Return of the Living Tech: Is Buy Now Profit Later back on the menu already?

News

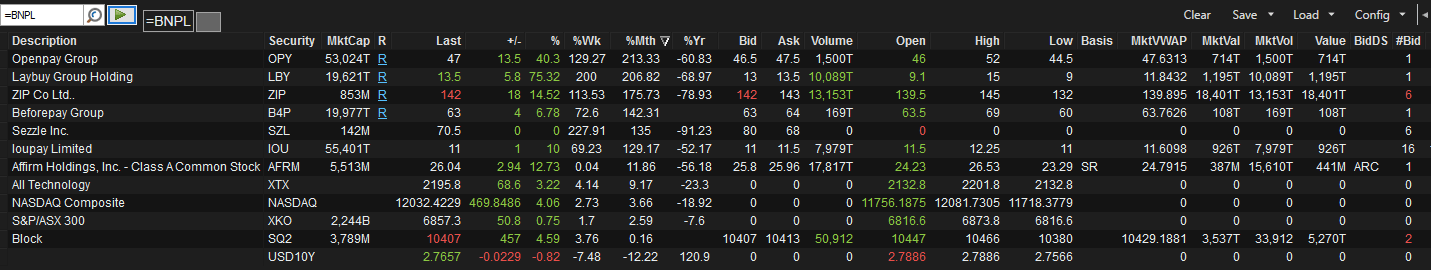

It really does appear Wednesday’s heroic post-lunchtime 50% surge in the value of Sezzle (ASX:SZL) shares (from $0.42 cents to about $0.80 cents, before someone at the ASX snapped awake and slapped the jited BNPL with a speeding ticket) is part of a broader real-life return of the living dead moment in Aussie BNPL shares.

Before the car was slammed into the garage, SZL had climbed down from 105% gains to a more reasonable 97%. In fact almost the entire junior buy now, pay later squadron had gone and posted more mammoth gains.

Laybuy (ASX:LBY) jumped 79%, it’s up 55% today making monthly returns clock 200%.

Openpay (ASX:OPY) 30% yesterday. 55% today. 203% this month.

Splitit (ASX:SPT) is up 117% month-to-date.

IOUPay (ASX:IOU) is up 12% today, 124% this month.

Even Humm (ASX:HUM) is ahead 7.8% this morning, adding 16% for the month.

The BNPL which left it to sezzle in its own juices at the M&A altar – ZIP Co (ASX:ZIP) ZIP added 23% to $1.27.

Even before Zip skipped out on its acquisition of Sezzle in a deal worth $491 million, shares in both had cratered by more than 80% each since January.

Zip had talked up that the combined group could generate positive cash flow by financial 2024, after both companies underwent rounds of cost cutting initiatives.

But, don’t feel bad for ZIP, or co-founder and CEO Larry Diamond.

At the time of writing – of the ASX-listed stocks, ZIP has just about tripled nearly, and has had the biggest gain, as measured by the amount of market capitalisation added, of any ASX BNPL company.

However, (puts hand over mic, gets given note) … I’ve just been informed Sezzle has responded to last nights’s speeding ticket – let’s go live to the pictures I just made below:

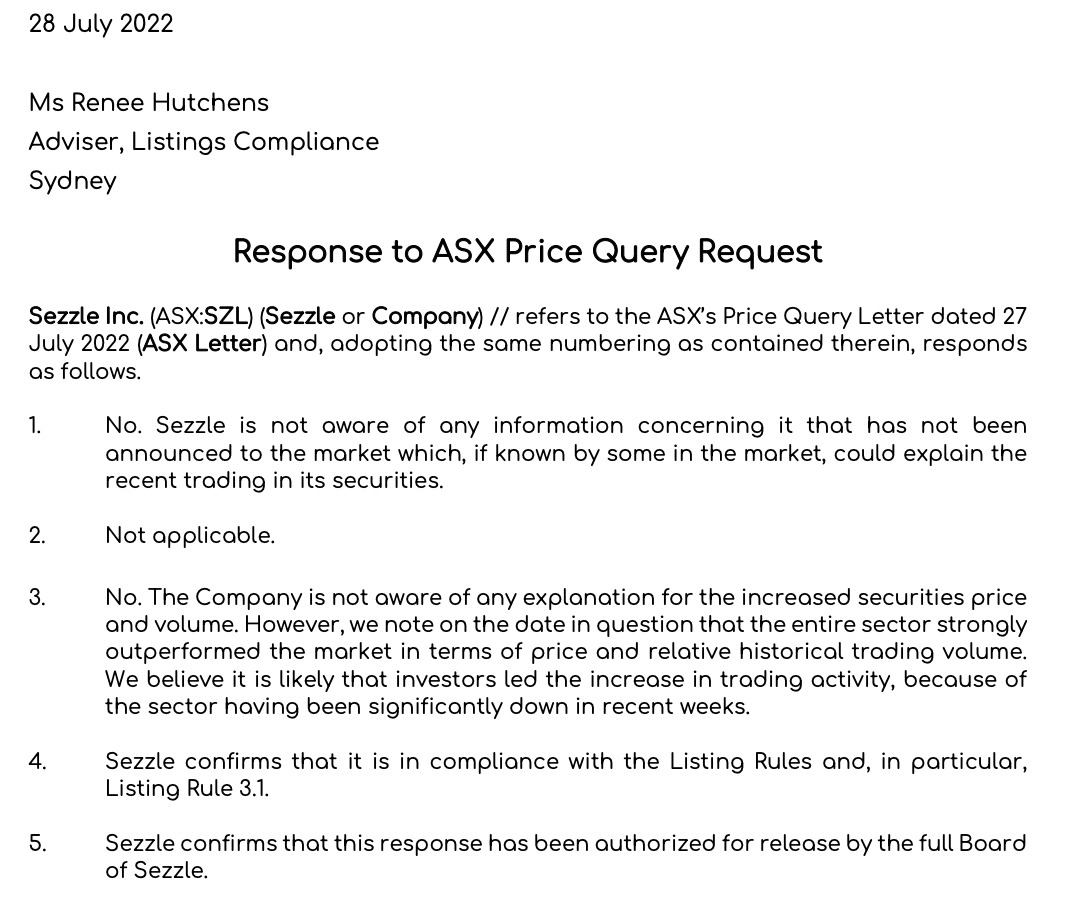

And the new one from SZL:

Well. There it is. You internet’ed it here first – SZL doesn’t know why its shares have gone gaga. Stockhead: Always breaking new ground in making pics and putting them up on digital media.

The BNPL sector has been getting its B kicked all year.

The model looked tired, investors took to the high road and headline mergers like Block and sector leader Afterpay – instead of consolidating strength – suddenly looked ill-advised.

The ASX Tech Index is up 9% over last month, more than triple the performance of the broader ASX300 (up 2.59%)

Since hitting a new 52-week low of 44 cents a pop at the end of last month, Zip is now up 192% for July. In terms of return it’s dramatically outperformed the US-listed BNPL benchmark Affirm, the largest listed pure play in the space, which is up 12% over the last month.

Also worth noting that Block, no longer a pure BNPL playa, is still underperforming, and barely changed in percentage terms over the same period.

Now, I can’t name names, but (and it pleasures me to use this expression) word on the street has it that there’s no pending acquisition announcement for SZL or anything like that.

It is possible the swift reckoning in inflation settings, in the sense that at least Stateside, investors have now entirely priced in cash rate changes, has triggered confidence that the bottom of market falls is close. BNPL names were among the first and the fastest to fall. Perhaps it wasn’t the bottom of the BNPL model that fell over, just the over-valuations following years of market-leading share price gains.

US 10-year bond yields have fallen 12% to a yield of 2.76% after hitting 3.42% yield on June 15 – perhaps it is the market telling us that it thinks rates are close to peaking and thus looking for the most hard hit sector in tech?

Or is it simply that the market is happy to pick through the wreckage for opportunities in the first-to-get-bombed-out tech sector.

SZL has a call tomorrow morning too which might provide some insights.

Tony Sycamore from City Index is enjoying the fireworks.

“Like the mythical phoenix rising from the ashes, the second coming of the BNPL sector appears to have arrived,” he wrote to us this morning.

“The trigger for the resurrection – the recent dissolution of the proposed marriage between Sezzle and ZIP.

“After the rally in the Sezzle share price yesterday – could it be that BNPL now stands for Buy Now Profit Later??”