ASX Lunch Wrap: ASX rips higher on US CPI and record bank profits

The ASX rips higher on Thursday. Picture via Getty Images

- ASX jumps on US CPI and bank profits

- Rio Tinto misses ore target but lifts sales

- Tabcorp surges as new exec joins

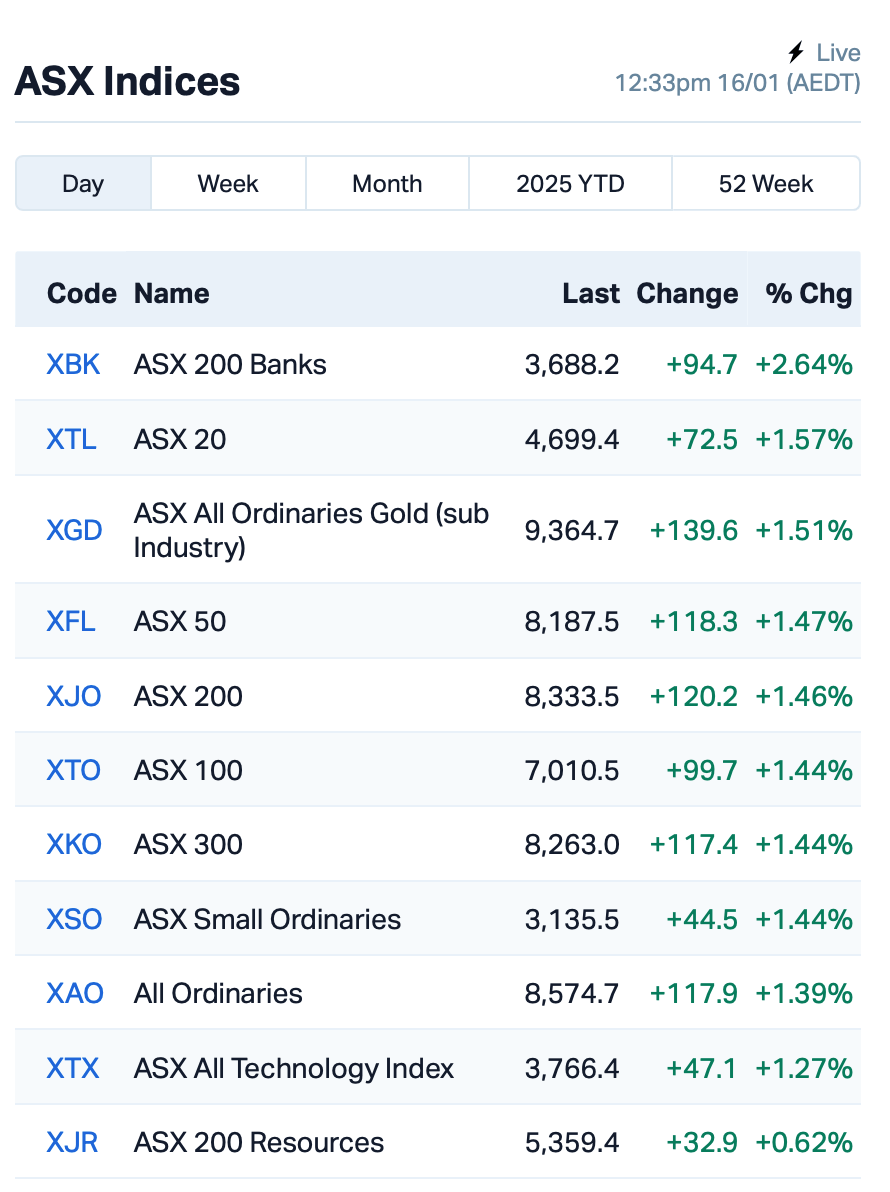

The ASX blasted out of the gates this morning, jumping 1.5% as investors soaked up a positive vibe from the US.

