ASX May Winners: Mid caps beat large caps; small caps lag. May was tough.

After a strong performance in April markets were down in May. Pic: Getty Images

- The S&P ASX 200 was down 2.5% in May, with mid caps performing the best and small caps lagging blue chips

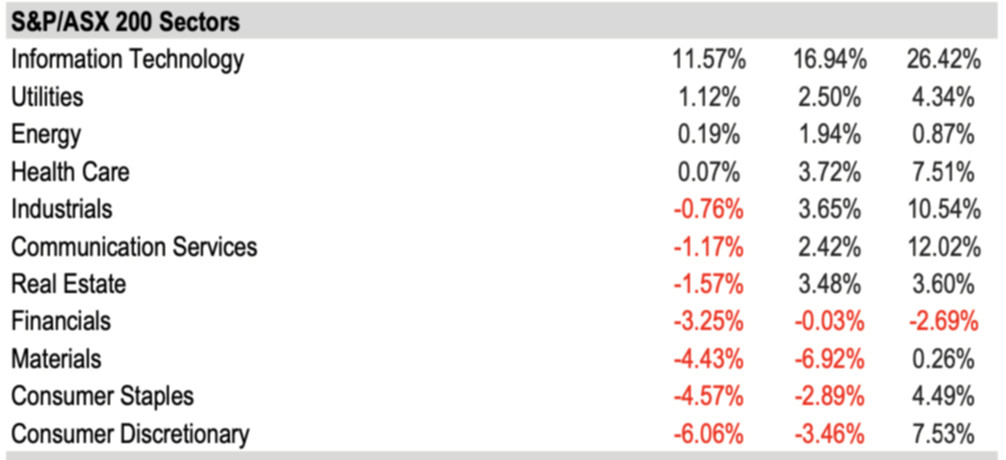

- The S&P ASX 200 Information Technology sector performed the best in May, up 11.6% following strong AI interest

- Wildcat Resources rockets higher after announcing the start of field work at its Tabba Tabba lithium project

After a mini rally in April, markets fell in May. The S&P ASX 200 was down 2.5% for the month, erasing gains for the quarter and YTD. Mid caps performed the best, while small caps lagged their blue chip peers. The S&P ASX MidCap 50 was flat for May and the S&P ASX Small Ordinaries shed 3.3%.

While the S&P ASX MidCap 50 is up for YTD, the S&P ASX Small Ordinaries and S&P ASX Emerging Companies indices still have some catch-up to do four months into 2023, according to S&P Dow Jones Indices.

US Debt ceiling and inflation impact markets

Several factors impacted markets during May, with the US debt ceiling among the top as experts speculated about what would happen if the world’s largest economy couldn’t pay its debts.

US President Joe Biden and US House of Representatives Speaker Kevin McCarthy held a 90-minute phone call on Saturday evening, after which they reached an deal ‘in principle’ to raise the US government’s $US31.4 trillion debt ceiling.

The House has voted 241-187 and advanced the debt ceiling bill to the Senate with experts confident it will pass despite a revolt among a handful of hard-line Republicans.

In Australia, a shock inflation report released on the last day of May lifted bets the RBA would hike the cash rate further in June.

Australia’s headline inflation came in at 6.8% for April, up from 6.3% the month before and above what experts had generally forecast.

Tech leads sector winners on back of AI frenzy

Seven of the 11 sectors finished in the red during May. The S&P ASX 200 Information Technology sector performed the best in May, up an impressive 11.6%, followed by utilities rising 1.12% and energy up 0.19%.

Tech has been having a good run globally, sparked by excitement about the emerging field of artificial intelligence (AI). Last week the NASDAQ saw one of the biggest companies in the world – graphics card specialist Nvidia – add almost US$200bn to its market cap in a single after hours session.

Upon release of its Q1 FY24 results after market close, the Nvidia share price spiked 26%. It’s up 164% YTD and now has a market cap of US$934 billion.

READ: As hot AI fuels a rebound in global tech stocks, which ASX plays could benefit?

But for all the good news for tech stocks, there were those sectors in the red. Leading the laggards was consumer discretionary down 6.06%, consumer staples lost 4.57% and the materials sector fell 4.43%.

All S&P reported Australian equity factor indices closed in the red for May, with Low Volatility holding up best, slipping 1.6%. At the other end of the spectrum, Shareholder Yield gave up 5.7%.

Fixed income was also sold off in Australia, however all reported fixed income indices are still holding on to robust YTD gains.

Australian equity implied volatility edged slightly higher in May, with the S&P/ASX 200 VIX Index (known as the fear index) closing May at 13, one point above its level at the previous month end.

