ASX Lunch Wrap: Jumbo, Inghams, Accent sink, ending ASX winning streak

Key sectors are struggling on Friday, with declines in gold and energy stocks. Pic via Getty Images

- ASX down 0.3pc at lunch, on track to end a 10-day winning streak

- Key sectors are struggling, with declines in gold and energy stocks

- Jumbo Interactive and Inghams Group both saw sharp drops

Australian shares are expected to end their 10-day winning streak today, with the benchmark ASX 200 index down 0.3% at lunchtime.

The fall follows a negative session on Wall Street where the Nasdaq fell by 1.7%.

Investors are combing through a thick pile of ASX earning reports this morning for insights into the sharemarket’s likely direction for the remainder of 2024.

See highlights below.

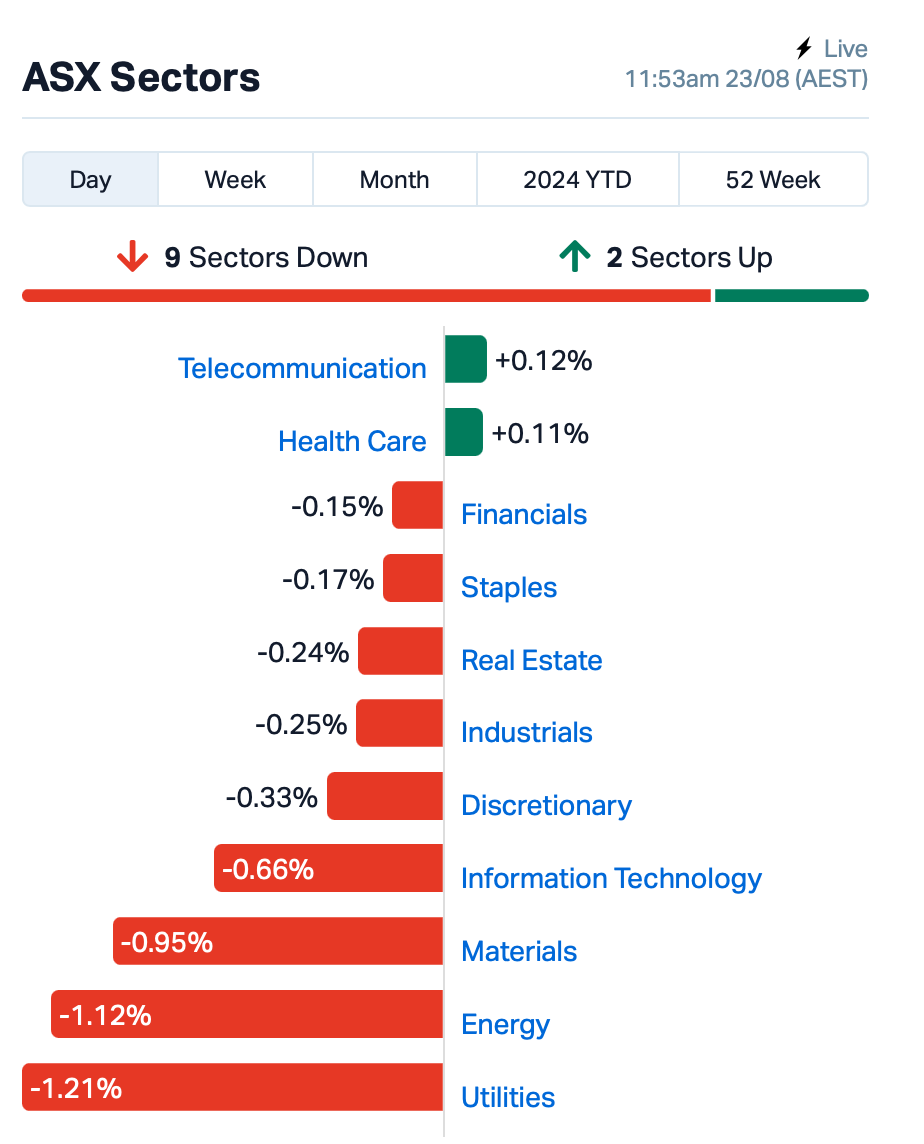

Nine out of 11 sectors were flashing red, with Utilities and Energy the worst performers.

Gold stocks were also sold off after bullion prices came down below the psychological US$2,500 an ounce level.

Meanwhile, Energy was dragged down by coal and oil-related stocks.

