ASX Lunch Wrap: ASX battles for momentum after Nasdaq’s Friday bounce

ASX keeps momentum going on Monday. Picture via Getty Images

- ASX chops after Wall Street bounced back on Friday

- Energy stocks surge as oil prices rise

- Insignia jumps on takeover bid, Bellevue tumbles

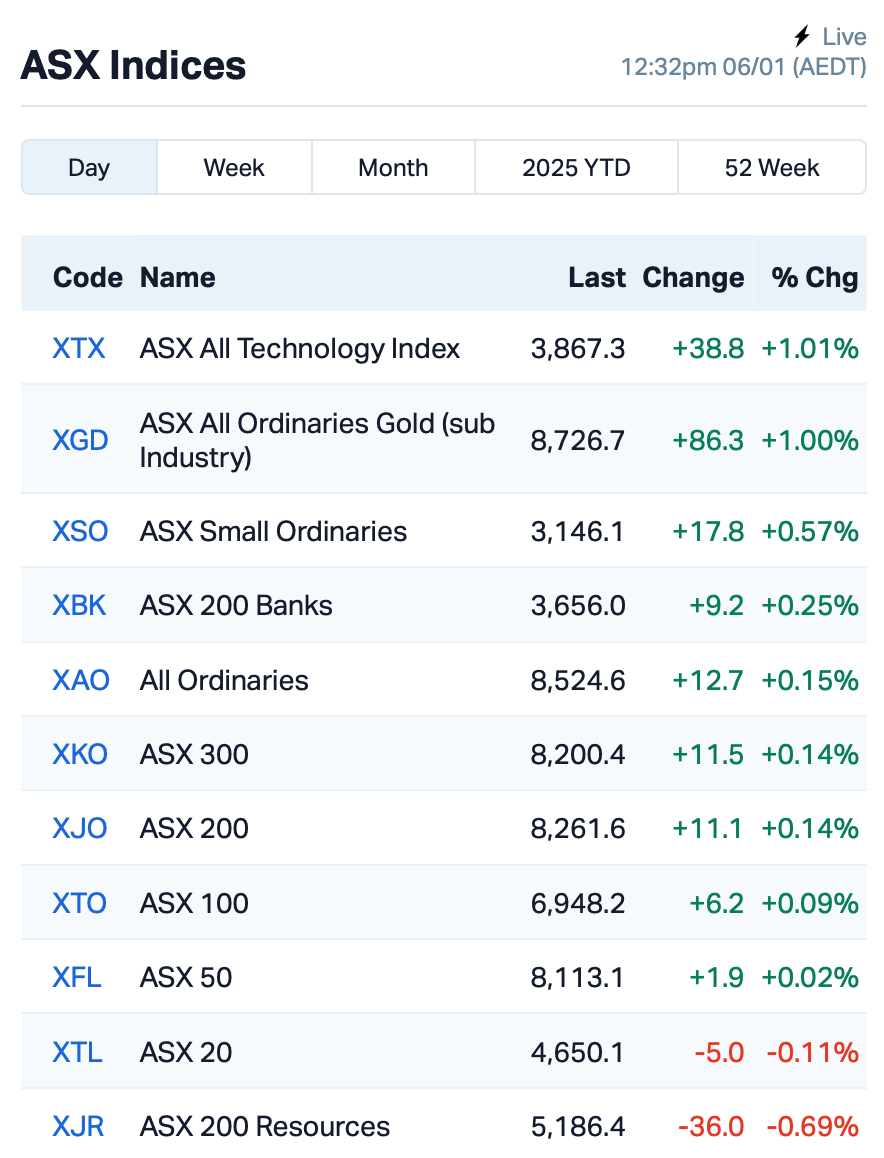

The ASX is in a battle to keep its momentum going on Monday with a gain of 0.04% at the time of writing, after Wall Street put an end to its losing streak.

Breaking free from a rough start to the year, US tech stocks came roaring back on Friday. The Nasdaq climbed 1.8%, ending a five-session losing streak.