Here are the 50 best performing ASX stocks for May:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | MAY RETURN % | MARKET CAP |

|---|---|---|---|---|

| WC8 | Wildcat Resources | 0.105 | 250% | $69,512,386 |

| ZLD | Zelira Therapeutics | 3.05 | 226% | $34,608,823 |

| WA1 | WA1 Resources | 5.19 | 189% | $203,576,193 |

| WSR | Westar Resources | 0.075 | 188% | $13,843,314 |

| VSR | Voltaic Strategic | 0.071 | 163% | $26,231,500 |

| SLM | Solis Minerals | 0.285 | 159% | $13,268,166 |

| ZEU | Zeus Resources Ltd | 0.029 | 142% | $12,710,700 |

| INP | Incentiapay Ltd | 0.013 | 117% | $16,445,827 |

| RR1 | Reach Resources Ltd | 0.0065 | 117% | $17,907,829 |

| ONE | Oneview Healthcare | 0.2025 | 115% | $108,027,102 |

| CG1 | Carbonxt Group | 0.098 | 96% | $26,979,290 |

| C1X | Cosmos Exploration | 0.485 | 90% | $21,570,375 |

| TPC | TPC Consolidated Ltd | 4.64 | 78% | $52,759,171 |

| BLZ | Blaze Minerals Ltd | 0.016 | 78% | $5,880,132 |

| NUC | Nuchev Limited | 0.26 | 74% | $13,457,793 |

| FFF | Forbidden Foods | 0.026 | 73% | $3,457,494 |

| ENR | Encounter Resources | 0.285 | 73% | $112,724,848 |

| LLL | Leo Lithium | 0.89 | 70% | $878,187,949 |

| KNG | Kingsland Minerals | 0.325 | 67% | $10,217,949 |

| RDN | Raiden Resources Ltd | 0.005 | 67% | $9,272,912 |

| CLA | Celsius Resource Ltd | 0.025 | 67% | $55,276,292 |

| AKP | Audio Pixels Ltd | 14.65 | 66% | $427,927,965 |

| ILA | Island Pharma | 0.13 | 65% | $10,564,901 |

| PGY | Pilot Energy Ltd | 0.018 | 64% | $17,503,697 |

| CLT | Cellnet Group | 0.026 | 63% | $6,333,460 |

| PRS | Prospech Limited | 0.039 | 63% | $8,512,832 |

| GSM | Golden State Mining | 0.053 | 61% | $7,646,003 |

| REC | Recharge Metals | 0.2 | 54% | $18,959,000 |

| AXE | Archer Materials | 0.62 | 53% | $158,005,148 |

| TZN | Terramin Australia | 0.029 | 53% | $61,380,319 |

| LEL | Lithenergy | 0.885 | 53% | $84,083,850 |

| CHZ | Chesser Resources | 0.1125 | 52% | $66,217,652 |

| GCR | Golden Cross | 0.006 | 50% | $6,583,537 |

| MEB | Medibio Limited | 0.0015 | 50% | $6,471,891 |

| MTB | Mount Burgess Mining | 0.003 | 50% | $2,649,513 |

| VPR | Volt Power Group | 0.0015 | 50% | $16,074,312 |

| LYN | Lycaon Resources | 0.23 | 48% | $7,571,313 |

| SKO | Serko | 2.84 | 48% | $345,890,393 |

| MGU | Magnum Mining & Exp | 0.028 | 47% | $20,137,707 |

| ICG | Inca Minerals Ltd | 0.025 | 47% | $12,087,862 |

| GRE | Greentech Metals | 0.12 | 46% | $5,029,150 |

| LVE | Love Group Global | 0.08 | 45% | $3,242,734 |

| GLV | Global Oil & Gas | 0.013 | 44% | $4,457,436 |

| GW1 | Greenwing Resources | 0.265 | 43% | $39,726,090 |

| ACS | Accent Resources NL | 0.01 | 43% | $4,731,273 |

| DLI | Delta Lithium | 0.65 | 43% | $294,658,536 |

| RTG | RTG Mining Inc. | 0.064 | 42% | $50,961,619 |

| AZS | Azure Minerals | 0.54 | 40% | $210,727,479 |

| 1TT | Thrive Tribe Tech | 0.028 | 40% | $6,438,736 |

| NAE | New Age Exploration | 0.007 | 40% | $10,051,292 |

Leading the winners list in May were several ASX resources stocks including Wildcat Resources (ASX:WC8) which is rocketing higher after announcing the start of field work at its highly prospective Tabba Tabba lithium project in the WA Pilbara.

The company has completed drone photography and a digital elevation survey to pinpoint which pegmatites it will drill first.

Tabba Tabba was once owned by Sons of Gwalia in the early 2000s, who owned significant projects back then including Pilgangoora, Wodgina and Greenbushes. The project is right next door to where Fortescue Metals Group (ASX:FMG) drilled out a lithium orebody and has since reportedly put in for a mining lease.

The company said 38 outcropping pegmatites have been mapped across the tenement package and have been shown to contain high-grade lithium mineralisation.

WC8 will focus on fast-tracking RC drilling of priority targets and a delineation of pegmatite-hosted LCT mineralisation.

Also up after a strong end to May is Zelira Therapeutics (ASX:ZLD), after an IRB-approved multi-arm head-to-head study of its proprietary diabetic nerve pain drug ZLT-L-007 showed that it outperforms the current go-to drug Lyrica.

