ASX Lunch Wrap: Banks lead ASX sell-off as investors cash out on ‘Trump trades’

The ASX was down by 1pc this morning. Picture via Getty Images

- Bank stocks, including CBA, see losses this morning

- Gold falls below US$2,600, hurting gold stocks; lithium drops on weak prices

- Trump trades run out of steam, while Nvidia hits record highs

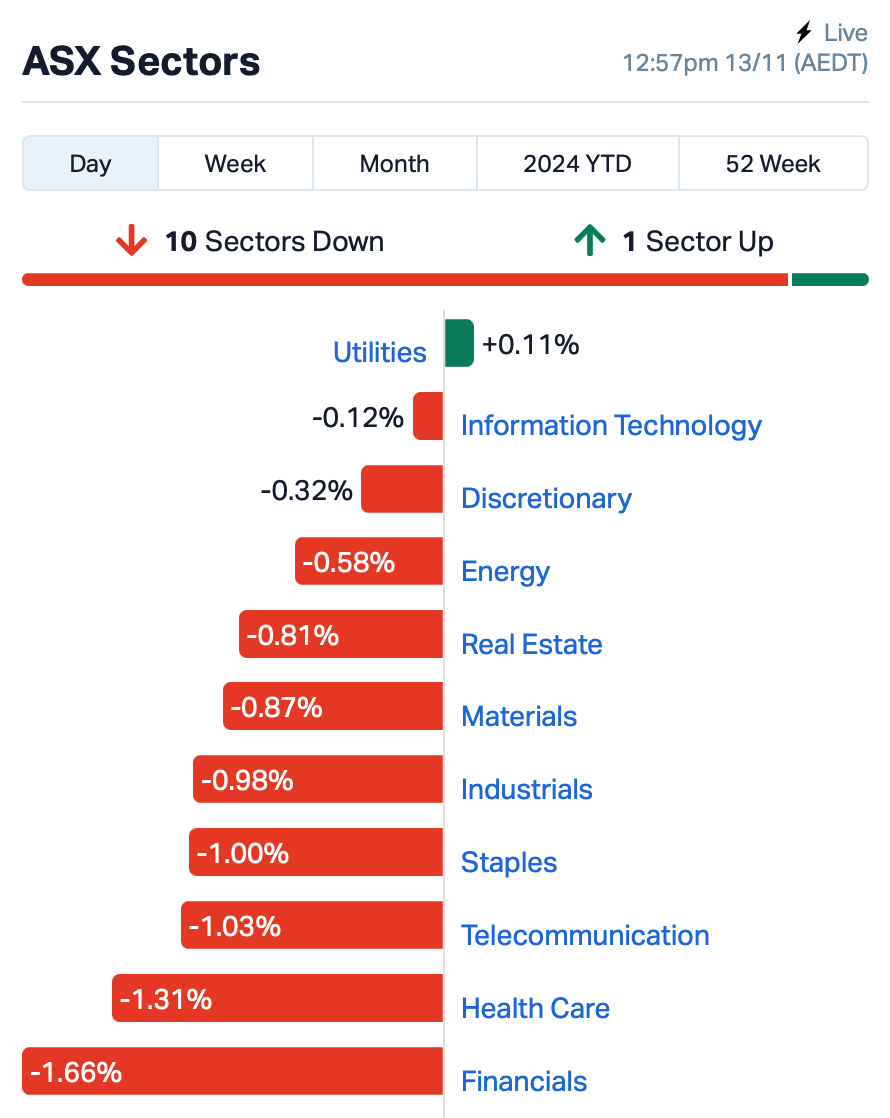

The Aussie market is facing another tough day today, with losses across the board as several big name stocks saw significant losses this morning.

At 12.45pm AEST, the S&P ASX 200 index was down by over 1%.

There was a sell-off in Australian bank stocks, triggered by Commonwealth Bank (ASX:CBA), which fell 1.5% following the release of its Q1 results for FY25.

While the CBA reported a a 3.5% rise in operating income, it also reported a 3% increase in expenses due to higher wages. The $2.5 billion profit was in line with market expectations, but loan impairments rose slightly.

Australia and New Zealand Banking Group (ASX:ANZ) shares were also down 4% after it went ex-dividend.

Gold continues to slide, weighing on gold stocks as it dropped below $US2,600 an ounce, while Bitcoin is trading near US$88,000.

Lithium stock Mineral Resources (ASX:MIN) tumbled by 5% after announcing it will halt operations at its Bald Hill site in Western Australia due to weak lithium prices. About 300 workers will be redeployed or offered redundancy.

Meanwhile, on the economic front, Australia’s wages grew by 0.8% in the September quarter, but annual wage growth has slowed to 3.5%, the lowest it’s been since mid-2023 – according to ABS data today.

