ASX Small Cap Lunch Wrap: Market flattish as Superloop snares Origin contract off Aussie Broadband

Pic: Getty Images

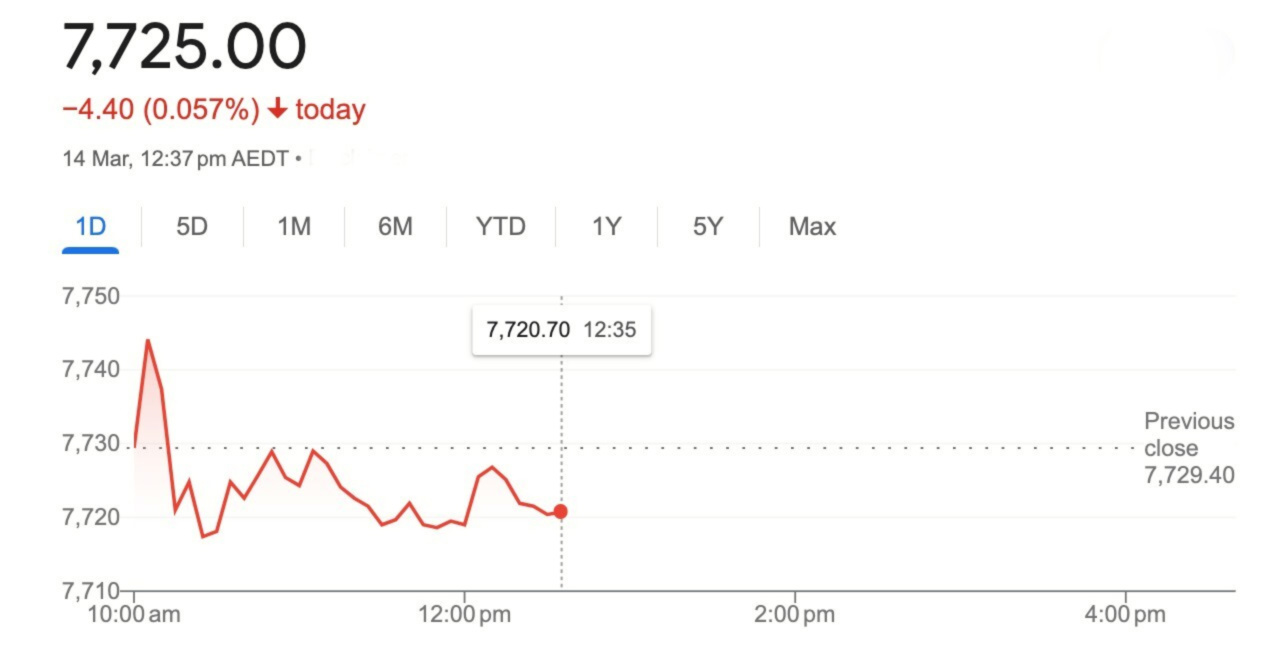

Aussie markets have been fairly flat in morning trade, with sharp falls in the banking sector offsetting gains by miners.

At 12.35 (AEDT) on Thursday, March 14, the S&P/ASX 200 was down ~0.057 per cent to 7725 points.

But first…

Are you a LEGO fan? Do you have boxes of LEGO from your childhood for your children to now enjoy and add to the collection?

A report late last year from consultancy firm Deloitte and eBay found LEGO sets to be among Australian collectors most sought after items.

A pitfall of LEGO for parents must surely be standing on pieces. Add to the list finding LEGO in places it really shouldn’t be like washing machines, or picking up pieces from around the house to make sure crawling babies and toddlers or ever-hungry golden retrievers don’t swallow a piece.

But here’s a piece of LEGO you may be happy to find on the floor of your living room and definitely wouldn’t want to vacuum up.

A goodwill store in the US recently auctioned off a rare 14-carat gold Lego piece, fetching US$18,101.

