ASX Lunch Wrap: Stocks and Bitcoin drop as markets worry about US debt ceiling deadline

ASX 200 drops after Wall Street sell-off. Picture via Getty Images

- ASX 200 drops after Wall Street sell-off

- US megatech hit hard as Nvidia and Microsoft lose ground

- Bitcoin tumbles as traders cash in on recent highs

Aussie investors had been gearing up for a festive finish to the year, but Monday’s market open quickly popped that bubble.

Face-planting out of the gates, the ASX 200 has now slid by 0.65% at 1pm, following Wall Street’s poor performances at the tail end of last week.

On Friday, the S&P 500 dropped a further 1%, dragged down by a sell-off in tech stocks and rising bond yields.

Investors were jittery after Treasury Secretary Janet Yellen warned the US could run out of money in weeks, and might have to start using “special accounting manoeuvres” as early as mid-January to avoid breaching the debt ceiling.

Nvidia was one of the hardest hit, dropping 2%, while Microsoft lost 1.7%.

That said, with the holiday season in full swing, market volumes were light, making the moves a little more exaggerated.

Over in crypto, it was a rocky day for Bitcoin, too, which tumbled 2% in the last 24 hours as traders cashed in on the record highs it reached earlier this month.

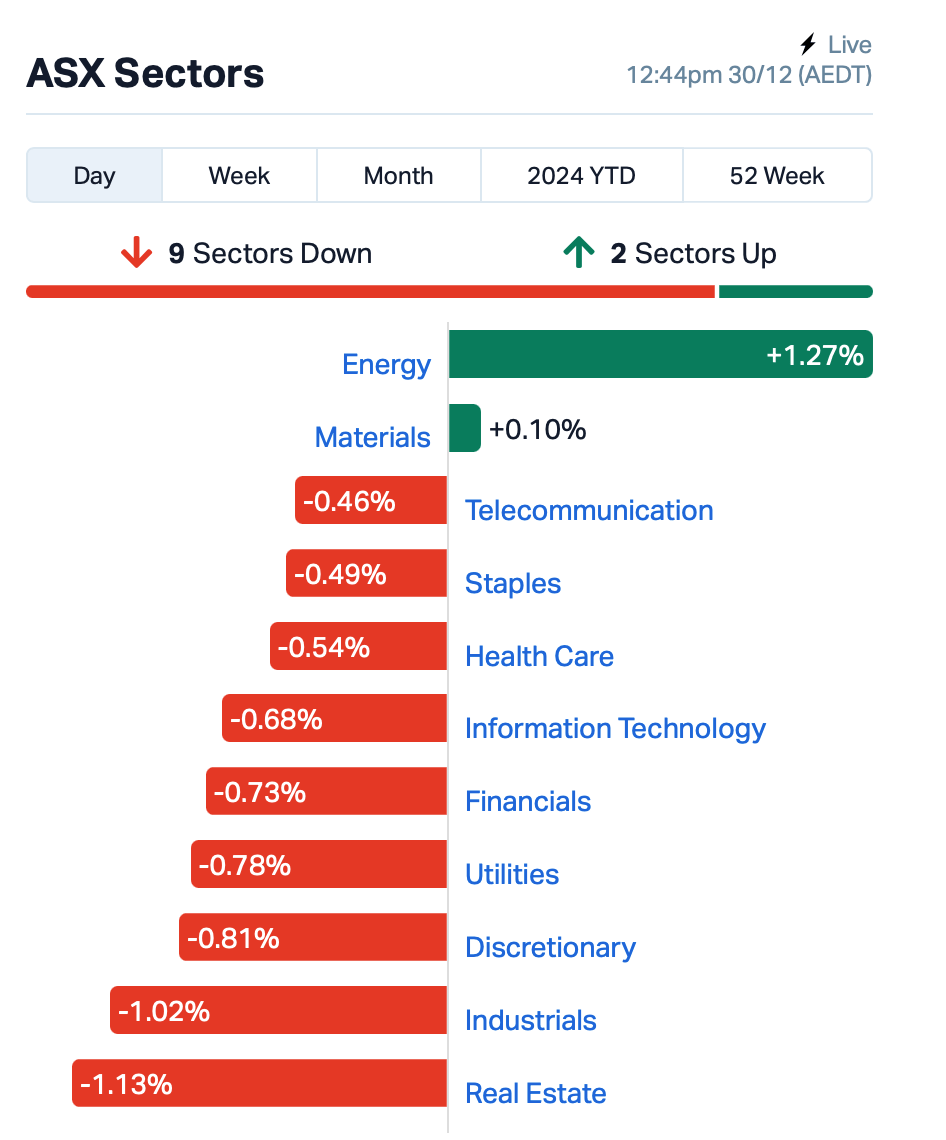

Meanwhile, here at home, 9 out of 11 ASX sectors were in the red this morning.

The real estate sector lagged the most, while energy and mining stocks bucked the trend:

In the large caps space, APA Group (ASX:APA), which owns gas pipelines, plunged 4%, while Transurban Group (ASX:TCL) lost 3%.

As for the banks, the big four opened lower, with the biggest heavyweight, Commonwealth Bank (ASX:CBA), down 0.5%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for December 30 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| NTM | Nt Minerals Limited | 0.003 | 50% | 37,988 | $2,421,806 |

| MXR | Maximus Resources | 0.060 | 33% | 6,661,173 | $19,256,746 |

| AOK | Australian Oil. | 0.003 | 25% | 166,666 | $2,003,566 |

