ASX July Winners: The best 50 stocks in a strong month for markets

The ASX had its strongest month of the year in July. Pic: Getty Images

- S&P/ASX 200 had its best month of the year in July finishing up 4% to record high

- S&P Dow Jones Indices says large cap companies continued to lead the market in July

- Consumer discretionary and real estate topped July sector leaders, while utilities led laggards

August may well be shaping to be a different story entirely, but Australia’s benchmark S&P/ASX 200 had its best month of the year in July, finishing up 4% to a new record high at 8,092, according to S&P Dow Jones Indices (S&P DJI).

Large-cap companies continued to lead the market, with the YTD return differential between the S&P/ASX 50 and the S&P/ASX Small Ordinaries widening further to 3%.

Global X investment strategist Billy Leung told Stockhead markets were influenced by several major events in July.

Inflation climbed slightly in the June quarter, from 3.6% to 3.8% for the year to June in line with economists’ expectations. But the trimmed mean inflation – the RBA’s approved measure of inflation – fell slightly in the June quarter from 4% to 3.9%.

“Inflation is still above the RBA target range of 2-3% and proving stickier and above the level they would want, which is why rate hikes have not been ruled out,” he said.

“But it is showing signs of coming down.”

Leung noted the upcoming US elections have played a significant role. He said events such as the first presidential debate, the assassination attempt on former president and Republican presidential nominee Donald Trump, JD Vance’s nomination as vice president, and president Joe Biden stepping down as the Democratic nominee, all contributed to market movements.

“These events together pushed forward the ‘election trade’, which historically happens around 60 days ahead of the election date,” he said.

And while the US Federal Reserve didn’t cut rates at its July FOMC meeting, dovish language by US Reserve chair Jerome Powell pointed to the possibility of a potential path towards a September rate cut.

Leung said the Bank of Japan (BoJ) decision to raise interest rates to levels unseen in 15 years along with a detailed plan to slow its massive bond buying has also impacted markets.

The BoJ raised rates on July 31 to 0.25% from 0-0.1% and projected inflation to stay around its 2% target in coming years.

“Markets were speculating on what the Bank of Japan would do throughout July with the increasing anticipation of raising rates,” he says.

“That pushed the Yen higher which led to an unwinding of the Yen carry trade or buying Yen and selling US risky assets.

Leung also noted that the tech earnings season was also a focus.

“Investors were cautious as they awaited earnings reports from major tech companies, which affected overall market sentiment and positioning,” he said.

Consumer Discretionary leads gains

S&P noted the S&P/ASX 200 sector returns were highly disperse. Consumer discretionary, real estate and financials rose more than 6% while materials, energy and utilities remained in the red.

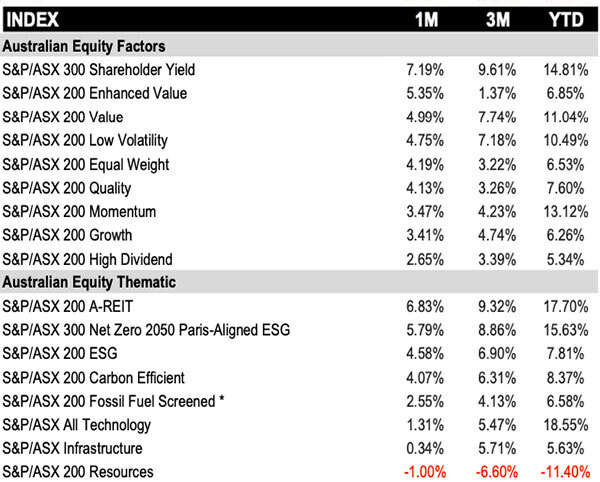

Among factor/thematic indices, the S&P/ASX 300 Net Zero 2050 Paris-Aligned ESG and the S&P/ASX 300 Shareholder Yield continued to shine, extending their YTD excess returns compared the S&P/ASX 300 to 7% and 6%, respectively.

S&P revealed that meanwhile, equity volatility was on the rise from its lows, indicating higher uncertainties being priced in the options market. The S&P/ASX 200 VIX ground higher over the month to close at 12.33.

“This is likely driven by geopolitical tensions and the focus on big tech earnings results,” Leung said.

Here were the 50 best performing ASX stocks for July

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | JULY RETURN % | MARKET CAP |

