ASX Lunch Wrap: ASX inches up ahead of US CPI, Guzman y Gomez surges

ASX edges up as US CPI looms. Picture via Getty Images

- ASX edges up as US CPI looms

- Bitcoin pushes to US$97k while Meta falls

- ASX iron ore and real estate stocks shine this morning

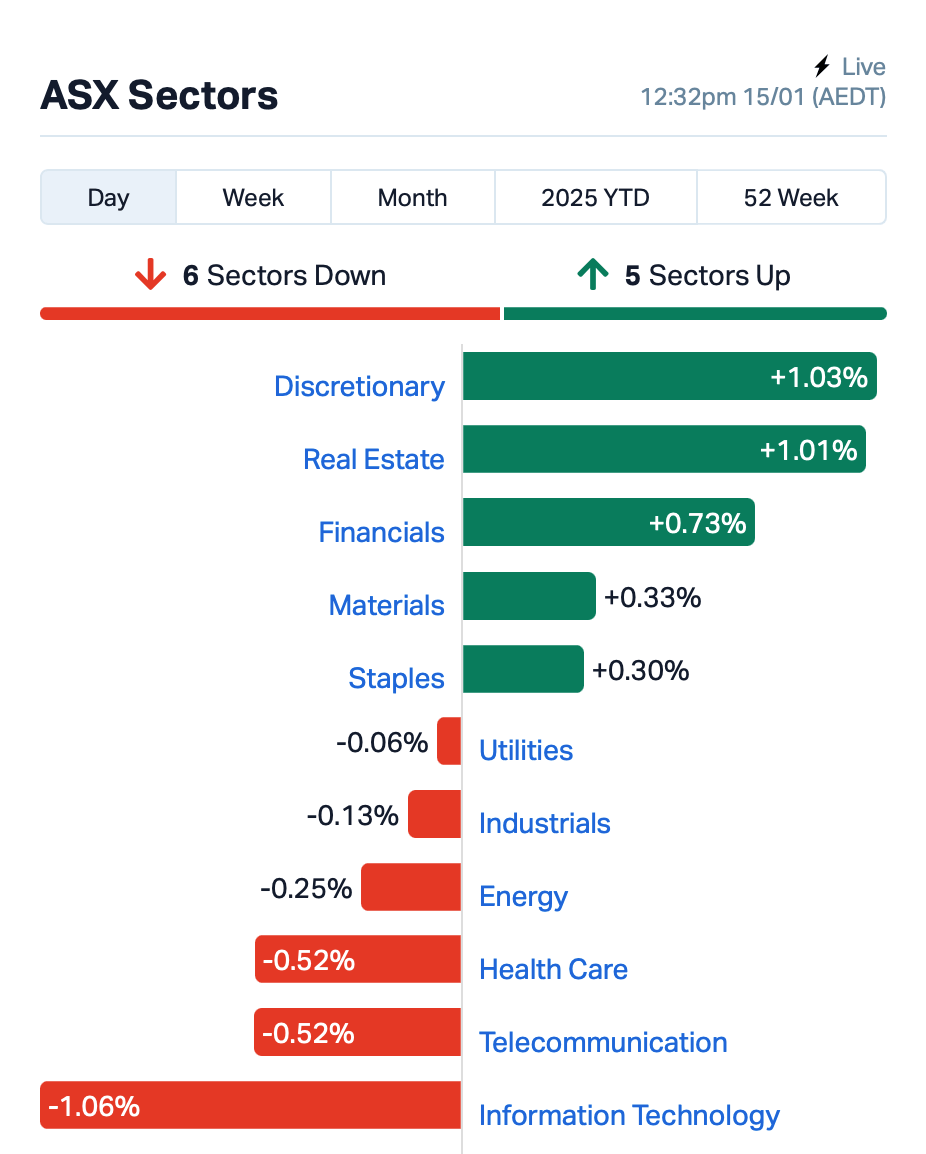

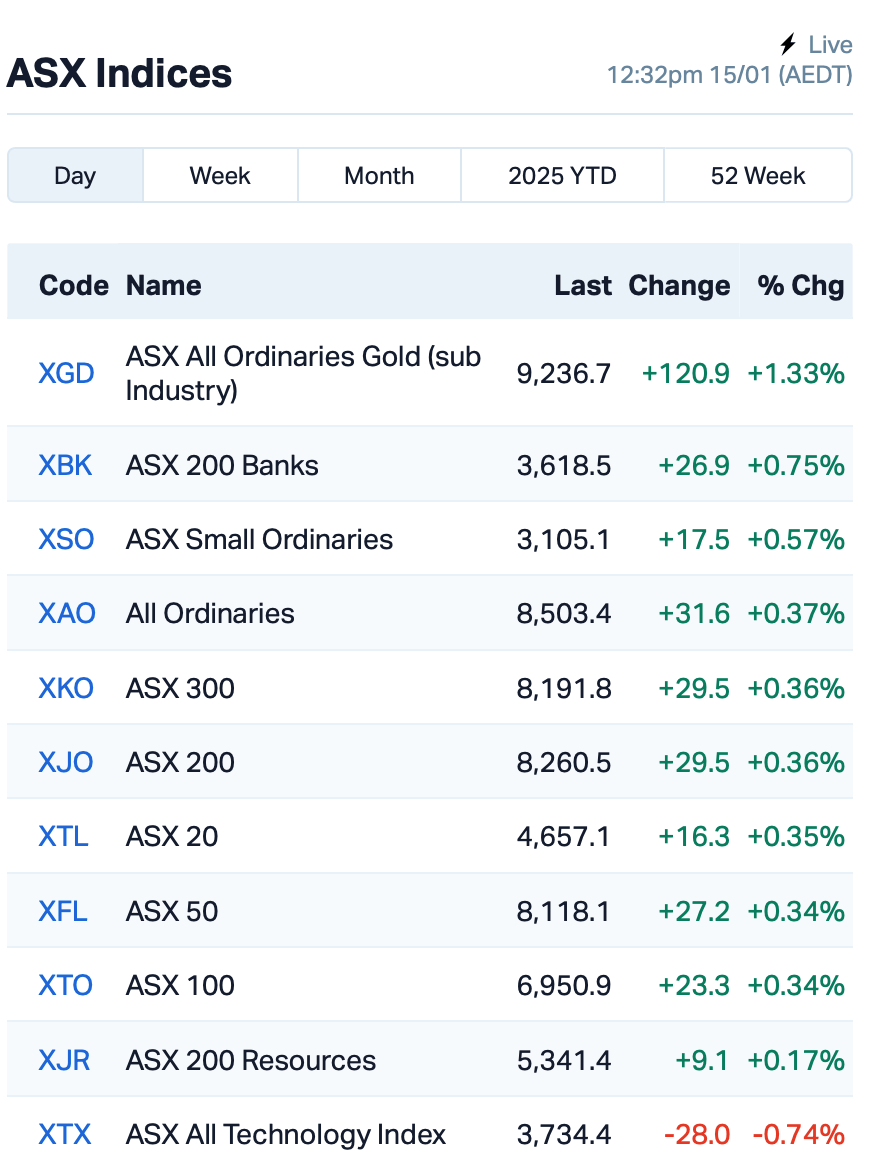

The ASX took a cautious step forward, ticking up 0.3% on Wednesday morning, with all eyes on the all-crucial US inflation data dropping tomorrow morning AEDT.

Overnight, Wall Street had a mixed session, with the blue-chip focused Dow Index rising by 0.5% and tech heavy Nasdaq slipping 0.2%.

Everyone’s basically holding their breath for the CPI report, which could flip rate bets and move stocks.

“They’re also waiting for some of the big US banks to report earnings (JP Morgan, Citigroup, Goldman Sachs, Bank of America) this week, and Donald Trump’s inauguration next week,” said Moomoo’s Jessica Amir.

“Traders are betting geopolitical tension will mount as Trump takes to the White House, and the US will cut rates.”

