ASX Lunch Wrap: ASX a sea of green after ceasefire; Island Pharma up 30pc on trial results

ASX was a sea of green after ceasefire talks between Israel and Lebanon. Picture via Getty Images

- ASX opens higher, boosted by Wall Street rally and ceasefire news

- Bitcoin dips below $92,000, but regains mark shortly after

- Web Travel jumps, Lynas up despite market concerns

The ASX opened in positive territory on Wednesday, buoyed by a record-setting day on Wall Street and news of a ceasefire between Israel and Hezbollah.

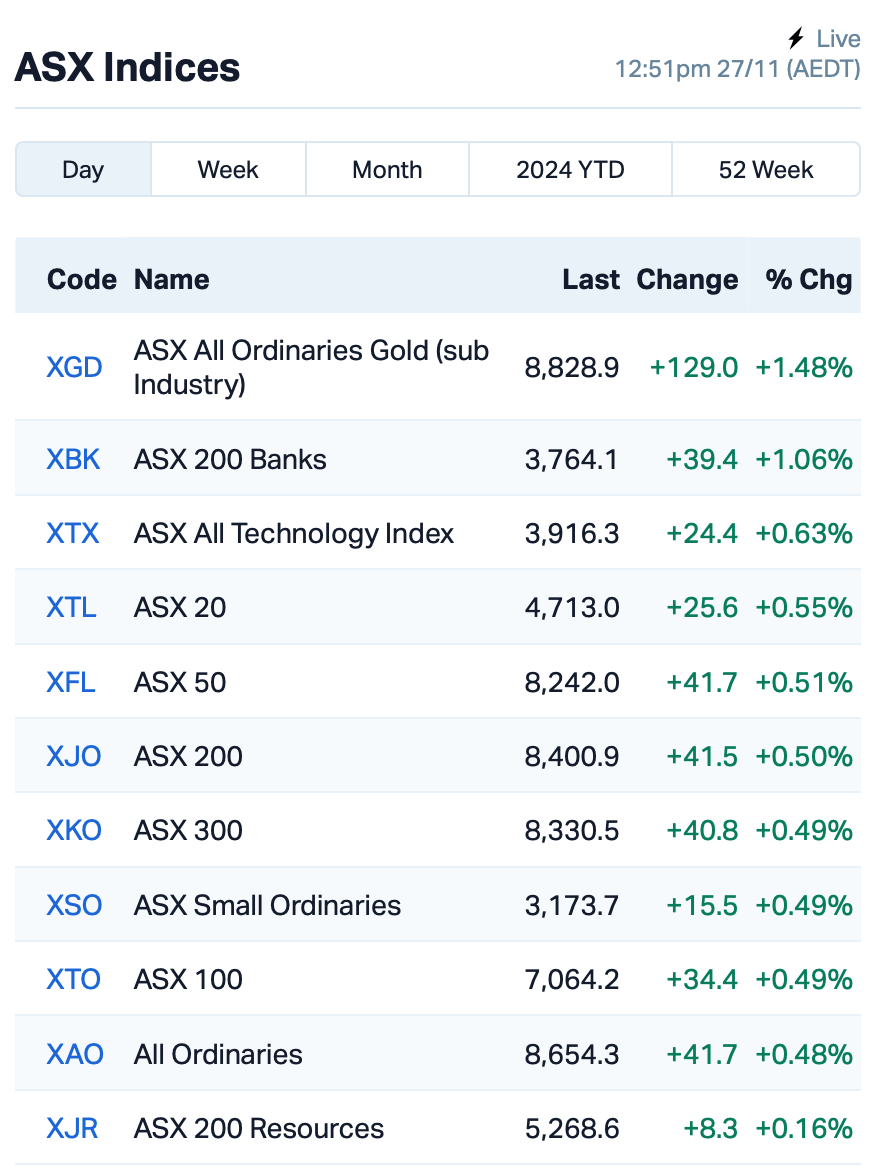

At around 1pm, the benchmark S&P/ASX 200 Index climbed 0.5%.

Overnight on Wall Street, the S&P 500 notched its 52nd record high as geopolitical tensions eased. Investors also shrugged off concerns over Donald Trump’s tariff plans, viewing them more as negotiating tactics than serious policy moves.

Mega tech stocks, led by Microsoft, traded higher, while US automakers with exposure to China and Mexico, like General Motors and Ford, took a hit.

Elsewhere, Bitcoin’s climb towards US$100,000 hit a hurdle, dipping below US$92,000 as traders took profits. The OG cryptocurrency is now back above US$92,500 at the time of writing.

