ASX Rebalance: Copper in, lithium out as hot biotechs climb ranks

Pic: Getty Images

- Copper stocks elevated to the S&P/ASX 200 and S&P/ASX 300 including Sandfire Resources and Capstone Copper Corp

- Radiopharmaceutical company Clarity Pharmaceuticals is among healthcare names elevated to the S&P/ASX 300

- Newly listed mexican fast food chain Guzman y Gomez has climbed the ranks to the S&P/ASX 200, while pizza play Domino’s removed from S&P/ASX 200

September is here, Spring is in the air, flowers are blooming and the weather is warming up. Q2 for the Australian financial year also signals a rebalance of some key S&P/ASX indices.

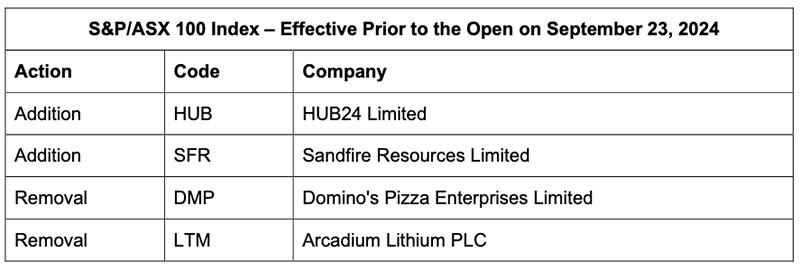

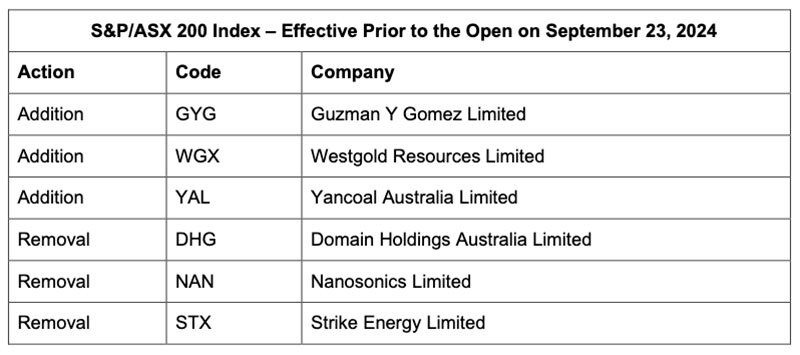

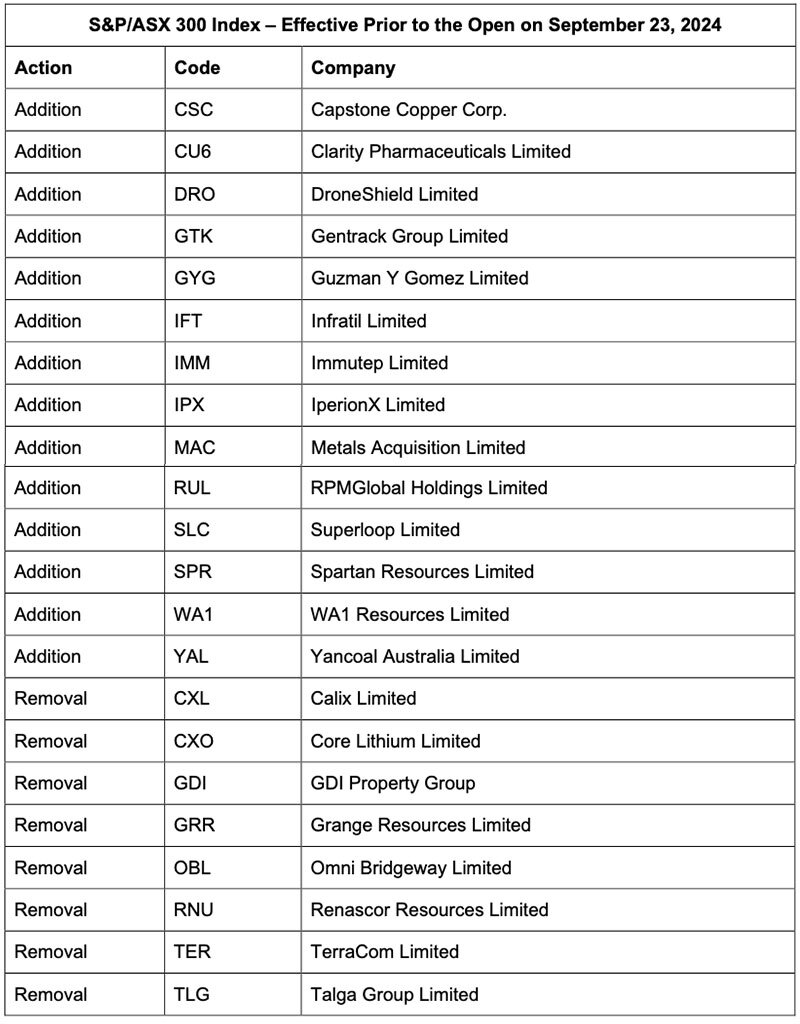

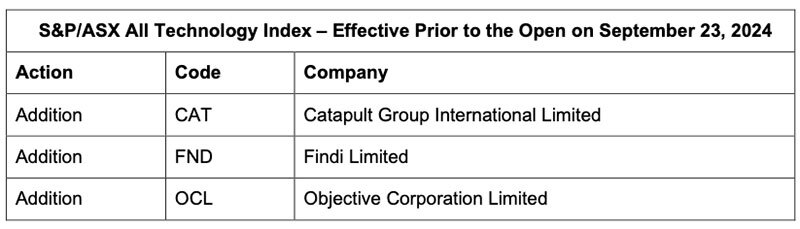

Responsibility for rebalancing falls on S&P Dow Jones Indices, part of credit rating agency S&P Global. Indexes rebalanced in the latest quarterly review included:

- S&P/ASX 20 – No change

- S&P/ASX 50 – No change

- S&P/ASX 100

- S&P/ASX 200

- S&P/ASX 300

- S&P/ASX All Technologies Index

The September rebalance comes into effect before opening trade on Monday, September 23, 2024.

Of particular note in rebalances, the S&P/ASX 200 and S&P/ASX 300 are ones many fund managers or investors use as a cutoff for investments.

Entering the S&P/ASX 300 is a major milestone for a company, signifying they’ve made it to the big league.

READ: The great rebalancing act and how it can impact share prices

Copper plays rise up the ranks