Bitcoin had a nice lift, pushing towards US$97k, but Meta was hit after confirming more layoffs.

Back to the ASX, real estate stocks were the stars this morning, led by Stockland’s (ASX:SGP) 2.5% gain.

Iron ore is also running along nicely, soaring by 2% and hitting a two-week high – with China’s record iron ore imports giving the market a lift.

But not all sectors were cruising – tech stocks were a bit shaky, with WiseTech Global (ASX:WTC) shedding 2.5%.

In the large caps space, Guzman y Gomez (ASX:GYG) was the day’s standout, popping 6.5% on no specific news, but it’s understood that UBS has upgraded the Mexican fast-food chain to “neutral”.

And, Yancoal Australia’s (ASX:YAL) CEO, David Moult, has stepped down after five years at the helm, saying it was time for fresh leadership as the company eyed new opportunities. Shares fell 1%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 15 [intraday]:

Security Description Last % Volume MktCap GMN Gold Mountain Ltd 0.003 50% 200,328 $9,158,446 WGR Western Gold 0.062 35% 1,738,169 $7,836,332 AOA Ausmon Resorces 0.002 33% 2,504,907 $1,634,591 AYT Austin Metals Ltd 0.005 25% 100,000 $5,296,765 TMK TMK Energy Limited 0.003 25% 1,830,390 $18,651,130 TSL Titanium Sands Ltd 0.005 25% 200,000 $8,846,989 VML Vital Metals Limited 0.003 25% 422,043 $11,790,134 YRL Yandal Resources 0.180 24% 375,862 $44,839,072 D3E D3 Energy Limited 0.080 23% 769,509 $5,165,875 NXS Next Science Limited 0.135 23% 193,276 $32,137,626 SGQ St George Min Ltd 0.028 22% 18,827,001 $28,486,430 BP8 Bph Global Ltd 0.003 20% 800 $1,183,270 CRR Critical Resources 0.006 20% 1,904,322 $12,159,816 IPB IPB Petroleum Ltd 0.006 20% 833 $3,532,015 ARU Arafura Rare Earths 0.138 20% 18,004,636 $283,397,799 PLC Premier1 Lithium Ltd 0.007 17% 501,447 $2,208,363 SKK Stakk Limited 0.007 17% 129,152 $12,450,478 VFX Visionflex Group Ltd 0.004 17% 669,510 $10,103,581 LM1 Leeuwin Metals Ltd 0.115 15% 14,652 $4,685,167 AAU Antilles Gold Ltd 0.004 14% 971,848 $6,502,566

Gold Mountain’s (ASX:GMN) drilling targets are set at its Salinas II project in Brazil’s Lithium Valley, with a 14-hole program planned to test 10 high-priority lithium anomalies. A strong regional structure mirrors the nearby Latin Resources’ lithium corridor, and GMN is now focused on securing permits before drilling begins.

Western Gold Resources (ASX:WGR) has tapped SSH Group as the preferred mining contractor for its Gold Duke project in WA. SSH has offered a deferred payment arrangement to support WGR’s cash flow as the project kicks off. The deal will have milestones like ore agreements and the Final Investment Decision. First-stage production will target 34,000 oz of gold across multiple deposits.

Yandal Resources (ASX:YRL) said its air-core drilling at Caladan is showing promise, with standout results like 11m at 1.7g/t Au from 97m in hole 24IWBAC063, including 3m at 3.5g/t Au. The gold’s coming from an 8km by 3km fold structure.

D3 Energy (ASX:D3E)’s testing at Nooitgedacht Major is showing potential in the northern part of ER315, with gas flowing at an average rate of 102 Mscfd over 7 days. The gas has 5.6% helium and 83.2% methane, which is pretty much in line with the southern boreholes, despite being shallower.

