ASX Lunch Wrap: ASX opens 2025 strong; Tesla Cybertruck explodes in Vegas; AUD crumbles

ASX moves higher on the first trading day of 2025. Picture via Getty Images

- ASX opens 2025 higher

- Lendlease sells UK unit, Brainchip rallies more

- Aussie dollar dips, national home prices slide

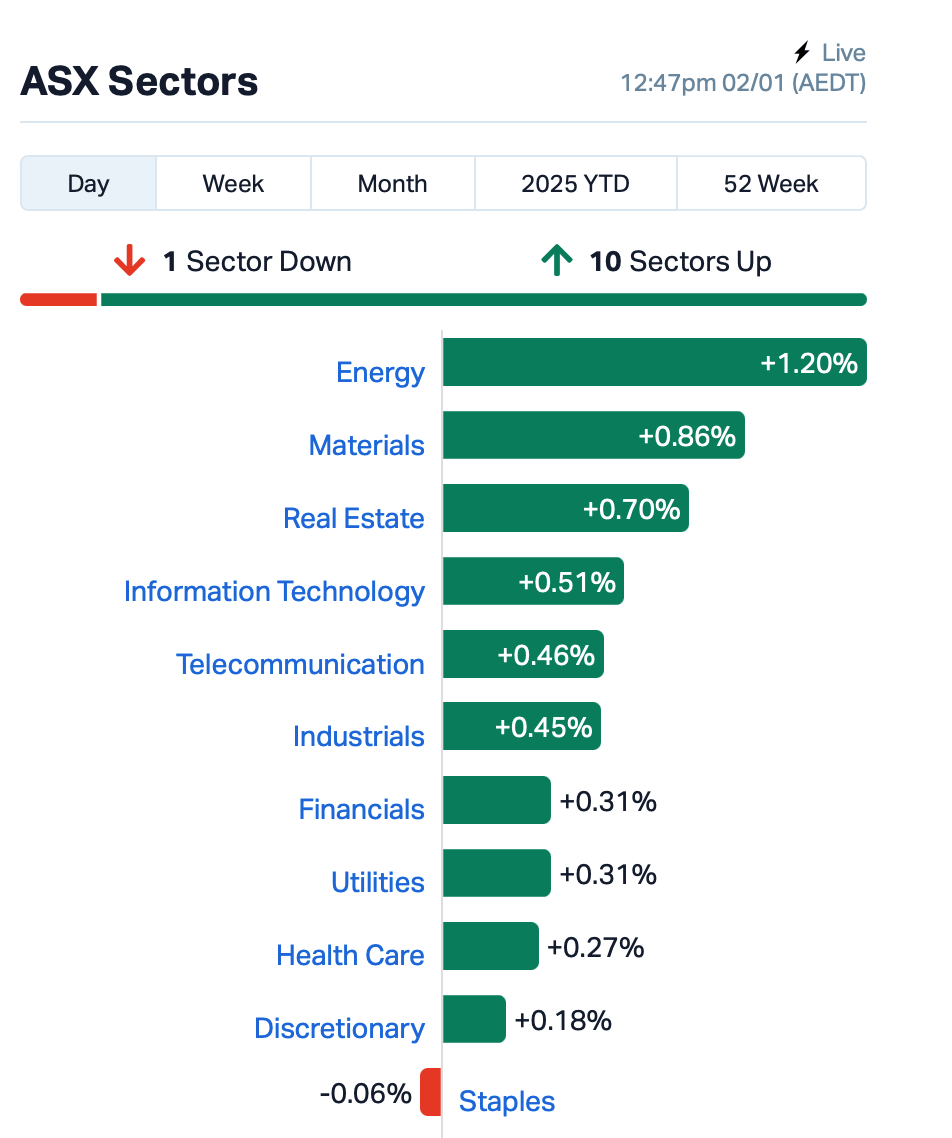

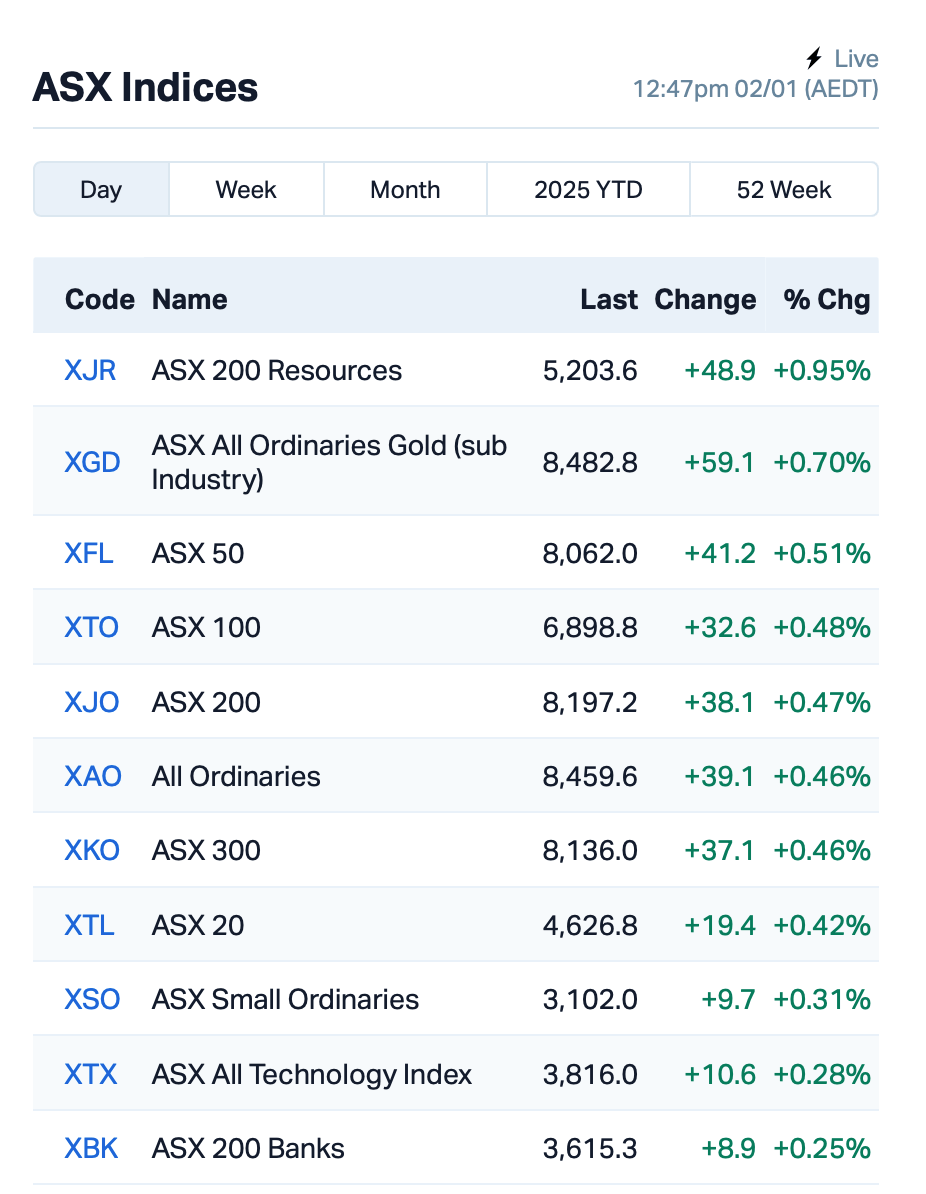

The ASX kicked off 2025 with a solid start on the first trading day, snapping a two-day losing streak and defying a somewhat lacklustre lead from global markets.

The benchmark S&P/ASX 200 Index crept up 0.4% at 12.45pm AEDT, a surprising turn considering ASX futures were bracing for a 1% drop this morning.

Just to recap, the Index ended the year with an 8% gain, its best performance since the pandemic-fuelled rally of 2021 when it surged 13%.

Wall Street fared much better in 2024. The S&P 500 ended up the year with a 23% gain, the Nasdaq was up 29%, and the Dow added 13%.

Meanwhile, breaking news just in the last couple of hours: a Tesla Cybertruck has exploded outside a Trump hotel in Las Vegas, leaving one dead.

Elon Musk suggested the explosion could be terror related.

We have now confirmed that the explosion was caused by very large fireworks and/or a bomb carried in the bed of the rented Cybertruck and is unrelated to the vehicle itself.

All vehicle telemetry was positive at the time of the explosion. https://t.co/HRjb87YbaJ

— Elon Musk (@elonmusk) January 1, 2025

Back to the ASX, of the 11 sectors, 10 were were in the green this morning, with energy and miners leading the charge.

In the large caps space, Lendlease Group (ASX:LLC) fell by 0.8% after selling its UK construction business to Atlas Holdings for $70 million.

It’s part of the company’s grand restructure, which will see it pull out of less profitable overseas ventures and zero in on the Aussie market.

Chip stock BrainChip Holdings (ASX:BRN) surged once again, this time by 9%, bringing its one-month gains to around 80% despite no clear news driving the rally.

In other markets, the Aussie dollar took another beating this morning and traded a tad below US$62c, the lowest level in two years.

National home prices, meanwhile, dipped 0.17% in December, marking the first decline in two years, though they’re still up 4.73% year-on-year – according to the latest data from PropTrack.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 2 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| NTM | Nt Minerals Limited | 0.003 | 50% | 37,988 | $2,421,806 |

