All aboard Eliza’s Pain or Gain Aussie property train

News

With a few days to Christmas, an overall recovery in home prices has given Aussie home sellers a handy boost over the last quarter, says CoreLogic’s Eliza Owen, but – and there’s always a but – the volume of loss-making resales (flips) has also increased.

Author of the year’s final quarterly Pain & Gain report, CoreLogic’s head of research and calculatrice de chaos Eliza Owen, says fast rising interest rates and higher mortgage stress have upped the instances of loss-making home resales in Australia.

Eliza et al analysed about 86,000 resales through Q3, with 93.5% making at least some money, for a national average gross profit of $298,000.

This was up from Q2’s revised 92.9% of profitable sales at a median gross gain of $290,000.

Total profits from resales in the September quarter was reckoned to be $27.4 billion, almost $6bn higher than the low of $21.6bn in the three months to February this year, which also happened to coincide with the bottom falling out of the national home pants.

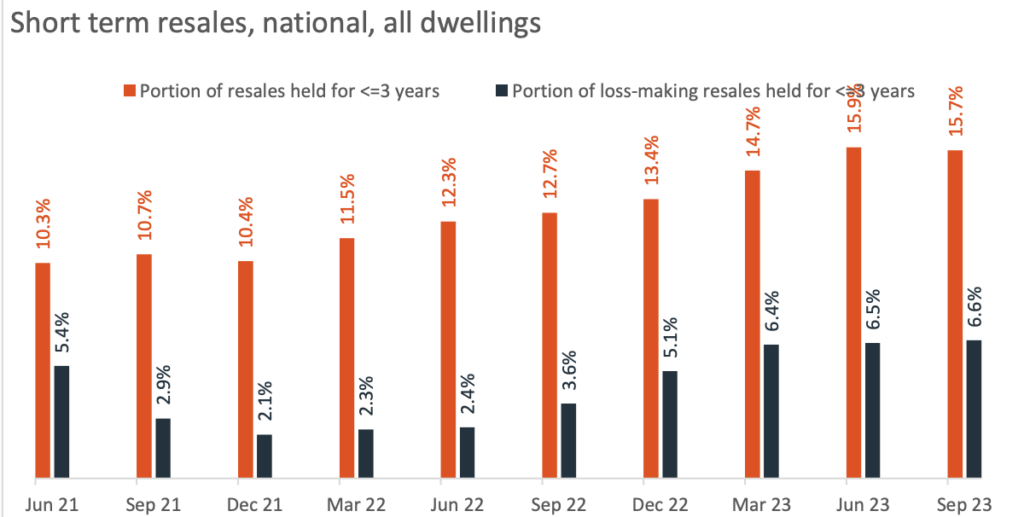

While overall profitability increased, loss-making short term resales (properties held for three years or less) rose to 6.6%, up from 3.6% just 12 months ago.

“While the portion of short term reselling dipped marginally quarter-on-quarter, resales with a hold period of three years or less hit a decade high in the year to September,” Owen said.

“Another emerging trend in resale analysis is the greater share of loss-making that occurred within a relatively short hold period, as opposed to properties commonly making a loss after being purchased in mining regions around a decade ago.”

Properties held for three years or less accounted for one in five loss-making resales and were widespread across the country. The highest portion were in Melbourne – Inner (4.1%), Melbourne – West (3.7%) and Sydney’s Central Coast (3.6%). The median loss from these short term resales was -$30,000 in the September quarter and most were houses (64.8%).

Owen said the higher share of short term loss-making house resales was quite different to the broader observations of all loss-making resales in the quarter, which were largely units (70.9%).

Every capital city dwelling market except ACT saw a decline in the rate of loss-making sales. Although the ACT saw a 50-basis point rise in the rate of loss-making sales, the rate itself was almost half the combined capital city rate, at 2.6%.

Adelaide proved to be the most profitable city for the fifth consecutive quarter, with only 1.5% of resales across the city making a nominal loss, which coincides with an extraordinary stretch of capital growth across the market.

Perth held onto its spot as the city with the second most loss-making sales, with 10% of home sales losing money.

In fact, among its capital city brethren, only Darwin had more – but quite a lot more, with almost 1 in 3 homes selling for less than the previous sales price, at 30.3%.

However, Eliza says some stronger capital growth has helped trim the rate of loss-making sales in Perth, down from 42.1% at the onset of the pandemic.

“Perth’s rate of loss-making sales is now far more comparable to that of east coast capitals, where Sydney and Melbourne had loss-making resale rates of around 9%,” Owen said.

Across all resales in Q3, houses continued to show a much higher rate of profitability than units, with 96.8% recording a median gross profit of $364,000.

Of unit resales, 87.4% made a nominal median gain of $167,000. However the rate of profitability increased faster for units at 170 basis points compared to just 23 basis points for houses quarter-on-quarter.

Owen said the rate of profitability in unit resales has improved vastly since a recent low of 84.7% in Q1 2023, while house resales have maintained a rate of profitability above 96% since Q4 2021.

The reduction in the rate of loss-making sales in the unit segment has seen the gap close between the rate of profitability in houses and units. In the three months to February, units were 4.3 times more likely to see a loss from resale than houses, whereas this reduced to 3.9 times in the September quarter.

Eliza flags that short term resales may remain prevalent in the coming quarters as the RBA’s higher interest rate regime hits the labour market.

“The RBA is forecasting unemployment to rise to 4.2% by the end of next year, up from 3.9% at the end of this year. This will test serviceability, and may lead to an increase in motivated selling for mortgagors with high debt levels and low savings buffers.

“However, this is ultimately a small share of mortgagors, so the portion of short term resales is not expected to grow substantially from where it is now. Ongoing increases in home values nationally should contain the rate of loss-making short term resales, though capital growth conditions were looking weaker across Sydney and Melbourne to the end of this year,” Owen adds.

· CoreLogic analysed approximately 86,000 dwelling resales in the September Quarter

· The incidence of profit-making sales nationally increased to 93.5%, higher than the decade average of 90.8%, and the highest rate of profitability since the three months to July 2022

· The median gains from resale were $298,000 in the quarter, and the total nominal profit from resales were $27.4 billion.

· The median losses from resale were -$40,000, and the total nominal losses were $313 million.

· Among the capital cities Darwin had the highest portion of loss-making resales at 30.3%, followed by Perth at 10.0%.

· Adelaide was the most profitable market of all the regions and capital cities, with just 1.5% of resales making a loss.

· Owner occupiers continued to see a smaller rate of loss-making than investors, at 3.2% compared to 10.0% of investors.

· The median hold period of resales across Australia was 8.8 years, up slightly from 8.7 years in the June quarter.