ASX August Winners: The 50 best stocks in a volatile month for markets

It was a wild ride for investors in August. Pic: Getty Images

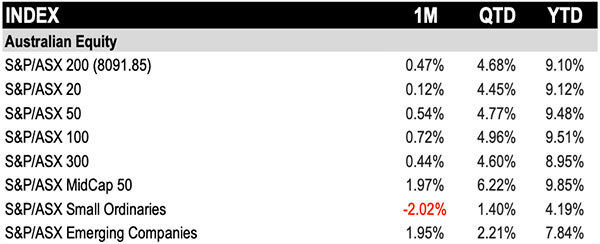

- S&P/ASX 200 recovers from heavy volatility early in the month to finish up 0.47% in August

- S&P Dow Jones Indices said mid-caps led the gains putting them ahead of large and small caps YTD

- Larvotto Resources rose on the back of China deciding to restrict exports of highly sought-after antimony

While Australia’s benchmark S&P/ASX 200 had its best month of the year in July, finishing up 4% to a new record high at 8,092, August was bit rougher. Traditionally, the last month of the northern summer is always a bit of a softer month for markets due to lower trading volumes as many investors and traders take vacations, reducing liquidity and momentum.

Analysts say earnings season also winds down in August, providing fewer catalysts for stock movements, while portfolio adjustments for the final months of the year can also contribute to subdued market activity.

Fears of a US recession in early August had investors all on edge, though and led to heavy falls globally including Australia.

On top of this Japan’s benchmark stock index, the Nikkei 225, suffered its biggest decline for nearly four decades. The Nikkei sunk by 12% on Monday, August 5 in its biggest single-day fall since the Black Monday crash of 1987 with flow-on effects globally.

Analysts noted that another factor leading to the decline in markets was carry trades, where investors borrow money from countries with low interest rates and weaker currencies to invest in higher-yielding assets elsewhere.

Japan was a popular country for carry trades because the Bank of Japan (BoJ) had a long-standing monetary policy of extremely low interest rates.

However, Japan’s central bank recently raised interest rates from nearly zero to 0.25% on July 31 and as the World Economic Forum explained, the small shift had “big implications for carry trades”.

The yen strengthened and interest rates rose as investors started selling stocks to repay these loans, contributing to the market downturn.

The CBOE Volatility Index (VIX) – often referred to as Wall Street’s fear gauge – jumped by 65% to 38.57 on August 5, which was the VIX’s highest closing level since October 2020.

Experts warned investors should hold their nerve and prepare for more volatility.

All said, Australia equities held up better than their global peers in August, “eking out small gains for the month”, according to S&P Dow Jones Indices (S&P DJI).

The benchmark S&P/ASX 200 recovered quickly from a 6% drop earlier in the month and finished 0.3% shy of its recent record high.

Australian mid-cap companies led the market with a 2% gain in the S&P/ASX MidCap 50, which put them ahead of large caps as well as small caps YTD.

