ASX Small Cap Lunch Wrap: Fear as ASX falls and a surprise AI buy emerges

Via Getty

Aussie markets are weighed down by a bit of the weakness.

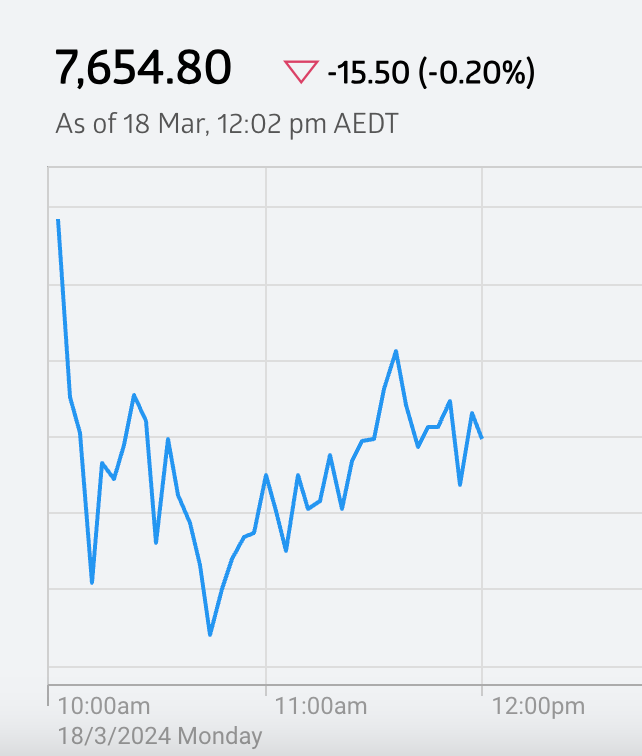

Observe. At 12pm (AEDT) on Monday, March 18, the S&P/ASX 200 was thus:

The ASX…

By lunchtime the S&P/ASX200 had dropped some 16 points or 0.20%, crossing below its 20-day moving average. It’s now a third straight morning of slipping and sliding for the ASX all around these softer global commodity prices.

China’s February economic read should be released early this arvo. If it’s a horror show beyond previous imagination, we could see some speculation on that front, but for now, well, there’s simply too much for a sleepy traders to take in on a wet Monday in Sydney.

Laying a pall darker than the autumn clouds – the price of iron ore and its apparent trajectory to somewhere horrible sub-US$100.

This is a scratch traders don’t know how to itch. Materials are up about 0.1%. Copper is surging, but it would appear the tension between snapping up an iron ore heavyweight bargain and actually accepting that China won’t be rising to the rescue for local commodities is a hard one.

Easier to accept, is the fear of rates that just won’t fall has its fingerprints all over the local market and traders know how to deal with that.

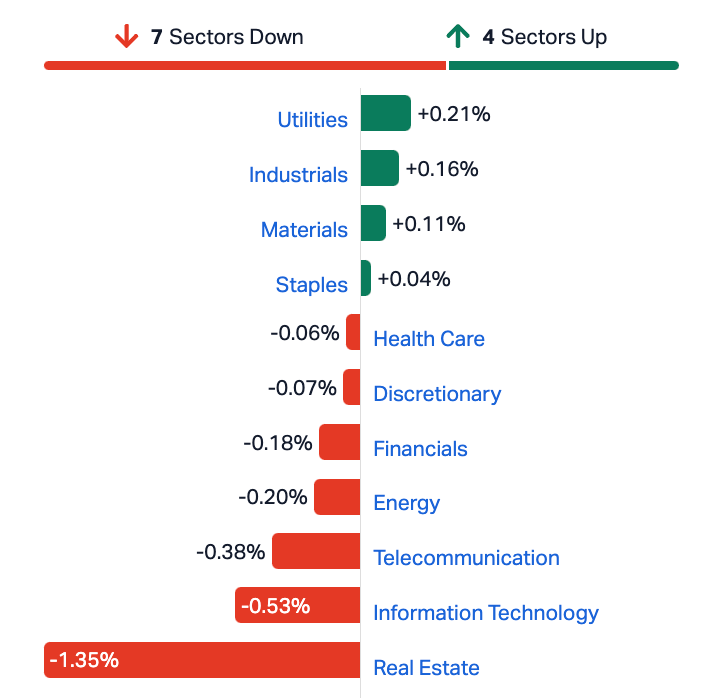

The cash rate sensitive sectors like IT and Real Estate are leading the bleeding.