|---|---|---|---|---|

| I88 | Infini Resources Ltd | 0.71 | 358% | $26,968,160.75 |

| AHN | Athena Resources | 0.007 | 250% | $5,352,337.79 |

| LRL | Labyrinth Resources | 0.014 | 250% | $18,527,278.49 |

| OSL | Oncosil Medical | 0.014 | 250% | $45,408,286.39 |

| AUK | Aumake Limited | 0.006 | 200% | $9,572,034.01 |

| WTM | Waratah Minerals Ltd | 0.305 | 154% | $52,209,037.85 |

| LVH | Livehire Limited | 0.026 | 136% | $12,196,730.60 |

| QHL | Quickstep Holdings | 0.375 | 134% | $28,690,485.60 |

| AEV | Avenira Limited | 0.009 | 125% | $21,771,306.54 |

| WLD | Wellard Limited | 0.037 | 118% | $19,125,011.23 |

| DEL | Delorean Corporation | 0.069 | 109% | $18,983,440.52 |

| KLI | Killiresources | 0.092 | 100% | $10,699,913.13 |

| MSG | MCS Services Limited | 0.004 | 100% | $792,398.61 |

| SVG | Savannah Goldfields | 0.026 | 100% | $6,183,868.15 |

| VPR | Volt Group | 0.002 | 100% | $10,716,208.21 |

| FBR | FBR Ltd | 0.048 | 100% | $227,559,448.83 |

| TTT | Titomic Limited | 0.145 | 99% | $156,701,608.60 |

| MMM | Marley Spoon Se | 0.027 | 93% | $2,472,212.46 |

| REZ | Resources & Energy Group | 0.021 | 91% | $13,579,421.56 |

| AMS | Atomos | 0.036 | 89% | $43,691,843.09 |

| ZLD | Zelira Therapeutics | 0.52 | 86% | $6,808,293.00 |

| T3D | 333D Limited | 0.011 | 83% | $955,559.48 |

| 3DP | Pointerra Limited | 0.074 | 80% | $53,135,068.60 |

| PSL | Paterson Resources | 0.027 | 80% | $11,856,984.85 |

| HXL | Hexima | 0.019 | 73% | $3,173,752.95 |

| CSX | Cleanspace Holdings | 0.43 | 72% | $32,885,859.10 |

| MEM | Memphasys Ltd | 0.012 | 71% | $15,210,229.72 |

| RIM | Rimfire Pacific | 0.048 | 71% | $110,131,251.74 |

| RXM | Rex Minerals Limited | 0.445 | 71% | $344,615,894.75 |

| CYL | Catalyst Metals | 1.92 | 70% | $443,662,698.96 |

| AL3 | Aml3D | 0.16 | 68% | $62,221,340.28 |

| MOM | Moab Minerals Ltd | 0.005 | 67% | $3,969,071.19 |

| NAE | New Age Exploration | 0.005 | 67% | $7,175,595.64 |

| REM | Remsense Technologies | 0.03 | 67% | $4,945,790.61 |

| TTI | Traffic Technologies | 0.005 | 67% | $4,864,425.94 |

| SMN | Structural Monitor | 0.66 | 65% | $86,536,202.76 |

| IXU | IXUP Limited | 0.023 | 64% | $29,407,299.27 |

| ASR | Asra Minerals Ltd | 0.0065 | 63% | $12,216,476.09 |

| JAL | Jameson Resources | 0.06 | 62% | $29,343,847.32 |

| SKS | SKS Tech Group Ltd | 1.62 | 62% | $184,468,935.75 |

| A1G | African Gold Ltd. | 0.034 | 62% | $8,133,334.17 |

| ALC | Alcidion Group Ltd | 0.075 | 60% | $103,370,438.02 |

| APX | Appen Limited | 0.75 | 60% | $149,411,100.81 |

| MLM | Metallica Minerals | 0.035 | 59% | $33,597,337.27 |

| AAJ | Aruma Resources Ltd | 0.019 | 58% | $2,756,481.08 |

| FCT | Firstwave Cloud Tech | 0.019 | 58% | $30,780,348.52 |

| DSK | Dusk Group | 0.915 | 58% | $52,305,006.60 |

| AI1 | Adisyn Ltd | 0.033 | 57% | $7,220,148.08 |

| DDB | Dynamic Group | 0.29 | 57% | $39,973,970.96 |

| SOM | SomnoMed Limited | 0.395 | 56% | $86,443,301.20 |

Infini Resources (ASX:I88) topped the leader board in July after announcing impressive uranium assays from its Portland Creek uranium project in Newfoundland, Canada.

As Stockhead’s Cameron Drummond explained a while back, I88 announced that its uranium assays were too much for the lab to handle, so they sent them somewhere else to get tested. The results came back with assays as high as 74,997ppm U3O8.

Iron ore junior Athena Resources (ASX:AHN) was up 250% in June after announcing a boardroom shuffle. John Welborn was appointed non-exec chair and Garry Plowright non-exec director with immediate effect, while Ed Edwards and Hau Wan Wai have resigned as directors of the company.

Welborn is executive chairman of Fenix Resources (ASX:FEX) which could be a potential +30% major shareholder in AHN if $1m worth of convertible notes are converted into shares.

AHN said it is investigating the opportunity to leverage FEX’s capabilities and experience to advance the Byro Magnetite Project and drive value for shareholders.

Focused on developing treatments for pancreatic cancer OncoSil Medical (ASX:OSL) rose 250% in July with the company noting it had successfully arranged for a $2.7m investment from an Aussie institutional investor.

This deal involves issuing new shares at a price of $0.007 each.

