ASX Lunch Wrap: ASX, Bitcoin take breather after yesterday’s leap; Iluka dumps on cost overrun

Bitcoin retreats after hitting US$100,000. Picture via Getty Images

- ASX dips as US pullback fuels profit taking

- Bitcoin retreats after hitting US$100,000 (although… rotation into altcoins seems on)

- APA Group rises while Iluka slumps on loan news

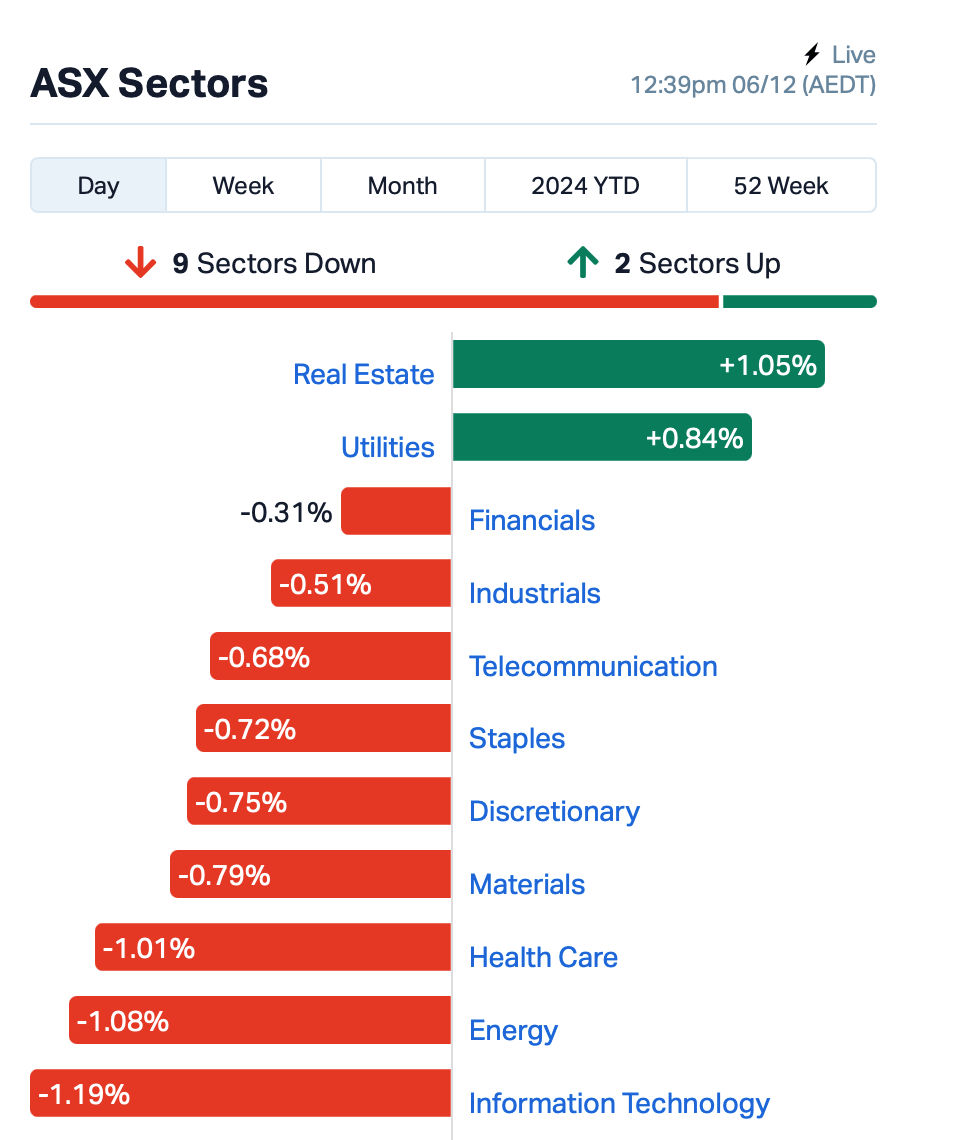

The ASX edged lower by 0.5% at the halfway mark on Friday, mirroring a pullback in US markets overnight as investors cashed in after yesterday’s rally.

Tech and Energy bore the brunt of the losses this morning, while mining stocks were under pressure, driven by weaker iron ore prices in Singapore.

