ASX Large Caps: New year party over as ASX slumps and tech sector tumbles

The ASX has a New Year hangover today. Pic: Getty Images

- ASX closes lower on second trading day of 2024 after a lacklustre session on Wall Street

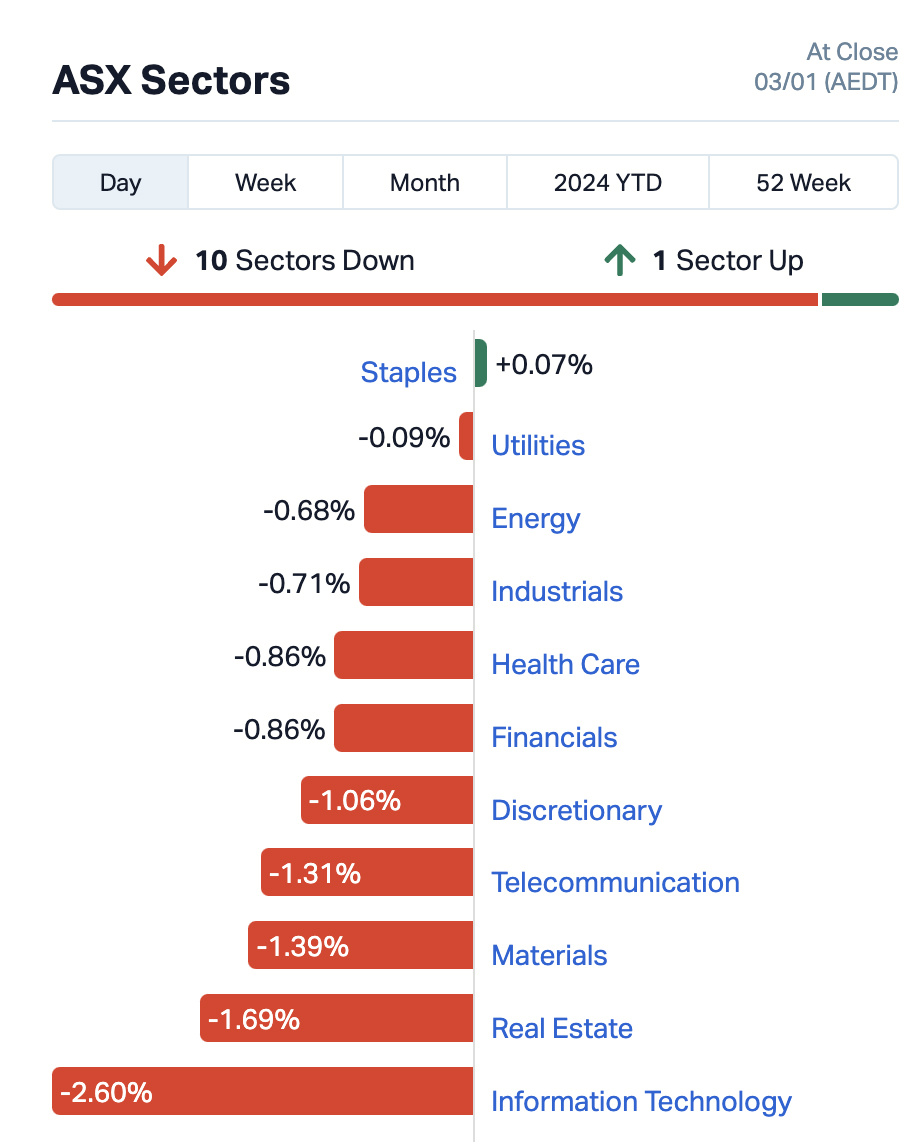

- Following US lead tech sector leads laggards with all sectors in the red except consumer staples

- Suncorp forecasts claims from ongoing weather events impacting east coast to be within its allowance

After a strong first trading day for 2024 yesterday in which the S&P ASX 200 hit a new 52-week high, it was a different story today.

As Stockhead’s Gregor Stronach so aptly described the markets in his ASX Small Caps Lunch Wrap today: “The New Year cheer on the ASX has lasted all of about 24 hours”.

The benchmark closed down 1.37% to 7,523.20 points, following a lacklustre first day trading for 2024 on Wall Street, which left the S&P 500 down 0.57%, and the tech-heavy NASDAQ falling 1.63%.

The Dow Jones index managed to stay just in the green, up 0.06%.

Sellers were piling into the NASDAQ, which gained more than 44% in 2023 after a strong tech rally. Apple led the losses and shed nearly 4% after Barclays downgraded the stock to underweight from neutral, citing disappointing demand for its iPhone 15.

The fall in Apple saw broader selling in the tech sector with Netflix falling almost 5%, while both Meta and Nvidia were both down more than 3%.

