ASX Lunch Wrap: Stocks, Bitcoin charge ahead; Capricorn jumps on record gold output

Stocks, Bitcoin soar; Capricorn hits gold record. Picture via Getty Images

- ASX extends gains, led by tech, consumer stocks

- Bitcoin touches US$102k on Trump’s crypto boost

- Syrah dips, Capricorn hits record gold output

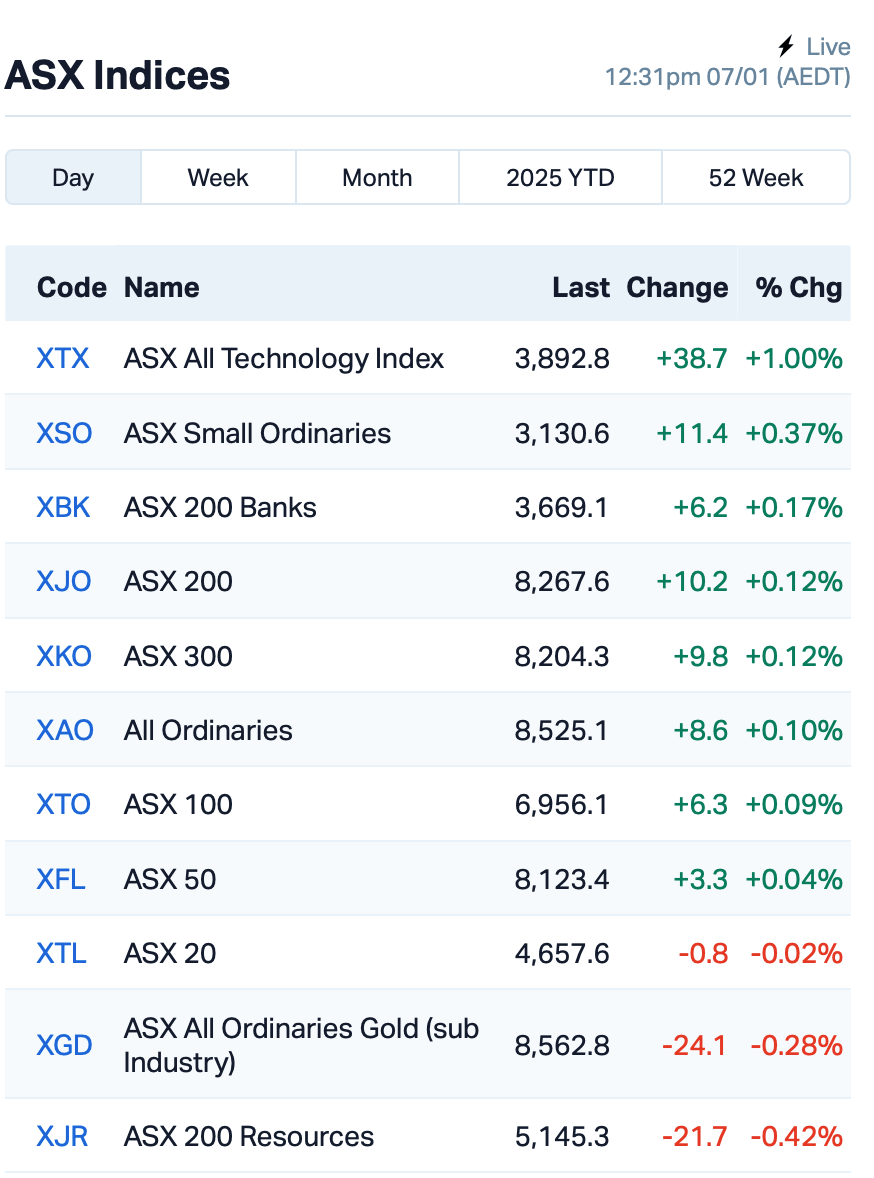

The ASX is off to another strong start on Tuesday, up 0.15% and marking its fourth consecutive gain.

Tech led the charge, but retailers also rallied as traders pinned hopes on a rebound in consumer sentiment for the new year.

The optimism follows a 3.6-point boost in consumer confidence for the first week of January, as reported by ANZ-Roy Morgan this morning.

On the crypto front, Bitcoin is making a comeback, surging back to just a tad over US$102,000 at the time of writing.

The rally was partly fuelled by pro-crypto ally Mike Johnson, who retained his position as speaker of the US House of Representatives, a win for Trump’s crypto-friendly agenda.

Overnight on Wall Street, it was the tech giants making the noise as the Magnificent Seven –Nvidia, Tesla, Amazon and co – all rose.

Nvidia led the way, hitting a fresh record as investors waited for CEO Jensen Huang’s speech at the world’s biggest consumer electronics show (CES) in Vegas.

