ASX July Winners Column: BNPL bounces back as markets catch hopium high

Pic:

- July a great month for stocks — ASX200 had its best month since March, Emerging Companies (XEC) gained an eye-watering +14%

- Copper explorer Cobre stands tall as broader mining and exploration sector wilts

- Standout sector was Buy Now Pay Later, which had been getting its arse kicked all year

July was excellent for ASX stocks, bizarrely enough.

A textbook economic turdstorm – ‘technical’ recession for the US, higher interest rates, ongoing inflation, and a weakening property market globally – was handily offset by investor hopium.

Wall Street closed out July with near-record gains after robust mega-cap tech earnings, hope that the Fed will pivot soon, and economic data that suggests the consumer is doing just fine.

The tech-heavy Nasdaq rose 12.55%, posting one of its best months on record.

The S&P500 (+9.1%) and Dow Jones (+6.7%) indices both recorded their best monthly gain since November 2020. For the first time this year, all sectors of the S&P500 index improved.

Asia-Pacific equity markets, excluding China, posted gains as well. The ASX200 had its best month since March after climbing 5.7%.

And S&P/ ASX Emerging Companies (XEC) gained an eyewatering +14% to put the index back into the black for 2022.

“I suppose we can attribute this reaction to the market looking ahead to see what is over the horizon,” Far East Capital analyst Warwick Grigor says.

“Investors are allowing themselves to be more optimistic than they were three months ago.

“Again, markets move on expectation and emotion, often more so than on actual news.”

We have experienced a market collapse in recent months – April, May and June were horrid — due to the fear of interest rate rises and inflation, so the selling has already happened, Grigor says.

“We are now seeing bargain hunting that is lifting stocks off their low,” he says.

“Steep downtrends are being broken and there are green shoots of optimism suggesting that we have seen the worst.

“Whether or not this is sustainable depends on how much money comes back into the market, but it is looking decidedly more positive for the time being.”

