ASX Lunch Wrap: ASX higher ahead of Fed; MinRes completes $780m gas deal with Rinehart

ASX up ahead of crucial Fed decision. Picture via Getty Images

- ASX steadies ahead of crucial Fed decision

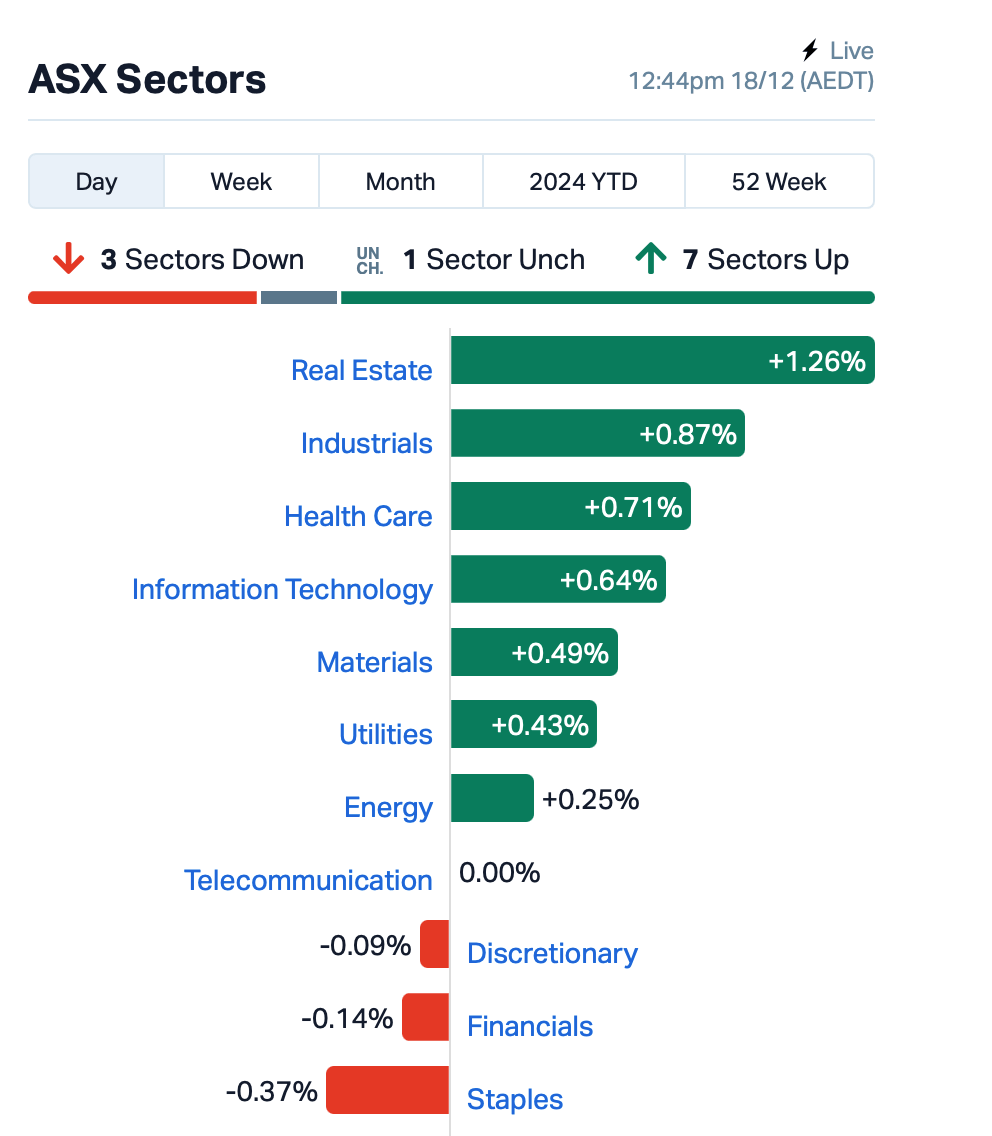

- Real Estate leads while energy and staples fall

- Percheron wiped out market value after disappointing top-line results