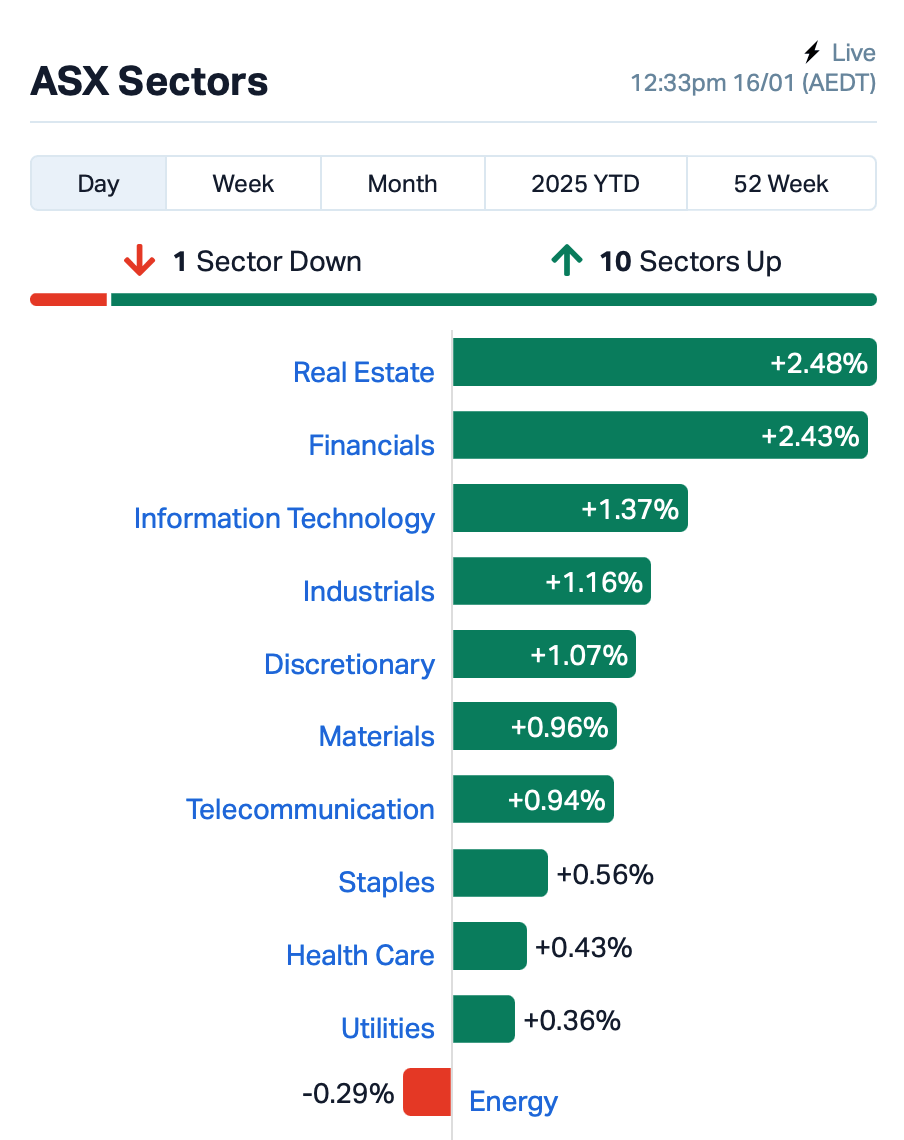

All sectors were in the green after the December CPI report from the US showed consumer prices rose at a slower-than-expected pace – a sign that inflation may be easing.

On top of that, four of America’s biggest banks – JPMorgan, Wells Fargo, Goldman Sachs and Citigroup – posted record profits, pumping up investor sentiment.

The Nasdaq soared 2.5%, while the S&P 500 also climbed by 1.8%.

Bitcoin joined the rally, too, cracking the US$100,000 mark briefly before settling back just shy of the psychological level. Hang on… at the time of writing it just inched back above it yet again.

Back on Aussie turf, the big banks followed suit, with Commonwealth Bank (ASX:CBA) jumping 2.5% this morning and Macquarie by 3%.

The interest-sensitive tech and real estate sectors also saw strong gains, driven by the US CPI data. WiseTech Global (ASX:WTC) bounced 1%, and property developer Goodman Group (ASX:GMG) surged 3%.

This is how things looked at 12:30pm AEDT:

In large caps news, Rio Tinto (ASX:RIO) reported lower iron ore shipments for the December quarter, down by 1% and missing expectations, but managed to raise sales volumes. RIO shares were up 0.5%.

Tabcorp Holdings (ASX:TAH) was also on the move, rising 6% after announcing the appointment of Michael Fitzsimons as its first chief wagering officer.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 16 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| NRZ | Neurizer Ltd | 0.002 | 100% | 2,829,297 | $2,964,871 |