NOT THE ASX

Overnight, US stocks fell for the first time since the US election a week ago, with investors taking some profits off the table ahead of US inflation data.

The S&P 500 lost 0.2%, with Trump-trade stocks, like Tesla and Trump Media, among the biggest losers.

Meanwhile, Nvidia rose 2% and back to record levels as traders position for a potential rally next week in anticipation it may report far better than expected quarterly profits.

“Also, keep an eye on Bitcoin,” said Jessica Amir at moomoo Australia.

“There’s speculation it could push through US$100,000, with Trump expected to make the cryptocurrency a US government strategic reserve asset, similar to gold.

“We could witness history today if Bitcoin rises above US$90,000.”

However, Amir warned that one of the well-known signs of a bubble market is an almost exponential rise in prices.

“Both Bitcoin and Tesla are now arguably displaying this characteristic,” she said.

“This chaotic price action in shares and cryptocurrencies is usually interpreted as a sign of instability, and potentially fragility, in markets.”

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for November 13 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RIE | Riedel Resources Ltd | 0.002 | 100% | 529,838 | $2,223,836 |

| SWF | Selfwealth | 0.210 | 75% | 7,032,321 | $27,687,805 |

| CDE | Codeifai Limited | 0.002 | 50% | 2,749,999 | $2,641,295 |

| AAU | Antilles Gold Ltd | 0.004 | 33% | 351,982 | $5,567,228 |

| APS | Allup Silica Ltd | 0.046 | 28% | 61,737 | $3,375,420 |

| NSX | NSX Limited | 0.029 | 26% | 159,911 | $10,528,962 |

| BMG | BMG Resources Ltd | 0.015 | 25% | 28,360,002 | $8,205,566 |

| AU1 | The Agency Group Aus | 0.025 | 25% | 113,993 | $8,571,532 |

| AVE | Avecho Biotech Ltd | 0.003 | 25% | 677,638 | $6,338,594 |

| DOU | Douugh Limited | 0.020 | 25% | 58,953,563 | $17,313,103 |

| PRX | Prodigy Gold NL | 0.003 | 25% | 2,644 | $6,350,111 |

| FFG | Fatfish Group | 0.016 | 23% | 36,872,835 | $18,285,449 |

| G50 | G50Corp Ltd | 0.180 | 20% | 95,496 | $18,384,000 |

| BLZ | Blaze Minerals Ltd | 0.006 | 20% | 250,000 | $3,142,791 |

| EPM | Eclipse Metals | 0.006 | 20% | 1,075,000 | $11,264,278 |

| TSO | Tesoro Gold Ltd | 0.024 | 20% | 2,341,106 | $31,068,281 |

| BXN | Bioxyne Ltd | 0.013 | 18% | 672,857 | $22,541,516 |

| MXO | Motio Ltd | 0.026 | 18% | 283,000 | $6,013,028 |

| ALM | Alma Metals Ltd | 0.007 | 17% | 713,857 | $9,399,133 |

| ALY | Alchemy Resource Ltd | 0.007 | 17% | 150,000 | $7,068,458 |

| CUF | Cufe Ltd | 0.007 | 17% | 2,503,254 | $8,020,049 |

| DTR | Dateline Resources | 0.004 | 17% | 632,775 | $7,548,781 |

| ID8 | Identitii Limited | 0.028 | 17% | 3,171,411 | $15,614,581 |

BMG Resources (ASX:BMG) is set to begin drilling at its 100%-owned Abercromby Gold Project later this month.

The drilling aims to expand high-grade gold zones and upgrade inferred resources. With a maiden resource of 518,000 ounces at 1.45 g/t Au, BMG is confident further drilling will grow this resource. Metallurgical tests show high gold recoveries of 93-95%. Additional drilling is planned to explore new targets and extend the resource, potentially adding significant value to the project.

Dateline Resources (ASX:DTR) is advancing studies on repurposing waste and tailings from its Colosseum Gold Mine in southern Nevada for use in construction materials.

The scoping study for the mine, released in October, highlighted the potential to produce aggregate and asphalt from waste rock, addressing a projected shortage of construction materials in the region, driven by projects such as the South Las Vegas construction boom and the Southern Nevada International Airport.

Laboratory tests have confirmed that the waste rock from the mine meets standards for concrete aggregate production, with all major rock types passing Alkali Silica Reactivity (ASR) tests for use in concrete and asphalt. There is also interest from potential buyers looking to acquire the mine’s tailings for use as sand in concrete production.

The ongoing definitive feasibility study will assess gold recovery and explore the potential to sell these materials as a cost-offset for the project.