US banks stocks were back in the spotlight, too. The big news? Michael Barr stepping down as Fed vice-chair for supervision.

Meanwhile, the US dollar strengthened again after Trump made it clear his tariff plans aren’t going anywhere.

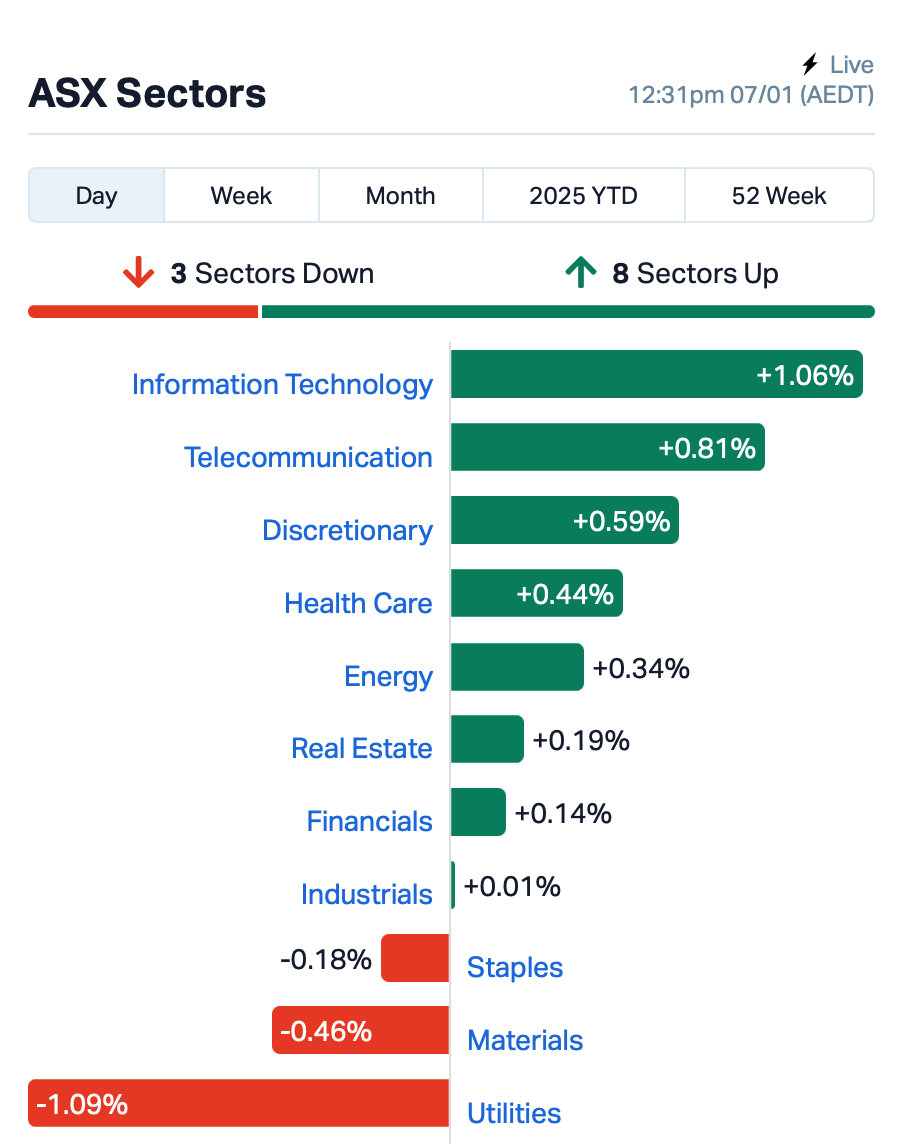

Back on the ASX, eight out of 11 sectors were in the green at 12: 30pm AEDT:

In the large caps space, making headlines on Tuesday was Capricorn Metals (ASX:CMM), which rose 3% after reporting record gold production for the December quarter, producing 28,702 ounces of gold, up from 25,559 the previous quarter.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 7 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.002 | 100% | 901,495 | $28,933,812 |

