ASX April Winners: The best 50 stocks as inflation and Middle East tension cloud markets

Storm clouds weighed heavily on markets in April. Pic: Getty Images

- S&P/ASX 200 fell 2.94% in April as all Australian equity indexes fell except Emerging Companies

- Utilities and Materials the only ASX sectors in positive territory for April, up 4.77% and 0.61% respectively

- Rincon Resources tops the winners chart in April as news of its uncovering of a ‘bullseye’ target excite investors

After a five-month winning streak Australia’s S&P/ASX 200 closed April down 2.94% with large-cap companies continuing to lag and only emerging companies in the black with a 2.76% gain.

Looking at key economic points released in April and Australia’s inflation came in higher than expected during the March quarter, lessening expectations of interest rate cuts later this year.

Consumer Price Index data from the Australian Bureau of Statistics showed prices increased by 1% during the March quarter, leaving the annual inflation rate at 3.6%.

Economists had forecast inflation to increase by 0.8% in the March quarter, and by 3.5% annually.

In the US – the world’s largest economy – markets were rattled in April following the latest round of economics data, including a soft US GDP of just 1.6%, and inflation increasing by 3.4% in Jan-Mar, compared to an increase of 1.8% in the final three months of 2023.

“If growth continues to slowly decelerate, but inflation strongly takes off again in the wrong direction, the expectation of a Fed interest rate cut in 2024 is starting to look increasingly more out of reach,” says Olu Sonola at Fitch.

Heightening tensions in the Middle East including Israel and Iran further spooked markets in April.

IG market analyst Tony Sycamore told Stockhead he expects a slower start to May trading after a rougher April.

“The falls in April came about as firmer inflation data reduced the chances of rate cuts both in Australia and the US, as well as rising geopolitical tensions which weighed on investor sentiment,” he says.

“Ongoing uncertainty around inflation, interest rates and geopolitical tensions on top of a lack of stocks offering investors exposure to AI technology will likely see a cautious start to trading for the S&P/ASX200 in May.”

All four of Australia’s Big Banks seem currently on the same page in terms of possible interest rate relief, with expectations of just one rate cut by the RBA this year, with November the month they’ve pegged it to happen.

Utilities top performer in April

The S&P/ASX 200 sectors largely moved lower, led down by Real Estate, which fell 8%

after being the winning sector in March. Utilities advanced the most with a 5% gain and Materials also remained in positive territory supported by strength in metal prices.

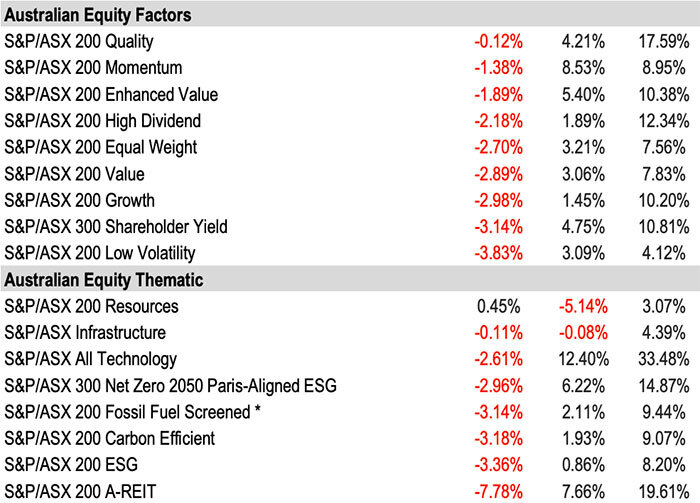

All equity factors fall in April

S&P says equity volatility rose amid a market correction with the S&P/ASX 200 VIX finished April two points up at a 12 level.

Fixed income back in negative territory

S&P says bonds remained under pressure in Australia, as inflation proved sticky in the first quarter and bolstered the case for the RBA to hold rates higher for longer.

Here are the 50 best performing ASX stocks for April:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | APRIL RETURN % | MARKET CAP |