Tech leads gains, up 38% YTD

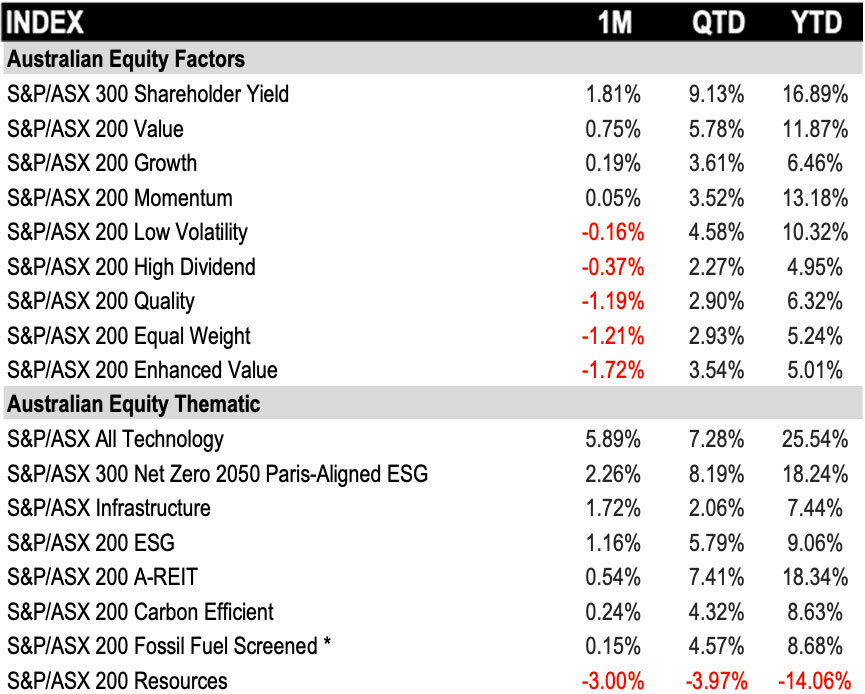

S&P noted sector returns were highly dispersed with five of the 11 sectors falling for August. The S&P/ASX 200 Information Technology soared 8% while Materials and Energy completed a third consecutive month in the red.

Among factor/thematic indices, the S&P/ASX 300 Net Zero 2050 Paris-Aligned ESG and the S&P/ASX 300 Shareholder Yield continued to outperform, extending their YTD excess returns versus the S&P/ASX 300 to 9% and 8%, respectively.

S&P said equity volatility stabilised quickly from an earlier spike. The S&P/ASX 200 VIX closed at 10.94, below its trailing one-year average.

Here were the 50 best performing ASX stocks for August

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | AUGUST RETURN % | MARKET CAP |