Furthermore, in a sign optimism central banks will soon start lowering rates is fading global bond yields headed higher.

The two-year US Treasury yield, which is considered by economists and analysts to reflect interest rate outlook, was up 8 basis points to 4.3%, while 10 year Treasury notes also went up 8 basis points to 3.9%, which is ~15 basis points above its six month low in December.

The yield on Australian three-year bonds, indicative of anticipated interest rates, increased by 8 basis points, reaching 3.69%, while the yield on 10-year bonds moved up by 9 basis points to 4.05%

Tracking the US, tech led the ASX laggards. Real estate and materials were the next biggest losers, while consumer staples narrowly stayed in the green.

BIG CAP WINNERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| HGH | Heartland Group | 1.495 | 7% | 1,018 | $1,001,371,378 |

| STX | Strike Energy Ltd | 0.49 | 3% | 5,352,804 | $1,359,557,284 |

| EDV | Endeavour | 5.38 | 3% | 2,803,930 | $9,384,735,289 |

| JLG | Johns Lyng Group | 6.2 | 2% | 569,839 | $1,689,472,637 |

| MPL | Medibank Private Ltd | 3.635 | 2% | 2,453,531 | $9,831,791,567 |

| QBE | QBE Insurance Group | 14.91 | 1% | 1,960,775 | $21,945,615,904 |

| LSF | L1 Long Short Fund | 2.97 | 1% | 253,843 | $1,815,011,172 |

| EBO | Ebos Group Ltd | 33.55 | 1% | 31,342 | $6,349,137,040 |

| NHF | NIB Holdings Limited | 7.47 | 1% | 231,342 | $3,573,962,452 |

| AMC | Amcor PLC | 14.32 | 1% | 1,791,371 | $9,077,570,132 |

| SIQ | Smart Group Corporation | 8.7 | 1% | 256,243 | $1,143,723,720 |

| SUN | Suncorp Group Ltd | 13.86 | 1% | 883,814 | $17,440,707,063 |

| ZIM | Zimplats Holding Ltd | 21.93 | 1% | 8,326 | $2,338,966,113 |

| AUI | Australian United In | 10.12 | 1% | 28,066 | $1,268,607,589 |

| IFT | Infratil Limited | 9.35 | 1% | 65,150 | $7,726,227,616 |

| BFL | Bsp Financial Group | 5.44 | 1% | 10,116 | $2,522,987,887 |

Suncorp Group (ASX:SUN) rose after providing a rather sunny update on the ongoing weather events that have impacted Queensland, New South Wales, Victoria and the ACT since the end of November, including ex-Tropical Cyclone Jasper.

SUN says while it is too early to provide a total forecast cost of the events given their ongoing nature it expects to be within its natural hazard allowance of $680 million for the half year to December 2023. The natural hazard allowance for FY24 is $1,360 million.

Australia’s largest alcohol retailer Endeavour Group (ASX:EDV) is looking to put the unpleasantries of 2023 behind after announcing the departure of under-seige chairman Peter Hearl.

Board director Bruce Mathieson Jr will also step down in a board restructure, which is hoped to put the BWS and Dan Murphy’s owner on a smoother path for 2024.

The departure of Mathieson Jr comes after a public battle before last year’s AGM that saw his father Bruce Mathieson Sr support another candidate for the board and launch a verbal attack on EDV CEO Steve Donohue and Mr Hearl.

The Mathieson family remains the largest shareholder in EDV.

BIG CAP LOSERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GOR | Gold Road Res Ltd | 1.79 | -8% | 7,123,150 | $2,113,748,424 |

| SQ2 | Block | 105.83 | -7% | 151,380 | $3,994,160,769 |

| BGL | Bellevue Gold Ltd | 1.5575 | -6% | 3,535,560 | $1,901,604,212 |

| CTT | Cettire | 2.76 | -5% | 1,537,772 | $1,113,215,602 |

| HLS | Healius | 1.57 | -5% | 890,803 | $1,205,271,291 |

| WAF | West African Res Ltd | 0.93 | -5% | 1,098,462 | $1,005,590,815 |

| CNI | Centuria Capital | 1.665 | -4% | 302,765 | $1,400,826,548 |

| SLR | Silver Lake Resource | 1.1575 | -4% | 2,214,590 | $1,126,366,921 |

| SLX | Silex Systems | 4.17 | -4% | 315,808 | $1,024,005,966 |

Shares in Block Inc (ASX:SQ2), which acquired Afterpay in January 2022, fell on Wednesday following a sell-off of the dual NYSE-listed buy now, pay later (BNPL) stock in New York overnight.

SQ2 closed down 6.6% on the NYSE overnight following as mentioned a larger sell-off in the US tech sector.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.