This is despite crude prices rebounding overnight, driven by developments from a severe attack on a crude tanker in the Red Sea.

The attack, which resulted in the evacuation of the crew and left 150,000 tonnes of crude onboard, is now viewed as a potential environmental hazard. No group has claimed responsibility for the attack.

Also in the news this morning, the Albanese government has placed the CFMEU’s construction division into administration, removing hundreds of officials nationwide.

The CFMEU, or Construction, Forestry, Maritime, Mining and Energy Union, is one of Australia’s largest trade unions.

This decision, announced by Attorney-General Mark Dreyfus, follows allegations of criminal infiltration within the union.

Today’s earnings season highlights

Lotto operator Jumbo Interactive (ASX:JIN) sank 10% despite record full-year results.

Total transaction value surged by 23.7% to $1.054 billion, which is a record, while revenue increased by 34.2% to $159.3 million. Underlying EBITDA rose 30% to $76.6 million, and underlying NPATA grew by 31.5% to $46.4 million.

Despite these strong results, Jumbo’s stock price reaction could be attributed to investor concerns about future growth amid a recent increase in the service fee paid to The Lottery Corporation and higher operating costs.

Poultry group Inghams Group (ASX:ING) also took a dive, down 18% after it announced that it expects underlying EBITDA for FY25 to remain flat, with a forecast range of $236 million to $250 million.

This is despite NPAT for FY24 rising to $101.5 million, an increase of 68%. Revenue also grew by 7.2%, reaching $3.26 billion. The company declared a final dividend of 8 cents per share, fully franked, down from 10 cents the previous year.

Telix Pharmaceuticals’ (ASX:TLX) shares posted a 6% gain after reporting impressive interim results, with NPAT of $29.65 million compared to a net loss of $14.32 million last year.

Revenue increased by 65% to $363.96 million, largely driven by sales of Illuccix, its cancer imaging product, in the US.

Telix has reaffirmed its full-year 2024 revenue guidance, which is projected to be between US$490 million and US$510 million.

Shoes retailer Accent Group (ASX:AX1) was also down 12% after reporting a 32.9% decline in full year NPAT, down to $59.53 million, despite a 2.4% increase in revenue to $1.45 billion.

Final dividend for the year has been set at 4.5 cents per share, fully franked, down from 5.5 cents last year.

NOT THE ASX

Overnight, Wall Street fell, driven mostly by the tech-heavy Nasdaq after a couple of Fed policymakers said any rate cuts would be “gradual” and “methodical”.

Philadelphia Fed President Patrick Harker told CNBC, “In September we need to start a process of moving rates down. We need to start bringing them down methodically.”

Kansas City Fed president Jeffrey Schmid said he wasn’t fully ready to support a cut. “It makes sense for me to really look at some of the data that comes in the next few weeks,” he told Bloomberg.

Treasury yields fell across curve, with the largest decline occurring in shorter-term maturities, indicating that traders are pricing in imminent rate cuts.

“It is problematic in my mind that the market is pricing in so many rate cuts right now,” said Mohamed El-Erian at Queens’s College Cambridge.

All eyes are now on the Fed’s Jackson Hole symposium, which began last night. Investors are eagerly awaiting any change in tone from the central bank, particularly when Jerome Powell speaks at the event on Friday.

To stocks, Tesla tumbled almost 6% on no specific news, leading all seven of the “Magnificent Seven” stocks lower.

Nvidia fell nearly 4% while Amazon and Microsoft were both off more than 2%.

Peloton, the fitness equipment maker, jumped 35% as the company posted a revenue beat for Q4.

And Uber says it plans to introduce self-driving Cruise LLC vehicles to its ride-hailing platform next year

