ASX October Winners: The 50 best stocks in weaker month for markets

Pic: Getty Images

- The S&P/ASX 200 fell 1.3% in October with small cap companies outperforming

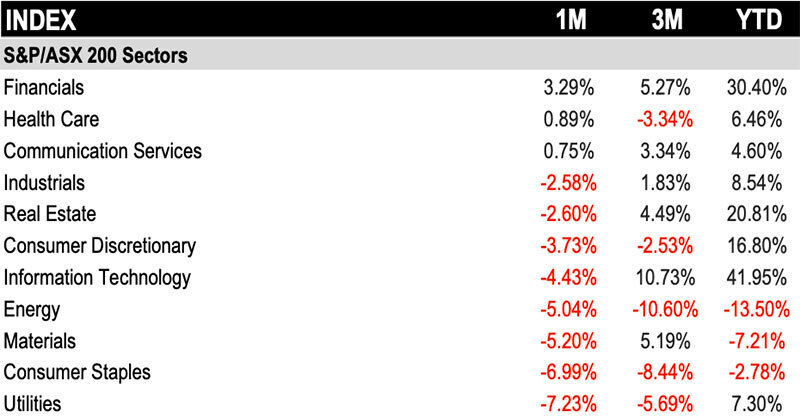

- S&P Dow Jones Indices said financials led the gains in October and is up 30% YTD

- Ovanti rose 525% in October after appointment of former Zip US CFO Simon Keast as CEO

After five consecutive months of gains, the S&P/ASX 200 fell 1.3% in October, erasing the Spring optimism that had lifted the benchmark by 3% in September, according to S&P Dow Jones Indices (S&P DJI).

Australian small-cap companies held up relatively better, with the S&P/ASX 200 ex-S&P/ASX 100, S&P/ASX Small Ordinaries and S&P/ASX Emerging Companies finishing the month with small gains.

VanEck Asia Pacific CEO and managing director Arian Neiron said October was positive for Australian investors with exposure to international equities, with MSCI World ex Australia up 3.92% in local dollar terms.

However, Australian equities went the other direction, largely due to Materials being down -5.2%.

“Bond proxies such as Utilities and A-REITs were also down, reflecting the inverse relationship with Australian 10-year bond yields,” he said.

The Australian dollar, which was generally pegged to Australian equities, fell relative to the US dollar by 5.6%. It is currently trading at US65c.

Neiron said in global bond markets, the month was characterised by a major sell-off. The Australian 10-year bond yield surged by 53bps, resulting in a 1.88% decline in Australian bonds. Similarly, the US 10-year bond yield rose sharply to 4.27%.

“The movement was primarily driven by persistent inflation concerns and renewed worries about US debt serviceability,” he said.

Inflation rose 0.2% in the September 2024 quarter and 2.8% annually, according to the latest data from the Australian Bureau of Statistics (ABS).

However, trimmed mean annual inflation was 3.5% for the September quarter down from 4% in the June quarter but above the Reserve Bank of Australia (RBA) 2-3% target. Trimmed mean inflation is often cited as the RBA’s preferred measure of inflation because it excludes more extreme price changes.

“The Australian quarterly inflation print pushed back on market expectations for an RBA rate cut, with resilience in the labour market and some persistence in inflation keeping the trimmed mean above the RBA’s target range,” Neiron said.

“We do not anticipate a rate cut till Q2 CY25, which is predicated on falls in inflation and a lift in the unemployment rate.”

Gold was the beneficiary of increased uncertainty in the market, jumping 6% over the month with a 35% gain YTD, according to S&P. Bitcoin was up more than 16%.

“We anticipate gold prices will continue rallying in light of central banking buying, increasing geopolitical risks and more rate cuts by the Fed which may spur the US dollar coming off,” Neiron said.

All eyes are on the US election and the FOMC meeting next week.

“Smalls caps, both domestically and internationally, have historically outperformed their large cap counterparts post a US Federal Election,” Neiron said.