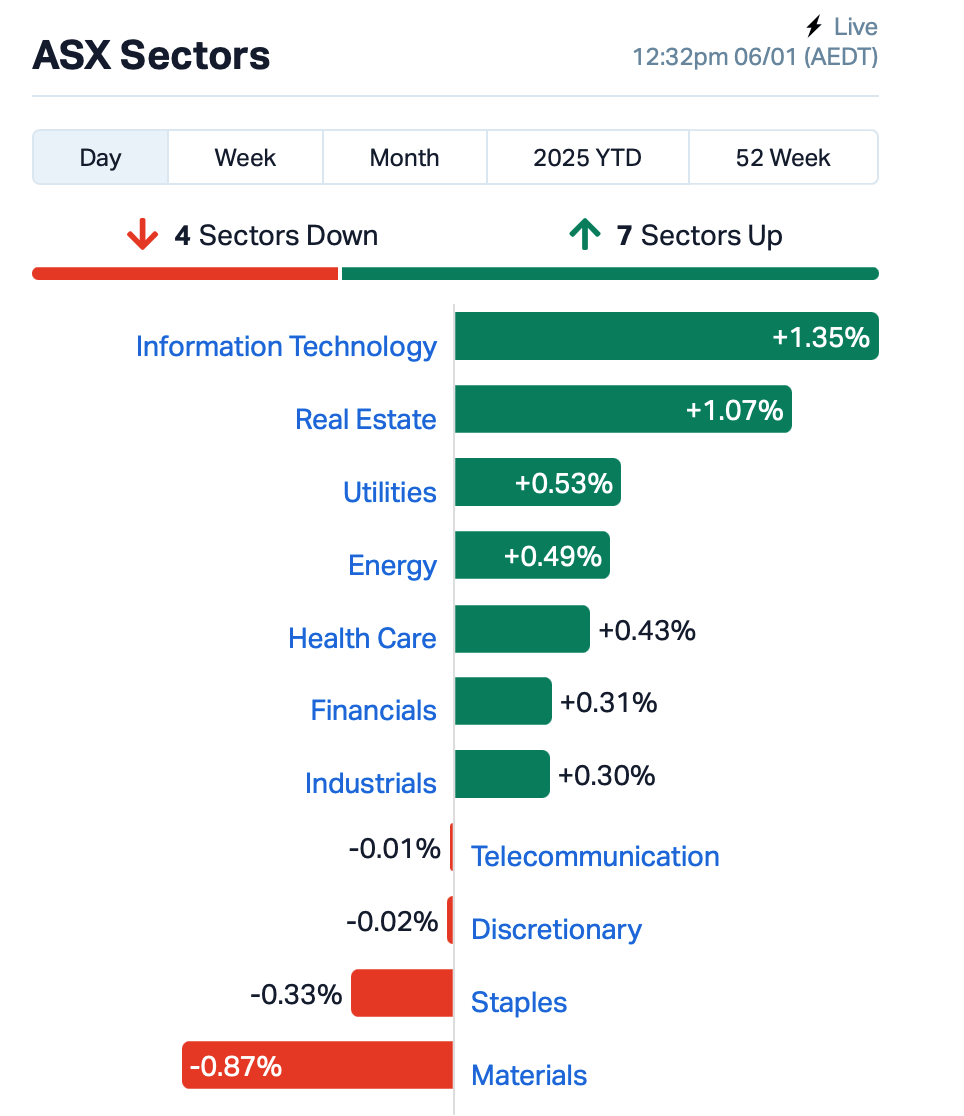

The ASX tech sector here rode the Wall Street wave this morning, while the broader market retreated slightly after earlier rising on optimism spilling over from Wall Street.

Energy stocks surged as global oil prices got a lift thanks to the chilly weather sweeping across Europe.

The mining sector, however, wasn’t feeling the same love. Iron ore prices slid by almost 3%, dragging down stocks like BHP (ASX:BHP) and Rio Tinto (ASX:RIO) – both falling almost 2% each.

This is where things stood at 12:30pm AEDT:

Making headlines was Insignia Financial (ASX:IFL), which surged by 13% after a $4.30-per-share takeover bid from private equity firm CC Capital Partners.

Bellevue Gold (ASX:BGL), however, took a hit of 9% after the company downgraded its production expectations for FY25. The miner’s issues with geological variability at some of its key sites were the culprit.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 6 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| SIS | Simble Solutions | 0.006 | 50% | 2,416,213 | $3,345,321 |

