ASX Lunch Wrap: ASX on track for weekly loss as miners, real estate continue to struggle

ASX drops as Wall Street weakness hits. Picture via Getty Images

- ASX drops as Wall Street weakness hits

- Insignia and Iress shine, but Rio Tinto slumps

- Westpac transitions leadership, Resolute CEO takes a break

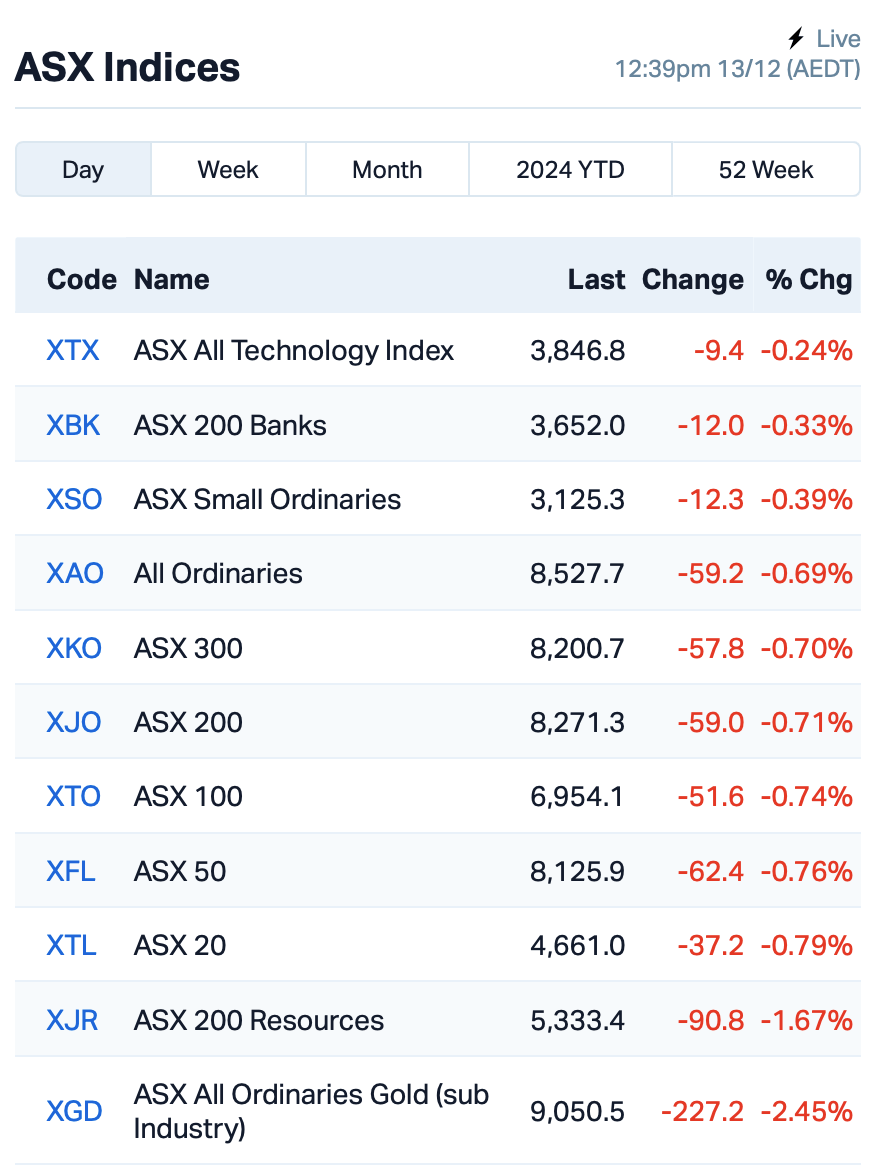

The ASX opened in the red on Friday, down by 0.7% at lunchtime as investor sentiment soured following weakness on Wall Street overnight.

The Dow Jones lost 0.5% and the Nasdaq dropped 0.7% after the latest US data showed a surprising increase in jobless claims, while wholesale inflation came in hotter than expected.

These reports have dampened hopes of a swift economic recovery, with investors now shifting their focus back to the Fed Reserve’s next move on December 18th.