“This investment serves to further validate the future potential of our device in the treatment pathway of patients afflicted with unresectable locally advanced pancreatic cancer,” CEO Nigel Lange said.

AuMake International (ASX:AUK) rose 200% in June after announcing had entered a non-binding three year strategic co-operation framework with Chinese State-Owned Enterprise Yangtze River New Silk Road International Logistics, to “establish a comprehensive end-to-end supply chain network for Australian goods and services”.

Here were the 50 worst performing ASX stocks for July

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | JULY RETURN % | MARKET CAP |

|---|---|---|---|---|

| OVT | Ovanti Limited | 0.003 | -80% | $4,960,421.94 |

| AX8 | Accelerate Resources | 0.01 | -72% | $6,207,539.32 |

| ECG | Ecargo Holdings | 0.006 | -68% | $3,691,500.00 |

| NRZ | Neurizer Ltd | 0.005 | -62% | $9,512,153.25 |

| HE8 | Helios Energy Ltd | 0.013 | -59% | $36,456,692.20 |

| AGY | Argosy Minerals Ltd | 0.039 | -58% | $59,692,758.29 |

| RCR | Rincon | 0.047 | -57% | $14,855,059.68 |

| ERA | Energy Resources | 0.015 | -53% | $442,965,983.76 |

| FMR | FMR Resources Ltd | 0.19 | -53% | $3,783,436.37 |

| CAQ | CAQ Holdings Ltd | 0.011 | -52% | $7,895,649.09 |

| 1TT | Thrive Tribe Tech | 0.002 | -50% | $941,243.04 |

| GCM | Green Critical Minerals | 0.0025 | -50% | $3,466,462.56 |

| PPG | Pro-Pac Packaging | 0.07 | -50% | $15,080,080.01 |

| RIE | Riedel Resources Ltd | 0.001 | -50% | $3,335,753.45 |

| IBX | Imagion Biosys Ltd | 0.044 | -48% | $1,819,820.65 |

| 1MC | Morella Corporation | 0.041 | -45% | $10,874,736.53 |

| PAM | Pan Asia Metals | 0.09 | -44% | $14,841,467.44 |

| RNX | Renegade Exploration | 0.009 | -44% | $11,520,480.83 |

| ICG | Inca Minerals Ltd | 0.004 | -43% | $3,242,145.92 |

| SUM | Summit Minerals | 0.195 | -43% | $13,297,418.53 |

| GTG | Genetic Technologies | 0.044 | -41% | $6,252,941.58 |

| DTR | Dateline Resources | 0.005 | -41% | $8,745,281.71 |

| FBM | Future Battery | 0.021 | -40% | $15,232,346.34 |

| M24 | Mamba Exploration | 0.009 | -40% | $1,656,740.48 |

| MEL | Metgasco Ltd | 0.003 | -40% | $7,237,933.73 |

| BEZ | Besra Gold Inc | 0.06 | -39% | $27,176,558.89 |

| NWC | New World Resources | 0.019 | -39% | $70,890,376.38 |

| IR1 | Irismetals | 0.215 | -38% | $27,682,171.31 |

| CTE | Cryosite Limited | 0.775 | -38% | $35,630,980.99 |

| WML | Woomera Mining Ltd | 0.0025 | -38% | $3,045,347.50 |

| VMM | Viridis Mining | 0.76 | -37% | $48,512,751.50 |

| RC1 | Redcastle Resources | 0.014 | -36% | $4,595,978.17 |

| KM1 | Kali Metals | 0.15 | -36% | $10,755,867.36 |

| CUF | Cufe Ltd | 0.009 | -36% | $13,366,748.65 |

| MEI | Meteoric Resources | 0.1 | -35% | $208,962,583.73 |

| RR1 | Reach Resources Ltd | 0.011 | -35% | $8,744,313.49 |

| FL1 | First Lithium Ltd | 0.115 | -34% | $9,956,700.50 |

| ADG | Adelong Gold Limited | 0.004 | -33% | $5,030,950.31 |

| BP8 | BPH Global Ltd | 0.002 | -33% | $1,189,924.44 |

| CMD | Cassius Mining Ltd | 0.006 | -33% | $3,252,026.97 |

| CR9 | Corellares | 0.008 | -33% | $3,720,739.46 |

| CUS | Copper Search Ltd | 0.06 | -33% | $6,360,782.79 |

| GRL | Godolphin Resources | 0.014 | -33% | $3,208,368.32 |

| LPD | Lepidico Ltd | 0.002 | -33% | $25,767,374.65 |

| ME1 | Melodiol Global Health | 0.002 | -33% | $1,215,472.97 |

| RIL | Redivium Limited | 0.002 | -33% | $5,461,709.62 |

| RNE | Renu Energy Ltd | 0.004 | -33% | $3,630,670.01 |

| TKL | Traka Resources | 0.001 | -33% | $2,918,487.83 |

| BCB | Bowen Coal Limited | 0.035 | -33% | $108,224,208.92 |

| SUH | Southern Hemisphere Mining | 0.027 | -33% | $20,614,721.23 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.