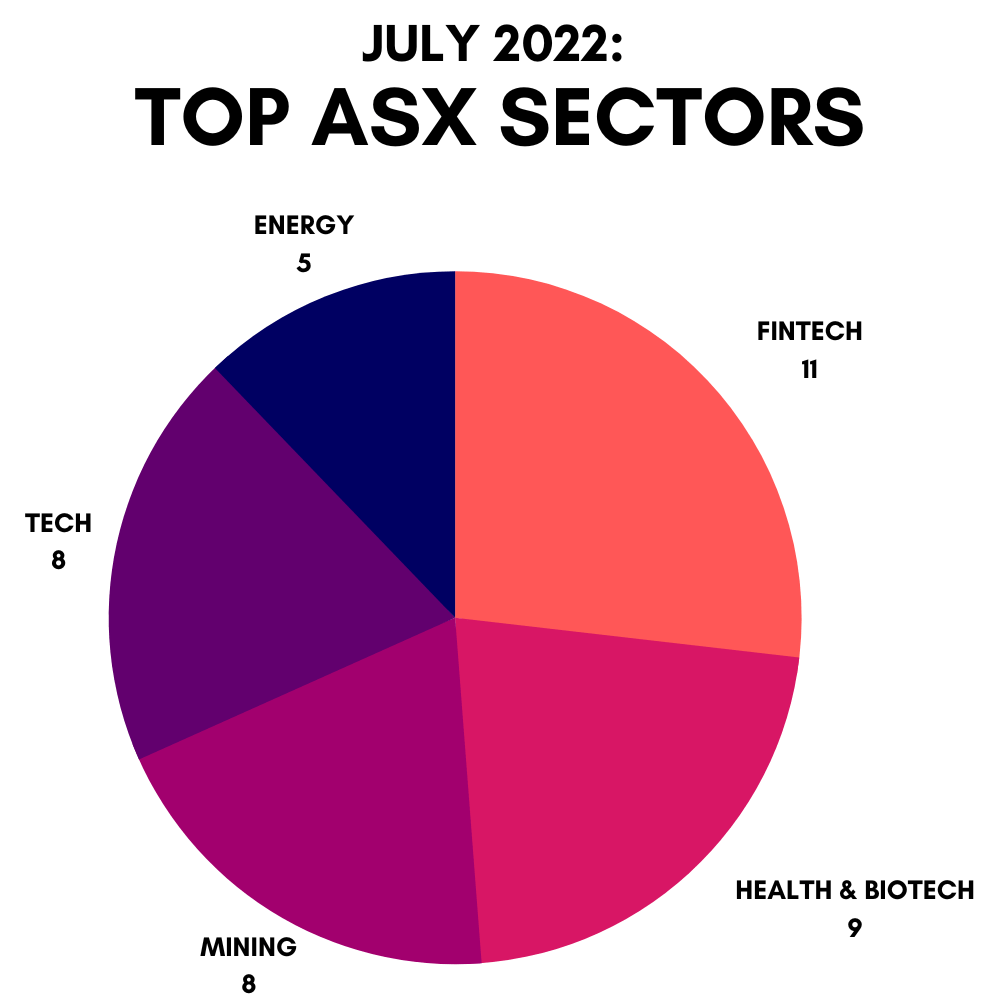

Which ASX sectors performed best in July?

Here are the top 50 performing ASX stocks for July:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | JULY RETURN % | LAST SHARE PRICE | MARKET CAP | SECTOR |