And, St George Mining (ASX:SGQ) has teamed up with steelmaking giant Fangda to push the Araxá niobium-REE Project in Brazil forward. The deal includes an offtake agreement where Fangda could secure 20% of the niobium output, plus potential funding support to develop the project.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for January 15 [intraday]:

Code Name Price % Change Volume Market Cap TFL Tasfoods Ltd 0.012 -29% 72,794 $7,430,624 FBM Future Battery 0.020 -23% 635,360 $17,299,254 CDT Castle Minerals 0.002 -20% 18,801,467 $4,742,035 POS Poseidon Nick Ltd 0.004 -20% 37,806 $21,019,423 KNG Kingsland Minerals 0.105 -19% 404,473 $9,432,918 ERA Energy Resources 0.003 -17% 104,188 $1,216,188,722 SHP South Harz Potash 0.010 -17% 13,750 $12,632,744 VEN Vintage Energy 0.005 -17% 3,557,872 $10,017,188 FRS Forrestaniaresources 0.011 -15% 655,940 $3,132,683 PPY Papyrus Australia 0.012 -14% 10,804 $7,728,635 RNX Renegade Exploration 0.006 -14% 167,766 $8,988,024 NVA Nova Minerals Ltd 0.325 -13% 506,468 $120,741,531 BCB Bowen Coal Limited 0.007 -13% 2,544,206 $86,204,221 EPM Eclipse Metals 0.007 -13% 440,714 $18,302,844 SER Strategic Energy 0.007 -13% 6,526,673 $5,368,267 JAL Jameson Resources 0.035 -13% 234,084 $24,429,333 LMS Litchfield Minerals 0.105 -13% 59,864 $3,385,362 LSA Lachlan Star Ltd 0.049 -13% 75,418 $14,144,099 AUZ Australian Mines Ltd 0.012 -12% 2,245,531 $18,180,658 LCY Legacy Iron Ore 0.008 -11% 104,555 $87,858,383 MVL Marvel Gold Limited 0.008 -11% 50,000 $7,774,116 TON Triton Min Ltd 0.008 -11% 100,000 $14,115,499

IN CASE YOU MISSED IT

African gold explorer Many Peaks Minerals (ASX:MPK) has kicked off diamond drilling at its Ferké project in Côte d’Ivoire, following on from nearly 7,000m of auger drilling. The company also recently dusted off more than 8,000m of air core drilling at its Odienné gold project, also in Côte d’Ivoire. Assay results from these recently completed programs are currently pending.

At Ferké, MPK’s diamond drilling is focused on defining the geologic controls to high-grade intercepts, where recent drilling intercepts included 45.3m at 3.16g/t gold from 45.9m and 39.7m at 3.54g/t gold from 51.4m.

Small cap darling Spartan Resources (ASX:SPR) has completed the sale of its Glenburgh and Egerton gold projects in Western Australia to Benz Mining Corp (ASX:BNZ).

The sale of these non-core assets nets SPR $1 million in cash and 33 million Benz CHESS Depository Instruments – roughly the equivalent of a 15% shareholding in Benz. SPR may also receive an additional $6 million in contingent payments. Following the transaction, SPR general manager of geology Nick Jolly has joined the BNZ board.

Canadian explorer White Cliff Minerals (ASX:WCN) was busy over the Christmas period, sharing with the market today a number of successes it has had on the approvals side of its Rae copper project in Nunavut.

WCN has received a Class A Land Use Permit from the Crown-Indigenous Relations and Northern Affairs Canada – paving the way for drilling activities and camp construction. This permit follows on from a positive screening decision by the Nunavut Impact Review Board, meaning Rae meets all regulator and environmental requirements.

The explorer is due to kick off a new round of drilling at Rae this March, welcoming back Aurora Geosciences to undertake the works after a successful engagement throughout 2024. Aurora has more than 40 years of experience operating in Canada’s North.

Greenvale Energy (ASX:GRV) has received $250,000 plus GST after completing the sale of EL145 to Mosman Oil & Gas. The sale comes after the company also received more than $1 million from a research and development rebate.

At Stockhead, we tell it like it is. While Many Peaks Minerals, Greenvale Energy, White Cliff Minerals and Spartan Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.