The week is bleak with truth telling moments for the near-term pace of global rate cuts.

At home, the RBA meets and greets and chooses our destiny on Tuesday.

Out front is not where Gov’nuh M. Bullock wants to be on this one.

Because 24 hours later we’ll watch the Bank of Japan, the Bank of England and the US Federal Reserve all make their monetary policy lines in the sand.

Even more troubling – the bureau of local data (ABS) drops critical rate-related jobs data on Thursday.

The upshot is no one wants to make their bed yet.

This morning, the benchmark’s worst is Audinate (ASX:AD8) and Strike Energy (ASX:STX) down 7.25% and 5.8%.

The index has lost 2.45% for the last five days, but is virtually unchanged over the last 12 months of drunk driving.

ASX stocks going ex-divvy on Monday

Centrepoint Alliance (ASX:CAF)

Contact Energy (ASX:CEN)

Mitchell Services (ASX:MSV)

Stanmore Coal (ASX:SMR)

Not the ASX…

It was early on Saturday morning in beautiful Sydenham when the S&P500 ended 0.7% lower and collected a second consecutive weekly loss, the first of 2024 and largely courtesy of Mega Tech.

The Dow Jones Industrial Average dipped 190.89 points, or 0.5%, to finish the session at 38,714.77, while the Nasdaq Composite slipped 0.95% to 15,973.17.

The return of ye olde indications of inflationary pressures have ensured an amped up degree of anxiety around equities ahead of this week’s Federal Reserve’s policy meet.

Tech stocks were smushed. Amazon (AMZN )and Microsoft MSFT) down more than 2% apiece.

Shares of Apple (APPL) and Google-daddy Alphabet (GOOG) also retreated.

Chip daddy of everyone, Nvidia (NVDA) has wobbled for the last few sessions but thast might be sorted later this week.

On a sector level in New York, Tech was the worst on Friday. Energy the best.

The S&P 500 shed 0.13 per cent last week. The 30-stock Dow inched lower by 0.02 per cent on the week, and the Nasdaq slipped 0.7 per cent.

However, according to UBS, the S&P500 has advanced strongly since late October, led by the 6 largest TECH+ stocks (NVDA, META, AMZN, MSFT, GOOG, AAPL).

UBS strategists believe the market’s advance, and its narrow leadership, are justified given the strength in earnings revisions over this period:

- 2024 EPS growth expectations for the largest 6 TECH+ stocks are for 26.3%, vs. 6.1% for the rest of the S&P 500.

- Revisions for the largest 6 TECH+ companies advanced 8.9%, with just over half of this upside coming from NVDA.

- Excluding the largest 6 stocks, estimates for the broader TECH+ sector have declined 1.9%.

- 2024 earnings estimates for the S&P 500 have decreased -0.7% since late October. However, this is much better than the historical average of -2.9% over the same period.

Outside of TECH+, UBS estimates there’ll be -3.0% step back, thanks to poor revisions in Energy, Materials, and Health Care.

At lunchtime in Sydney US futures are mixed.

ASX small cap winners

Here are the best performing ASX small cap stocks for March 18 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| DVL | Dorsavi Ltd | 0.024 | 60% | 54,512,916 | $8,949,924 |