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 23 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price Franking (%) Ex Dividend Date Pay Date AOV Amotiv 22 100 23/08/2024 12/09/2024 ALD Ampol 60 100 30/08/2024 26/09/2024 ARB ARB Corporation 35 100 03/10/2024 18/10/2024 AUB AUB Group 59 100 06/09/2024 27/09/2024 AUI Aust. United Investment 28 100 26/08/2024 17/09/2024 BAP Bapcor 5.5 100 29/08/2024 19/09/2024 BPT Beach Energy 2 100 29/08/2024 30/09/2024 BFG Bell Financial Group 4 100 28/08/2024 10/09/2024 BWF Blackwall 2.5 100 20/09/2024 11/10/2024 BSL BlueScope Steel 30 100 10/09/2024 15/10/2024 BRG Breville Group 17 100 12/09/2024 04/10/2024 CDM Cadence Capital 3 100 15/10/2024 31/10/2024 CIN Carlton Investments 63 100 30/08/2024 16/09/2024 CWP Cedar Woods Properties 17 100 25/09/2024 25/10/2024 CGF Challenger 13.5 100 26/08/2024 18/09/2024 CWY Cleanaway Waste 2.6 100 13/09/2024 07/10/2024 CDA Codan 12 100 03/09/2024 18/09/2024 CCG Comms Group 0.3 100 27/09/2024 16/10/2024 CRN Coronado Global 0.5 100 27/08/2024 18/09/2024 CYG Coventry Group 3.8 100 27/09/2024 11/10/2024 CCP Credit Corp Group 23 100 16/09/2024 27/09/2024 DTL Data3 12.9 100 13/09/2024 30/09/2024 DRR Deterra Royalties 14.4 100 27/08/2024 24/09/2024 APE Eagers Automotive 24 100 10/09/2024 20/09/2024 EGG Enero Group 2 100 19/09/2024 03/10/2024 EVN Evolution Mining 5 100 29/08/2024 04/10/2024 FID Fiducian Group 21.1 100 28/08/2024 12/09/2024 GEM G8 Education 2 100 06/09/2024 30/09/2024 HLI Helia Group 15 100 04/09/2024 19/09/2024 HIT HiTech Group 5 100 30/08/2024 12/09/2024 HUB HUB24 19.5 100 09/09/2024 11/10/2024 HUM Humm Group 1.3 100 27/08/2024 03/10/2024 ILU Iluka Resources 4 100 03/09/2024 27/09/2024 IMD Imdex 1.3 100 25/09/2024 10/10/2024 IRI Integrated Research 2 100 02/09/2024 15/10/2024 LIC Lifestyle Communities 5 100 04/09/2024 03/10/2024 LYL Lycopodium 40 100 19/09/2024 04/10/2024 LGL Lynch Group Holdings 8 100 03/09/2024 18/09/2024 MAF MA Financial Group 6 100 27/08/2024 18/09/2024 MGH MAAS Group Holdings 3.5 100 17/09/2024 02/10/2024 MAH Macmahon Holdings 0.6 100 19/09/2024 11/10/2024 MAD Mader Group 4 100 19/09/2024 04/10/2024 MPL Medibank Private 9.4 100 04/09/2024 26/09/2024 MFF MFF Capital Investments 7 100 08/10/2024 01/11/2024 MND Monadelphous 33 100 05/09/2024 27/09/2024 NWL Netwealth Group 14 100 26/08/2024 26/09/2024 NCK Nick Scali 33 100 25/09/2024 17/10/2024 NWH NRW Holdings 9 100 19/09/2024 09/10/2024 OCL Objective Corp 8 100 04/09/2024 16/09/2024 OML Oohmedia 1.8 100 28/08/2024 23/09/2024 ORG Origin Energy 27.5 100 05/09/2024 27/09/2024 PWR Peter Warren Automotive 6 100 03/09/2024 02/10/2024 PME Pro Medicus 22 100 04/09/2024 26/09/2024 PWH PWR Holdings 9.2 100 12/09/2024 