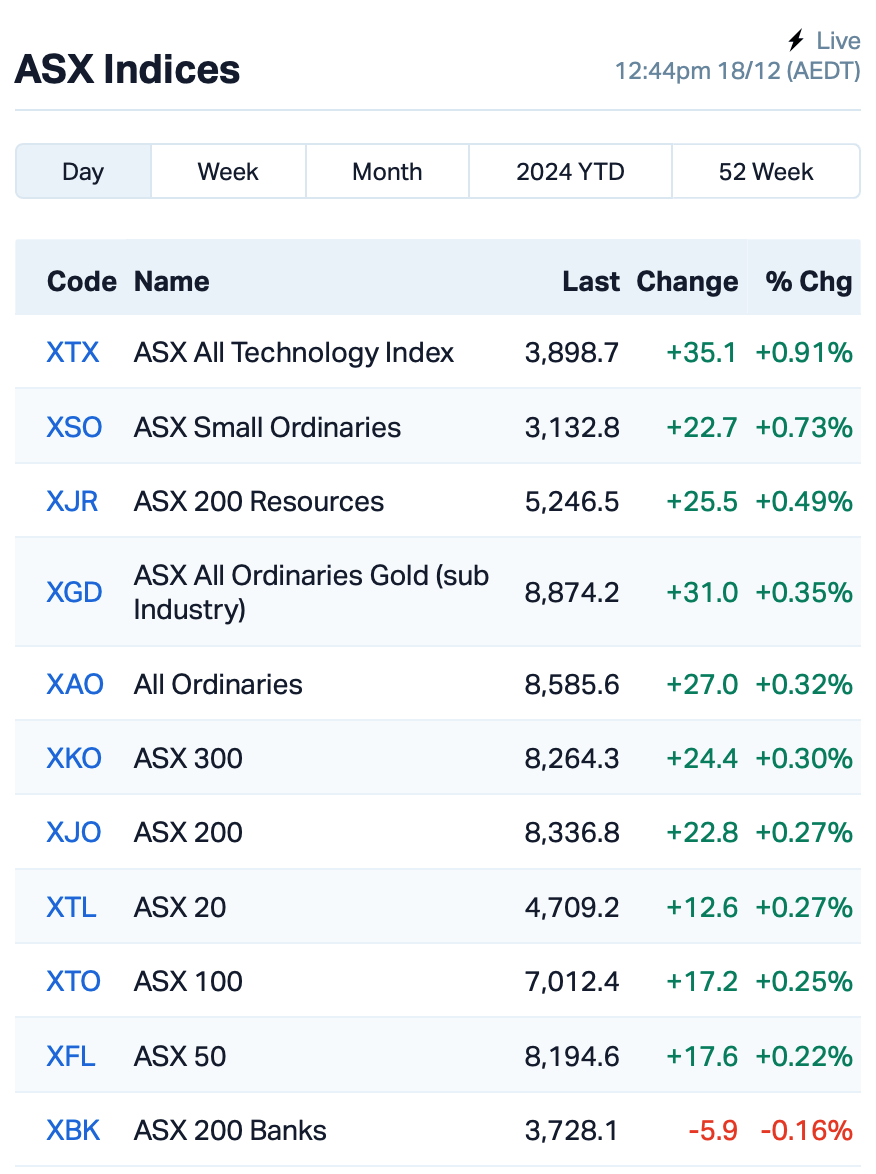

The benchmark ASX 200 crept up by 0.26% by Wednesday lunch time AEDT, after a lacklustre night on Wall Street.

Traders are keeping a very close eye on the Federal Reserve’s decision later today (US time), which could have a big impact on sentiment both locally and globally.

The consensus expectation is for a 25 basis point rate cut.

