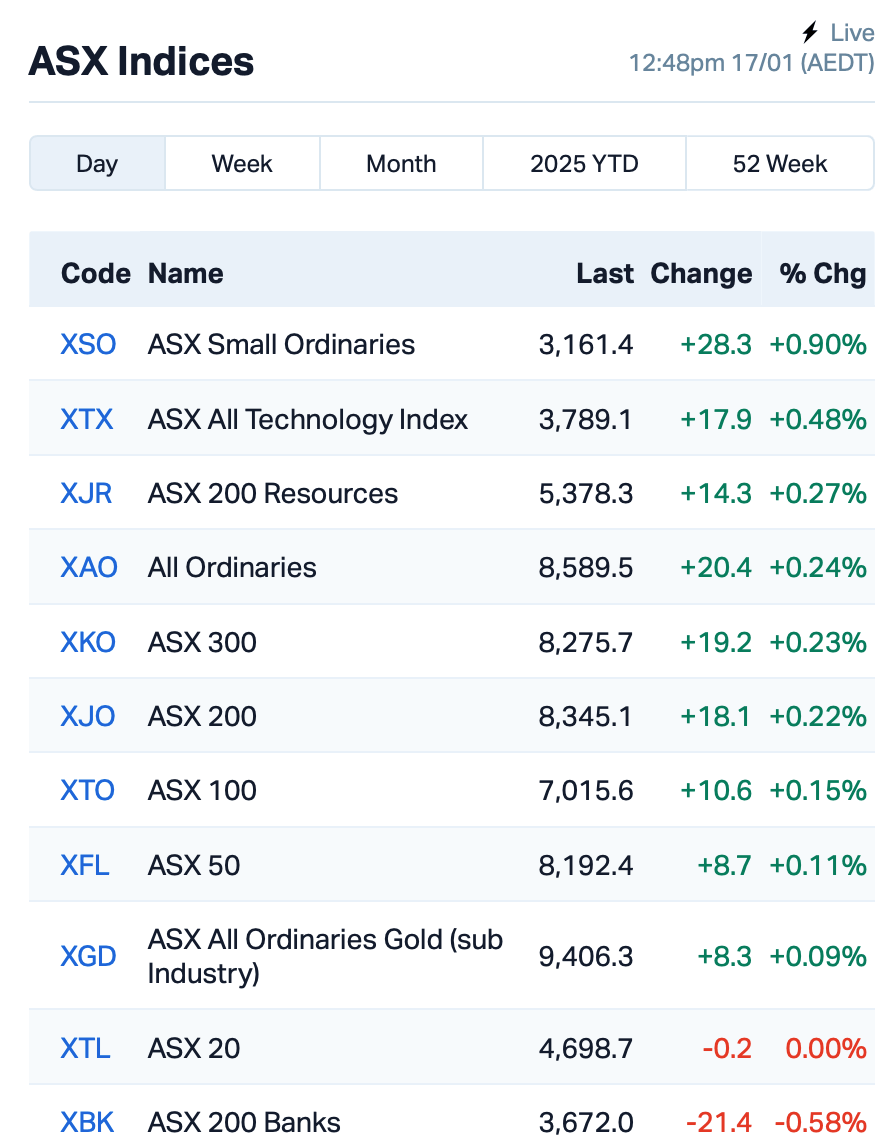

The ASX rose at the opening bell, inched lower, then rallied again to settle 0.08% higher at the time of writing following the slip in US tech stocks overnight.

The tech-heavy Nasdaq dropped 1%, largely on the backs of Apple and Tesla.

Apple tumbled by 4% after news that it was losing ground in China to rivals Vivo and Huawei. Tesla also slid 4%, with word on the street that it’s offering discounts of up to US$1,600 on its Cybertrucks.

Meanwhile, gold hit a high of US$2,700 an ounce overnight, iron ore gained 2%, and Bitcoin managed to edge above the US$101,000 mark.

Back home, retailers led the ASX charge this morning, with Utilities hot on its heels.

In the large caps space, CC Capital is turning the screws on its takeover bid for Insignia Financial (ASX:IFL). The private equity firm has now upped its bid to $4.60 per share from $4.30, bringing the deal value to $3 billion. IFL’s shares jumped 6%.

Lynas (ASX:LYC) is seeing revenue growth from its new Kalgoorlie facility, despite production dipping slightly in December. The miner’s revenue hit $141.2 million for the quarter, up from $120.5 million in the previous one. Shares were down 3.5%.

Aussie Broadband (ASX:ABB) has promoted Brian Maher to group CEO. Maher’s been with the telco since 2019. Co-founder Phillip Britt will retire and move to a non-executive director role. Shares were up 3.5%.

