ASX Lunch Wrap: Shares on track for 10th straight gain, First Lithium soars, Megaport sinks 20pc

The ASX is on track to make its 10th straight gain. Pic via Getty Images

- The ASX is on track to make its 10th straight daily gain

- Earnings highlight includes Megaport, which fell 18pc weak guidance

- Last night, a slowing US jobs report boosted hopes of Fed rate cut

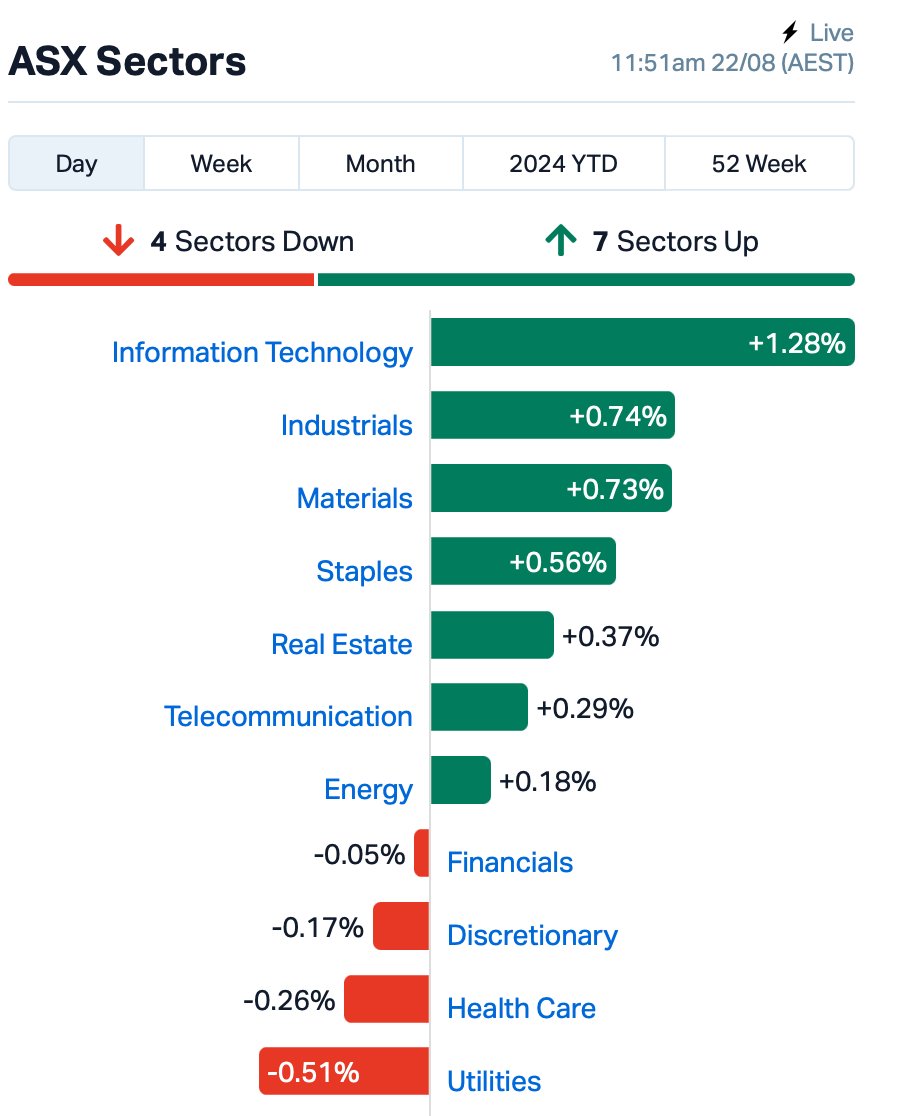

The ASX was up 0.25% at Thursday lunch, and is on track for its 10th consecutive day of gains, driven by a wave of earnings reports from local stocks.

The uptick follows Wall Street’s gains overnight, spurred by US jobs data that suggests the labour market is cooling and supports expectations for a Fed Reserve rate cut in September.

Additionally, the latest Fed meeting minutes, released overnight, indicate that a 25 basis point rate cut in September is all but locked in.

This morning, Tech was the best performer despite Megaport’s (ASX:MP1) downcast earnings report. See more below.

Lithium stocks also caught bids, along with gold stocks.

