ASX October Winners: Modest gains for ASX as Mount Ridley soars 967pc

Mount Ridley jumped 967% as critical minerals heat up

- The ASX 200 rose 0.39% in October with seven of 11 sectors gaining

- Australia’s unemployment rose to 4.5% as inflation came in higher than expected

- Mount Ridley Mines soars 967% as Western demand for critical minerals shines spotlight on company

The ASX 200 posted a minor gain of 0.39% in October as rising inflation and a lift in unemployment reignited concerns that Australia could be edging toward a period of stagflation, where price pressures persist even as economic growth slows.

Australia’s unemployment rate climbed to a 4-year high of 4.5% in September, up from a revised 4.3% in August, according to the latest Australian Bureau of Statistics figures.

The number of Australians who lost their job in September rose to 34,000, while the number of people who gained work was 15,000. Underemployment also rose from 5.7% to 5.9%.

Inflation also came in much hotter than economists and markets expected with consumer prices jumping to 3.2% in the September quarter, up from 2.1% in the June quarter 2025.

Headline inflation rose by 1.3% in the September quarter, the highest quarterly rise since March quarter 2023.

The largest contributor was electricity prices, up 9% as government rebates began to fall off.

“This is the highest annual inflation rate since the June 2024 quarter when annual inflation was 3.8%,” ABS head of prices statistics Michelle Marquardt said.

The numbers don’t look great for a Melbourne Cup rate cut today, with inflation now above the Reserve Bank of Australia’s 2-3% target.

Morgans’ investment strategist Tom Sartor told Stockhead the hotter than expected inflation may have taken further rate cuts off the table for the immediate term.

“It is also plausible that the Australian rate cutting cycle may be complete,” he said.

Small caps keep climbing

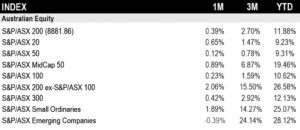

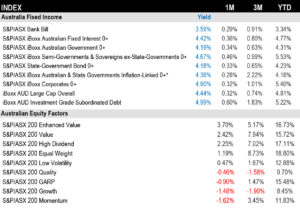

Small caps continued to shine in October, with the ASX Small Ordinaries rising 2%, achieving a 25% YTD gain and significantly outperforming the 12% increase in the ASX 200, according to S&P Dow Jones Indices (S&P DJI).

Small caps are now up 25.07% YTD. Emerging companies took a breather in October, falling 0.39%, but remain top performer YTD, up more than 28%.

China and US trade shapes global market sentiment

On Wall Street, blockbuster earnings from big tech on the final trading days for the month helped the Nasdaq lift 4.7% for October, while the S&P 500 rose 2.3% and the Dow advanced 2.5%.

“Globally, sentiment across capital markets in October was shaped by renewed trade tensions between the US and China, which evolved into cautious optimism after the Trump-Xi meeting late in the month,” Sartor said.

He said economic data released during the month painted a mixed, yet resilient picture for the US economy despite the ongoing federal government shutdown.

“Labour market conditions have softened, yet inflation has remained steady and elevated, posing a delicate environment for the US Fed to balance,” he said.

The US Federal Reserve delivered its second consecutive 25bps rate cut in October, lowering the Fed funds rate to 3.75%–4.00%.

Chair Jerome Powell emphasised that further cuts were “not a foregone conclusion”, citing data uncertainty due to the shutdown and divergent views within the FOMC.

“Market expectations for a December cut remain high but have moderated, with the Fed signalling a cautious, data-dependent approach, ” Sartor said,

“The hawkish tone from the Fed drove US dollar strength, influencing market risk appetite and volatile moves in the gold price during the month.”

Materials leads gainers as tech falls heavily

Among the ASX 200 sectors, seven out of 11 reported gains, led by materials up 4.33% and energy up 3.67%.

In contrast, the tech sector fell more than 8% and consumer discretionary ~7% as Sartor said investors questioned the trajectory for domestic interest rates.

“While large-cap ASX stalwarts remain in healthy shape to be able to weather bumpier markets, recent market events both locally and overseas do increase the importance of reviewing and re-balancing portfolios more actively,” he said.

Fixed income moves higher as gold and copper rise

Bonds continued their upward momentum in October, In Australian factor indices, Enhanced Value and Value outperformed, while Momentum and Growth trailed behind.

S&P DJI said commodities advanced overall, led by a 7% rise in copper. Gold added another 4%, achieving a YTD gain of 51%.