20/09/2024 QAL Qualitas 5.8 100 11/09/2024 03/10/2024 QUB Qube Holdings 5.2 100 16/09/2024 15/10/2024 REA REA Group 102 100 29/08/2024 13/09/2024 RDX Redox 6.5 100 27/08/2024 20/09/2024 REH Reece 17.8 100 08/10/2024 23/10/2024 RIC Ridley Corp 4.7 100 07/10/2024 24/10/2024 SFC Schaffer Corporation 45 100 05/09/2024 20/09/2024 SEK SEEK 16 100 04/09/2024 03/10/2024 SSM Service Stream 2.5 100 18/09/2024 04/10/2024 SGM Sims 10 100 01/10/2024 16/10/2024 SKS SKS Technologies 1 100 13/09/2024 14/10/2024 SVR Solvar 5 100 03/09/2024 11/10/2024 SXE Southern Cross 5 100 24/09/2024 09/10/2024 SRG SRG Global 2.5 100 23/08/2024 26/09/2024 S66 Star Combo Pharma 0.4 100 14/10/2024 31/10/2024 STP Step One Clothing 2.8 100 26/08/2024 13/09/2024 SUL Super Retail Group 37 100 09/09/2024 17/10/2024 SUL Super Retail Group 50 100 09/09/2024 17/10/2024 SNL Supply Network 33 100 18/09/2024 03/10/2024 TLS Telstra 9 100 28/08/2024 26/09/2024 TLC The Lottery Corporation 10.5 100 28/08/2024 25/09/2024 WQG WCM Global Growth 1.8 100 12/09/2024 30/09/2024 WHC Whitehaven Coal 13 100 04/09/2024 17/09/2024 WTC Wisetech Global 9.2 100 06/09/2024 04/10/2024 XRF XRF Scientific 3.9 100 12/09/2024 27/09/2024 EBO EBOS Group 49.7 95 29/08/2024 18/09/2024 COH Cochlear 210 80 17/09/2024 10/10/2024 VNT Ventia Services Group 9.4 80 29/08/2024 07/10/2024 PNI Pinnacle Investment 26.4 71 02/09/2024 20/09/2024 HMC HMC Capital 6 70 27/08/2024 02/10/2024 TWE Treasury Wine Estates 19 70 28/08/2024 01/10/2024 AZJ Aurizon Holdings 7.3 60 26/08/2024 25/09/2024 CAR CAR Group 38.5 50 13/09/2024 14/10/2024 IAG Insurance Aust. Grp. 17 50 29/08/2024 26/09/2024 HSN Hansen Technologies 5 42 26/08/2024 20/09/2024 BXB Brambles 28.9 35 11/09/2024 10/10/2024 LLC LendLease 9.5 33 23/08/2024 18/09/2024 IPH IPH 19 30 27/08/2024 20/09/2024 PRN Perenti 4 6 08/10/2024 23/10/2024 AGL AGL Energy 35 0 27/08/2024 24/09/2024 AMC Amcor 19 0 05/09/2024 26/09/2024 ANN Ansell 32.8 0 26/08/2024 12/09/2024 AIA Auckland Airport 6 0 18/09/2024 04/10/2024 CEN Contact Energy 20.6 0 27/08/2024 27/09/2024 CTD Corporate Travel 12 0 29/08/2024 04/10/2024 CTE Cryosite 2 0 06/09/2024 10/10/2024 CSL CSL 220.3 0 09/09/2024 02/10/2024 DMP Domino's Pizza 50.4 0 26/08/2024 25/09/2024 INA Ingenia Communities 6.1 0 23/08/2024 19/09/2024 MCY Mercury NZ 12.7 0 11/09/2024 30/09/2024 NEM Newmont 26.5 0 04/09/2024 30/09/2024 NWS News Corporation 10.7 0 10/09/2024 09/10/2024 NST Northern Star 25 0 03/09/2024 26/09/2024 ORA Orora 5 0 30/08/2024 08/10/2024 RWC Reliance Worldwide 3.8 0 05/09/2024 04/10/2024 STO Santos 19.4 0 26/08/2024 25/09/2024 SKT Sky Network TV 10.9 0 05/09/2024 20/09/2024 SHL Sonic Healthcare 63 0 04/09/2024 19/09/2024 VCX Vicinity Centres 5.9 0 23/08/2024 16/09/2024