| CND | Condor Energy Ltd | 0.030 | 58% | 42,555,479 | $11,140,340 |

| HLX | Helix Resources | 0.004 | 33% | 194,287 | $10,092,581 |

| MSG | Mcs Services Limited | 0.004 | 33% | 1,382,500 | $594,299 |

| SCP | Scalare Partners | 0.200 | 29% | 5,000 | $5,406,834 |

| VTI | Vision Tech Inc | 0.075 | 25% | 1,610,446 | $3,302,188 |

| AHN | Athena Resources | 0.005 | 25% | 100,000 | $8,012,806 |

| GES | Genesis Resources | 0.005 | 25% | 94,730 | $3,131,365 |

| H2G | Greenhy2 Limited | 0.005 | 25% | 130,000 | $2,392,737 |

| LNR | Lanthanein Resources | 0.003 | 25% | 1,032,160 | $4,887,272 |

| VMC | Venus Metals Cor Ltd | 0.075 | 23% | 230,158 | $11,963,850 |

| AS1 | Asara Resources Ltd | 0.022 | 22% | 461,079 | $17,939,886 |

| AYA | Artryalimited | 0.990 | 19% | 362,855 | $75,928,157 |

| IND | Industrialminerals | 0.130 | 18% | 5,384 | $8,835,475 |

| EUR | European Lithium Ltd | 0.073 | 18% | 6,146,735 | $89,601,251 |

| IVR | Investigator Res Ltd | 0.024 | 17% | 3,458,897 | $32,572,031 |

| GCM | Green Critical Min | 0.021 | 17% | 46,969,233 | $34,335,959 |

| OD6 | Od6Metalsltd | 0.070 | 17% | 403,936 | $8,081,410 |

| SPN | Sparc Tech Ltd | 0.245 | 17% | 200,204 | $20,133,319 |

| AJX | Alexium Int Group | 0.014 | 17% | 93,500 | $18,918,137 |

MLG Oz (ASX:MLG) has locked in $45 million worth of contracts with Northern Star Resources to provide haulage and site services across four of its gold mines in WA. The deals could generate over $45 million in revenue for MLG each year, with two running until 2027. This win follows a string of recent contracts, including $80 million in new deals with Evolution Mining.

Condor Energy (ASX:CND) has just dropped some exciting news – its Piedra Redonda gas field off the coast of Peru now holds a best estimate of 1 trillion cubic feet (Tcf) of gas, a massive jump from previous figures. This marks a 147% increase in resources, with even more potential in the pipeline as it plans future drilling. The field is now one of the biggest undeveloped offshore gas discoveries on South America’s west coast.

Visioneering Technologies (ASX:VTI) said its NaturalVue Multifocal 1 Day Contact Lenses have shown promising results in the second year of the PROTECT trial, which is testing myopia control in children. The lenses have significantly slowed myopia progression, with a 53% reduction in refractive error and an 86% reduction in axial length growth compared to the control group. These results align with the only FDA-approved therapy for myopia control.

Bell Financial Group (ASX:BFG) said it’s expecting a bumper profit increase of 26% for FY24, forecasting a jump to $37.1 million. This is all down to its strong retail and wholesale broking revenues.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for January 16 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CDT | Castle Minerals | 0.002 | -33% | 1,559,203 | $5,690,442 |

| EDE | Eden Inv Ltd | 0.001 | -33% | 1,963 | $6,164,814 |

| SFG | Seafarms Group Ltd | 0.001 | -33% | 3,569 | $7,254,899 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 608,000 | $57,867,624 |

| AYT | Austin Metals Ltd | 0.004 | -20% | 50,000 | $6,620,957 |

| RLL | Rapid Lithium Ltd | 0.004 | -20% | 110,799 | $3,660,554 |

| SNX | Sierra Nevada Gold | 0.035 | -19% | 751,269 | $7,022,623 |

| LSA | Lachlan Star Ltd | 0.040 | -18% | 814,357 | $12,376,087 |

| ALR | Altairminerals | 0.003 | -17% | 97,222 | $12,890,233 |

| ERA | Energy Resources | 0.003 | -17% | 28,462 | $1,216,188,722 |

| VML | Vital Metals Limited | 0.003 | -17% | 629 | $17,685,201 |

| VRL | Verity Resources | 0.017 | -15% | 23,695 | $2,965,311 |

| AJL | AJ Lucas Group | 0.006 | -14% | 3,781 | $9,630,107 |

| VFX | Visionflex Group Ltd | 0.003 | -14% | 1,930,368 | $11,787,512 |

| AKN | Auking Mining Ltd | 0.004 | -13% | 20,000 | $2,059,115 |

| AQD | Ausquest Limited | 0.007 | -13% | 2,000,000 | $9,039,478 |

| AZI | Altamin Limited | 0.022 | -12% | 39,394 | $14,362,572 |

| TMB | Tambourahmetals | 0.022 | -12% | 302,194 | $2,764,751 |

| HMD | Heramed Limited | 0.016 | -11% | 9,000 | $15,760,849 |

| LU7 | Lithium Universe Ltd | 0.008 | -11% | 261,117 | $7,073,817 |

| TEM | Tempest Minerals | 0.004 | -11% | 19,500 | $2,855,384 |

| ROC | Rocketboots | 0.063 | -10% | 91,664 | $7,960,604 |

IN CASE YOU MISSED IT

Asra Minerals (ASX:ASR) is banking nearly $3 million today after selling its Tarmoola Pastoral Lease to Vault Minerals (ASX:VAU) – a transaction first signalled to the market in September of last year.

ASR will retain access to the site’s exploration camp and access road while it will use the funds to accelerate regional consolidation and exploration programs across its Leonora gold projects.

“With the Leonora gold projects as our priority, we are well-positioned to accelerate exploration and growth initiatives that target high-grade, belt-scale discoveries,” ASR CEO Paul Stephen told the market today.

At Stockhead, we tell it like it is. While Asra Minerals is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.