The item, a petite golden Kanohi Hau mask, hails from LEGO’s discontinued Bionicle collection and was discovered among a bag of jewellery donated to the goodwill store in Du Bois, Pennsylvania.

According to reports, LEGO produced only 30 golden Kanohi Hau masks, all distributed during a 2001 promotion. Within the Bionicle narrative, these masks confer protective abilities upon the wearer, with the golden Kanohi Hau mask possessing exceptional strength.

Staff at the Goodwill store didn’t know how valuable the LEGO piece was at first listing it on their online store for US$14.95. After 48 offers the LEGO piece was sold to a buyer who wished to remain anonymous for the much larger sum.

The ASX…

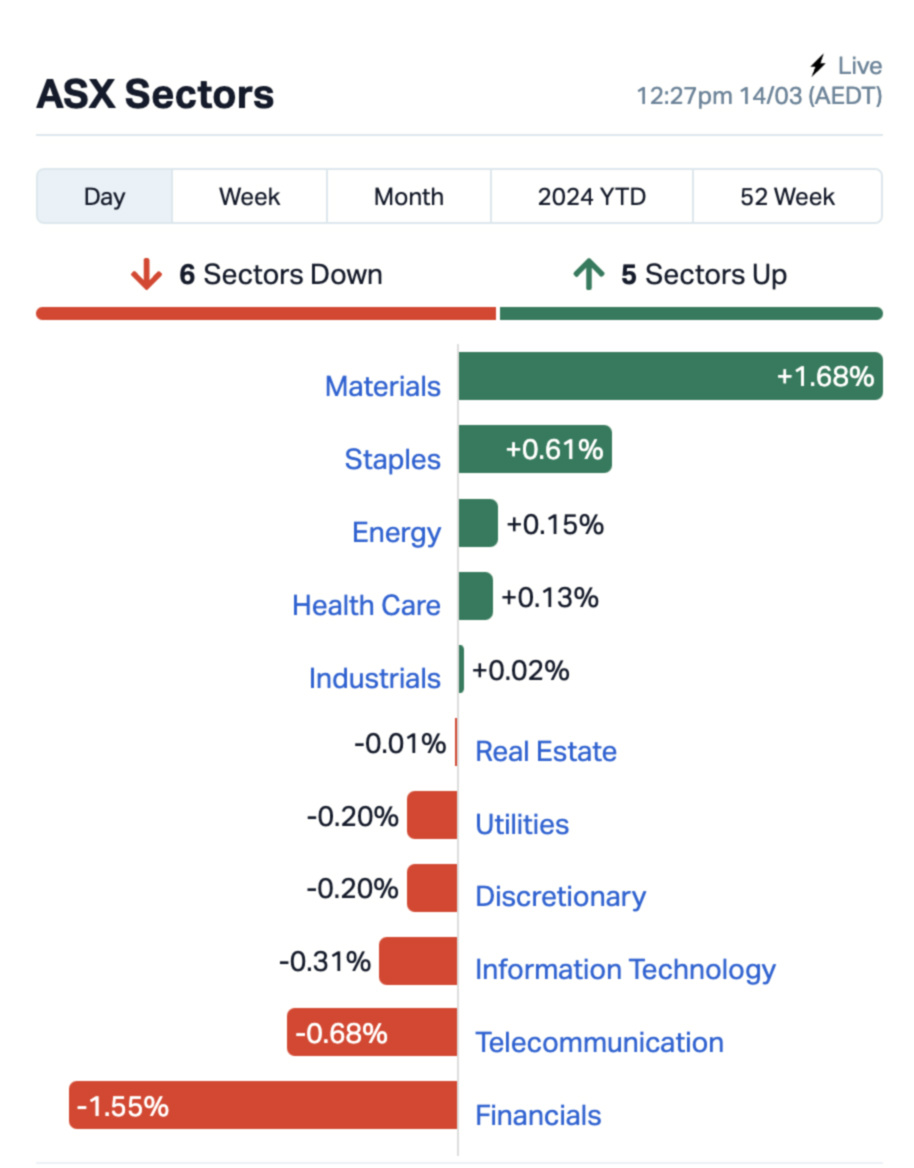

There were five sectors up today and six in the red. Leading the winners was materials, up 1.68% with staples rising 0.61% and energy stocks up 0.15%.