Meanwhile, Bitcoin, which surged above US$102,000 yesterday, took a breather, trading at US$98,020 at the time of writing.

“This spike in volatility over the last 24 hours [in BTC] has the hallmarks of a classic blow-off top,” said Tony Sycamore at broker IG.

“While we don’t see this as the end of the Bitcoin bull run, it does signal we are entering a consolidation phase in the days or weeks ahead.”

[Ed: One thing to note, however, after scouring the broader crypto market, there appears to be some rotation from Bitcoin (BTC) into “altcoins”, with several AI-themed cryptocurrencies in particular seeing strong, double-digit gains at the time of writing.]

A notable announcement this morning came from natural gas transmitter APA Group (ASX:APA), which gained 2.5% gain after the energy regulator confirmed it wouldn’t apply full price regulation to its South West Queensland gas pipeline.

And, Iluka Resources (ASX:ILU) slumped 9.5% after announcing that it has secured an additional $400 million loan from the Australian government for its Eneabba rare earths refinery to cover cost overruns at its domestic rare earths refinery.

As part of the agreement, Iluka will also contribute an additional $214 million cash equity, on top of an initial $200 million.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for December 6 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ARN | Aldoro Resources | 0.255 | 59% | 3,620,385 | $21,539,799 |

| VRC | Volt Resources Ltd | 0.004 | 33% | 1,000,000 | $12,476,034 |

| AR3 | Austrare | 0.130 | 30% | 219,749 | $15,863,666 |

| TMK | TMK Energy Limited | 0.003 | 25% | 8,456,309 | $18,651,130 |

| TMS | Tennant Minerals Ltd | 0.011 | 22% | 1,271,318 | $8,603,014 |

| GBZ | GBM Rsources Ltd | 0.009 | 20% | 7,211,041 | $8,675,167 |

| CR9 | Corellares | 0.006 | 20% | 96,378 | $2,325,462 |

| CRI | Criticalim | 0.012 | 20% | 1,505,788 | $26,723,155 |

| GCM | Green Critical Min | 0.006 | 20% | 7,365,714 | $9,537,766 |

| GGE | Grand Gulf Energy | 0.003 | 20% | 200,500 | $6,125,968 |

| MPR | Mpower Group Limited | 0.012 | 20% | 471,523 | $3,437,033 |

| TIG | Tigers Realm Coal | 0.003 | 20% | 1,361,523 | $32,666,756 |

| TFL | Tasfoods Ltd | 0.013 | 18% | 218,417 | $4,808,051 |

| BWN | Bhagwan Marine | 0.650 | 17% | 1,184,118 | $152,736,132 |

| C7A | Clara Resources | 0.007 | 17% | 102,935 | $1,643,079 |

| COY | Coppermoly Limited | 0.014 | 17% | 54,712 | $8,491,889 |

| CSX | Cleanspace Holdings | 0.405 | 16% | 193,804 | $27,291,138 |

| C1X | Cosmosexploration | 0.038 | 15% | 62,266 | $2,754,398 |

| D3E | D3 Energy Limited | 0.115 | 15% | 67,629 | $7,947,501 |

| LDR | Lode Resources | 0.115 | 15% | 590,224 | $11,748,018 |

| PTR | Petratherm Ltd | 0.345 | 15% | 1,576,539 | $92,758,977 |

| DUB | Dubber Corp Ltd | 0.023 | 15% | 2,256,969 | $51,901,864 |

| BP8 | Bph Global Ltd | 0.004 | 14% | 12,000 | $1,388,245 |

Australian Rare Earths (ASX:AR3) has secured a $5 million grant from the Australian federal government for its Koppamurra project. The funding will support metallurgical testwork, a pre-feasibility study, and the construction of a demonstration plant, with AR3 matching the grant for a total $10 million investment over 2025 and 2026. The project, backed by strategic partner Neo Performance Materials, aims to strengthen rare earth supply chains for the clean energy transition.

GBM Resources (ASX:GBZ) said it has sold approximately 466 ounces of gold in the December quarter, generating around $1.9 million in revenue. The increase in production and sales is attributed to new heap leach material, mineralised material recovered from the gold room and elution circuits, and the rising AUD gold price. The company said further higher production is expected next quarter as maintenance continues, with additional gold set for assay and sale.