Allup Silica (ASX:APS) had a nice lift this morning after announcing that managing director Simon Finnis will be speaking at the Noosa Mining Conference, held from November 13-15, at Peppers Noosa Resort in Queensland. Finnis’ presentation will take place on Wednesday, November 13, at 4:15 pm AEST.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for November 13 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ATH | Alterity Therap Ltd | 0.003 | -25% | 936,390 | $21,281,344 |

| EVR | Ev Resources Ltd | 0.003 | -25% | 37,287 | $5,585,086 |

| GMN | Gold Mountain Ltd | 0.002 | -25% | 911,353 | $7,814,946 |

| BNL | Blue Star Helium Ltd | 0.004 | -20% | 416,265 | $13,474,426 |

| RIL | Redivium Limited | 0.004 | -20% | 16,605 | $13,734,274 |

| ADO | Anteotech Ltd | 0.022 | -19% | 5,739,564 | $67,223,790 |

| RFT | Rectifier Technolog | 0.009 | -18% | 422,986 | $15,201,823 |

| NXL | Nuix Limited | 6.240 | -18% | 2,707,094 | $2,491,040,649 |

| OVT | Ovanti Limited | 0.034 | -17% | 155,023,169 | $83,235,969 |

| NME | Nex Metals Explorat | 0.030 | -17% | 129,623 | $9,802,006 |

| ICG | Inca Minerals Ltd | 0.005 | -17% | 1,083,562 | $6,160,335 |

| MPK | Many Peaks Minerals | 0.185 | -16% | 552,665 | $17,927,291 |

| BCC | Beam Communications | 0.064 | -16% | 52,560 | $6,568,066 |

| DGR | DGR Global Ltd | 0.011 | -15% | 1,999,561 | $13,568,048 |

| MNC | Merino and Co | 0.610 | -15% | 183,347 | $38,215,130 |

| JAV | Javelin Minerals Ltd | 0.003 | -14% | 27,628,441 | $18,162,887 |

| M2R | Miramar | 0.006 | -14% | 350,000 | $2,777,763 |

| NVU | Nanoveu Limited | 0.048 | -14% | 11,732,454 | $28,275,671 |

| XPN | Xpon Technologies | 0.012 | -14% | 523,019 | $5,074,181 |

| 1AI | Algorae Pharma | 0.007 | -13% | 307,383 | $13,499,158 |

| CMD | Cassius Mining Ltd | 0.007 | -13% | 1,430,400 | $4,336,036 |

| CRR | Critical Resources | 0.007 | -13% | 635,714 | $15,709,469 |

| RLG | Roolife Group Ltd | 0.004 | -13% | 35,000 | $4,707,985 |

| RNX | Renegade Exploration | 0.007 | -13% | 1,522,408 | $10,272,027 |

| TYX | Tyranna Res Ltd | 0.004 | -13% | 12 | $13,151,701 |

Nuix (ASX:NXL) crashed by 18% this morning following an update released at its annual general meeting, where CEO Jonathan Rubinsztein discussed the company’s targets for FY25.

Rubinsztein said Nuix is aiming for around 15% growth in annual contract value (ACV), and positive underlying cash flow for the year. While the company is still targeting these goals, Rubinsztein acknowledged that the first half of FY25 is likely to fall short of these expectations.

This raised concerns among investors that Nuix may not meet its targets for the full year, even though Rubinsztein reassured that growth is expected to be weighted towards the second half of the fiscal year.

IN CASE YOU MISSED IT

Sovereign Metals (ASX:SVM) has wrapped up test mining of the pilot phase at its Kasiya rutile-graphite project in Malawi.

Trials showed the soft, friable Kasiya orebody is suitable for mining using different methods. The pilot phase continues under the oversight of the Sovereign-Rio Tinto Technical Committee, as SVM aims to optimise operations at its Tier 1 project, which boasts the world’s largest natural rutile deposit.

GTI Energy (ASX:GTR) is on track to deliver a mineral resource estimate and exploration target for its Lo Herma uranium project in Wyoming by the end of the year.

The company will then decide whether to proceed with an interim scoping study for the project. GTI is also busy expanding its claim area at Lo Herma, possibly adding another 1.6kms via a staking program. It’s aiming to finish drilling in December, with the construction of three hydrogeologic and water-monitoring wells.

Meanwhile, preparations for flow testing the Welchau-1 discovery well in Upper Austria are progressing for ADX Energy (ASX:ADX), which holds a 75% economic interest in the Welchau Investment Area.

The workover rig and other surface testing equipment are already on site, while it’s also working on the rig up of flow testing facilities, the test separator, necessary permits, and production storage tanks. Flow testing of the Steinalm formation is expected to begin about a week after well perforation, once the testing facilities are fully set up and tested.

At Stockhead we tell it like it is. While Sovereign Metals, GTI Energy, and ADX Energy are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should really consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.