| RGT | Argent Biopharma Ltd | 0.250 | 47% | 163,485 | $9,226,286 |

| ICG | Inca Minerals Ltd | 0.008 | 33% | 8,676,176 | $6,160,335 |

| PPY | Papyrus Australia | 0.015 | 25% | 1,322,797 | $6,624,544 |

| ADD | Adavale Resource Ltd | 0.003 | 25% | 3,938,486 | $3,081,664 |

| CUL | Cullen Resources | 0.005 | 25% | 1,519,725 | $2,773,607 |

| MOH | Moho Resources | 0.005 | 25% | 873,000 | $2,865,898 |

| DXB | Dimerix Ltd | 0.440 | 24% | 6,584,843 | $198,042,756 |

| PIM | Pinnacleminerals | 0.058 | 21% | 40,000 | $2,182,239 |

| KKO | Kinetiko Energy Ltd | 0.073 | 20% | 83,004 | $87,387,691 |

| JAV | Javelin Minerals Ltd | 0.004 | 17% | 11,980 | $18,065,874 |

| VRC | Volt Resources Ltd | 0.004 | 17% | 484,750 | $12,639,719 |

| FGH | Foresta Group | 0.008 | 14% | 100,000 | $18,403,831 |

| PVT | Pivotal Metals Ltd | 0.008 | 14% | 30,006 | $6,350,581 |

| SKK | Stakk Limited | 0.008 | 14% | 463,000 | $14,525,558 |

| KZR | Kalamazoo Resources | 0.083 | 14% | 145,774 | $14,839,700 |

| SCN | Scorpion Minerals | 0.017 | 13% | 4,690 | $6,141,843 |

| SBW | Shekel Brainweigh | 0.026 | 13% | 54,822 | $5,245,408 |

| BML | Boab Metals Ltd | 0.180 | 13% | 1,439,820 | $37,343,217 |

| AEV | Avenira Limited | 0.009 | 13% | 150,000 | $25,352,272 |

Dimerix (ASX:DXB) has struck an exclusive deal with Japanese company Fuso Pharmaceutical Industries to develop and commercialise DMX-200 for treating FSGS in Japan. Fuso will cover all clinical trial costs and regulatory work in Japan, while Dimerix retains rights outside of Japan. Dimerix is set to receive up to ¥10.5 billion (~$107 million) in upfront and milestone payments, plus 15-20% royalties on net sales. The ACTION3 trial for DMX-200 is already approved in Japan, with the first clinical sites expected to open in Q1 2025.

Argent Biopharma (ASX:RGT) has successfully raised US$4.5 million by issuing 11.25 million shares at US$0.40 each, with one free warrant for every two shares. The funds will support the development of CannEpil and other treatments, while the company plans a US listing after its LSE delisting.

Smart sensors tech company Shekel Brainweigh (ASX:SBW) ended 2024 with a bang, reporting a record Q4 revenue of US$7.65m – up 27% from the previous year. Retail tech sales soared 106%, and local Israeli market revenue jumped 75%. Entering 2025, the company said it has a US$6.11m order backlog, up 19%.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for January 7 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SIS | Simble Solutions | 0.004 | -33% | 434,166 | $5,017,982 |

| GMN | Gold Mountain Ltd | 0.003 | -25% | 769,608 | $18,269,893 |

| NAE | New Age Exploration | 0.003 | -25% | 195,666 | $8,575,596 |

| TMX | Terrain Minerals | 0.003 | -25% | 162,805 | $7,242,782 |

| TTI | Traffic Technologies | 0.003 | -25% | 810,157 | $4,614,933 |

| SGQ | St George Min Ltd | 0.020 | -20% | 11,952,557 | $30,963,511 |

| MEL | Metgasco Ltd | 0.004 | -20% | 49,998 | $7,287,934 |

| RLG | Roolife Group Ltd | 0.004 | -20% | 25,000 | $5,980,156 |

| TYX | Tyranna Res Ltd | 0.004 | -20% | 317,798 | $16,439,627 |

| ERA | Energy Resources | 0.003 | -17% | 540,000 | $1,216,188,722 |

| PWN | Parkway Corp Ltd | 0.011 | -15% | 35,918 | $35,972,480 |

| BRN | Brainchip Ltd | 0.320 | -15% | 24,826,278 | $739,675,491 |

| CCO | The Calmer Co Int | 0.006 | -14% | 181,097 | $17,785,969 |

| GTR | Gti Energy Ltd | 0.003 | -14% | 190,827 | $10,370,324 |

| KRR | King River Resources | 0.012 | -14% | 149,000 | $21,395,091 |

| SER | Strategic Energy | 0.007 | -13% | 25,000 | $5,368,267 |

| 1AD | Adalta Limited | 0.015 | -12% | 55,000 | $10,734,787 |

| KNB | Koonenberrygold | 0.015 | -12% | 4,061,893 | $14,862,887 |

| BIT | Biotron Limited | 0.016 | -11% | 100,000 | $16,242,890 |

| PUA | Peak Minerals Ltd | 0.008 | -11% | 178,490 | $22,968,992 |

| RC1 | Redcastle Resources | 0.008 | -11% | 85,000 | $6,692,102 |

| TOY | Toys R Us | 0.051 | -11% | 1,122,435 | $8,621,943 |

Syrah Resources (ASX:SYR) fell 2% despite securing a loan waiver from the US government’s development bank. The waiver, valued at US$53 million, comes after civil unrest in Mozambique halted production at its graphite mine.

At Stockhead we tell it like it is. While Dimerix is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.