|---|---|---|---|---|---|

| CBE | Cobre | 231% | 0.086 | $14,225,003 | Minerals |

| SZL | Sezzle Inc. | 215% | 0.82 | $164,685,184 | Fintech |

| LBY | Laybuy Group Holding | 211% | 0.115 | $29,304,208 | Fintech |

| B4P | Beforepay Group | 167% | 0.64 | $21,670,073 | Fintech |

| IOU | Ioupay Limited | 162% | 0.11 | $60,941,327 | Fintech |

| SMX | Security Matters | 157% | 0.27 | $44,796,114 | Technology |

| AGH | Althea Group | 154% | 0.155 | $49,793,418 | Health & Biotech |

| PSC | Prospect Res Ltd | 150% | 0.12 | $55,471,135 | Minerals |

| ZIP | ZIP Co Ltd. | 149% | 1.135 | $780,861,317 | Fintech |

| OPY | Openpay Group | 145% | 0.355 | $56,189,165 | Fintech |

| INP | Incentiapay Ltd | 143% | 0.017 | $21,506,082 | Fintech |

| DOU | Douugh Limited | 140% | 0.036 | $21,414,754 | Fintech |

| FBR | FBR Ltd | 122% | 0.04 | $111,156,133 | Technology |

| DTC | Damstra Holdings | 122% | 0.255 | $65,712,579 | Technology |

| ZLD | Zelira Therapeutics | 122% | 2.15 | $20,590,799 | Health & Biotech |

| NSX | NSX Limited | 114% | 0.06 | $16,967,671 | Financial Services |

| EBR | EBR Systems | 109% | 0.71 | $186,720,436 | Health & Biotech |

| NUH | Nuheara Limited | 104% | 0.245 | $33,612,855 | Health & Biotech |

| SPT | Splitit | 104% | 0.255 | $120,211,330 | Fintech |

| OBM | Ora Banda Mining Ltd | 104% | 0.055 | $75,569,302 | Minerals |

| AFW | Applyflow Limited | 100% | 0.003 | $8,872,824 | Technology |

| EXL | Elixinol Wellness | 100% | 0.04 | $12,650,623 | Health & Biotech |

| MCM | Mc Mining Ltd | 96% | 0.235 | $46,448,894 | Minerals |

| RCW | Rightcrowd | 90% | 0.076 | $19,865,282 | Technology |

| PRL | Province Resources | 89% | 0.1 | $117,399,314 | Energy |

| GNX | Genex Power Ltd | 87% | 0.215 | $297,813,085 | Energy |

| TYX | Tyranna Res Ltd | 86% | 0.026 | $39,841,377 | Minerals |

| HAL | Halo Technologies | 85% | 0.51 | $66,047,871 | Financial Services |

| 1VG | Victory Goldfields | 85% | 0.185 | $7,114,757 | Minerals |

| ABE | Ausbondexchange | 84% | 0.415 | $14,473,616 | Financial Services |

| MDC | Medlab Clinical Ltd | 81% | 0.087 | $29,769,283 | Health & Biotech |

| KNO | Knosys Limited | 81% | 0.105 | $22,694,563 | Technology |

| GCR | Golden Cross | 80% | 0.009 | $9,875,305 | Minerals |

| MVP | Medical Developments | 79% | 2.52 | $179,688,744 | Health & Biotech |

| ECS | ECS Botanics Holding | 79% | 0.025 | $27,668,267 | Health & Biotech |

| DCC | Digitalx Limited | 78% | 0.048 | $35,637,314 | Crypto |

| TNG | TNG Limited | 78% | 0.087 | $120,792,385 | Minerals |

| NGY | Nuenergy Gas Ltd | 76% | 0.03 | $44,428,665 | Energy |

| PYR | Payright Limited | 76% | 0.13 | $10,167,848 | Fintech |

| HIQ | Hitiq Limited | 75% | 0.07 | $7,920,933 | Technology |

| SDV | Scidev Ltd | 74% | 0.34 | $64,457,771 | Environmental |

| MR1 | Montem Resources | 74% | 0.04 | $10,302,443 | Energy |

| GFN | Gefen Int | 73% | 0.13 | $8,832,217 | Fintech |

| CNQ | Clean Teq Water | 73% | 0.605 | $27,023,035 | Environmental |

| SPX | Spenda Limited | 70% | 0.017 | $54,088,250 | Fintech |

| CFO | Cfoam Limited | 67% | 0.005 | $3,669,203 | Shell Company |

| VR1 | Vection Technologies | 66% | 0.093 | $103,222,959 | Technology |

| IMR | Imricor Med Sys | 65% | 0.305 | $43,795,631 | Health & Biotech |

| NWM | Norwest Minerals | 64% | 0.046 | $8,307,940 | Minerals |

| LAW | Lawfinance Ltd | 64% | 0.27 | $17,193,848 | Financial Services |

Cobre stands tall as broader mining and exploration sector wilts

It managed to eke out a win, but the miner-heavy S&P/ASX 200 Materials [XMJ] index was still one of the worst performers last month as stocks battle higher inflation and a slowing Chinese economy.

Standing tall was exploration minnow Cobre (ASX:CBE), which hit paydirt at its Ngami copper project in Botswana on July 27.

The first diamond drill hole intersected a broad zone of copper, one of the main commodities at the heart of most electrical technologies, over a 59m interval.

“This new copper discovery represents a transformational moment for Cobre shareholders,” CBE executive chairman and MD Martin Holland said. Investors agreed.

A buy now, pay later renaissance?

The BNPL sector had been getting its arse kicked all year.

“The model looked tired, investors took to the high road and headline mergers like Block and sector leader Afterpay – instead of consolidating strength – suddenly looked ill-advised,” Stockhead’s Christian Edwards says.

But then, in July, the ASX Tech Index went on a massive run to outperform the broader ASX300 by quite some margin.

Since hitting a new 52-week low of 44 cents a pop at the end of June, industry stalwart Zip (ASX:ZIP) has jumped 150%. Joining it in our top 50 for July is (almost) the entire ASX buy now, pay later squad.

Why though?

“It is possible the swift reckoning in inflation settings, in the sense that at least Stateside, investors have now entirely priced in cash rate changes, has triggered confidence that the bottom of market falls is close,” Edwards writes.

“BNPL names were among the first and the fastest to fall. Perhaps it wasn’t the bottom of the BNPL model that fell over, just the over-valuations following years of market-leading share price gains.

“US 10-year bond yields have fallen 12% to a yield of 2.76% after hitting 3.42% yield on June 15 – perhaps it is the market telling us that it thinks rates are close to peaking and thus looking for the most hard hit sector in tech?

“Or is it simply that the market is happy to pick through the wreckage for opportunities in the first-to-get-bombed-out tech sector?”

That’s bargain hunting.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.