ASX Lunch Wrap: ASX takes another big hit as Bitcoin trades below US$97k

The ASX took another big hit on Friday morning. Picture via Getty Images

- ASX falls further as Fed’s cautious outlook weighs

- Bitcoin drops below US$97k, gold miners also hit

- Wesfarmers sells Coregas for $770 million, shares slide

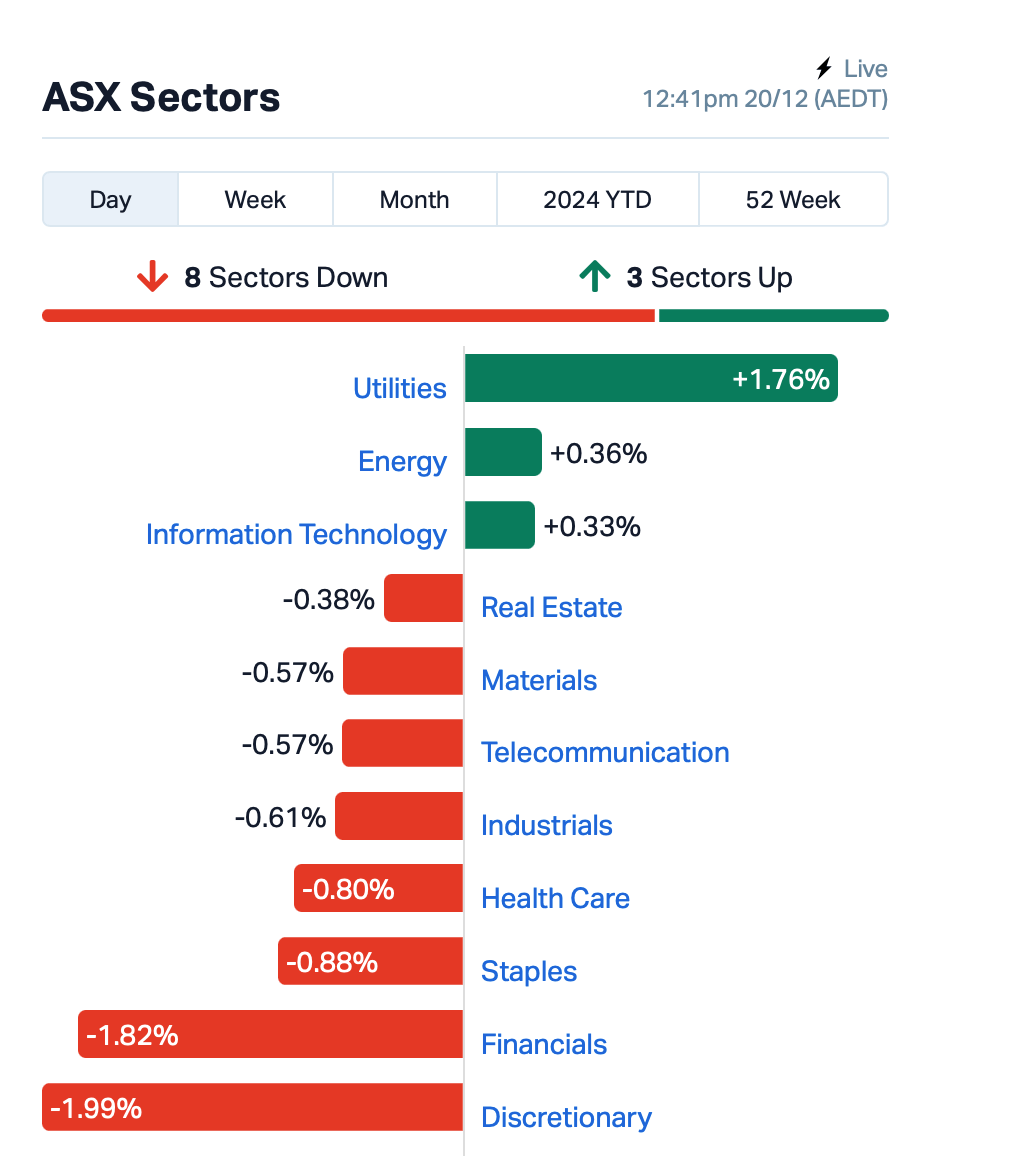

The ASX extended yesterday’s 2% losses with another steep decline of about 1% on Friday morning.

The local market is still feeling the weight of the Federal Reserve’s cautious outlook, and some experts believe the risk-off sentiment is likely to continue for the short term.

“The prospect of no further rate cuts in early 2025 means that portfolio adjustments are critical to navigate this shifting environment,” said de Vere Group’s Nigel Green.

Read more: Pivotal moment? How to position as Fed turns hawkish amid stubborn inflation

The Bank of England, however, held its ground overnight, leaving its benchmark interest rate unchanged at 4.75%.

Wall Street, meanwhile, initially traded downward, but staged a late recovery to finish more or less flat.

Bitcoin fell to under US$97k this morning as the Fed’s outlook hurt risky assets.

On the ASX, the biggest losers were the retailers and the big banks. Gold miners also saw losses.

In the large caps space, Meridian (ASX:MEZ) fell almost 1% despite a $660 million joint venture with Nova to build the Te Rahui solar farm in NZ, which will power 100,000 homes and is set to make a final investment decision in early 2025.