The Aussie dollar keeps going downhill, falling to a four-month low after Trump’s tariff threats.

And meanwhile, ABS data released this morning showed that Aussie inflation remained steady at 2.1% in October, below the forecasted 2.3%, keeping it within the RBA’s target range.

On the ASX on Wednesday, it was a sea of green with the financial sector leading the charge.

Notable large caps announcements came from Web Travel Group (ASX:WEB), which surged more than 14% after reporting a solid net profit of $52.5 million for the six months to September 30.

Lynas (ASX:LYC) rose over 1% despite giving warning at its AGM that any easing in market volatility for rare earth prices would depend on the health of the Chinese economy.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for November 27 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap WML Woomera Mining Ltd 0.002 100% 1,750,579 $2,166,590 88E 88 Energy Ltd 0.002 50% 1,172,871 $28,933,812 AVE Avecho Biotech Ltd 0.003 50% 16,836,688 $6,338,594 MTL Mantle Minerals Ltd 0.002 50% 1,664,695 $6,197,446 SOM SomnoMed Limited 0.390 44% 101,616 $58,349,228 NAG Nagambie Resources 0.024 41% 11,263,627 $13,542,807 FHS Freehill Mining Ltd. 0.004 33% 1,100,180 $9,235,583 GMN Gold Mountain Ltd 0.002 33% 2,444,454 $5,861,210 RLG Roolife Group Ltd 0.004 33% 5,267,407 $3,530,989 ILA Island Pharma 0.215 30% 2,817,890 $25,726,917 HTG Harvest Tech Grp Ltd 0.029 26% 1,997,545 $20,009,162 AKN Auking Mining Ltd 0.005 25% 9,444,807 $1,565,401 BP8 Bph Global Ltd 0.005 25% 2,012,500 $1,586,566 PAB Patrys Limited 0.005 25% 251,963 $8,229,789 TMK TMK Energy Limited 0.003 25% 800,000 $18,651,130 G50 G50Corp Ltd 0.180 24% 751,263 $17,873,327 BIT Biotron Limited 0.022 22% 2,978,255 $16,242,890 BXN Bioxyne Ltd 0.017 21% 9,817,115 $28,689,202 EXT Excite Technology 0.012 20% 586,303 $16,862,792 MEM Memphasys Ltd 0.006 20% 1,000,000 $8,815,407 FSG Field Solu Hldgs Ltd 0.025 19% 463,772 $16,242,336 DOU Douugh Limited 0.010 19% 1,675,958 $8,656,551 WMG Western Mines 0.195 18% 77,197 $14,049,928 TSO Tesoro Gold Ltd 0.026 18% 432,307 $34,175,109

Nagambie Resources (ASX:NAG) has entered a two-month trial to store Potential Acid Sulfate Soil (PASS) material from the North East Link Project in the West Pit at its Nagambie Mine. The trial, managed by EPH Environmental and involving the earthmoving contractor VicCivil, will see PASS delivered by EPH trucks and stored under water as part of the mine’s rehabilitation. The arrangement is expected to be cashflow positive for Nagambie, and it hopes this trial could lead to a long-term contract with EPH, generating significant revenue.

Somnomed (ASX:SOM) has upgraded its FY25 guidance following a strong start to the year, with Q1 revenue of $25.3 million, up 18.2% year-on-year. The company now expects FY25 revenue of around $105 million and EBITDA of over $7 million. Also, the company has appointed Ye-Fei Guo as its new Chief Financial Officer, effective from November 27. Guo, who joined SomnoMed in August as Finance Director, brings over 20 years of finance experience.

Island Pharmaceuticals (ASX:ILA) has announced positive results from its phase 2a trial of ISLA-101, an antiviral treatment for dengue. The trial showed that ISLA-101 reduced viral load in treated subjects, demonstrating its anti-dengue activity. The Safety Review Committee (SRC) found no safety concerns and recommended moving forward with the next phase 2b cohort of the trial, which is planned to start in January 2025. The trial was fully funded through a recent $3.5 million placement, and Island is now preparing to submit the SRC’s findings to the US FDA.

Hartshead Resources (ASX:HHR) has provided an update on its Anning and Somerville gas fields development following the UK government’s budget announcement on October 30, which clarified fiscal terms for the project. The company is considering an updated gas export route, and will meet with the UK’s North Sea Transition Authority (NSTA) in December to review the project’s progress. Hartshead is also assessing exploration opportunities within its licence area, which could add significant value to the development.