But it was another extremely busy day on the earnings front today.

Highlights include:

Megaport (ASX:MP1) sank by 21% after declaring a sluggish guidance for FY25.

The company projects FY25 revenue between $214 million and $222 million, with EBITDA ranging from $57 million to $65 million – lower than what the market had expected.

Sonic Healthcare (ASX:SHL) announced a final dividend of 63 cents, which is unfranked, compared to 62 cents, which was fully franked, from the previous year. The company’s full-year NPAT stood at $511.09 million. Revenue for the year increased by 9.8% to $8.97 billion.

Medibank Private (ASX:MPL) declared a final dividend of 9.4 cents, fully franked, up from 8.3 cents the previous year. The company reported a 59.6% increase in full-year NPAT, reaching $492.5 million.

Super Retail Group (ASX:SUL) announced a final dividend of 37 cents and a special dividend of 50 cents, both fully franked, compared to a 44-cent final dividend the previous year. The company’s full-year NPAT decreased by 8.7% to $240.1 million, while revenue increased by 2.1% to a record $3.88 billion.

Northern Star Resources (ASX:NST) declared a final dividend of 25 cents, up from 15.5 cents the previous year. The company’s full-year NPAT increased by 9.1% to $638.5 million, and revenue rose by 19.1% to $4.92 billion.

Whitehaven Coal (ASX:WHC) declared a final dividend of 13 cents fully franked, down from 42 cents the previous year. Its full year NPAT dropped by 87% to $355 million, and revenue fell by 37% to $3.82 billion.

Meanwhile, Synlait Milk (ASX:SM1) dropped 2% after confirming media speculation that it was reviewing its North Island assets in New Zealand, including milk collection and processing.

No decisions have been made, but there is speculation about selling raw milk to Open Country. An update is expected before September 30.

NOT THE ASX

Overnight, Wall Street rose after US employment data showed the labor market was slowing down, increasing expectations that the Fed Reserve will lower rates next month.

Traders also reviewed the minutes from the most recent Fed meeting.

The minutes revealed that some officials had seen a reasonable argument for lowering rates in July, but the central bank ultimately chose to keep rates unchanged with a unanimous vote.

“The Fed minutes removed all doubt about a September rate cut,” said Jamie Cox at Harris Financial.

Bret Kenwell at eToro added, “The question isn’t whether the Fed will cut rates in September, but rather, how much will the Fed cut?”

All eyes will now turn to Jerome Powell’s speech in Jackson Hole on Friday.

To stocks, Walt Disney rose 1% after appointing James Gorman, the former CEO of Morgan Stanley, to head the committee responsible for finding a successor to current CEO Bob Iger.

Zoom Video jumped 3% post-trading after providing a sales forecast for the current quarter that exceeded analysts’ expectations, driven by the company’s expansion of its product offerings.

Apple Inc’s shares saw little change as the head of the App Store left amid a company reorganisation of the profitable division, which has been under regulatory scrutiny for its influence in the mobile software market.

Ford Motor Co rose 1.5% after revising its electrification strategy once more, scrapping plans for a fully electric SUV in a move that could cost the company approximately US$1.9 billion.

And, Walmart Inc. increased by 1% after raising about US$3.6 billion from selling its stake in Chinese e-commerce company JD.com Inc.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 23 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap CNJ Conico Ltd 0.002 50% 706,834 $2,201,528 LSR Lodestar Minerals 0.002 50% 1,090,300 $2,600,780 FL1 First Lithium Ltd 0.130 37% 365,556 $7,567,092 A8G Australasian Metals 0.135 35% 226,754 $5,212,049 CDT Castle Minerals 0.004 33% 4,386,749 $3,983,479 MTL Mantle Minerals Ltd 0.002 33% 500,247 $9,296,169 SMM Somerset Minerals 0.004 33% 202,500 $3,092,996 IMI Infinitymining 0.025 25% 6,441 $2,375,068 ICG Inca Minerals Ltd 0.005 25% 935,023 $3,242,146 RDS Redstone Resources 0.005 25% 100,000 $3,701,514 LTP Ltr Pharma Limited 1.590 20% 1,464,098 $112,345,491 IRX Inhalerx Limited 0.024 20% 91,438 $3,795,339 PUR Pursuit Minerals 0.003 20% 167,648 $9,088,500 CNQ Clean Teq Water 0.285 19% 301,765 $17,338,153 DTM Dart Mining NL 0.019 19% 66,000 $4,134,926 HXL Hexima 0.020 18% 943,264 $2,839,674 LLI Loyal Lithium Ltd 0.140 17% 296,922 $11,127,968 GTR Gti Energy Ltd 0.004 17% 416,829 $7,649,841 TEG Triangle Energy Ltd 0.007 17% 1,586,509 $12,480,804 MKR Manuka Resources. 0.029 16% 1,772,999 $19,494,192 PBH Pointsbet Holdings 0.575 15% 2,512,762 $165,669,348 HPG Hipages Group 1.468 15% 264,071 $171,578,081 CHR Charger Metals 0.094 15% 1,502,210 $6,348,461 CRR Critical Resources 0.008 14% 4,967,432 $12,462,452 POS Poseidon Nick Ltd 0.004 14% 98,910 $12,997,372