Wesfarmers (ASX:WES) announced that it will sell its Coregas business to Japan’s Nippon Sanso for $770 million. Wesfarmers expects a pre-tax profit on the sale, ranging from $230 million to $260 million, but shares slid almost 3%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for December 20 [intraday]:

Security Description Last % Volume MktCap WBE Whitebark Energy 0.011 57% 19,479,491 $1,766,334 PKO Peako Limited 0.003 50% 166,667 $2,190,283 QHL Quickstep Holdings 0.555 41% 1,294,523 $28,331,855 ABX ABX Group Limited 0.045 29% 316,503 $8,760,270 IFG Infocusgroup Hldltd 0.023 28% 1,028,383 $2,824,368 MNC Merino and Co 0.415 26% 26,348 $17,515,268 ZMM Zimi Ltd 0.015 25% 1,855 $4,643,329 CDT Castle Minerals 0.003 25% 503,275 $3,345,628 HCT Holista CollTech Ltd 0.010 25% 160,000 $2,286,134 MMR Mec Resources 0.005 25% 760,893 $7,327,228 MTB Mount Burgess Mining 0.005 25% 62,500 $1,358,150 PRM Prominence Energy 0.005 25% 6,501 $1,556,706 TSL Titanium Sands Ltd 0.005 25% 21,400 $8,846,989 CYB Aucyber Limited 0.125 22% 69,391 $16,765,244 BCB Bowen Coal Limited 0.006 20% 916,605 $53,875,163 RLL Rapid Lithium Ltd 0.006 20% 440,000 $3,660,554 AAU Antilles Gold Ltd 0.004 17% 600,000 $5,573,628 CHM Chimeric Therapeutic 0.007 17% 1,300,000 $9,450,899 IXR Ionic Rare Earths 0.007 17% 609,257 $30,714,291 OSL Oncosil Medical 0.007 17% 90,000 $27,639,481 STM Sunstone Metals Ltd 0.007 17% 322,864 $30,899,422

Whitebark Energy (ASX:WBE) has agreed to acquire King Energy, gaining control of one of Australia’s largest prospective hydrogen, helium and hydrocarbon projects in South Australia. The company said the Alinya project, in the Officer Basin, holds vast potential, with estimates of 710 million kilograms of white hydrogen, 97 Bcf of helium, and 153 million barrels of oil equivalent. Whitebark will issue 100 million shares and options to King shareholders in a deal valued at around $1.67 million.

Aerospace tech company Quickstep Holdings (ASX:QHL) has struck a deal with ASDAM to be acquired for $0.575 per share, a premium of up to 195% on recent trading prices. The board is fully behind the deal, believing it offers strong value and stability for shareholders, provided no better offers come along.

Rapid Lithium (ASX:RLL) has signed a binding agreement to acquire the Prophet River Gallium-Germanium project in BC, Canada, covering 2,110 hectares, including the Cay Mine. With high grades of zinc, gallium, and germanium, the project is seen as strategic, especially with rising prices and China’s export bans. Rapid will pay CAD$130k and issue shares and options on completion.

ABx Group (ASX:ABX) is raising $1.8 million through the issue of 1.8 million convertible notes, with the funds aimed at advancing its Deep Leads Rare Earths Project and ALCORE fluorine recycling plant. The placement, backed by existing shareholders, will be conducted in two tranches, with directors contributing $230k. Investors will also receive unlisted options if shareholder approval is granted, with a 12% annual coupon on the notes.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for December 20 [intraday]:

Code Name Price % Change Volume Market Cap JAY Jayride Group 0.003 -40% 5,030,651 $1,192,895 ERA Energy Resources 0.002 -33% 1,610,918 $1,216,188,722 LNR Lanthanein Resources 0.002 -33% 100,000 $7,330,908 TIG Tigers Realm Coal 0.002 -33% 27,777 $39,200,107 VML Vital Metals Limited 0.002 -33% 30,000 $17,685,201 AMD Arrow Minerals 0.002 -25% 4,617,232 $26,447,256 CTO Citigold Corp Ltd 0.003 -25% 625,000 $12,000,000 NRZ Neurizer Ltd 0.002 -25% 10,005,324 $5,929,721 CSS Clean Seas Ltd 0.095 -24% 575,884 $25,164,160 MDR Medadvisor Limited 0.220 -19% 1,382,403 $149,010,472 MSB Mesoblast Limited 2.495 -18% 18,640,187 $3,482,441,548 PAT Patriot Lithium 0.037 -18% 125,000 $5,688,808 ARV Artemis Resources 0.008 -17% 1,844,979 $17,251,942 CTN Catalina Resources 0.003 -17% 173,444 $3,731,286 IXU Ixup Limited 0.010 -17% 140,220 $24,191,831 RMI Resource Mining Corp 0.005 -17% 1,561,967 $3,914,087 AJX Alexium Int Group 0.011 -15% 49,257 $20,494,648 WYX Western Yilgarn NL 0.022 -15% 115,983 $3,219,048 LAT Latitude 66 Limited 0.047 -15% 205,428 $7,887,039 ADN Andromeda Metals Ltd 0.006 -14% 8,697 $24,001,094 ALY Alchemy Resource Ltd 0.006 -14% 200,000 $8,246,534 ATH Alterity Therap Ltd 0.006 -14% 380,440 $37,242,353 PXX Polarx Limited 0.006 -14% 750,000 $16,628,507

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.