ASX Small Cap Lunch Wrap: Tech and Consumer stocks lead market sell-off; down, down, prices are down

Via Getty

It’s time for our medicine here in ASX200 land. Here, you hold down the patient:

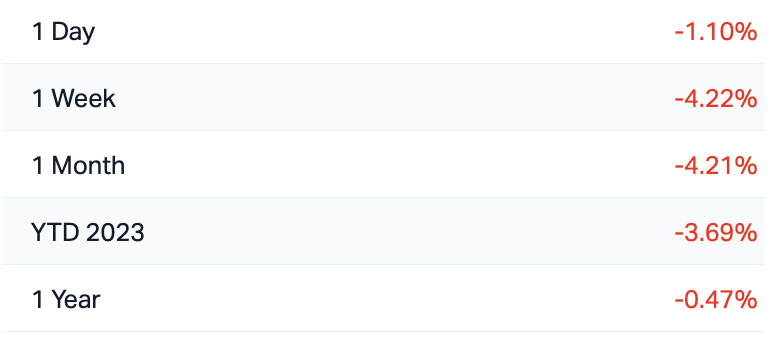

The ASX200 at lunch on Thursday:

Yes. A chill has blown through Sydney and right across the benchmark local index which has fallen -0.6%, and has crumbled to a new low in about a year.

The cold winds arrived from Wall Street overnight as disappointing earnings reports and another feisty surge in US Treasury yields dominated proceedings.

At home, we’re all still a bit stung by Wednesday’s unpleasantness around inflation and what the new Reserve Bank of Australia Governor Michele Bullock might do about it.

The stronger-than-expected Aussie inflation data has suddenly ushered in a new paradigm of crapness. Basically in one foul swoop rejigging the math and boosting the odds of further RBA squeezing.

About 10 hours before the data dropped Bullock pledged that her central bank ‘would not hesitate’ to raise its 4.1% cash rate if there were a ‘material’ bump to the inflation outlook.

Technology stocks are just the worst. AND they’re leading the top 200 into another session of misery.

Sounding off a few: Megaport (-14%%), Zero (-3%) and Wisetech Global (-2%).

The ASX200 at 1230 on Thursday

THE ASX SO FAR

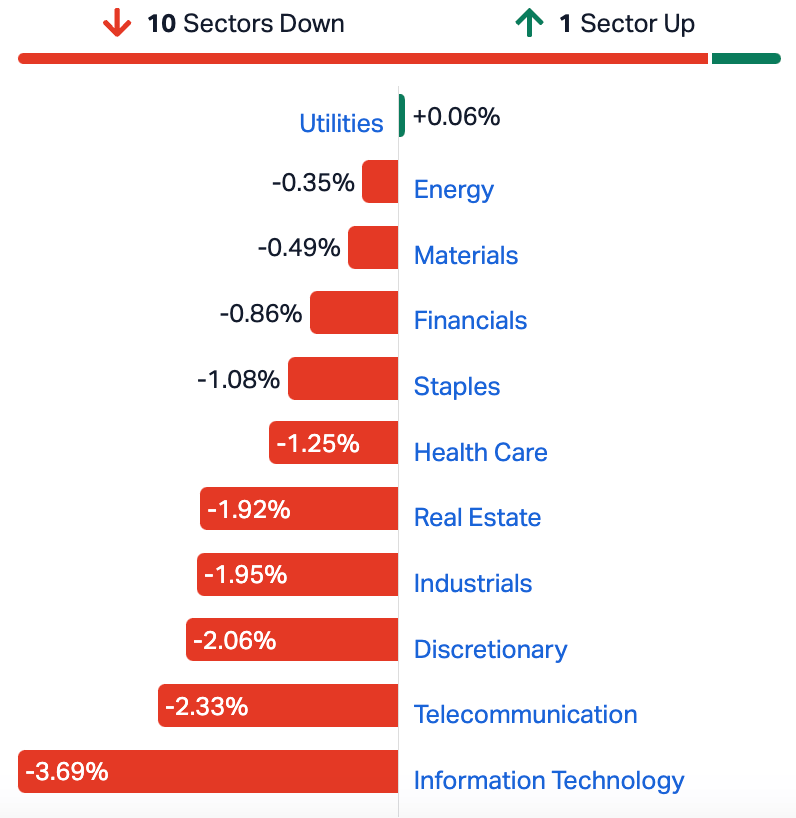

The big banks, the heavyweight diggers, the Telcos, Industrials, Property stocks… anything consumer-related is down, down, prices are down.

Utilities, on the other hand, is killing it.

The ASX Sectors

NOT THE ASX

In New York, the S&P 500 fell by -1.43%, the blue chips Dow Jones index was down by -0.32%, and the tech-heavy Nasdaq plunged by -2.43% – its worst one-day drop in 2023.

Nasdaq was dragged down by Google parent Alphabet, which fell -9.5% after its Q3 cloud division results missed estimates. Overall however, Alphabet beat analysts’ expectations on revenue and earnings per share.

Apple and Amazon were also down ahead of their results, while Microsoft rose 4% in after its Q1 net income jumped 27%.