“We reinforce being selective and focusing on quality assets as well as opportunistically buying into duration, gold bullion and gold miners.”

Financials lead gains, up 30% YTD

Eight out of the 11 S&P/ASX 200 sectors had losses, with utilities and consumer staples dipping 7% over the month. Financials remained resilient with a 3% gain and are up 30% YTD.

Information technology lost ground, dipping 4.43% in October but remains the best performing sector YTD, up ~42%.

Equity volatility continued to trend higher globally, implying increased uncertainty priced in the options market. The S&P/ASX 200 VIX closed the month at 13.7, up 1.9 points from the end of September.

Here were the 50 best performing ASX stocks in October

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | OCTOBER RETURN % | MARKET CAP |

|---|---|---|---|---|

| OVT | Ovanti Limited | 0.025 | 525% | $50,753,640 |

| JBY | James Bay Minerals | 0.7 | 367% | $23,409,750 |

| TZL | TZ Limited | 0.08 | 321% | $20,526,649 |

| GCM | Green Critical Min | 0.008 | 300% | $12,208,341 |

| YRL | Yandal Resources | 0.29 | 222% | $77,664,208 |

| BDG | Black Dragon Gold | 0.044 | 214% | $11,770,778 |

| UCM | Uscom Limited | 0.041 | 193% | $10,269,557 |

| AZ9 | Asian Battery Met PLC | 0.081 | 179% | $24,479,414 |

| POL | Polymetals Resources | 0.8 | 167% | $155,808,532 |

| PUA | Peak Minerals Ltd | 0.005 | 150% | $12,485,551 |

| AUZ | Australian Mines Ltd | 0.016 | 129% | $22,376,194 |

| PPY | Papyrus Australia | 0.016 | 129% | $7,883,081 |

| LM8 | Lunnon Metals | 0.36 | 118% | $79,368,749 |

| HIQ | Hitiq Limited | 0.026 | 117% | $9,147,969 |

| RSH | Respiri Limited | 0.078 | 117% | $100,695,576 |

| NVU | Nanoveu Limited | 0.043 | 115% | $21,711,676 |

| VR1 | Vection Technologies | 0.017 | 113% | $22,552,012 |

| NOU | Noumi Limited | 0.27 | 108% | $74,819,516 |

| EG1 | Evergreen Lithium | 0.084 | 105% | $4,723,320 |

| AYA | Artrya Limited | 0.53 | 104% | $41,739,616 |

| CCZ | Castillo Copper Ltd | 0.008 | 100% | $11,629,883 |

| GCR | Golden Cross | 0.004 | 100% | $4,389,024 |

| MKG | Mako Gold | 0.018 | 100% | $17,759,143 |

| ODE | Odessa Minerals Ltd | 0.008 | 100% | $10,146,260 |

| PEC | Perpetual Res Ltd | 0.017 | 100% | $12,512,517 |

| RFA | Rare Foods Australia | 0.024 | 100% | $6,527,598 |

| TKL | Traka Resources | 0.002 | 100% | $3,891,317 |

| XPN | Xpon Technologies | 0.014 | 100% | $5,074,181 |

| EWC | Energy World Corpor. | 0.02 | 100% | $61,578,425 |

| AVM | Advance Metals Ltd | 0.047 | 96% | $7,919,461 |

| SES | Secos Group Ltd | 0.035 | 94% | $20,881,351 |

| A1G | African Gold Ltd. | 0.082 | 91% | $29,434,681 |

| LRV | Larvottor Rsources | 0.71 | 89% | $227,487,649 |

| NVA | Nova Minerals Ltd | 0.25 | 85% | $67,984,220 |

| NYR | Nyrada Inc. | 0.12 | 85% | $21,865,044 |

| AIV | Activex Limited | 0.009 | 80% | $1,939,523 |

| G88 | Golden Mile Resources | 0.018 | 80% | $7,402,011 |

| EEL | Enrg Elements Ltd | 0.002 | 80% | $2,326,032 |

| TYP | Tryptamine Ltd | 0.032 | 78% | $34,849,555 |

| TZN | Terramin Australia | 0.077 | 75% | $162,975,329 |

| MM8 | Medallion Metals | 0.091 | 72% | $37,127,550 |

| CY5 | Cygnus Metals Ltd | 0.145 | 71% | $68,824,203 |