Auking Mining (ASX:AKN) has secured $1.385 million in funding through a shortfall placement following its recent rights issue. The funding will support ongoing exploration and an earn-in agreement for a 15% interest in a gold project near Cloncurry, Queensland. The company has partnered with Orion Resources to explore and develop this gold project.

TMK Energy (ASX:TMK) has successfully completed three new pilot production wells (LF-04, LF-05, and LF-06) at its Gurvantes XXXV Coal Seam Gas (CSG) project, on time and within budget. The installation of a Distributed Temperature Sensing (DTS) system has been completed and is ready for data collection from the new wells.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for November 27 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap 1TT Thrive Tribe Tech 0.001 -50% 105,000 $1,406,723 CDE Codeifai Limited 0.001 -33% 76,142,750 $4,381,942 VML Vital Metals Limited 0.002 -33% 862,243 $17,685,201 BDG Black Dragon Gold 0.037 -26% 2,811,462 $15,094,136 CCX City Chic Collective 0.100 -26% 13,670,061 $51,996,302 AOK Australian Oil. 0.003 -25% 2,201,400 $4,007,132 IBG Ironbark Zinc Ltd 0.003 -25% 1,017,895 $7,334,591 LNU Linius Tech Limited 0.002 -25% 240,000 $12,302,431 LPD Lepidico Ltd 0.002 -25% 890 $17,178,371 BEL Bentley Capital Ltd 0.010 -23% 3,904 $989,663 NVX Novonix Limited 0.770 -20% 13,396,772 $476,482,566 CTO Citigold Corp Ltd 0.004 -20% 834,240 $15,000,000 TAS Tasman Resources Ltd 0.004 -20% 500,000 $4,026,248 BET Betmakers Tech Group 0.110 -19% 3,194,068 $130,965,443 G11 G11 Resources Ltd 0.015 -17% 1,961,520 $17,399,198 ALM Alma Metals Ltd 0.005 -17% 943,367 $9,399,133 ERA Energy Resources 0.003 -17% 31,736,524 $1,216,188,722 ERW Errawarra Resources 0.066 -15% 98,504 $7,481,812 NOR Norwood Systems Ltd. 0.028 -15% 215,795 $15,724,066 ASR Asra Minerals Ltd 0.003 -14% 194 $7,882,396 CR9 Corellares 0.006 -14% 45,646 $3,255,647 GTR Gti Energy Ltd 0.003 -14% 45,285 $10,370,324 ICG Inca Minerals Ltd 0.006 -14% 1,013,766 $7,187,058 JAV Javelin Minerals Ltd 0.003 -14% 333,334 $18,162,887

IN CASE YOU MISSED IT

Vertex Minerals (ASX:VTX) is ahead of schedule in installing the gravity gold processing plant at its mine-ready project in New South Wales. It’s time made up from the weather restricting prior civil construction, with the company now hopeful it’ll be able to power the plant up for testing in just a few weeks’ time. And after that – Vertex will move on to commissioning the plant with the gold ore stockpiles it has sitting at the plant.

Chariot Corporation (ASX:CC9) has kicked off Phase 2 drilling at its Black Mountain lithium project in Wyoming, USA. The drilling effort is targeting high-grade lithium zones, with 18 RC holes planned for ~1,000m. Drilling will aim to define a resource that could underpin a pilot mine to supply lithium to the rapidly-growing US market.

Prodigy Gold (ASX:PRX) has reported high-grade gold results exceeding 8.5g/t from its Tanami North project in the Northern Territory. The results came from Photon Assay analysis of 30 RC samples, a method known for its speed, accuracy, and environmental benefits, though subject to sampling bias. The company cross-checked these with fire assays results, bolstering confidence in the project’s future development potential.

Killi Resources’ (ASX:KLI) JV partner Gold Fields has commenced a 1600km2 airborne gravity survey at the West Tanami project in WA’s Kimberley. It marks the first step in Gold Fields’ agreement to earn up to an 85% interest by investing $13 million in exploration over two stages.

Anson Resources (ASX:ASN) has enjoyed success in testing its chemical-free pretreatment process to reduce iron content in brine ahead of being fed into the Koch DLE process.So far, the testwork has yielded 122,000 litres of lithium eluate after pretreatment. The approach looks to lower production costs and improve environmental outcomes, with testing continuing until February 2025.

At Stockhead, we tell it like it is. While Vertex Minerals, Chariot Corporation, Prodigy Gold, Killi Resources and Anson Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.