Financials led the laggards, falling 1.55% followed by telecommunications losing 0.68% and the tech sector down 0.31%.

Major banks were all down today with Westpac (ASX:WBC) the weakest, falling 2.75%. The Australian says Macquarie has cut Australia and New Zealand Bank Group (ASX:ANZ), National Australia Bank (ASX:NAB) and WBC to underperform, while leaving Commonwealth Bank (ASX:CBA) at that rating.

Rising copper prices along with gold have send miners focusing on the metals up today. Evolution Mining (ASX:EVN) is up ~7%.

BHP (ASX:BHP) has also regained some lost ground, up 2.72% today after Citi upgraded the Big Australian to a buy.

Stocks going ex-dividend

Austin Engineering (ASX:ANG) is paying 0.4 cents fully franked

Eagers Automotive (ASX:APE) is paying 50 cents fully franked

Breville (ASX:BRG) is paying 16 cents fully franked

Embelton (ASX:EMB) is paying 15 cents fully franked

H&G High Conviction (ASX:HCF) is paying 2 cents fully franked

Inghams (ASX:ING) is paying 12 cents fully franked

Plato Inc Max Ltd. (ASX:PL8) is paying 0.55 cents fully franked

PWR Holdings Limited (ASX:PWH) is paying 4.8 cents fully franked

Regis Healthcare (ASX:REG) is paying 6.28 cents 50 per cent franked

Shriro (ASX:SHM) is paying 2 cents fully franked

SRG Global (ASX:SRG) is paying 2 cents fully franked

Southern Cross Media Group (ASX:SXL) is paying 1 cents fully franked

TPG Telecom (ASX:TPM) is paying 9 cents fully franked

WCM Global Growth (ASX:WQG) is paying 1.72 cents fully franked

Not the ASX…

Overnight on Wall Street, the Dow Jones Industrial Average saw a slight increase of 0.1%, while the S&P 500 ended the session down 0.2%, and the technology-centric NASDAQ composite fell 0.5%.

This session marked the first full day of trading since the release of US inflation data on Tuesday, which surpassed expectations.

The most recent US Consumer Price Index (CPI) data revealed that headline inflation rose by 0.4% in February and 3.2% over the previous year, showing a slight uptick from January’s 0.3% increase and 3.1% annual rise, exceeding forecasts.

Core CPI, which excludes food and energy prices, also showed a 0.4% increase for the month and a 3.1% gain over the year.

Investors are closely monitoring for signals on when the US Federal Reserve might adjust interest rates.

In an interview with Fox US Treasury Secretary Janet Yellen says inflation could take a bumpy return to the 2% target after after back-to-back reports show that price pressures within the US economy rebounded at the start of the year.

“I wouldn’t expect this to be a smooth path month to month, but the trend is clearly favourable (sic),” she says.

“That said, President Biden’s top priority is addressing the issue of high costs that concerns so many Americans.”

Global oil prices hit four-month high

Global oil prices rose over 2% to a four‑month high on Wednesday on a surprise withdrawal in US crude inventories, a bigger‑than‑expected drop in US gasoline stocks and potential supply disruptions after Ukrainian attacks on Russian refineries.

US energy firms pulled a surprise 1.5 million barrels of crude from stockpiles last week.

Analysts had forecast a 1.3 million barrel build. The Brent crude price rose by $US2.11 or 2.6% to $US84.03 a barrel.

Base metal prices have been mixed.

Copper futures jumped 3.2% to an 11‑month high after Chinese smelters, which process half of the world’s mined copper, agreed on a joint production cut. Aluminium futures slid 0.2%.