| LIS | Lisenergy Limited | 0.2 | 70% | $128,040,046 |

| TIP | Teaminvest Private | 2.2 | 69% | $59,724,124 |

| GW1 | Greenwing Resources | 0.067 | 68% | $16,123,649 |

| HPC | The Hydration Company | 0.015 | 67% | $4,573,696 |

| SLZ | Sultan Resources Ltd | 0.01 | 67% | $1,975,865 |

| VIG | Victor Group Hldgs | 0.05 | 67% | $28,611,334 |

| ARD | Argent Minerals | 0.03 | 67% | $43,317,770 |

| RWD | Reward Minerals Ltd | 0.068 | 66% | $15,494,013 |

Fintech Ovanti (ASX:OVT) topped the October winners list, clocking up a 525% rise for the month after announcing the appointment of former Zip US CFO, Simon Keast, as its new CEO. Keast has a clear mandate to launch the company’s BNPL offering in the US market.

“We are excited to re-launch our BNPL offering with entry into the US market with such deep potential to win market share in various segments of the US market presently under-serviced by the large incumbents,” said Ovanti chairman David Halliday.

Meanwhile, resources dominated the list of winners in October with James Bay Minerals (ASX:JBY) rising by 367% in October after several positive announcements including the proposed acquisition of the Independence Gold Project in Nevada.

“The company believes the increase in share price is a result of this announcement, combined with the significant increase in gold and silver prices during the same period,” JBY responded when hit with an ASX price query.

Green Critical Minerals (ASX:GCM) rose 300% in October after inking a binding technology purchase agreement with Cerex Pty Ltd to acquire 100% rights to a late-stage graphite technology which produces saleable graphite blocks from graphite powder.

“The acquisition of this VHD Graphite technology represents q significant milestone for GCM, aligned with our strategy to move to

revenue generating operations expediently through opportunities where we have q significant competitive advantage,” GCM managing director Clinton Booth said.

Black Dragon Gold (ASX:BDG) rose 214% on not a great deal of news other than a placement to Spanish investors and releasing its quarterly report on October 31, which delivered updates on its 1.5Moz Salave gold project in Asturias in Northern Spain, where a laborious approvals process is currently underway.

The company provided commentary about support from pro-mining stakeholders, who “expressed frustration at the slow process relating to the Environmental Impact Assessment progressing”. It’s been ongoing since 2019.

US-focused e-health provider Respiri (ASX:RSH) rose 117% in October after posting revenue of $409,000 for the quarter, which was 93% higher on pcp with cash receipts of $242,000.

As Stockhead’s Tim Boreham noted given the company managed $500,000 of revenue in the full 2023-24 year, this showed decent traction for the previously struggling company.

RSH’s lead device is the Wheezo, a blow-in-the-phone diagnostic for respiratory diseases. The company reported total patient enrolment of 2435, up 71% on the June quarter.

Here were the 50 worst performing ASX stocks in October

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | OCTOBER RETURN % | MARKET CAP |