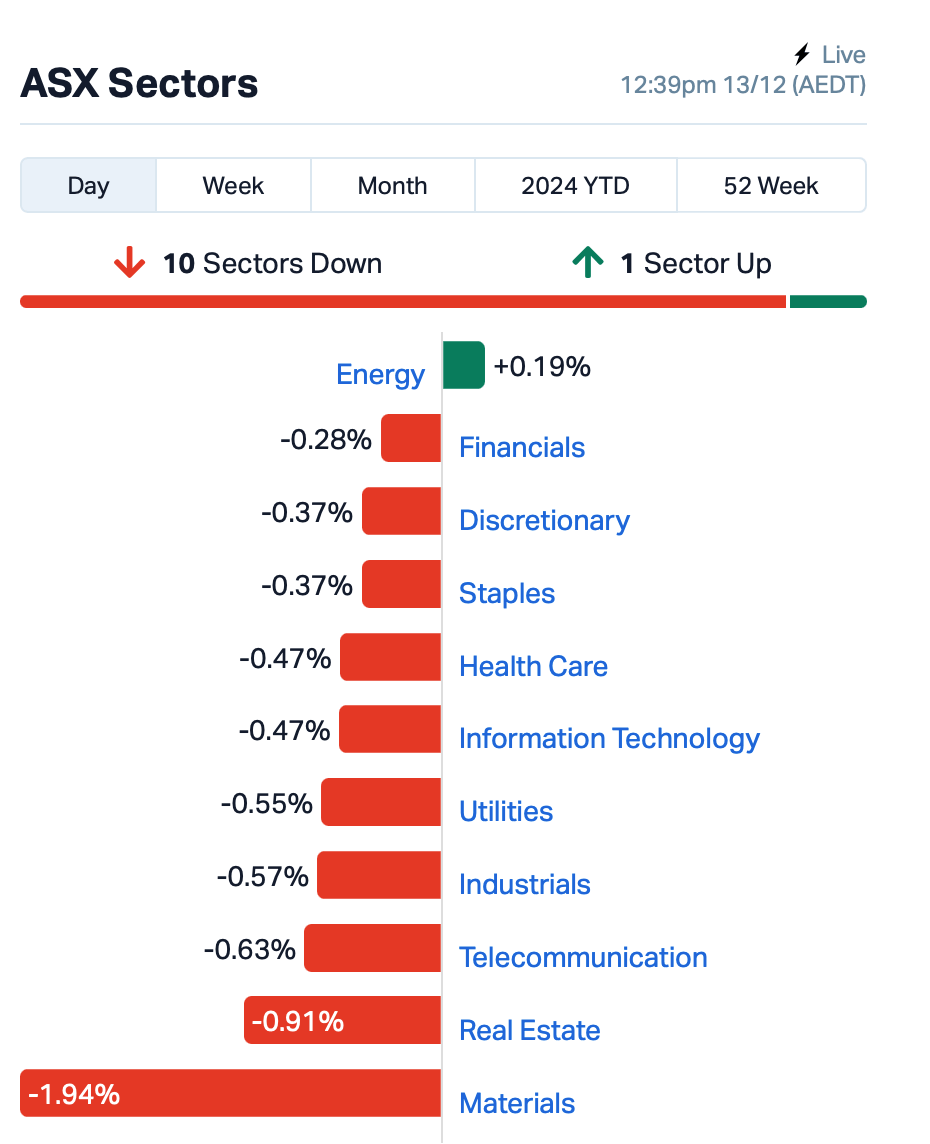

To the ASX, with Energy the only sector in the green, it was clear investors were once again focused on the RBA’s tightening path after a solid jobs report earlier in the week.

Miners bore the brunt of the selling, while the real estate stocks weren’t spared either.

In the large caps space, shares of Insignia Financial (ASX:IFL) surged 8% after Bain Capital made a non-binding takeover offer at $4 per share. A nice premium, but will it be enough to sway investors?

Iress (ASX:IRE), the market data firm, saw a strong start to the day, jumping by 5% after it reaffirmed its FY24 earnings guidance, targeting a range of $126m to $132m.

Rio Tinto (ASX:RIO), however, was in the doghouse, dropping 2% after the mining giant doubled down on lithium via a US$2.5bn expansion of the Rincon lithium project in South America despite the ongoing slump in lithium prices.

Vulcan Energy Resources (ASX:VUL), the renewable energy and lithium miner, caught investor attention with a €500m loan commitment from the European Investment Bank to fund its Lionheart Lithium Project. Shares slumped by 10%.

And, there was news that Resolute Mining (ASX:RSG) CEO Terry Holohan would be taking a leave of absence until January 2025, sending shares 4% lower. The company also made the final $30m payment to the government of Mali as part of a tax dispute settlement. Holohan was previously detained in Bamako with other RSG execs ahead of the “settlement”. Mali is currently run by a military junta who have introduced sweeping changes to the West African nation’s Mining Code.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for December 11 [intraday]:

Code Name Price % Change Volume Market Cap XGL Xamble Group Limited 0.030 50% 273,554 $5,923,142 AUH Austchina Holdings 0.002 50% 113,085 $2,400,384 ICU Investor Centre Ltd 0.003 50% 1,011,772 $609,023 TMK TMK Energy Limited 0.003 50% 4,437,244 $18,651,130 HRE Heavy Rare Earths 0.034 31% 37,515 $2,191,154 PAT Patriot Lithium 0.039 26% 387,493 $3,918,957 AAU Antilles Gold Ltd 0.005 25% 100,000 $7,431,504 AKN Auking Mining Ltd 0.005 25% 1,589,880 $1,565,401 CUL Cullen Resources 0.005 25% 1,014,300 $2,773,607 ENL Enlitic Inc. 0.090 23% 1,200 $42,017,655 AOK Australian Oil. 0.003 20% 664,969 $2,504,457 CZN Corazon Ltd 0.003 20% 100,000 $1,919,764 PIL Peppermint Inv Ltd 0.006 20% 912,166 $10,794,292 OZM Ozaurum Resources 0.033 18% 27,214 $4,445,000 HAW Hawthorn Resources 0.048 17% 107,267 $13,735,640 ALY Alchemy Resource Ltd 0.007 17% 1,437,000 $7,068,458 ASR Asra Minerals Ltd 0.004 17% 27,054 $6,937,807 GTR Gti Energy Ltd 0.004 17% 3,045,000 $8,888,849 ICE Icetana Limited 0.016 14% 50,000 $3,704,798 ION Iondrive Limited 0.024 14% 16,874,278 $18,472,307 AXE Archer Materials 0.325 14% 590,471 $72,631,399

Marketing platform, Xamble Group, has secured a $1.5 million strategic investment from 7-Eleven Malaysia’s subsidiary, Convenience Shopping (Sabah). The investment, which involves the issuance of 42.8 million new shares, will help Xamble enhance its influencer marketing platform and expand its operations.

Base metals explorer Cullen Resources (ASX:CUL) said RC drilling has started to test strong IP anomalies at the Wongan and Rupert Prospects. The drilling program, which involves 4-6 holes over 600-800m, will begin at Wongan, where harvesting has been completed, and then move to Rupert, following additional harvesting and weather considerations.

OzAurum Resources (ASX:OZM) has raised $1 million through a share placement of 38.46 million shares at $0.026 each. The funds will be used to continue exploration at its Mulgabbie and Patricia gold projects in Western Australia and progress work at the Brazil Niobium project. The placement was supported by both existing and new investors, and is expected to settle by 20 December.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for December 11 [intraday]:

Code Name Price % Change Volume Market Cap IBX Imagion Biosys Ltd 0.025 -31% 4,489,599 $1,815,767 NC6 Nanollose Limited 0.022 -27% 1,009,903 $5,160,191 88E 88 Energy Ltd 0.002 -25% 897,975 $57,867,624 JAV Javelin Minerals Ltd 0.003 -25% 150,000 $22,079,728 LNU Linius Tech Limited 0.002 -25% 1,595,997 $12,302,431 CMB Cambium Bio Limited 0.430 -20% 32,485 $6,442,743 PNT Panthermetalsltd 0.012 -20% 3,136,196 $3,530,230 EVR Ev Resources Ltd 0.002 -20% 170,666 $4,511,258 VML Vital Metals Limited 0.002 -20% 25,000 $14,737,667 NWM Norwest Minerals 0.017 -19% 964,707 $10,187,510 OLI Oliver'S Real Food 0.009 -18% 312,500 $5,948,051 APC APC Minerals 0.019 -17% 135,081 $2,349,981 BLZ Blaze Minerals Ltd 0.005 -17% 500,000 $7,521,349 GGE Grand Gulf Energy 0.003 -17% 9,573,832 $7,351,161 HHR Hartshead Resources 0.005 -17% 1,324,029 $16,852,093 RLL Rapid Lithium Ltd 0.005 -17% 600,000 $4,392,665 AJL AJ Lucas Group 0.006 -14% 3,678,740 $9,630,107 SHE Stonehorse Energy Lt 0.006 -14% 37,681 $4,791,046 EQR Eq Resources Limited 0.043 -14% 2,115,119 $111,876,623 SUM Summitminerals 0.125 -14% 58,763 $12,517,558 IMI Infinitymining 0.014 -13% 174,560 $6,736,252 PXX Polarx Limited 0.007 -13% 7,217,769 $19,004,008 RR1 Reach Resources Ltd 0.007 -13% 100,000 $6,995,451

IN CASE YOU MISSED IT

Brazilian Critical Minerals (ASX:BCM) has attracted further interest from brokers and sophisticated investors, raising $1.44 million through the placement of 144 million shares at 1 cent each. The funds will support ongoing studies and an updated MRE for BCM’s Ema project in northern Brazil.

Javelin Minerals (ASX:JAV) shareholders have approved the acquisition of the Eureka gold project in WA from Delta Lithium (ASX:DLI), which has a MRE of 2.45Mt at 1.42 g/t gold for 112,000oz. The company plans to begin its first drill program in early 2025 and has appointed experienced finance professional Peter Gilford as a non-executive director.

At Stockhead, we tell it like it is. While OzAurum Resources, Brazilian Critical Minerals and Javelin Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.