| ADX | ADX Energy Ltd | 0.155 | 35% | 8,721,319 | $49,315,806 |

| AN1 | Anagenics Limited | 0.015 | 25% | 150,000 | $5,029,594 |

| ESR | Estrella Res Ltd | 0.005 | 25% | 58,284 | $7,037,487 |

| OSX | Osteopore Limited | 0.066 | 23% | 4,000 | $554,031 |

| CLU | Cluey Ltd | 0.086 | 23% | 34,888 | $14,112,950 |

| ANX | Anax Metals Ltd | 0.024 | 20% | 427,940 | $10,848,959 |

| SIS | Simble Solutions | 0.006 | 20% | 319,166 | $3,495,195 |

| VRC | Volt Resources Ltd | 0.006 | 20% | 50,000 | $20,650,533 |

| CLA | Celsius Resource Ltd | 0.0155 | 19% | 10,639,063 | $29,198,672 |

| HXG | Hexagon Energy | 0.02 | 18% | 1,885,981 | $8,719,570 |

| AML | Aeon Metals Ltd. | 0.007 | 17% | 71,500 | $6,578,404 |

| AYT | Austin Metals Ltd | 0.007 | 17% | 922 | $7,711,148 |

| EPM | Eclipse Metals | 0.007 | 17% | 1,151,479 | $12,450,325 |

| OAU | Ora Gold Limited | 0.007 | 17% | 158,080 | $34,440,005 |

| GLV | Global Oil & Gas | 0.029 | 16% | 15,195,558 | $13,933,342 |

| ASP | Aspermont Limited | 0.015 | 15% | 1,035,000 | $31,923,251 |

| KOR | Korab Resources | 0.008 | 14% | 1,663 | $2,569,350 |

| PEC | Perpetual Res Ltd | 0.008 | 14% | 1,342,177 | $4,480,206 |

| FLN | Freelancer Ltd | 0.2 | 14% | 102,070 | $78,910,104 |

| APL | Associate Global | 0.08 | 14% | 22,733 | $3,954,470 |

| RAC | Race Oncology Ltd | 1.77 | 14% | 342,573 | $254,960,723 |

| E25 | Element 25 Ltd | 0.25 | 14% | 326,160 | $47,856,674 |

| MIO | Macarthur Minerals | 0.11 | 13% | 18,000 | $16,126,588 |

| ATH | Alterity Therap Ltd | 0.0045 | 13% | 446,939 | $20,952,072 |

ASX small cap losers

Here are the most-worst performing ASX small cap stocks for March 18 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AXP AXP Energy Ltd 0.001 -50% 10,200 $11,649,361 JAV Javelin Minerals Ltd 0.001 -50% 207,851 $4,352,462 AOA Ausmon Resorces 0.002 -33% 459,968 $3,176,998 BP8 Bph Global Ltd 0.001 -33% 500,000 $2,931,174 SIH Sihayo Gold Limited 0.001 -33% 13 $18,306,384 AUK Aumake Limited 0.003 -25% 1,501,227 $7,657,627 PIQ Proteomics Int Lab 0.985 -21% 713,297 $163,615,770 MXO Motio Ltd 0.023 -21% 97,032 $7,777,752 AEE Aura Energy 0.175 -20% 1,420,086 $130,346,627 PRX Prodigy Gold NL 0.004 -20% 227,335 $8,755,539 TMK TMK Energy Limited 0.004 -20% 924,634 $30,612,897 VAL Valor Resources Ltd 0.002 -20% 38,810 $11,472,533 OZM Ozaurum Resources 0.0595 -18% 942,577 $11,588,750 STG Straker Limited 0.355 -18% 57,651 $27,987,595 NVO Novo Resources Corp 0.14 -18% 265,800 $14,918,270 BIM Bindimetalslimited 0.1 -17% 184,059 $3,471,300 KGD Kula Gold Limited 0.0075 -17% 501,028 $4,162,157 INP Incentiapay Ltd 0.005 -17% 190,147 $7,463,580 ASH Ashley Services Grp 0.22 -15% 534,843 $37,433,735 HPR High Peak Royalties 0.05 -15% 10,000 $12,275,523 CTQ Careteq Limited 0.017 -15% 2,602,914 $4,710,946 RTG RTG Mining Inc. 0.017 -15% 750,957 $21,702,690 1TT Thrive Tribe Tech 0.023 -15% 34,898 $8,008,781 AHN Athena Resources 0.003 -14% 3,249,938 $3,746,636 BCK Brockman Mining Ltd 0.025 -14% 8 $269,126,732

In case you missed it

Rare earth metallurgical specialists ANSTO has independently validated previously announced “breakthrough” leach results over Red Metal’s (ASX:RDM) Sybella discovery in northwest Queensland.

Phase 1 test work first reported in early February suggested the potential for low-cost processing at Sybella involving heap leach methods. Subsequent leach tests by ANSTO on the same RC chip samples originally assessed by Core Resources were consistent with the preliminary results.

RDM is now turning its attention to Phase 2 work which will provided the company with more optimised data for an early-stage mining study. Results of the comminution tests and additional processing of the pregnant leach solution to recover the rare earths are expected in Q2 2024.

Land access preparations are also progressing for a regional step-out drilling program set to begin in early May.

At Stockhead, we tell it like it is. While Red Metal is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.