The 50 best performing ASX stocks in October

| CODE | COMPANY | LAST SHARE PRICE | OCT RETURN % | MARKET CAP |

|---|---|---|---|---|

| MRD | Mount Ridley Mines | 0.032 | 967% | $29,842,042 |

| EAT | Entertainment Rewards | 0.021 | 950% | $27,484,506 |

| LMS | Litchfield Minerals | 0.665 | 454% | $37,648,165 |

| CUF | Cufe Ltd | 0.05 | 317% | $83,267,515 |

| PVT | Pivotal Metals Ltd | 0.023 | 188% | $24,495,099 |

| EUR | European Lithium Ltd | 0.26 | 186% | $317,602,187 |

| NYR | Nyrada Inc | 0.81 | 166% | $168,549,311 |

| COB | Cobalt Blue Ltd | 0.13 | 155% | $61,413,097 |

| MOM | Moab Minerals Ltd | 0.0025 | 150% | $3,749,332 |

| FML | Focus Minerals Ltd | 2.59 | 143% | $713,531,026 |

| TMB | Tambourah Metals | 0.098 | 139% | $23,097,568 |

| EMU | EMU NL | 0.049 | 133% | $11,122,450 |

| VBS | Vectus Biosystems | 0.14 | 133% | $6,133,333 |

| ELT | Elementos Limited | 0.34 | 127% | $98,856,528 |

| VHM | VHM Limited | 0.54 | 125% | $152,911,140 |

| NVA | Nova Minerals Ltd | 0.98 | 123% | $334,568,239 |

| AUR | Auris Minerals Ltd | 0.02 | 122% | $14,799,236 |

| 8IH | 8I Holdings Ltd | 0.031 | 121% | $17,059,882 |

| KEY | KEY Petroleum | 0.099 | 120% | $3,384,287 |

| TRI | Trivarx Ltd | 0.022 | 120% | $15,558,422 |

| ADV | Ardiden Ltd | 0.36 | 118% | $20,005,602 |

| RML | Resolution Minerals | 0.1 | 117% | $149,249,096 |

| AHK | Ark Mines Limited | 0.65 | 113% | $42,875,920 |

| HAS | Hastings Tech Metals | 0.66 | 113% | $125,458,943 |

| FIN | FIN Resources Ltd | 0.01 | 100% | $6,253,996 |

| SKN | Skin Elements Ltd | 0.006 | 100% | $7,396,285 |

| FLC | Fluence Corporation | 0.125 | 98% | $125,104,083 |

| AGD | Austral Gold | 0.087 | 93% | $48,372,597 |

| PAB | Patrys Limited | 0.043 | 91% | $13,288,417 |

| AR3 | Austrare | 0.21 | 91% | $49,301,913 |

| 1MC | Morella Corporation | 0.041 | 86% | $15,105,588 |

| ADG | Adelong Gold Limited | 0.013 | 86% | $33,368,873 |

| MIO | Macarthur Minerals | 0.061 | 85% | $18,449,968 |

| AMS | Atomos | 0.022 | 83% | $23,259,580 |

| HWK | Hawk Resources | 0.036 | 80% | $11,514,501 |

| WBE | Whitebark Energy | 0.009 | 80% | $5,628,101 |

| ABX | ABX Group Limited | 0.115 | 80% | $31,291,000 |

| AXE | Archer Materials | 0.465 | 79% | $109,584,216 |

| ASM | Aust Strategic Materials | 1.01 | 77% | $246,598,827 |

| VRC | Volt Resources Ltd | 0.007 | 75% | $32,793,946 |

| OLL | Openlearning | 0.04 | 74% | $22,311,036 |

| CTO | Citigold Corp Ltd | 0.012 | 71% | $39,000,000 |

| WBT | Weebit Nano Ltd | 5.44 | 71% | $1,096,185,137 |

| ACE | Acusensus Limited | 2 | 70% | $254,904,475 |

| PIM | Pinnacle Minerals | 0.17 | 70% | $14,567,195 |

| IOD | Iodm Limited | 0.17 | 70% | $98,650,270 |

| CAE | Cannindah Resources | 0.056 | 70% | $50,541,111 |

| NH3 | NH3 Clean Energy | 0.105 | 69% | $66,561,015 |

| IR1 | Iris Metals | 0.345 | 68% | $69,390,642 |

| TVN | Tivan Limited | 0.185 | 68% | $413,743,942 |

Mount Ridley Mines (ASX:MRD) rose 967% in October as the need for the West to secure critical minerals, including gallium, to reduce reliance on China put a spotlight on the company and its namesake project in southern WA, which hosts an inferred resource of 838.7Mt grading 29.3ppm for 24,584t of gallium.

The maiden resource declared last week and the appointment of Allister Caird as CEO announced today has sent shares soaring as investors rush to get on board.

Since October 23, the company has had an amazing rise from 0.5c and with strong daily volumes, including today when more than 387 million shares changed hands valued at over $22 million.

Entertainment Rewards (ASX:EAT) skyrocketed 950% in October after receiving a conditional takeover offer from its majority shareholder, Suzerain.