|---|---|---|---|---|

| HCT | Holista CollTech Ltd | 0.026 | 271% | $7,248,802 |

| MHI | Merchant House | 0.135 | 238% | $12,725,977 |

| TGH | Terragen | 0.044 | 214% | $16,239,570 |

| LRV | Larvotto Resources | 0.375 | 213% | $115,658,964 |

| LTP | LTR Pharma Limited | 1.88 | 141% | $159,403,414 |

| KPO | Kalina Power Limited | 0.007 | 133% | $17,404,758 |

| AQC | Auspac Coal | 0.22 | 129% | $117,436,203 |

| FXG | Felix Gold Limited | 0.089 | 117% | $22,742,244 |

| MTM | MTM Critical Metals | 0.059 | 111% | $16,585,304 |

| CNJ | Conico Ltd | 0.002 | 100% | $4,403,055 |

| LSR | Lodestar Minerals | 0.002 | 100% | $5,201,560 |

| NME | Nex Metals Explorat | 0.048 | 100% | $13,069,342 |

| RIL | Redivium Limited | 0.004 | 100% | $10,923,419 |

| AME | Alto Metals Limited | 0.065 | 97% | $46,899,006 |

| IMI | Infinity Mining | 0.019 | 90% | $2,256,314 |

| M2R | Miramar | 0.013 | 86% | $5,132,134 |

| BXN | Bioxyne Ltd | 0.011 | 83% | $22,513,099 |

| MHK | Metalhawk | 0.091 | 82% | $9,160,970 |

| NAG | Nagambie Resources | 0.021 | 75% | $16,729,349 |

| CRR | Critical Resources | 0.012 | 71% | $21,364,203 |

| SPA | Spacetalk Ltd | 0.029 | 71% | $13,763,192 |

| AAU | Antilles Gold Ltd | 0.005 | 67% | $7,307,139 |

| EXL | Elixinol Wellness | 0.005 | 67% | $6,605,912 |

| NIM | Nimy Resources | 0.085 | 67% | $14,157,907 |

| EXR | Elixir Energy Ltd | 0.165 | 65% | $197,419,013 |

| CBL | Control Bionics | 0.09 | 64% | $18,835,810 |

| RIM | Rimfire Pacific | 0.078 | 63% | $179,028,284 |

| HCL | Highcom Ltd | 0.205 | 58% | $21,049,948 |

| EWC | Energy World Corp | 0.014 | 56% | $43,104,897 |

| GT1 | Green Technology | 0.095 | 53% | $30,566,449 |

| ATP | Atlas Pearls Ltd | 0.145 | 53% | $63,331,159 |

| HUM | Humm Group Limited | 0.685 | 52% | $336,589,371 |

| WGR | Western Gold Resources | 0.035 | 52% | $5,962,427 |

| A8G | Australasian Metals | 0.13 | 51% | $6,775,664 |

| CHR | Charger Metals | 0.089 | 51% | $6,890,402 |

| AEV | Avenira Limited | 0.0135 | 50% | $36,504,460 |

| AOA | Ausmon Resorces | 0.003 | 50% | $2,117,999 |

| HLX | Helix Resources | 0.0045 | 50% | $14,688,872 |

| ICU | Investor Centre Ltd | 0.006 | 50% | $1,827,068 |

| MTB | Mount Burgess Mining | 0.0015 | 50% | $1,298,147 |

| SHO | Sportshero Ltd | 0.006 | 50% | $3,706,997 |

| MCM | Mc Mining Ltd | 0.21 | 50% | $86,942,803 |

| APX | Appen Limited | 1 | 49% | $223,001,643 |

| BEZ | Besra Gold | 0.097 | 49% | $40,555,788 |

| EZZ | EZZ Life Science | 2.66 | 49% | $118,139,112 |

| CUS | Copper Search | 0.083 | 48% | $9,427,589 |

| LSA | Lachlan Star Ltd | 0.105 | 48% | $21,795,185 |

| GW1 | Greenwing Resources | 0.059 | 48% | $13,084,733 |

| PYC | PYC Therapeutics | 0.14 | 47% | $653,251,677 |

| PNR | Pantoro Limited | 0.125 | 47% | $806,753,814 |

Larvotto Resources (ASX:LRV) rose 213% in August. As Stockhead’s Cameron Drummond reported, LRV was on tear on the back of China deciding to restrict exports of highly sought-after antimony – of which it currently dominates production.

A 5250m RC drilling program is also about to kick off at the Clarks Gully deposit at the explorer’s Hillgrove gold-antimony project in NSW to increase confidence in the current 266,000t antimony (Sb) and 2g/t gold (10.6g/t AuEq) resource.

LTR Pharma (ASX:LTP) rose in a key milestone in the rollout of its nasal spray treatment for erectile dysfunction (ED) with the first select group of patients receiving Spontan under the Therapeutic Goods Administration (TGA) Authorised Prescriber Scheme (APS).

LTP says the milestone marks a significant step forward in the market introduction strategy with APS providing faster patient access to Spontan.

Clean-energy-focused company Kalina Power (ASX:KPO) rose 133% in August. The company had a couple of announcements during the month including that it had signed an MOU with a major US data centre developer to build AI-focused data centres in Alberta, Canada using natural gas with carbon capture.

Kalina aims to capitalise on Alberta’s data centre boom and meet the growing electricity demand. The company says its low-CO2 power projects are well-suited to meet this demand.

MTM Critical Metals (ASX:MTM) rose 11% during August also on the back of several key announcements including the appointment of new CEO Michael Walshe, who the company described as being “a highly credentialled mineral processing executive”.

MTM also made a significant discovery following the recovery of gallium from semiconductor and LED scrap via Flash Joule Heating (FJH) technology. The company said the lab-scale breakthrough places MTM at the forefront of efforts to resolve the critical supply chain challenges surrounding gallium — a metal that is indispensable to high-tech and defence industries.