And, Telix Pharmaceuticals (ASX:TLX) scored a huge win with European regulators, getting the green light for its prostate cancer imaging agent, Illuccix. This sets the stage for a commercial launch in Europe. Shares climbed 2.5%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 17 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| RGL | Riversgold | 0.004 | 33% | 625,241 | $5,051,138 |

| CND | Condor Energy Ltd | 0.034 | 26% | 25,997,983 | $15,831,009 |

| VML | Vital Metals Limited | 0.003 | 25% | 9,861 | $11,790,134 |

| L1M | Lightning Minerals | 0.080 | 21% | 1,153,053 | $6,819,669 |

| EQS | Equitystorygroupltd | 0.023 | 21% | 25,000 | $2,785,203 |

| NIM | Nimyresourceslimited | 0.105 | 21% | 1,039,906 | $16,201,032 |

| 1TT | Thrive Tribe Tech | 0.003 | 20% | 38,587,824 | $5,079,308 |

| BOA | BOA Resources Ltd | 0.024 | 20% | 821,557 | $2,467,057 |

| CRR | Critical Resources | 0.006 | 20% | 425,285 | $12,159,816 |

| IS3 | I Synergy Group Ltd | 0.006 | 20% | 30,000 | $1,781,089 |

| APC | APC Minerals | 0.013 | 18% | 346,172 | $1,123,904 |

| EPM | Eclipse Metals | 0.007 | 17% | 1,472,611 | $13,727,133 |

| HHR | Hartshead Resources | 0.007 | 17% | 2,724,895 | $16,852,093 |

| SKK | Stakk Limited | 0.007 | 17% | 449,302 | $12,450,478 |

| AAU | Antilles Gold Ltd | 0.004 | 14% | 378,287 | $6,502,566 |

| PLC | Premier1 Lithium Ltd | 0.008 | 14% | 477,227 | $2,576,424 |

| ASE | Astute Metals NL | 0.024 | 14% | 78,035 | $11,220,584 |

| ASQ | Australian Silica | 0.025 | 14% | 19,393 | $6,200,928 |

| FBM | Future Battery | 0.025 | 14% | 102,038 | $14,637,830 |

| KNB | Koonenberrygold | 0.017 | 13% | 1,415,364 | $13,114,312 |

Lightning Minerals (ASX:L1M) has confirmed spodumene at its Esperança Project in Brazil’s Lithium Valley, with high-grade lithium soil samples returning up to 429ppm at Caraíbas and 320ppm at Canabrava. These results are building momentum for their upcoming 2,000m drill program at Esperança, set for Q1 2025. The confirmation of spodumene minerals and the strong lithium assays bolster confidence in the area’s potential as a major lithium hotspot.

Immuron’s (ASX:IMC) Travelan, a supplement targeting harmful bacteria in the gut, is on fire, with sales soaring in the December 2024 quarter. Global sales hit $2.5 million, up 70% on the prior quarter and 249% from last year. Australia’s sales jumped 83% quarter-on-quarter, while North America grew 43%. The growth is driven by new listings in Australian pharmacies, expanded distribution in Canada and the US, and a strong presence on Amazon.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for January 17 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| NUZ | Neurizon Therapeutic | 0.125 | -26% | 3,252,554 | $83,691,980 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 604,472 | $57,867,624 |

| AXP | AXP Energy Ltd | 0.002 | -25% | 5,490,000 | $11,649,361 |

| GES | Genesis Resources | 0.004 | -20% | 323,152 | $3,914,206 |

| SIS | Simble Solutions | 0.004 | -20% | 1,500,000 | $4,181,652 |

| TMX | Terrain Minerals | 0.004 | -20% | 25,850,676 | $9,053,477 |

| YOW | Yowie Group | 0.018 | -18% | 15,000 | $5,046,094 |

| AOK | Australian Oil. | 0.003 | -17% | 4,706 | $3,005,349 |

| ASR | Asra Minerals Ltd | 0.003 | -17% | 299,057 | $6,937,890 |

| AVE | Avecho Biotech Ltd | 0.003 | -17% | 1,492,305 | $9,507,891 |

| BP8 | Bph Global Ltd | 0.003 | -17% | 6,000 | $1,419,924 |

| GMN | Gold Mountain Ltd | 0.003 | -17% | 100,000 | $13,737,670 |

| LML | Lincoln Minerals | 0.005 | -17% | 966,057 | $12,337,557 |

| OSL | Oncosil Medical | 0.005 | -17% | 5,078,349 | $27,639,481 |

| PXX | Polarx Limited | 0.005 | -17% | 1,000,000 | $14,253,006 |

| OLH | Oldfields Holdings | 0.055 | -15% | 40,000 | $13,848,843 |

| AJL | AJ Lucas Group | 0.006 | -14% | 28,992 | $9,630,107 |

| IPB | IPB Petroleum Ltd | 0.006 | -14% | 370,872 | $4,944,821 |

| IXR | Ionic Rare Earths | 0.006 | -14% | 2,570,092 | $36,598,998 |

| RMI | Resource Mining Corp | 0.006 | -14% | 8,040 | $4,566,435 |

| RNX | Renegade Exploration | 0.006 | -14% | 643,381 | $8,988,024 |

| ALV | Alvomin | 0.045 | -13% | 22,507 | $6,092,262 |

IN CASE YOU MISSED IT

Health technology company Singular Health Group Ltd (ASX:SHG) is flexing today with a successful proof of concept demonstration for its 3Dicom software with MoU partner Provider Network Solutions (PNS) – based in Florida, US.

3Dicom helps compartmentalise patient information so practitioners can easily access medical imaging data from across the industry. Today’s successful technical proof of concept with PNS marks Phase 1 of the MoU between the two companies.

PNS CEO Dr Jose Pelayo said he was “blown away by the speed of the DICOM retrievals”. PNS established in Florida in 1998 and today connects payors with more than 3,200 specialty providers, managing roughly 3.5 million lives across the southern US state.

At Stockhead, we tell it like it is. While Singular Health group is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.