| BNL | Blue Star Helium Ltd | 0.005 | 25% | 253,009 | $10,779,541 |

| TEM | Tempest Minerals | 0.005 | 25% | 200,000 | $2,538,119 |

| BDG | Black Dragon Gold | 0.067 | 24% | 1,021,502 | $16,301,667 |

| GCM | Green Critical Min | 0.014 | 23% | 32,139,746 | $20,983,086 |

| BCB | Bowen Coal Limited | 0.009 | 21% | 42,632,214 | $75,425,228 |

| PIQ | Proteomics Int Lab | 0.730 | 21% | 557,246 | $79,256,644 |

| ADG | Adelong Gold Limited | 0.006 | 20% | 436,814 | $5,589,945 |

| BPP | Babylon Pump & Power | 0.006 | 20% | 6,000,000 | $12,497,745 |

| EVR | Ev Resources Ltd | 0.003 | 20% | 168,015 | $4,531,258 |

| A1G | African Gold Ltd. | 0.062 | 19% | 1,617,794 | $19,848,245 |

| PUA | Peak Minerals Ltd | 0.010 | 19% | 6,323,723 | $20,416,882 |

| BUY | Bounty Oil & Gas NL | 0.004 | 17% | 186,257 | $4,495,503 |

| GTR | Gti Energy Ltd | 0.004 | 17% | 377,953 | $8,888,849 |

| T3D | 333D Limited | 0.014 | 17% | 31,538 | $2,114,202 |

| AHF | Aust Dairy Limited | 0.078 | 16% | 6,807,521 | $49,802,562 |

| A11 | Atlantic Lithium | 0.325 | 16% | 289,620 | $194,081,248 |

| 5EA | 5Eadvanced | 0.087 | 16% | 1,040,007 | $25,269,083 |

| AGD | Austral Gold | 0.030 | 15% | 260,182 | $15,920,095 |

Astral Resources (ASX:AAR) has acquired a 19.99% stake in Maximus Resources (ASX:MXR) and proposed a 7 cents per share takeover offer. The offer gives Maximus shareholders a 165% premium on its 12-month low. Both companies are now in exclusive talks, with due diligence underway, but the deal is still subject to final approvals. If it goes ahead, it would create a larger company with 1.8Moz in mineral resources.

Proteomics International Laboratories (ASX:PIQ) said it has developed a blood test, PromarkerEndo, which can now diagnose all stages of endometriosis with high accuracy. Unlike the current method, which involves invasive surgery, this non-invasive test uses a panel of 10 protein biomarkers to identify the condition early – often before it causes severe damage. Endometriosis affects 1 in 9 women, and the PromarkerEndo is expected to launch in Q2 2025.