|---|---|---|---|---|

| RCR | Rincon Resources | 0.077 | 208% | $17,028,655.03 |

| RNX | Renegade Exploration | 0.018 | 200% | $18,066,055.05 |

| MSI | Multistack International | 0.014 | 180% | $1,908,254.94 |

| WMG | Western Mines | 0.415 | 159% | $31,159,520.53 |

| SUM | Summit Minerals | 0.155 | 146% | $7,386,854.69 |

| M4M | Macro Metals Limited | 0.017 | 143% | $54,945,134.85 |

| FXG | Felix Gold Limited | 0.08 | 129% | $16,577,209.04 |

| MGA | Metals Grove Mining | 0.06 | 129% | $2,232,030.00 |

| BSE | Base Res Limited | 0.25 | 117% | $294,502,962.50 |

| LNR | Lanthanein Resources | 0.006 | 100% | $11,729,453.42 |

| SIH | Sihayo Gold Limited | 0.002 | 100% | $24,408,512.36 |

| PSC | Prospect Res Ltd | 0.16 | 100% | $74,133,113.92 |

| CYM | Cyprium Metals Ltd | 0.036 | 89% | $54,889,643.70 |

| CHW | Chilwa Minerals | 0.395 | 88% | $18,120,625.40 |

| LYN | Lycaon Resources | 0.33 | 83% | $14,538,562.83 |

| NPM | Newpeak Metals | 0.02 | 82% | $2,272,367.98 |

| SKS | SKS Tech Group Ltd | 0.72 | 80% | $79,055,535.60 |

| MSB | Mesoblast Limited | 0.99 | 78% | $1,130,366,272.86 |

| LU7 | Lithium Universe Ltd | 0.033 | 74% | $13,585,997.60 |

| BVR | Bellavista Resources | 0.18 | 71% | $8,929,974.96 |

| EPM | Eclipse Metals | 0.01 | 67% | $22,308,555.24 |

| MKL | Mighty Kingdom Ltd | 0.005 | 67% | $12,487,998.51 |

| LSA | Lachlan Star Ltd | 0.066 | 65% | $13,699,830.87 |

| DCG | Decmil Group Limited | 0.28 | 65% | $43,564,124.24 |

| AIS | Aeris Resources Ltd | 0.255 | 65% | $246,719,012.70 |

| ASE | Astute Metals NL | 0.044 | 63% | $18,062,857.56 |

| GLL | Galilee Energy Ltd | 0.053 | 61% | $18,006,466.08 |

| CMB | Cambium Bio Limited | 0.008 | 60% | $6,128,738.28 |

| GTI | Gratifii | 0.008 | 60% | $12,896,359.77 |

| SLS | Solstice Minerals | 0.16 | 60% | $16,053,889.44 |

| WA1 | WA1 Resources | 17.26 | 59% | $1,058,665,642.64 |

| EMH | European Metals Holdings | 0.445 | 59% | $55,001,153.17 |

| DTM | Dart Mining NL | 0.027 | 59% | $6,977,687.54 |

| SDV | Scidev Ltd | 0.365 | 59% | $69,278,285.17 |

| OMX | Orange Minerals | 0.038 | 58% | $3,258,506.54 |

| CY5 | Cygnus Metals Ltd | 0.08 | 57% | $23,324,731.12 |

| WGR | Western Gold Resources | 0.036 | 57% | $5,532,781.90 |

| WR1 | Winsome Resources | 1.375 | 56% | $262,329,445.13 |

| EXR | Elixir Energy Ltd | 0.11 | 55% | $124,591,532.45 |

| ARD | Argent Minerals | 0.017 | 55% | $21,959,903.03 |

| POD | Podium Minerals | 0.051 | 55% | $23,192,085.83 |

| NNG | Nexion Group | 0.02 | 54% | $4,046,157.08 |

| NWM | Norwest Minerals | 0.043 | 54% | $16,689,138.93 |

| EZZ | EZZ Life Science | 0.89 | 53% | $39,527,748.00 |

| ENR | Encounter Resources | 0.375 | 53% | $168,741,770.25 |

| CR1 | Constellation Resources | 0.175 | 52% | $10,374,074.55 |

| 14D | 1414 Degrees Limited | 0.0865 | 52% | $20,601,577.07 |

| SPD | Southern Palladium | 0.5 | 52% | $21,539,163.50 |

| SBM | St Barbara Limited | 0.265 | 51% | $216,762,150.70 |

| GBZ | GBM Resources | 0.012 | 50% | $13,880,266.67 |

Resource companies dominated the list of ASX winners in April. Rising critical metals junior player Rincon Resources (ASX:RCR) topped the winners chart in April, up more than 200% as news of its uncovering of a ‘bullseye’ target at its project in the West Arunta region of WA drew attention of investors.

Dubbed Avalon, RCR says the target is “of similar size and character” to WA1 Resources’ (ASX:WA1) Luni carbonatite, and IOCG (iron oxide copper-gold) deposits like Prominent Hill and Ernest Henry.

Western Mines (ASX:WMG) was up in April after positive announcements including a ~750m deep drill hole hit ~700m of rock containing “disseminated nickel sulphide mineralisation and numerous sets of remobilised nickel sulphide veinlets” at the Mulga Tank project in WA.

As Stockhead’s Reuben Adams noted these veinlets — confirmed by spot pXRF up to 42.2% nickel — appear oblique to the drill core “indicating a possible source at depth”.

WMG also announced it had been granted two awards, totalling $318k to fund drilling at the Mulga Tank project, under the WA State Government’s Co-funded Exploration Drilling Program, part of the Exploration Incentive Scheme (EIS).