First Lithium (ASX:FL1) rose 30% higher on Thursday morning after announcing the assay results for its recent drilling at the Blakala lithium prospect in Mali. The results from the Series Two drilling, which included RC pre-collars and diamond drill tails, show high-grade lithium levels. These results confirm the continuity and extension of the Main Pegmatite at depths between 60 to 100 metres, following earlier promising results. The drilling has revealed that the Main Pegmatite extends approximately 1,200 metres with consistent high-grade lithium, further supported by both surface sampling and previous drilling.

Australasian Metals (ASX:A8G) was also up 30%+ this morning after announcing promising results from its due diligence on the Dingo Hole Highly Pure Quartz (HPQ) Project. Sampling showed an average silica content of 99.95% SiO2 after preliminary acid leaching, aligning with historical data. The levels of aluminum, titanium, and lithium were extremely low. SRK Consulting estimates that the Exploration Target for Dingo Hole ranges from 10.4 million to 42.6 million tonnes, with silica grades between 99.37% and 99.85%. The next steps involve removing additional elements to reach higher purity levels, potentially up to 99.999%.

Castle Minerals (ASX:CDT) was another riser today after saying that it has completed a 1,106-metre, 9-hole RC drilling program at its Kpali Gold Project in Ghana. This drilling is the first phase of a larger campaign to explore the potential of a new gold camp in West Africa. Initial results from earlier drilling showed high-grade gold mineralisation, and the recent program included holes at both Kpali and the nearby Kpali East prospect.

The assay results from this drilling are expected by mid-September and will guide the next stages of exploration at Kpali and other nearby prospects. The project is located in a promising area known for major gold deposits.

hipages Group (ASX:HPG), which connects homeowners with tradespeople, saw a 13% increase in full year revenue, reaching $75.8 million. Recurring revenue grew by 15% to $72.1 million, while Monthly Recurring Revenue (MRR) and Average Revenue Per User (ARPU) both saw strong growth of 13% and 11%, respectively. EBITDA rose by 33% to $16.4 million, improving the margin to 22%.

Critical Resources (ASX:CRR) gained after reporting results from its recent stripping program at the Tot pegmatite within the Mavis Lake Lithium Project in Ontario. The program revealed high lithium grades, including up to 3.79% Li2O. The Tot pegmatite shows significant high-grade spodumene mineralization over a 50-metre strike length. This supports the company’s Exploration Target of 18–29 million tonnes at 0.8–1.2% Li2O. The company plans further exploration and is well-positioned to benefit from growing sector activity.

And Osteopore (ASX:OSX) has completed successful pre-clinical studies in collaboration with the University of Chile. This work is part of a project funded by a US$360k grant from the Government of Chile and the University of Chile, aimed at developing a new type of 3D-printed bone implant designed to accelerate bone regeneration. The studies have shown that the new implant materials are compatible with bone, and promote faster bone growth. Specifically, they increased cell adhesion and bone-mineralising activity significantly compared to baseline levels. Osteopore now plans to start clinical trials in the latter half of 2025.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 23 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| FAU | First Au Ltd | 0.001 | -50% | 200,000 | $3,623,987 |