Australian Oil Company (ASX:AOK) has received $300k from Blue Sky Resources as part of the Tranche 3 payment under the revised settlement deal. The next payment of $1.2 million is due by 27 January, and will attract 9% interest on the deferred portion of the Tranche 3 payment. AOK also said it’s on track to connect its pipeline from Pacific Gas and Electric to its Rec Board wells in January, with plans to boost production. AOK is also exploring new gas assets in Australia and South-East Asia.

Austral Gold (ASX:AGD)’s subsidiary, Casposo, has signed a Toll Processing Agreement with Challenger Gold (ASX:CEL), following a deal announced earlier in December. Under the agreement, Casposo will process Challenger’s gold at its plant in Argentina, starting in the second half of 2025. The deal includes a US$3 million upfront payment, plus a monthly fee of US$110k and extra bonuses tied to gold recovery. To get the plant ready, Casposo has secured a US$7 million loan for refurbishments.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for December 30 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| X2M | X2M Connect Limited | 0.020 | -38% | 137,680 | $12,062,102 |

| MOM | Moab Minerals Ltd | 0.002 | -33% | 3,999 | $4,700,998 |

| MKL | Mighty Kingdom Ltd | 0.013 | -32% | 635,930 | $4,105,205 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 9,404,087 | $57,867,624 |

| DOU | Douugh Limited | 0.006 | -25% | 423,000 | $9,458,047 |

| PRX | Prodigy Gold NL | 0.002 | -25% | 3,537,717 | $6,350,111 |

| ECT | Env Clean Tech Ltd. | 0.002 | -20% | 20,441 | $7,929,526 |

| RMI | Resource Mining Corp | 0.005 | -17% | 1,410,732 | $3,914,087 |

| ADN | Andromeda Metals Ltd | 0.006 | -14% | 626,626 | $24,001,094 |

| CCO | The Calmer Co Int | 0.006 | -14% | 2,654,106 | $17,785,969 |

| MQR | Marquee Resource Ltd | 0.014 | -13% | 640,000 | $6,662,150 |

| PAB | Patrys Limited | 0.004 | -13% | 234,321 | $8,229,789 |

| RGL | Riversgold | 0.004 | -13% | 1,125,000 | $6,734,850 |

| CYM | Cyprium Metals Ltd | 0.024 | -11% | 149,722 | $46,215,268 |

| FOS | FOS Capital Ltd | 0.320 | -11% | 38,729 | $19,370,210 |

| ICE | Icetana Limited | 0.016 | -11% | 309,698 | $4,763,312 |

| LM1 | Leeuwin Metals Ltd | 0.125 | -11% | 14,218 | $6,559,234 |

| NGX | Ngxlimited | 0.170 | -11% | 31,581 | $17,216,250 |

| ASV | Assetvisonco | 0.018 | -10% | 1,361,660 | $14,787,231 |

| BCM | Brazilian Critical | 0.009 | -10% | 64,907 | $10,504,586 |

| CUF | Cufe Ltd | 0.009 | -10% | 166,666 | $13,366,749 |

| SPX | Spenda Limited | 0.009 | -10% | 619,500 | $46,152,155 |

IN CASE YOU MISSED IT

Challenger Gold (ASX:CEL) has finalised a previously announced binding MoU with Casposo, a subsidiary of Austral Gold, for a toll treatment agreement to process mineralised material from CEL’s Hualilan project at the Casposo Plant in San Juan, Argentina. Operations are expected to begin in the second half of 2025, with Challenger also completing a strategic placement of $6.6m to contribute to plant refurbishment and preparation for tolling operations.

Imricor Medical Systems (ASX:IMR) has expanded into the Middle East, receiving its first purchase order for capital equipment and consumables from Qatar. The company is partnering with East Agency WWL, the exclusive distributor of Imricor products in Qatar under a five-year agreement.

At Stockhead, we tell it like it is. While Challenger Gold and Imricor Medical Systems are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.