With its broad industrial use case and status as a critical mineral to the global energy transition, including manufacturing of electric vehicles and EV batteries, copper has been attracting plenty of interest from investors this year.

While the copper price did very well at the start of 2024, briefly breaching record highs above US$11k a tonne in May, the commodity has retreated in the second half of the year as concerns about the global economy and a possible US recession intensify.

‘Doctor Copper’ – market lingo for the idea the commodity is a barometer of economic health – has come under pressure of late. That said, there are forecasts supply of the red metal won’t keep up with increasing demand, piquing interest in ASX copper plays and helping to lift some share prices.

And so, with a market cap of ~3.68 billion, copper-focused mining company Sandfire Resources (ASX:SFR) has been elevated to the S&P/ASX100.

Minelife founding director and senior resource analyst Gavin Wendt told Stockhead SFR was founded just over 20 years ago and has evolved from micro-cap exploration company to established copper producer in multiple jurisdictions.

“Sandfire’s early growth stemmed from the discovery of the high-grade DeGrussa copper-gold deposit, 900km northeast of Perth, which provided the business with the platform to grow and diversify across the globe, through the transformational US$1.865bn acquisition of the MATSA Copper Operations in Spain, and the development of the new Motheo Copper Operations in Botswana,” he said.

“Along the way the company has picked up a swag of industry awards, including Prospector of the Year, Best Australian Explorer, Developer of the Year, and Hard Rock Mine of the Year.