| TAS | Tasman Resources Ltd | 0.004 | -30% | 1,050,000 | $4,026,248 |

| PRX | Prodigy Gold NL | 0.002 | -25% | 260,160 | $5,647,469 |

| IEC | Intra Energy Corp | 0.002 | -25% | 2,857,743 | $3,381,563 |

| MRQ | Mrg Metals Limited | 0.003 | -25% | 75,990 | $10,846,075 |

| AMD | Arrow Minerals | 0.002 | -20% | 31,913,784 | $26,348,413 |

| PKO | Peako Limited | 0.004 | -20% | 412,212 | $4,392,374 |

| TX3 | Trinex Minerals Ltd | 0.002 | -20% | 75,556 | $4,571,631 |

| MP1 | Megaport Limited | 9.440 | -20% | 3,146,465 | $1,880,514,585 |

| ASQ | Australian Silica | 0.024 | -17% | 40,956 | $8,173,951 |

| CMD | Cassius Mining Ltd | 0.005 | -17% | 1,500,500 | $3,252,027 |

| GTI | Gratifii | 0.005 | -17% | 166,666 | $10,536,286 |

| LML | Lincoln Minerals | 0.005 | -17% | 6,265 | $12,337,557 |

| WML | Woomera Mining Ltd | 0.003 | -17% | 1,001,000 | $4,554,417 |

| PLC | Premier1 Lithium Ltd | 0.011 | -15% | 6,166 | $2,269,463 |

| BGE | Bridgesaaslimited | 0.012 | -14% | 125,000 | $1,718,225 |

| BPP | Babylon Pump | 0.006 | -14% | 1,379,571 | $17,496,843 |

| IXR | Ionic Rare Earths | 0.006 | -14% | 887,065 | $34,088,339 |

| HMY | Harmoney Corp Ltd | 0.455 | -14% | 40,971 | $54,040,998 |

| BRI | Big Riv Indust Ltd | 1.490 | -14% | 279,979 | $147,677,596 |

| TAT | Tartana Minerals Ltd | 0.025 | -14% | 3,000 | $5,296,731 |

| CSX | Cleanspace Holdings | 0.365 | -13% | 28,324 | $32,498,967 |

| UNT | Unith Ltd | 0.020 | -13% | 3,941,547 | $28,234,894 |

ICYMI – AM EDITION

Bioxyne has achieved an Australian first with the successful manufacturing and delivery of the country’s first pharmaceutical cannabis pastilles (gummies) under its Goods Manufacturing Practice certification.

The company is one step closer to kicking off maiden diamond drilling at the Andover South lithium project with heritage approvals in place and the State Deed for E47/4062 executed.

D3 Energy’s multi-well production testing program at ER315 in South Africa, has yielded an average flow rate of 199 Mscfd over a 6.9 day period at RBD10, mirroring the success seen at RBD03. Total gas produced during this testing period was 1,367 Mscfd.

In May, the company announced that the helium and methane composition at RBD10 was measured at 5% helium and 85% methane. Once testing is completed at RBD10 D3E will begin drilling RBD12.

The company has announced plans to raise up to $2.19m via a placement at $0.006875 to raise around $361,014, plus a non-renounceable entitlement offer to issue one new share for every one share held to raise approximately $1,826,381.

The funds will progress exploration at its flagship Rathdowney Trend base and critical metals project – and to pursue the acquisition of complimentary natural resource projects.

Strategic Energy Resources (ASX:SER)

SER has wrapped up a gravity survey at its Canobie Farm-In and Joint Venture with Fortescue (ASX:FMG) subsidiary FMG Resources in QLD.

The companies have collected 3,225 new gravity measurements – a crucial dataset in the search for Iron Oxide Copper-Gold (IOCG) deposits the company says.

“The ongoing investment by Fortescue in baseline datasets at Canobie demonstrates their willingness to explore the Canobie project in a systematic manner in search of a Tier-1 discovery undercover,” managing director Dr David DeTata noted.

Charger says the first assays results from the current RC drill program have confirmed a new discovery at the Medcalf West prospect at its Lake Johnston lithium project in WA.

The first two drill holes intersected spodumene-bearing pegmatites including 18m at 1.46% Li2O.

So far, preliminary modelling of the ~1.2km long trend at Medcalf West suggests 3 main spodumene-bearing pegmatites within a mineralised zone up to 35m thick, with further assays pending.

At Stockhead, we tell it like it is. While Bioxyne, Raiden Resources, D3 Energy, Zinc of Ireland, Strategic Energy Resources and Charger Metals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.