| MXR | Maximus Resources | 0.060 | 33% | 6,661,173 | $19,256,746 |

| AOK | Australian Oil. | 0.003 | 25% | 166,666 | $2,003,566 |

| BNL | Blue Star Helium Ltd | 0.005 | 25% | 253,009 | $10,779,541 |

| TEM | Tempest Minerals | 0.005 | 25% | 200,000 | $2,538,119 |

| BDG | Black Dragon Gold | 0.067 | 24% | 1,021,502 | $16,301,667 |

| GCM | Green Critical Min | 0.014 | 23% | 32,139,746 | $20,983,086 |

| BCB | Bowen Coal Limited | 0.009 | 21% | 42,632,214 | $75,425,228 |

| PIQ | Proteomics Int Lab | 0.730 | 21% | 557,246 | $79,256,644 |

| ADG | Adelong Gold Limited | 0.006 | 20% | 436,814 | $5,589,945 |

| BPP | Babylon Pump & Power | 0.006 | 20% | 6,000,000 | $12,497,745 |

| EVR | Ev Resources Ltd | 0.003 | 20% | 168,015 | $4,531,258 |

| A1G | African Gold Ltd. | 0.062 | 19% | 1,617,794 | $19,848,245 |

| PUA | Peak Minerals Ltd | 0.010 | 19% | 6,323,723 | $20,416,882 |

| BUY | Bounty Oil & Gas NL | 0.004 | 17% | 186,257 | $4,495,503 |

| GTR | Gti Energy Ltd | 0.004 | 17% | 377,953 | $8,888,849 |

| T3D | 333D Limited | 0.014 | 17% | 31,538 | $2,114,202 |

| AHF | Aust Dairy Limited | 0.078 | 16% | 6,807,521 | $49,802,562 |

| A11 | Atlantic Lithium | 0.325 | 16% | 289,620 | $194,081,248 |

| 5EA | 5Eadvanced | 0.087 | 16% | 1,040,007 | $25,269,083 |

| AGD | Austral Gold | 0.030 | 15% | 260,182 | $15,920,095 |

Lycaon Resources (ASX:LYN) has appointed Tony Rovira, a seasoned mining exec, to its board as a non-executive director from January 1. Rovira has more than 40 years of experience, and was most recently the MD of Azure Minerals, overseeing the discovery of the world-class Andover lithium deposit, which led to a $1.7 billion takeover. As part of his appointment, Rovira will invest $360k into Lycaon through a share placement.

Green Critical Minerals (ASX:GCM) has fast-tracked its VHD Technology pilot plant in NSW, completing construction of Line 1 and starting commissioning well ahead of schedule. The plant is now in its ‘wet commissioning’ phase, following successful checks in the ‘dry commissioning’ phase. Initial prototype blocks are expected in January, with first qualification blocks due in February. The company said this will put GCM ahead of schedule, allowing it to ramp up production sooner and accelerate the commercialisation of its VHD graphite technology.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for January 2 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| X2M | X2M Connect Limited | 0.020 | -38% | 137,680 | $12,062,102 |

| MOM | Moab Minerals Ltd | 0.002 | -33% | 3,999 | $4,700,998 |

| MKL | Mighty Kingdom Ltd | 0.013 | -32% | 635,930 | $4,105,205 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 9,404,087 | $57,867,624 |

| DOU | Douugh Limited | 0.006 | -25% | 423,000 | $9,458,047 |

| PRX | Prodigy Gold NL | 0.002 | -25% | 3,537,717 | $6,350,111 |

| ECT | Env Clean Tech Ltd. | 0.002 | -20% | 20,441 | $7,929,526 |

| RMI | Resource Mining Corp | 0.005 | -17% | 1,410,732 | $3,914,087 |

| ADN | Andromeda Metals Ltd | 0.006 | -14% | 626,626 | $24,001,094 |

| CCO | The Calmer Co Int | 0.006 | -14% | 2,654,106 | $17,785,969 |

| MQR | Marquee Resource Ltd | 0.014 | -13% | 640,000 | $6,662,150 |

| PAB | Patrys Limited | 0.004 | -13% | 234,321 | $8,229,789 |

| RGL | Riversgold | 0.004 | -13% | 1,125,000 | $6,734,850 |

| CYM | Cyprium Metals Ltd | 0.024 | -11% | 149,722 | $46,215,268 |

| FOS | FOS Capital Ltd | 0.320 | -11% | 38,729 | $19,370,210 |

| ICE | Icetana Limited | 0.016 | -11% | 309,698 | $4,763,312 |

| LM1 | Leeuwin Metals Ltd | 0.125 | -11% | 14,218 | $6,559,234 |

| NGX | Ngxlimited | 0.170 | -11% | 31,581 | $17,216,250 |

| ASV | Assetvisonco | 0.018 | -10% | 1,361,660 | $14,787,231 |

| BCM | Brazilian Critical | 0.009 | -10% | 64,907 | $10,504,586 |

| CUF | Cufe Ltd | 0.009 | -10% | 166,666 | $13,366,749 |

| SPX | Spenda Limited | 0.009 | -10% | 619,500 | $46,152,155 |

IN CASE YOU MISSED IT

QPM Energy (ASX:QPM) has completed the acquisition of the 12.8MW Moranbah Power Station, reducing costs by more than $500,000 per month and generating new revenue. The acquisition supports its QLD-based Moranbah gas project and marks the first step in building an electricity portfolio in the region.

At Stockhead, we tell it like it is. While QPM Energy is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.