Here were the 50 worst performing ASX stocks for August

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | AUGUST RETURN % | MARKET CAP |

|---|---|---|---|---|

| ERA | Energy Resources | 0.005 | -75% | $110,741,496 |

| BCB | Bowen Coal Limited | 0.014 | -63% | $39,888,508 |

| TEG | Triangle Energy Ltd | 0.0055 | -61% | $10,400,670 |

| CDE | Codeifai Limited | 0.001 | -60% | $3,961,942 |

| ADN | Andromeda Metals Ltd | 0.009 | -57% | $30,542,438 |

| FGH | Foresta Group | 0.004 | -56% | $9,421,516 |

| ME1 | Melodiol Global Health | 0.001 | -50% | $1,125,828 |

| RNE | Renu Energy Ltd | 0.0025 | -50% | $1,815,335 |

| 8VI | 8Vi Holdings Limited | 0.068 | -50% | $2,849,977 |

| MOZ | Mosaic Brands Ltd | 0.036 | -49% | $6,426,232 |

| FRS | Forrestania Resources | 0.015 | -48% | $2,426,786 |

| CMO | Cosmo Metals | 0.028 | -47% | $3,667,800 |

| FGL | Frugl Group Limited | 0.022 | -46% | $2,307,990 |

| AKG | Academies Aus Grp | 0.092 | -46% | $12,200,531 |

| DGR | DGR Global Ltd | 0.012 | -45% | $12,524,322 |

| RCR | Rincon | 0.028 | -45% | $8,191,748 |

| OPL | Opyl Limited | 0.016 | -45% | $2,731,434 |

| GHY | Gold Hydrogen | 0.635 | -44% | $48,681,020 |

| FHE | Frontier Energy Ltd | 0.245 | -44% | $109,460,345 |

| GAS | State GAS Limited | 0.045 | -43% | $16,253,868 |

| AS2 | Askari Metals | 0.02 | -43% | $1,961,403 |

| EOF | Ecofibre Limited | 0.024 | -41% | $9,092,974 |

| AKN | Auking Mining Ltd | 0.01 | -41% | $3,186,870 |

| IXR | Ionic Rare Earths | 0.006 | -40% | $29,218,576 |

| RFA | Rare Foods Australia | 0.015 | -40% | $4,079,749 |

| WNR | Wingara Ag Ltd | 0.006 | -40% | $1,053,255 |

| ACW | Actinogen Medical | 0.045 | -39% | $122,030,028 |

| ATV | Activeportgroupltd | 0.042 | -39% | $14,844,544 |

| RPG | Raptis Group Limited | 0.008 | -38% | $507,891 |

| DME | Dome Gold Mines Ltd | 0.105 | -38% | $38,997,919 |

| HOR | Horseshoe Metals Ltd | 0.005 | -38% | $3,316,408 |

| SVL | Silver Mines Limited | 0.094 | -37% | $141,755,408 |

| FEX | Fenix Resources Ltd | 0.275 | -37% | $198,169,928 |

| TM1 | Terra Metals Limited | 0.038 | -37% | $15,039,590 |

| LOM | Lucapa Diamond Ltd | 0.045 | -37% | $14,215,978 |

| BSN | Basin Energy | 0.033 | -37% | $2,743,948 |

| C1X | Cosmo Exploration | 0.028 | -36% | $2,159,183 |

| CLU | Cluey Ltd | 0.028 | -36% | $9,879,065 |

| CXU | Cauldron Energy Ltd | 0.016 | -36% | $19,624,490 |

| 5EA | 5E Advanced | 0.094 | -35% | $31,216,019 |

| AAP | Australian Agri Ltd | 0.024 | -35% | $8,846,489 |

| TOE | Toro Energy Limited | 0.215 | -35% | $25,860,597 |

| CAZ | Cazaly Resources | 0.015 | -35% | $6,919,545 |

| JLG | Johns Lyng Group | 3.75 | -35% | $1,075,085,436 |

| AD8 | Audinate Group Ltd | 9.45 | -34% | $786,691,500 |

| BCT | Bluechiip Limited | 0.004 | -33% | $4,728,158 |

| CTN | Catalina Resources | 0.002 | -33% | $2,476,974 |

| DMG | Dragon Mountain Gold | 0.004 | -33% | $1,578,687 |

| ECT | Env Clean Tech | 0.002 | -33% | $7,929,526 |

| IBG | Ironbark Zinc Ltd | 0.002 | -33% | $3,667,296 |

At Stockhead, we tell it like it is. While LTR Pharma is a Stockhead advertiser, the company did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.