The gold futures price rose by $US14.70 or 0.7% to $US2,180.80 an ounce. Spot gold was trading near $US2,173 an ounce at the US close.

Iron ore futures slid $US1.38 or 1.2% to $US111.77 a tonne, on demand concerns in China amid rising equipment maintenance among steelmakers and the latest environmental curbs in northern region of the country.

Currencies were stronger against the US dollar in European and US trade. The Aussie dollar lifted from US66.02 cents to US66.34 cents and was near US66.20 cents at the US close.

Bitcoin is trading higher, up 2.55% to $73,298 after buyers jostled to take advantage of yesterday’s post-CPI dip back to the November 2021 high of $69,000.

ASX small cap winners

Here are the best performing ASX small cap stocks for March 14 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| BP8 | BPH Global Ltd | 0.0015 | 50% | 451988 | $1,954,115.88 |

| NTM | Nt Minerals Limited | 0.007 | 40% | 20863 | $4,299,514.58 |

| PPY | Papyrus Australia | 0.02 | 33% | 35252 | $7,390,388.90 |

| INP | Incentiapay Ltd | 0.009 | 29% | 200000 | $8,707,510.11 |

| M4M | Macro Metals Limited | 0.005 | 25% | 3306686 | $12,928,267.02 |

| MCT | Metalicity Limited | 0.0025 | 25% | 857578 | $8,970,107.59 |

| PUR | Pursuit Minerals | 0.005 | 25% | 1257820 | $11,775,885.66 |

| SLC | Superloop Limited | 1.31 | 25% | 11172537 | $515,733,267.00 |

| CVV | Caravel Minerals Ltd | 0.175 | 17% | 1204771 | $78,641,969.85 |

| ICG | Inca Minerals Ltd | 0.007 | 17% | 50000 | $3,526,958.08 |

| PXX | Polarx Limited | 0.014 | 17% | 2709770 | $19,675,401.30 |

| HHR | Hartshead Resources | 0.008 | 14% | 750000 | $19,660,774.89 |

| OSL | Oncosil Medical | 0.008 | 14% | 248625 | $13,821,787.92 |

| RLG | Roolife Group Ltd | 0.008 | 14% | 33333 | $5,057,906.93 |

| TRE | Toubani Res Ltd | 0.12 | 14% | 1000 | $14,055,894.93 |

| K2F | K2Fly Ltd | 0.082 | 14% | 49560 | $13,396,284.29 |

| AQC | Auspac Coal Ltd | 0.091 | 14% | 1958313 | $41,037,407.28 |

| SHP | South Harz Potash | 0.026 | 13% | 104663 | $18,528,339.36 |

| 8CO | 8Common Limited | 0.045 | 13% | 40000 | $8,963,796.12 |

| PVL | Powerhouse Ven Ltd | 0.045 | 13% | 4599 | $4,829,727.04 |

| ATH | Alterity Therapeutics | 0.0045 | 13% | 117600 | $20,952,071.60 |

| POD | Podium Minerals | 0.036 | 13% | 147997 | $14,551,896.99 |

| RKT | Rocketdna Ltd. | 0.009 | 13% | 2252440 | $5,248,918.73 |

| TMX | Terrain Minerals | 0.0045 | 13% | 1687658 | $5,726,682.69 |

| AON | Apollo Minerals Ltd | 0.028 | 12% | 503000 | $17,408,572.50 |

It’s a case of a win for Superloop (ASX:SLC) and loss for Aussie Broadband (ASX:ABB) today. SLC has announced a six-year contract with Origin Energy (ASX:ORG) and its subsidiaries to provide wholesale internet services.

SLC says the contract is expected to add +$19m of annualised earnings once the current subscriber base is fully transitioned.

As Stockhead’s Reuben Adam’s mentioned in Top 10 at 10 mentioning artificial intelligence in an announcement was enough to give $2m capped biotech BPH Global (ASX:BP8) “a nice bump at Thursday’s open”.