“Sandfire has been included in the S&P/ASX 100 Index as it’s market valuation has trebled to just under $4 billion since 2021.”

Wendt said also worth noting was the perhaps lesser-known copper play Capstone Copper Corp (ASX:CSC), with a market cap of just under $7 billion, which has been elevated to the S&P/ASX 300.

The dual Toronto Stock Exchange-listed company made its ASX debut in April and doesn’t have any Australian assets but has operations in Arizona, Mexico and Chile, with headquarters in Canada.

“The company’s secondary listing on the ASX is a strategic one, as it looks to tap into investors with an appetite for resources,” Wendt said.

“Capstone was born from the acquisition of its low-cost, underground Cozamin copper mine in Mexico in 2004, followed by the acquisition of Far West Mining in 2011, which gave it ownership of the Santo Domingo copper project in Chile.”

He said another major catalyst occurred in 2013 when Capstone acquired the long-life Pinto Valley open-pit copper mine in a prolific mining district in Arizona, USA from BHP (ASX:BHP).

“Then in 2022, Capstone Mining merged with Mantos Copper to form Capstone Copper Corp, cementing its position as a mid-tier copper producer with a diversified asset base.

“One of the driving factors for the merger was the creation of a world-class mining district by combining the operating Mantoverde mine with the Santo Domingo project, separated by only 35km in the Atacama region of Chile.”

CSC’s flagship copper asset is its Mantoverde Development Project in Chile, where it produced first saleable copper concentrate during June and expects to get up to full run-rate capacity during the second half of this year.

The Mantoverde project increases Capstone’s annual production by more than 50% from 164,000 tonnes of copper to around 260,000 tonnes of copper, on an annualised run rate.

With not many copper plays historically on the main ASX indexes, the inclusion of some new names opens up the opportunity for index funds to trade more equities focused on the commodity.

Rising gold prices have also helped boost ASX gold plays with Westgold Resources (ASX:WGX) entering the S&P/ASX 200 and Spartan Resources (ASX:SPR) the S&P/ASX 300.

Also worth noting among resources stocks is the addition of coal producer Yancoal Australia (ASX:YAL) to the S&P/ASX 200 and S&P/ASX 300 since Chinese investors sold off their stakes.

Rebalance not so good for lithium

Lithium companies have fallen off the indexes with Arcadium Lithium (ASX:LTM) removed from the S&P/ASX100 and Core Lithium (ASX:CXO) removed from S&P/ASX 300.

“The lithium space remains mired in negativity, impacted by both demand and supply considerations,” Wendt said.

“The lithium boom has turned to lithium bust over the past two years as a wave of new supply overwhelms weaker-than-expected demand for EV batteries.

“We’ve been here before, with a similar boom-bust cycle during 2016-2017, but the difference this time is that there is very little prospect of a speedy recovery.

Wendt said the short-term outlook is for prices to remain weak as the market digests surplus material.

“Lithium producers view their product as a bespoke chemical tailored to battery-makers’ tight specifications rather than as a generic commodity.

“However, lithium’s price behaviour is increasingly mirroring that of any other commodity, with periods of high pricing encouraging over-production that then leads to periods of low pricing.”

He said compounding lithium’s price weakness has been a downgrade in expectations for EV sales, as the Chinese market matures, and the Western market loses some of its recent momentum.

“But there’s also been a change in the product mix, with sales of pure battery slowing and sales of hybrid gas-electric vehicles booming, even in China,” he said.

This isn’t great news, however good for lithium, as many hybrids use a nickel hydride battery with no lithium.

“The outlook for lithium for the remainder of 2024 and beyond remains somewhat pessimistic,” he said.

Whilst the worst is likely behind us in price terms, a rapid turnaround is highly unlikely, based on soft market fundamentals that don’t appear to show any clear indication of changing any time soon.

“The lithium market has potentially entered a new period of price stability.”