It is big news for ZLD with Lyrica (also known as pregabalin) a multi-billion dollar drug, prescribed heavily around the world to tackle pain associated with peripheral neuropathy (nerve damage) brought on by diabetes and other ailments.

Zelira was already up 192.55% by lunchtime after the announcement was made on May 31, and closed more than 220% higher for the day.

Here are the 50 worst performing ASX stocks for May:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | MAY RETURN % | MARKET CAP |

|---|---|---|---|---|

| GFN | Gefen Int | 0.006 | -70% | $408,601 |

| PYR | Payright Limited | 0.005 | -67% | $4,404,426 |

| APC | Aust Potash Ltd | 0.01 | -66% | $10,386,791 |

| LRD | Lord Resources | 0.11 | -55% | $4,084,533 |

| LVT | Livetiles Limited | 0.012 | -52% | $12,565,988 |

| MDX | Mindax Limited | 0.095 | -51% | $194,328,084 |

| ARE | Argonaut Resources | 0.001 | -50% | $6,361,871 |

| CDX | Cardiex Limited | 0.18 | -50% | $25,823,794 |

| CLE | Cyclone Metals | 0.001 | -50% | $9,089,248 |

| ROO | Roots Sustainable | 0.005 | -50% | $693,611 |

| WEL | Winchester Energy | 0.003 | -50% | $3,061,266 |

| TSI | Top Shelf | 0.23 | -49% | $19,358,993 |

| OPN | Oppenneg | 0.03 | -48% | $6,027,437 |

| DAF | Discovery Alaska Ltd | 0.026 | -48% | $6,090,102 |

| CHM | Chimeric Therapeutic | 0.037 | -47% | $16,172,492 |

| ETR | Entyr Limited | 0.014 | -46% | $24,273,985 |

| LRV | Larvotto Resources | 0.175 | -46% | $11,769,576 |

| SRT | Strata Investment | 0.18 | -45% | $30,496,244 |

| SIS | Simble Solutions | 0.005 | -44% | $3,014,754 |

| TYM | Tymlez Group | 0.005 | -44% | $5,460,976 |

| FRB | Firebird Metals | 0.084 | -44% | $6,138,300 |

| BFC | Beston Global Ltd | 0.008 | -43% | $15,976,375 |

| MRD | Mount Ridley Mines | 0.002 | -43% | $15,569,766 |

| LDR | Lode Resources | 0.205 | -42% | $13,605,695 |

| EX1 | Exopharm Limited | 0.011 | -42% | $4,833,654 |

| TTT | Titomic Limited | 0.064 | -42% | $15,295,357 |

| LSA | Lachlan Star Ltd | 0.007 | -42% | $9,233,089 |

| LME | Limeade Inc. | 0.12 | -41% | $30,904,525 |

| KED | Keypath Education | 0.28 | -41% | $59,853,561 |

| 29M | 29 Metals | 0.705 | -41% | $339,846,725 |

| EQS | Equity Story Group | 0.033 | -40% | $1,340,288 |

| MCL | Mighty Craft Ltd | 0.09 | -40% | $32,360,799 |

| PUA | Peak Minerals Ltd | 0.003 | -40% | $3,124,130 |

| UNI | Universal Store | 2.83 | -40% | $217,119,892 |

| RPG | Raptis Group Limited | 0.02 | -39% | $1,269,727 |

| CBL | Control Bionics | 0.091 | -39% | $8,233,592 |

| YOJ | Yojee Limited | 0.014 | -39% | $15,868,474 |

| TTM | Titan Minerals | 0.038 | -39% | $53,628,381 |

| DCL | Domacom Limited | 0.027 | -39% | $11,758,548 |

| VUL | Vulcan Energy | 3.66 | -39% | $603,297,202 |

| RNX | Renegade Exploration | 0.013 | -38% | $12,325,609 |

| ICN | Icon Energy Limited | 0.005 | -38% | $3,840,068 |

| KNM | Kneomedia Limited | 0.005 | -38% | $7,523,927 |

| TKL | Traka Resources | 0.005 | -38% | $4,356,646 |

| PGL | Prospa Group | 0.3 | -37% | $49,012,667 |

| FFT | Future First Tech | 0.019 | -37% | $13,581,895 |

| PET | Phoslock Env Tec Ltd | 0.019 | -37% | $11,863,420 |

| PRX | Prodigy Gold NL | 0.007 | -36% | $12,257,755 |

| RDS | Redstone Resources | 0.007 | -36% | $5,802,149 |

| ALA | Arovella Therapeutic | 0.048 | -36% | $36,422,283 |

On the laggards list for May is Lord Resources (ASX:LRD), down 55% despite what appears to be positive news coming through in May.

The share price doesn’t appear to be a concern for LRD executive director Barnaby Egerton-Warburton, who took advantage of the slump to position himself as a substantial holder with nearly 7% voting power after conversion of performance rights.

This comes off a May 11 announcement that LRD had completed the purchase of the Jingjing lithium project in WA’s Eastern Goldfields.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.