|---|---|---|---|---|

| EXR | Elixir Energy Ltd | 0.055 | -69% | $65,824,594 |

| PPG | Pro-Pac Packaging | 0.017 | -66% | $3,088,691 |

| KLI | Killi Resources | 0.066 | -62% | $9,254,767 |

| M4M | Macro Metals Limited | 0.009 | -61% | $32,607,962 |

| NOV | Novatti Group Ltd | 0.034 | -56% | $13,816,342 |

| CAN | Cann Group Ltd | 0.04 | -55% | $18,746,659 |

| CDD | Cardno Limited | 0.15 | -55% | $5,859,099 |

| SER | Strategic Energy | 0.01 | -52% | $6,710,333 |

| MOV | Move Logistics Group | 0.16 | -52% | $20,418,243 |

| ATV | Active Port Group | 0.02 | -51% | $7,068,831 |

| CNJ | Conico Ltd | 0.001 | -50% | $2,201,528 |

| ICU | Investor Centre Ltd | 0.003 | -50% | $913,534 |

| MTB | Mount Burgess Mining | 0.001 | -50% | $1,298,147 |

| EQN | Equinox Resources | 0.14 | -48% | $17,339,000 |

| TOU | Tlou Energy Ltd | 0.015 | -46% | $19,478,765 |

| ANX | Anax Metals Ltd | 0.012 | -45% | $10,457,219 |

| MDR | Medadvisor Limited | 0.235 | -45% | $129,557,295 |

| CML | Connected Minerals | 0.2 | -44% | $8,271,642 |

| QEM | QEM Limited | 0.059 | -44% | $11,259,188 |

| OSL | Oncosil Medical | 0.008 | -43% | $30,272,641 |

| WIN | WIN Metals | 0.027 | -41% | $8,951,988 |

| RTG | RTG Mining Inc. | 0.026 | -40% | $28,208,505 |

| CVB | Curvebeam Ai Limited | 0.094 | -39% | $29,854,863 |

| TEM | Tempest Minerals | 0.0055 | -39% | $3,449,984 |

| LVH | Livehire Limited | 0.028 | -38% | $10,685,208 |

| AUK | Aumake Limited | 0.005 | -38% | $13,566,205 |

| MNB | Minbos Resources Ltd | 0.037 | -37% | $32,509,031 |

| GEN | Genmin | 0.049 | -37% | $41,955,569 |

| BPM | BPM Minerals | 0.066 | -37% | $5,535,566 |

| CPV | Clearvue Technologie | 0.29 | -36% | $77,349,082 |

| CHM | Chimeric Therapeutic | 0.009 | -36% | $8,776,267 |

| CMO | Cosmo Metals | 0.018 | -36% | $2,357,872 |

| ADA | Adacel Technologies | 0.32 | -35% | $24,423,996 |

| AW1 | American West Metals | 0.072 | -35% | $42,845,462 |

| SMP | Smartpay Holdings | 0.615 | -34% | $148,795,230 |

| CXU | Cauldron Energy Ltd | 0.013 | -33% | $18,987,788 |

| AFA | ASF Group Limited | 0.02 | -33% | $15,847,951 |

| AHN | Athena Resources | 0.004 | -33% | $4,281,870 |

| AOA | Ausmon Resorces | 0.002 | -33% | $2,117,999 |

| BCB | Bowen Coal Limited | 0.008 | -33% | $23,443,918 |

| BCM | Brazilian Critical | 0.008 | -33% | $6,953,531 |

| EDE | Eden Inv Ltd | 0.001 | -33% | $4,108,209 |

| GMN | Gold Mountain Ltd | 0.002 | -33% | $7,814,946 |

| IVX | Invion Ltd | 0.002 | -33% | $13,633,183 |

| NES | Nelson Resources | 0.002 | -33% | $1,410,522 |

| PAB | Patrys Limited | 0.004 | -33% | $8,229,789 |

| RLC | Reedy Lagoon Corp. | 0.002 | -33% | $1,523,413 |

| SIT | Site Group Int Ltd | 0.002 | -33% | $6,304,980 |

| TMX | Terrain Minerals | 0.003 | -33% | $5,400,086 |

| VMM | Viridis Mining | 0.47 | -33% | $33,793,924 |

The most high profile loss was WiseTech Global (ASX:WTC), which finished October down 14% after recovering from heavier losses earlier in the month following allegations of misconduct by founder, executive director and CEO Richard White.

WTC announced on October 24 White would be stepping down from his CEO and executive director positions, causing its share price to recover some losses. He will continue in a consultancy role with a salary of $1m per year.

At Stockhead, we tell it like it is. While James Bay Minerals and Green Critical Minerals are Stockhead advertisers, the companies did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.