Bhagwan Marine (ASX:BWN) expects strong earnings growth for the first half of FY25, with pro-forma EBITDA projected to be between $26 million and $28 million, a 26% to 36% increase compared to the previous period. This follows the successful completion of a large-scale oil and gas decommissioning project in Q1, marking the company’s largest project of its kind. The project, involving 180 offshore personnel, delivered over 800,000 working hours without any lost-time injuries.

And, Cleanspace (ASX:CSX) has appointed Gabrielle O’Carroll as CEO, effective 1 January 2025. O’Carroll, formerly of 3M, brings extensive experience in marketing, sales, and business leadership, including managing 3M’s Personal Safety division in Australia and New Zealand. The appointment comes as CleanSpace prepares for its next phase of growth.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for December 6 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ADD | Adavale Resource Ltd | 0.002 | -33% | 1,692,228 | $3,704,796 |

| MTL | Mantle Minerals Ltd | 0.001 | -33% | 883,333 | $9,296,169 |

| TKL | Traka Resources | 0.001 | -33% | 409,285 | $2,918,488 |

| VML | Vital Metals Limited | 0.002 | -33% | 606,572 | $17,685,201 |

| WEC | White Energy | 0.028 | -26% | 21 | $7,561,402 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 2,219,354 | $57,867,624 |

| CRB | Carbine Resources | 0.003 | -25% | 300,000 | $2,206,951 |

| GTR | Gti Energy Ltd | 0.003 | -25% | 380,000 | $11,851,799 |

| H2G | Greenhy2 Limited | 0.003 | -25% | 642,499 | $2,392,737 |

| WNR | Wingara Ag Ltd | 0.007 | -22% | 30,000 | $1,579,883 |

| NVO | Novo Resources Corp | 0.091 | -21% | 280,766 | $12,864,673 |

| S66 | Star Combo | 0.115 | -21% | 6,001 | $19,587,032 |

| AYT | Austin Metals Ltd | 0.004 | -20% | 2,122,400 | $6,620,957 |

| CZN | Corazon Ltd | 0.002 | -20% | 33,896 | $1,919,764 |

| M2R | Miramar | 0.004 | -20% | 91,375 | $1,984,116 |

| ERA | Energy Resources | 0.003 | -17% | 209,276 | $1,216,188,722 |

| HLX | Helix Resources | 0.003 | -14% | 12,438 | $11,424,678 |

| LGM | Legacy Minerals | 0.155 | -14% | 402,048 | $18,981,899 |

| HMI | Hiremii | 0.050 | -14% | 26,000 | $8,532,693 |

| CHM | Chimeric Therapeutic | 0.007 | -13% | 16,190,135 | $7,961,127 |

| EM2 | Eagle Mountain | 0.014 | -13% | 135,377 | $6,285,999 |

| MKG | Mako Gold | 0.014 | -13% | 1,059,102 | $15,785,905 |

| ZEU | Zeus Resources Ltd | 0.007 | -13% | 60,000 | $4,825,385 |

Worth a mention here, Micro-X (ASX:MX1) fell 1% despite announcing that it has achieved a milestone with the successful production of full 3D CT images using its proprietary miniature X-ray technology. The images, which show detailed brain anatomy, were produced with one-third of the radiation dose of conventional CT scans. This has triggered a $0.5m payment under the Medical Research Future Fund program. The company is now preparing hospital test benches for ethics approval and plans to begin human clinical trials in early 2025.

IN CASE YOU MISSED IT

EBR Systems (ASX: EBR) has scheduled its Day-100 Meeting with the US Food and Drug Administration (FDA) for December 20.

The meeting is an important step in reviewing the company’s pre-market approval application, giving the FDA a chance to assess its progress and request any additional information or documentation.

Sunshine Metals (ASX:SHN) will receive $950,000 in cash and around 83 million fully-paid ordinary shares in Dart Mining (ASX:DTM) as part of the sale of its Triumph gold project.

The deal enables Sunshine to concentrate on the growth of its Ravenswood Consolidated project while maintaining a significant interest in Triumph as a 13.93% shareholder in Dart.

Raiden Resources (ASX:RDN) is making strong progress at its Andover South project in WA, expanding the current drill program from 5,000 metres to up to 15,000 metres, including drilling Target Area 7, with over 7,000 metres already completed.

Some core samples have been sent to a Perth lab, with assay results expected early in the new year.

At Stockhead, we tell it like it is. While EBR Systems, Sunshine Metals and Raiden Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.