“I expect that during the December FOMC meeting and press conference, Powell will aim not to rock the boat too much relative to consensus expectations and market pricing,” said Blerina Uruçi, Chief US Economist at T. Rowe Price.

On the ASX, the real estate sector led this morning, while consumer staples saw losses.

Large cap stocks in focus this morning include Insignia Financial (ASX:IFL), which dropped 1.5% after rejecting a $4-a-share takeover bid from Bain Capital.

Mineral Resources (ASX:MIN) has completed its $780 million gas deal with Hancock in the Perth Basin and Carnarvon Basin in WA.

Hancock will now provide the additional $24 million as part of the exploration joint ventures and purchase of 50% of Mineral Resources’ Explorer drill rig and associated infrastructure.

Vulcan Energy Resources (ASX:VUL) rose 1.5% following the announcement of a €879 million financing deal for its Lionheart Project in Germany. The deal involves a group of banks and Export Finance Australia.

DigiCo Infrastructure REIT (ASX:DGT) recovered after a lacklustre IPO last week, with shares up 3.5% this morning.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for December 18 [intraday]:

Security Description Last % Volume MktCap AYM Australia United Min 0.004 100% 977,360 $3,685,155 AMD Arrow Minerals 0.002 50% 3,118,346 $13,223,628 IBG Ironbark Zinc Ltd 0.003 50% 2,047,671 $3,667,296 BDG Black Dragon Gold 0.036 44% 2,821,386 $7,547,068 OBL Omni Bridgeway Ltd 1.385 44% 1,296,533 $272,693,739 NRZ Neurizer Ltd 0.002 33% 4,105,000 $4,226,791 AKN Auking Mining Ltd 0.005 25% 100,083 $1,565,401 T3D 333D Limited 0.010 25% 2,008 $1,409,468 TMK TMK Energy Limited 0.003 25% 1,586,000 $18,651,130 DCC Digitalx Limited 0.067 24% 39,991,599 $46,785,818 YOJ Yojee Limited 0.150 20% 123,413 $34,450,482 LNR Lanthanein Resources 0.003 20% 1,000,000 $6,109,090 CDR Codrus Minerals Ltd 0.019 19% 20,000 $2,646,200 CU6 Clarity Pharma 5.410 17% 1,913,339 $1,478,162,446 ICL Iceni Gold 0.075 17% 3,915,853 $17,753,908 RVT Richmond Vanadium 0.245 17% 13,056 $18,103,639 BUY Bounty Oil & Gas NL 0.004 17% 166,666 $4,495,503 OSL Oncosil Medical 0.007 17% 6,600,000 $27,639,481 PAB Patrys Limited 0.004 17% 250,000 $6,172,342 RGL Riversgold 0.004 17% 732,398 $4,882,388 WBE Whitebark Energy 0.007 17% 424,872 $1,514,001

Litigation financing company Omni Bridgeway (ASX:OBL) has agreed with Ares Management to establish Fund 9, acquiring OBL’s co-investment in 150+ assets. Ares will pay $310 million for a 70% stake, with OBL retaining 30%. The deal provides OBL a 3.2x return on invested capital and a 2% management fee from Fund 9. Ares also has the option to buy up to $35 million in OBL equity.

DigitalX (ASX:DCC) has raised $15.4 million through a private placement and rights issue. Tony Guoga joins as strategic advisor to expand digital asset services, investing $4.7 million. DCC expects 41 Bitcoin from Mt Gox in 2025, valued at $7 million, and growth in its Bitcoin ETF.

Clarity Pharmaceuticals (ASX:CU6) said it has developed a new FAP-targeted radiopharmaceutical, SAR-bisFAP, designed for cancer diagnosis and treatment. This product uses copper isotopes for imaging and therapy, showing strong tumour targeting and retention in pre-clinical models. FAP is widely expressed in many cancers, offering a broad treatment potential.