The company announced on October 15 it had entered into an implementation deed with Suzerain, which plans to make a conditional off-market takeover offer to acquire all remaining shares it does not already own, at a proposed price of $0.022 per share.

Entertainment Rewards operates in the entertainment and leisure sector, delivering rewards and loyalty programs that help businesses boost customer engagement through tailored incentive initiatives.

The 50 worst performing ASX stocks in October

| CODE | COMPANY | LAST SHARE PRICE | OCT RETURN % | MARKET CAP |

|---|---|---|---|---|

| LRD | Lord Resources | 0.02 | -60% | $3,540,041 |

| RNX | Renegade Exploration | 0.004 | -58% | $8,279,187 |

| IS3 | I Synergy Group Ltd | 0.011 | -58% | $19,092,316 |

| IFG | Infocus Group | 0.011 | -52% | $4,963,029 |

| JAV | Javelin Minerals Ltd | 0.002 | -50% | $23,376,675 |

| MTL | Mantle Minerals Ltd | 0.001 | -50% | $7,233,115 |

| T3D | 333D Limited | 0.067 | -48% | $12,292,749 |

| LRM | Lion Rock Minerals | 0.032 | -44% | $82,725,763 |

| FND | Findi Limited | 1.87 | -44% | $124,220,454 |

| BMM | Bayan Mining and Minerals | 0.13 | -41% | $16,205,338 |

| SNX | Sierra Nevada Gold | 0.037 | -40% | $7,631,671 |

| DTR | Dateline Resources | 0.285 | -40% | $951,462,488 |

| EOS | Electro Optic Systems | 6.21 | -39% | $1,258,047,685 |

| PUR | Pursuit Minerals | 0.068 | -38% | $9,777,107 |

| RCM | Rapid Critical Metals | 0.05 | -38% | $38,328,902 |

| DBO | Diablo Resources | 0.024 | -37% | $5,896,055 |

| IGN | Ignite Ltd | 0.95 | -37% | $15,713,196 |

| TGM | Theta Gold Mines Ltd | 0.165 | -37% | $167,356,956 |

| AXP | AXP Energy Ltd | 0.016 | -36% | $6,390,091 |

| ZNC | Zenith Minerals Ltd | 0.093 | -36% | $49,997,586 |

| VR1 | Vection Technologies | 0.042 | -35% | $96,636,222 |

| JAT | Jatcorp Limited | 0.16 | -35% | $16,010,666 |

| SLM | Solis Minerals | 0.054 | -34% | $7,705,089 |

| CZN | Corazon Ltd | 0.165 | -34% | $8,033,924 |

| DTZ | Dotz Nano Ltd | 0.059 | -34% | $30,926,459 |

| AOK | Australian Oil | 0.002 | -33% | $2,122,566 |

| MDR | Medadvisor Limited | 0.028 | -33% | $18,337,821 |

| TMK | TMK Energy Limited | 0.002 | -33% | $11,897,383 |

| VFX | Visionflex Group Ltd | 0.002 | -33% | $6,758,296 |

| VTX | Vertex Minerals | 0.24 | -33% | $68,047,854 |

| CCE | Carnegie Clean Energy | 0.074 | -33% | $28,540,924 |

| T92 | Terra Critical Minerals | 0.06 | -33% | $8,647,957 |

| ODY | Odyssey Gold Ltd | 0.029 | -33% | $32,511,707 |

| FME | Future Metals NL | 0.025 | -32% | $22,043,219 |

| SFX | Sheffield Resources | 0.099 | -32% | $38,761,676 |

| ICR | Intelicare Holdings | 0.02 | -31% | $12,782,465 |

| H2G | Greenhy2 Limited | 0.009 | -31% | $6,252,570 |

| DY6 | DY6 Metals | 0.16 | -30% | $15,641,165 |

| HYD | Hydrix Limited | 0.016 | -30% | $4,364,302 |

| JGH | Jade Gas Holdings | 0.032 | -30% | $55,015,025 |

| KLR | Kaili Resources Ltd | 0.195 | -30% | $28,743,071 |

| CDT | Castle Minerals | 0.053 | -30% | $10,276,060 |

| MDI | Middle Island Res | 0.03 | -30% | $10,263,189 |

| WLD | Wellard Limited | 0.03 | -30% | $15,937,509 |

| GBE | Globe Metals & Mining | 0.049 | -30% | $41,562,626 |

| NHE | Noble Helium | 0.027 | -30% | $18,585,275 |

| CAN | Cann Group Ltd | 0.012 | -29% | $9,887,638 |

| BDG | Black Dragon Gold | 0.065 | -29% | $20,770,711 |

| PVW | PVW Resources | 0.029 | -29% | $5,225,450 |

| AVH | Avita Medical | 1.15 | -29% | $98,871,933 |

While Mount Ridley Mines is a Stockhead advertisers, the company did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.