Here are the 50 worst performing ASX stocks for April:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | APRIL RETURN % | MARKET CAP |

|---|---|---|---|---|

| DUB | Dubber Corp Ltd | 0.054 | -60% | $30,859,621.27 |

| ZNO | Zoono Group Ltd | 0.04 | -56% | $8,548,962.40 |

| CLZ | Classic Min Ltd | 0.008 | -53% | $2,480,275.88 |

| BXN | Bioxyne Ltd | 0.006 | -50% | $12,279,872.39 |

| MMM | Marley Spoon SE | 0.042 | -50% | $4,944,424.93 |

| RFT | Rectifier Technologies | 0.009 | -50% | $12,437,855.52 |

| ADR | Adherium Ltd | 0.02099 | -48% | $7,140,499.56 |

| MCL | Mighty Craft Ltd | 0.013 | -48% | $4,746,718.15 |

| AVH | Avita Medical | 2.69 | -46% | $161,923,796.80 |

| THB | Thunderbird Resource | 0.035 | -46% | $6,424,642.74 |

| MXO | Motio Ltd | 0.016 | -45% | $4,291,173.54 |

| ECG | Ecargo Holdings | 0.017 | -45% | $10,459,250.00 |

| M2R | Miramar | 0.01 | -44% | $1,860,869.30 |

| NGS | NGS Ltd | 0.005 | -44% | $1,256,136.99 |

| RMX | Red Mount Mining | 0.001 | -43% | $2,673,576.04 |

| ADO | Anteotech Ltd | 0.021 | -43% | $50,577,291.07 |

| AIV | Activex Limited | 0.007 | -42% | $1,508,518.04 |

| LVH | Livehire Limited | 0.019 | -41% | $6,991,471.48 |

| PAA | PharmAust Limited | 0.22 | -41% | $86,903,007.18 |

| BMO | Bastion Minerals | 0.006 | -40% | $2,583,503.07 |

| CTN | Catalina Resources | 0.003 | -40% | $3,715,460.68 |

| EMUDA | EMU NL | 0.018 | -40% | $1,214,862.77 |

| RR1DA | Reach Resources Ltd | 0.009 | -40% | $6,642,036.43 |

| SIS | Simble Solutions | 0.003 | -40% | $2,097,116.86 |

| VTI | Vision Tech Inc | 0.11 | -39% | $6,023,147.13 |

| SAN | Sagalio Energy Ltd | 0.005 | -38% | $1,023,300.65 |

| SEN | Senetas Corporation | 0.013 | -38% | $20,426,683.75 |

| TML | Timah Resources Ltd | 0.026 | -38% | $2,307,753.79 |

| H2G | Greenhy2 Limited | 0.006 | -38% | $2,512,534.97 |

| CHR | Charger Metals | 0.079 | -37% | $6,116,199.75 |

| ASP | Aspermont Limited | 0.012 | -37% | $29,467,616.44 |

| LPD | Lepidico Ltd | 0.003 | -37% | $22,914,923.84 |

| KGN | Kogan.Com Ltd | 5.08 | -36% | $511,492,972.44 |

| IRX | Inhalerx Limited | 0.032 | -36% | $6,072,542.62 |

| JRV | Jervois Global Ltd | 0.016 | -36% | $43,240,330.96 |

| ICU | Investor Centre Ltd | 0.021 | -36% | $6,367,158.86 |

| AAU | Antilles Gold Ltd | 0.013 | -35% | $12,239,954.91 |

| ASV | Assetvisonco | 0.013 | -35% | $9,435,875.35 |

| VIT | Vitura Health Ltd | 0.12 | -35% | $69,104,854.56 |

| PIL | Peppermint Innovation | 0.011 | -35% | $23,279,941.70 |

| WAK | Wakaolin | 0.042 | -35% | $17,798,933.08 |

| OLY | Olympio Metals Ltd | 0.045 | -34% | $3,161,777.94 |

| MNB | Minbos Resources Ltd | 0.06 | -34% | $51,907,348.14 |

| COB | Cobalt Blue Ltd | 0.092 | -34% | $38,800,228.76 |

| GEN | Genmin | 0.105 | -34% | $71,949,090.78 |

| GCR | Golden Cross | 0.002 | -33% | $2,194,512.22 |

| MHC | Manhattan Corp Ltd | 0.002 | -33% | $5,873,959.55 |

| MRQ | MRG Metals | 0.001 | -33% | $2,525,118.63 |

| NVQ | Noviqtech Limited | 0.004 | -33% | $5,949,229.18 |

| OAR | OAR Resources Ltd | 0.002 | -33% | $6,306,621.96 |

Dubber Corp’s (ASX:DUB) woes continued in April after the call recording technology company’s shares came out of a seven-week voluntary suspension on April 17.

In late February, the company halted trade after discovering that up to $26.6 million was missing after an audit. Dubber MD and CEO Steve McGovern was suspended on March 1 and fired on April 9 following an investigation. The company says it was “finalising the structure and terms of an equity capital raising to replenish its balance sheet”.

On April 10 DUB announced a $24.06 million capital raising, comprising an institutional placement to raise a ~$3.14 million and a one for one non-renounceable accelerated pro-rata entitlement offer to raise ~$20.92 million.

On April 30, DUB released its quarterly report where it noted revenue of $9.6m for Q3 FY24 was flat on Q2 FY24 and 29% up on pcp, “reflecting the disruption to the business experienced in the quarter following the announcement of the alleged misuse of funds in late February 2024”.

DUB says it liaised closely with its partners and customers during this period and “the disruption is expected to be short term”.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.