BP8 says it will “expand its seaweed research and development activities into essential mineral extraction utilising AI search technology”.

ASX small cap losers

Here are the most-worst performing ASX small cap stocks for March 14 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| VPR | Volt Power Group | 0.001 | -50% | 96898 | $21,432,416 |

| SLZ | Sultan Resources Ltd | 0.014 | -36% | 8768289 | $3,645,539 |

| CYQ | Cycliq Group Ltd | 0.003 | -25% | 4243975 | $1,430,067 |

| MRQ | MRG Metals Limited | 0.0015 | -25% | 50000 | $5,050,237 |

| SKY | SKY Metals Ltd | 0.033 | -21% | 1501456 | $19,378,720 |

| POL | Polymetals Resources | 0.21 | -21% | 183847 | $41,768,719 |

| MIO | Macarthur Minerals | 0.1 | -20% | 65354 | $20,781,686 |

| ECT | Env Clean Tech Ltd | 0.004 | -20% | 65901 | $14,321,552 |

| ESR | Estrella Res Ltd | 0.004 | -20% | 2078464 | $8,796,859 |

| ME1 | Melodiol Glb Health | 0.004 | -20% | 1617533 | $1,964,980 |

| NAE | New Age Exploration | 0.004 | -20% | 1530911 | $8,969,495 |

| VML | Vital Metals Limited | 0.004 | -20% | 2040295 | $29,475,335 |

| OSX | Osteopore Limited | 0.29 | -19% | 62564 | $3,718,328 |

| ABB | Aussie Broadband | 3.515 | -19% | 5151492 | $1,278,149,911 |

| ODE | Odessa Minerals Ltd | 0.005 | -17% | 501371 | $6,259,695 |

| RAS | Ragusa Minerals Ltd | 0.031 | -16% | 158446 | $5,276,155 |

| NYR | Nyrada Inc | 0.11 | -15% | 2376777 | $20,281,131 |

| PLN | Pioneer Lithium | 0.14 | -15% | 47714 | $4,690,125 |

| HLX | Helix Resources | 0.003 | -14% | 125000 | $8,131,010 |

| VN8 | Vonex Limited. | 0.012 | -14% | 134342 | $5,065,601 |

| FNX | Finexia Financialgrp | 0.19 | -14% | 24889 | $10,835,594 |

| APX | Appen Limited | 0.835 | -13% | 12138247 | $211,568,405 |

| HAR | Haranga Resources | 0.13 | -13% | 202048 | $13,429,406 |

| M2M | Mt Malcolm Mines NL | 0.026 | -13% | 2727652 | $4,368,105 |

ABB announced it received unexpected notice that ORG will terminate its white label wholesale agreement effective 12 April 2024.

The internet provider says Origin has requested that Aussie Broadband continue to provide certain services under the

deal for up to 6 months post termination and assist with the transfer to its new wholesale provider.

In Case You Missed It

Fintech lender MoneyMe (ASX:MME) has appointed financial services veteran Jamie McPhee as a non-executive director.

McPhee was chief executive of ME Bank for a decade until 2020 and previously served as executive director of Bendigo and Adelaide Bank and managing director of Adelaide Bank.

A former board member of the South Australian Cricket Association, he was also chair of SocietyOne until its acquisition by MME in March 2022.

Sultan Resources (ASX:SLZ) has completed its initial RC drilling program at the Calesi nickel prospect near Kulin in WA’s Wheatbelt region. It was the first major campaign completed under the junior’s lucrative farm-in and joint venture agreement with Rio Tinto’s (ASX:RIO) exploration arm.

Two holes were drilled to depths of 210m and 350m respectively with both cased for downhole electromagnetic surveys which began this morning and will be completed over the coming days.

While no visible support for magmatic nickel sulphides was observed in the drilling, samples have been sent to ALS for gold and multi-element analysis with results expected in a fortnight.

At Stockhead, we tell it like it is. While MoneyMe and Sultan Resources are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.