Hot healthcare stocks elevated

On the healthcare front Clarity Pharmaceuticals (ASX:CU6), Opthea (ASX:OPT) and Immutep (ASX:IMM) have all been elevated to the S&P/ASX 300.

Operating in the hot radiopharmaceutical space, CU6 recently announced it had been granted FDA ‘Fast Track’ designation for its 64Cu-SAR-bisPSMA, a new imaging agent designed for detecting prostate cancer. The CU6 share price is up ~257% YTD.

Some good news for shareholders of retinal diseases-focused biotech OPT, which have seen the company’s share price dip more than 80% in the past five years. OPT is regaining ground up ~15% YTD and back in a major index.

OPT currently has two pivotal trials underway aimed at getting US FDA approval for its drug candidate sozinibercept (OPT-302), a potentially new treatment for the leading cause of blindness among the over-50s – wet AMD (age-related macular degeneration).

Developer of LAG-3 immunotherapeutic products for cancer and autoimmune diseases, IMM also has several late-stage trials underway and has seen its share price rise ~19% YTD.

Morgans said this is positive for CU6, OPT and IMM as funds will need to weigh into them.

“All three companies have chunky clinical data due out over the next 12 months,” he said.

However, Morgans noted disinfection device maker Nanosonics (ASX:NAN) fell out of S&P/ASX 200, which could see some selling pressure as funds lighten positions.

“NAN share price has been strong recently after providing FY25 guidance, which looks conservative, and [then there’s] the CORIS approval potentially within 12 months,” the broker said.

Coris is NAN’s newest device intended for cleaning flexible probes commonly used in procedures such as colonoscopies, gastroscopies, enteroscopies, endoscopic ultrasounds and bronchoscopies.

NAN filed a de novo regulatory submission for Coris in April and is forecasting approval within about a year.

Mexican in, Pizza out

Mexican fast-food fave Guzman y Gomez (ASX:GYG) is also set to join the S&P/ASX 200 index from September 23 after making its much-anticiapted IPO on the ASX in June.

It’s not so good news for another fast food chain operator, though, with Domino’s Pizza Enterprises (ASX:DMP) out of the benchmark and S&P/ASX 100.

GYG is up 34% YTD, while DMP is down 51% after a string of news stories that have disappointed investors, including on Monday that it had been hit with a shareholder class action filed in the Federal Court of Australia.

“The proceeding includes allegations that Domino’s engaged in misleading or deceptive conduct and breached its disclosure obligations with respect to Domino’s expected performance in the Japan market,” DMP said in an ASX announcement.

“Domino’s denies any liability and will defend the proceeding.”

Strong tech performers head up ranks

There were three additions to the S&P/ASX All Technology index, all strong performers so far in FY24.

Catapult Group (ASX:CAT), which is up ~59% YTD, was originally established from a partnership between the Australian Institute of Sport (AIS) and the Cooperative Research Centres (CRC) to maximise the performance of Aussie athletes ahead of the Sydney Olympics.

CAT now provides wearable analytic devices to elite teams in 40-plus sports including NFL, AFL, the NBA and other basketball leagues, and US football (soccer).

Meanwhile Indian-focused fintech Findi (ASX:FND) has climbed ~270% YTD to become a new addition to the S&P/ASX All technology Index.

FND recently announced it expected to report FY25 revenue in the range of $80-90m, up from $66.5m in FY24 and FY25 EBITDA in the range of $30-35m, up from $27.4m in FY24.

“Following a record financial result in FY24, we are pleased to report strong expectations for the 2025 financial

year,” chairman Nicholas Smedley said in the ASX announcement.

Objective Corp (ASX:OCL) is also a new addition to the index, up a more modest ~7% YTD. OCL provides software to government and enterprise customers.

CEO Tony Walls said in his annual letter to shareholders OCL revenue of $118m in FY24 was driven by a record 81% recurring revenue and marked the completion of its transition to a subscription-only software business.

“We remain confident that our overall ARR growth target of 15% is the right goal for us, and that our business model assures the growth achieved will drive an increased level of profitability,” he said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.