| GES | Genesis Resources | 0.007 | 40% | 359,999 | $3,914,206 |

| AAU | Antilles Gold Ltd | 0.004 | 33% | 2,924,672 | $5,573,628 |

| GMN | Gold Mountain Ltd | 0.004 | 33% | 109,688,118 | $11,902,420 |

| FDR | Finder | 0.041 | 28% | 142,500 | $9,097,226 |

| SUM | Summitminerals | 0.190 | 27% | 4,173,335 | $12,949,198 |

| BNL | Blue Star Helium Ltd | 0.005 | 25% | 289,839 | $10,779,541 |

| NTM | Nt Minerals Limited | 0.005 | 25% | 500,008 | $4,843,612 |

| TMK | TMK Energy Limited | 0.003 | 25% | 1,569,047 | $18,651,130 |

| CYC | Cyclopharm Limited | 1.990 | 24% | 155,515 | $177,818,960 |

| ALR | Altairminerals | 0.003 | 20% | 184,356 | $10,741,444 |

| ICG | Inca Minerals Ltd | 0.006 | 20% | 238,917 | $5,133,613 |

| PIL | Peppermint Inv Ltd | 0.006 | 20% | 11,516,311 | $10,794,292 |

| PNT | Panthermetalsltd | 0.012 | 20% | 2,315,059 | $2,481,708 |

| RMI | Resource Mining Corp | 0.006 | 20% | 83,342 | $3,261,739 |

| RNX | Renegade Exploration | 0.006 | 20% | 1,713,341 | $6,420,017 |

| VEN | Vintage Energy | 0.006 | 20% | 685,999 | $8,347,656 |

| TG6 | Tgmetalslimited | 0.155 | 19% | 100,622 | $9,243,980 |

| MAG | Magmatic Resrce Ltd | 0.039 | 18% | 49,398 | $13,762,674 |

| FTL | Firetail Resources | 0.067 | 18% | 19,308 | $18,897,095 |

| 1TT | Thrive Tribe Tech | 0.004 | 17% | 679,976 | $6,095,169 |

Summit Minerals (ASX:SUM) is set to acquire the Mundo Novo Niobium-REE-Phosphate Carbonatite project in Brazil. SUM said the site is rich in niobium, rare earth elements (REE), and phosphate, with promising mineralisation confirmed, though it remains underexplored. The project lies near Highway 156 – some 6km east of Mundo Novo, in Goiás State. The acquisition depends on Summit completing a satisfactory due diligence.

EBR Systems’ (ASX:EBR) stock jumped 40% last week and another 2% today, prompting a probe from the ASX. The company denied it knew anything about the big spike.

DroneShield (ASX:DRO), the drone detection tech company, shot up 4% after it scored a $9.7 million order from a major Latin American military customer.

Metro Mining (ASX:MMI) has announced record shipments of 5.7 million WMT in 2024, a 24% increase on 2023, but the share price was flat today. December shipments hit a record 0.48 million WMT, up 53% on last year, despite challenging weather conditions.

Imugene’s (ASX:IMU) shares keep on surging after Friday’s announcement. The biotech company said it has dosed its first Australian patient in the Phase 1b clinical trial of its allogeneic CAR T-cell therapy, azer-cel, at Royal Prince Alfred Hospital in Sydney. The trial targets relapsed or refractory diffuse large B-cell lymphoma (DLBCL), a tough form of non-Hodgkin’s lymphoma.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for January 6 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| IS3 | I Synergy Group Ltd | 0.003 | -40% | 105,000 | $1,781,089 |

| AVE | Avecho Biotech Ltd | 0.002 | -33% | 820,003 | $9,507,891 |

| ERA | Energy Resources | 0.002 | -33% | 2,563,775 | $1,216,188,722 |

| D3E | D3 Energy Limited | 0.056 | -30% | 12,007 | $6,358,000 |

| OSL | Oncosil Medical | 0.005 | -29% | 26,012,210 | $32,246,061 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 1,669,374 | $57,867,624 |

| BYH | Bryah Resources Ltd | 0.003 | -25% | 128,267 | $2,013,147 |

| RGL | Riversgold | 0.003 | -25% | 1,045,911 | $6,734,850 |

| TMX | Terrain Minerals | 0.003 | -25% | 9,173,105 | $7,242,782 |

| LYK | Lykosmetalslimited | 0.010 | -23% | 271,199 | $2,448,622 |

| CHM | Chimeric Therapeutic | 0.006 | -20% | 908,084 | $11,813,624 |

| CDT | Castle Minerals | 0.002 | -20% | 75,000 | $4,742,035 |

| CYQ | Cycliq Group Ltd | 0.004 | -20% | 302,278 | $2,302,583 |

| ROG | Red Sky Energy. | 0.008 | -20% | 51,392,791 | $54,222,272 |

| GLL | Galilee Energy Ltd | 0.009 | -18% | 300,000 | $6,129,122 |

| LM1 | Leeuwin Metals Ltd | 0.100 | -17% | 15,032 | $5,622,201 |

| CRR | Critical Resources | 0.005 | -17% | 5,040 | $14,591,779 |

| EVR | Ev Resources Ltd | 0.003 | -17% | 100,558 | $5,437,510 |

| LNR | Lanthanein Resources | 0.003 | -17% | 236,000 | $7,330,908 |

| AON | Apollo Minerals Ltd | 0.012 | -14% | 1,036,037 | $10,996,196 |

| CCO | The Calmer Co Int | 0.006 | -14% | 5,666,666 | $17,785,969 |

| SLZ | Sultan Resources Ltd | 0.006 | -14% | 10,087 | $1,620,289 |

IN CASE YOU MISSED IT

Anson Resources (ASX:ASN) has secured approval to drill 24 exploration holes for ~1,000 metres at its Yellow Cat uranium and vanadium project in Utah, USA. Drilling will target extensions of mineralisation near the Windy Point and Mineral Treasure mines, where previous sampling returned grades of up to 10.33% U3O8 and 25.6% V2O5.

Firetail Resources (ASX:FTL) has been selected as one of eight early-stage exploration companies to participate in the 2025 BHP Xplor program. BHP will provide US$500,000 in non-dilutive funding to support and drive Firetail’s exploration plans for its Picha copper-silver project in Peru during the six-month program.

At Stockhead, we tell it like it is. While Anson Resources and Firetail Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.