Iceni Gold (ASX:ICL) has signed a farm-in deal with Gold Road Resources (ASX:GOR) worth up to $44 million for exploration on its Guyer Gold Trend in Western Australia. GOR will invest $5 million initially, with the potential to earn up to 80% of the project. GOR is also taking a 9.9% stake in Iceni for $3.05 million. Exploration starts in January 2025.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for December 18 [intraday]:

Code Name Price % Change Volume Market Cap PER Percheron 0.008 -86% 238,879,649 $64,158,820 NTD Ntaw Holdings Ltd 0.225 -42% 1,371,570 $64,567,430 MTL Mantle Minerals Ltd 0.001 -33% 167,650 $9,296,169 PKO Peako Limited 0.002 -33% 500,000 $3,285,425 TD1 Tali Digital Limited 0.001 -33% 1,380,000 $4,942,733 TKL Traka Resources 0.001 -33% 12,450 $2,963,488 PGY Pilot Energy Ltd 0.007 -30% 28,873,580 $16,420,716 CRR Critical Resources 0.005 -29% 11,462,290 $17,023,742 1TT Thrive Tribe Tech 0.002 -25% 256,064 $1,406,723 88E 88 Energy Ltd 0.002 -25% 1,510,910 $57,867,624 CR9 Corellares 0.003 -25% 1,023,116 $1,860,370 LNU Linius Tech Limited 0.002 -25% 300,000 $12,302,431 TX3 Trinex Minerals Ltd 0.002 -25% 21,989 $3,657,305 VRC Volt Resources Ltd 0.003 -25% 6,796,333 $16,634,713 ERG Eneco Refresh Ltd 0.010 -23% 80,000 $3,540,659 FHS Freehill Mining Ltd. 0.004 -20% 2,450,235 $15,392,639 AUK Aumake Limited 0.005 -17% 9,425 $18,064,153 AUR Auris Minerals Ltd 0.005 -17% 8,592 $2,859,756 BLZ Blaze Minerals Ltd 0.005 -17% 2,461,618 $9,401,687 ECT Env Clean Tech Ltd. 0.003 -17% 3,198,507 $9,515,431 RNX Renegade Exploration 0.005 -17% 400,000 $7,704,021 VML Vital Metals Limited 0.003 -17% 1,415,615 $17,685,201 BMR Ballymore Resources 0.130 -16% 217,709 $27,393,241

Percheron Therapeutics (ASX:PER) plunged by almost 90% after announcing that its phase IIb trial of avicursen for Duchenne muscular dystrophy (DMD) did not meet its primary endpoint or show significant efficacy in secondary endpoints.

Based on these results, the company has decided to terminate the trial and will conduct a strategic review of its pipeline in early 2025. Percheron said it remains committed to advancing DMD research and will provide further updates in the new year.

IN CASE YOU MISSED IT

Tungsten Mining (ASX:TGN) has raised $4.5 million through the issue of convertible notes to professional and sophisticated investors. The funds will be used to acquire the Mt Mulgine project and support ongoing project development, with TGN now holding all mineral rights to the project.

Godolphin Resources (ASX:GRL) has struck a 37m-wide sulphide zone in its third drill hole (GLPDD007) as part of a 1,500m drilling program at its Lewis Ponds project in NSW. It follows the success of the previous two drill holes, including a 40m intersection of semi-massive sulphide mineralisation in GLPDD006. Further assay results are expected in late January 2025.

In the US, cleantech company Carbonxt Group (ASX:CG1) has achieved mechanical completion of its cutting-edge activated carbon production plant in Kentucky and increased its ownership stake to 40%. The plant is primed to meet the growing demand for premium activated carbon products in North America, with sample production scheduled for the March quarter, which will allow CG1 to finalise potential offtake agreements.

At Stockhead, we tell it like it is. While Tungsten Mining, Godolphin Resources and Carbonnxt Group are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.