Meta meanwhile jumped 3% in extended trading following beats on top and bottom lines as its revenue jumped by 23% in Q3.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 25 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap LSA Lachlan Star 0.12 76% 1,037,018 $14,114,977 AZS Azure Minerals 3.4 39% 24,914,889 $1,087,665,095 PNX PNX Metals 0.004 33% 2,333,330 $16,141,874 LVE Love Group Global 0.14 33% 90,342 $4,256,088 CRS Caprice Resources 0.032 28% 147,124 $2,918,923 EDE Eden Inv Ltd 0.0025 25% 1,000,000 $6,727,274 SEG Sports Entertainment Group 0.22 22% 5,000 $47,000,165 HRE Heavy Rare Earths 0.069 21% 148,343 $3,447,812 GMR Golden Rim Resources 0.023 21% 1,063,627 $11,240,179 MTL Mantle Minerals Ltd 0.003 20% 3,500,034 $15,368,615 ROG Red Sky Energy 0.006 20% 1,110,000 $26,511,136 ERW Errawarra Resources 0.16 19% 2,451,864 $9,383,040 DVL Dorsavi Ltd 0.013 18% 36,600 $6,123,278 MYE Metarock Group Ltd 0.135 17% 111,439 $35,197,669 BNR Bulletin Res Ltd 0.1225 17% 922,386 $30,827,066 BFC Beston Global Ltd 0.007 17% 70,000 $11,982,281 NVQ Noviqtech Limited 0.0035 17% 160,000 $3,714,586 VAL Valor Resources Ltd 0.0035 17% 1,795,011 $11,620,004 ARV Artemis Resources 0.023 15% 4,428,578 $31,498,367 AGR Aguia Res Ltd 0.016 14% 100,000 $6,556,718 EFE Eastern Resources 0.008 14% 240,823 $8,693,625 WA1 WA1 Resources 6.4 14% 981,994 $238,138,320 EPX EP&T Global Limited 0.024 14% 25,686 $9,364,188 IMR Imricor Medical Systems 0.575 14% 33,710 $85,303,658 DEL Delorean Corporation 0.034 13% 186,856 $6,471,627

The saviour for optimists this morning has been the outrageous ongoing success of Azure Minerals (ASX:AZS) up sharply again before lunch.

According to this cracking piece of journalism from our Josh Chiat, AZS shareholders will net a 1430% if they take up a massive offer lobbed in by shareholder lithium monster, SQM.

The Chilean miner is offering $3.52 cash per share to take the 60% owner of the Andover lithium discovery in WA’s north off the market.

The project, 40% owned by legendary prospector Mark Creasy, has demonstrated its potential to become a tier-1 lithium discovery and Josh notes that SQM has given itself some protection against any Rinehart-like interference – nobody in lithium land would’ve missed the very public murder of Albemarle’s bid for WA’s next major lithium producer Liontown Resources (ASX:LTR).

Josh says SQM has acquired a blocking stake on market.

“Should the scheme fail, SQM will make a $3.50 per share off-market takeover offer, ensuring a raider would need to outbid SQM to get a slice of the pie.”

Up even higher than Azure on Thursday morning: ASX-listed Lachlan Star (ASX:LSA) , after DevEx Resources (ASX:DEV) informed the market operator that it’s now completed the sale of its portfolio of copper-gold exploration assets in the Lachlan Fold Belt to LSA.

In a great deal for DEV as well, the company gets 75,672,720 ordinary shares in LSA for a deemed value of $7.5 million (representing a holding of 36.46%) plus a 2% net smelter royalty.

DevEx’s Managing Director Brendan Bradley, and Executive Director Stacey Apostolou, will also join the board of LSA.

“The sale of our NSW copper-gold assets to Lachlan Star allows us to focus on the exciting emerging discoveries we have at the Nabarlek Uranium Project in the NT and Kennedy Ionic Clay-hosted REE Project in Queensland. The transaction will see the copper-gold portfolio become the key focus for Lachlan Star, with DevEx retaining exposure to the significant upside of these assets through our 36% shareholding,” Bradley said this morning.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 25 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MTH Mithril Resources 0.001 -33% 26,315 $5,053,207 MTL Mantle Minerals Ltd 0.002 -33% 1,169,251 $18,442,338 CHM Chimeric Therapeutic 0.03 -27% 3,112,828 $21,902,321 CCE Carnegie Clean Energy 0.0015 -25% 122,614 $31,285,147 PAM Pan Asia Metals 0.15 -25% 417,378 $31,764,287 ICN Icon Energy Limited 0.008 -20% 52 $7,680,137 LBT LBT Innovations 0.004 -20% 2,262,999 $1,779,502 BCA Black Canyon Limited 0.125 -17% 4,452 $9,846,657 ICI Icandy Interactive 0.03 -17% 3,968,053 $48,319,405 AQD Ausquest Limited 0.011 -15% 710,182 $10,726,940 PFE Pantera Minerals 0.057 -15% 16,875 $6,567,761 M2R Miramar 0.029 -15% 29,791 $5,061,564 AYT Austin Metals Ltd 0.006 -14% 408,050 $7,111,123 DES Desoto Resources 0.12 -14% 113,333 $8,389,710 RNO Rhinomed Ltd 0.03 -14% 2,500 $10,000,189 EOL Energy One Limited 4.29 -14% 16,501 $150,132,925 XRG Xreality Group Ltd 0.037 -14% 358,121 $19,350,483 NWF Newfield Resources 0.13 -13% 50,000 $132,307,086 DY6 Dy6 Metalsltd 0.1 -13% 6,238 $4,434,687 OD6 Od6 Metals 0.17 -13% 158,811 $10,728,022 1AG Alterra Limited 0.007 -13% 517,999 $5,572,420 VAL Valor Resources Ltd 0.0035 -13% 256,000 $15,493,339 M2M Mt Malcolm Mines 0.022 -12% 183,790 $2,558,588 AHI Advanced Health 0.12 -11% 192,911 $29,390,036 CCO The Calmer Co International 0.004 -11% 5,838,609 $3,677,037

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.