Bioxyne (ASX:BXN) was still riding high from its recent announcement. On Tuesday, the company said it has achieved an Australian first with the successful manufacturing and delivery of the country’s first pharmaceutical cannabis pastilles (gummies) under its Goods Manufacturing Practice certification.

Elixir Energy (ASX:EXR) announced that the Daydream-2 well in Queensland’s Taroom Trough has successfully flowed gas from the deepest coal seams yet recorded in Australia. This marks the first gas flow from these deep coals in the region and achieves a key goal for the project. The gas flow occurred naturally through a full well-bore of water, and Elixir will now work with independent certifiers to begin converting prospective resources into contingent resources. The next phase involves removing plugs from the well’s six stimulated zones and conducting a comprehensive flow test.

Buxton Resources (ASX:BUX) provided an update on its Graphite Bull and Narryer Projects. Core drilling at Graphite Bull has been completed, totalling 1,221.5 metres across two holes. Reverse Circulation (RC) drilling is ongoing. All holes intersected graphite, with one notable intersection of 68 metres at over 10% visually estimated Total Graphitic Carbon (TGC). Product qualification with BTR in China has begun, and RC drilling will soon start at the Narryer Project. Recent drilling aims to support a significant Mineral Resource Estimate by Q4 2024.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 23 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| VPR | Volt Group | 0.001 | -50% | 1,200,494 | $21,432,416 |

| PNX | PNX Metals Limited | 0.003 | -33% | 5,547,523 | $26,865,966 |

| ECT | Env Clean Tech Ltd. | 0.002 | -33% | 25,926 | $9,515,431 |

| ME1 | Melodiol Glb Health | 0.001 | -33% | 5 | $1,387,229 |

| MEL | Metgasco Ltd | 0.003 | -25% | 100,250 | $5,790,347 |

| MRQ | Mrg Metals Limited | 0.003 | -25% | 7,045,343 | $10,846,075 |

| ING | Inghams Group | 3.070 | -21% | 9,092,771 | $1,438,400,056 |

| ICG | Inca Minerals Ltd | 0.004 | -20% | 2,460,137 | $4,052,682 |

| MVL | Marvel Gold Limited | 0.008 | -20% | 4,429 | $8,637,907 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 227,239 | $5,294,436 |

| MCM | Mc Mining Ltd | 0.037 | -18% | 989,122 | $18,630,601 |

| ROG | Red Sky Energy. | 0.005 | -17% | 2,650,000 | $32,533,363 |

| GTR | Gti Energy Ltd | 0.003 | -14% | 200,000 | $8,924,815 |

| AX1 | Accent Group Ltd | 2.080 | -14% | 1,727,066 | $1,362,588,734 |

| ASE | Astute Metals NL | 0.031 | -14% | 412,000 | $15,265,085 |

| PLY | Playside Studios | 0.565 | -13% | 2,088,766 | $265,224,642 |

| CUL | Cullen Resources | 0.007 | -13% | 1,680,476 | $4,561,386 |

| NAG | Nagambie Resources | 0.014 | -13% | 846,588 | $12,746,171 |

| SP8 | Streamplay Studio | 0.007 | -13% | 550,000 | $9,204,990 |

| WSR | Westar Resources | 0.007 | -13% | 190 | $3,189,799 |

| LGM | Legacy Minerals | 0.210 | -13% | 133,371 | $25,309,199 |

| JIN | Jumbo Interactive | 14.010 | -12% | 341,238 | $1,006,863,597 |

| ELS | Elsight Ltd | 0.300 | -12% | 48,405 | $51,457,922 |

PNX Metals (ASX: PNX) is set to be acquired by Patronus Resources (ASX:PTN) through a scheme of arrangement. Shareholders will vote on this proposal at a meeting scheduled on 27 August.

Inca Minerals (ASX:ICG) has identified new targets across its projects after reviewing geophysical data from the past three years. A review of historical drill results from the MaCauley Creek Project has identified a promising central area, with strong silicification and copper occurrences. Recent fieldwork has assessed access for potential drilling.

Playside Studios (ASX:PLY) reported record revenue of $64.6 million for the year, up 68%, with increases in original IP and work-for-hire revenues. The company achieved an EBITDA of $17.5 million and a net profit of $11.3 million. During the year, Playside secured a Game of Thrones license with Warner Bros., a publishing deal for the shooter MOUSE, and launched Dumb Ways to Survive on Netflix Games. The twin-stick shooter Kill Knight is set for an October release, and its Meta Horizon Worlds contract is extended through December 2025. Playside will provide its FY25 guidance in October.

Bowen Coking Coal (ASX: BCB) has announced the resignation of Mr David Conry AM as a non-executive director. Conry, who joined the board in June 2023, has been instrumental in supporting the company’s transformation plan. Conry stated that his resignation was due to his need to focus on other significant business commitments and new ventures.

ICYMI – AM EDITION

American West Metals’ (ASX:AW1) deep diamond drilling has confirmed the large lateral extent of the Storm copper system with the red metal now intersected in all holes drilled to date over a 10km2 area.

Pan Asia Metals (ASX:PAM) expects to start an inverse polarisation survey to map and detect Manto-style copper mineralisation within its Rosario project in Chile on or about September 23, 2024.

The company has engaged Quantec Geoscience to carry out the survey of 19 IP lines totalling ~27km to assist with drill targeting, delineation and structural control identification.

“We are excited to be conducting the first ever geophysical survey at Rosario and look forward to seeing what’s below, given the high-grade rock chip and channel samples and Rosario’s proximity to the famous El Salvador mine 10km to the south, which has been in operation since 1959,” managing director Paul Lock said.

“The IP program will be closely followed by an inaugural drill program.”

At Stockhead, we tell it like it is. While Bioxyne, American West Metals and Pan Asia Metals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.