After 872 days suspended, Sky and Space Global is delisting from the ASX

Pic: d3sign / Moment via Getty Images

The saga of Sky and Space Global’s (ASX:SAS) attempts to get back onto the ASX since April 8, 2019 is over, but the company says it’s still “business as usual”.

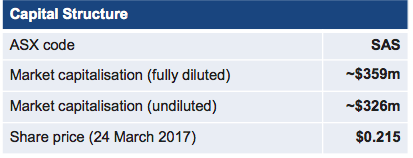

Sky and Space Global first listed on the ASX in 2016 through a reverse takeover of Burleson Energy and at its all time highs surpassed a market capitalisation of $350 million.

Unfortunately, as time went on it continued to bleed cash far faster than any satellites were launched and kept having to raise capital at continued dilution to existing shareholders.

It last traded on April 8, 2019 nearly 900 days ago.

Sky and Space Global (ASX:SAS) share price chart

Arguably the company is in a better position than in 2019 having been recapitalised, replaced its board and obtained Virgin Orbit as a business partner and shareholder in the company.

But earlier this week the company was singled out by the ASX for not paying its annual listing fees and threatened with delisting. The board has now resigned to that fate.

Nevertheless the company declared it was “business as usual”.

“The business has continued business as usual across all the company’s operating entities and we continue to see encouraging results,” it said.

What now for the company and shareholders?

For the time being, ASX shareholders of Sky and Space will only be able to trade their shares through off-market transactions.

The company has promised it will still lodge relevant material updates as an unlisted disclosing entity.

It has also said that it may list on another exchange in the future pointing to Virgin Orbit’s decision to list on the NASDAQ.

“The company has taken the strategic decision to become a public unlisted business for the next period to allow it time to launch the first batch of satellites and recognise revenues from existing customer contracts, prior to seeking to relist on a recognised securities exchange,” it said.

“The company intends to undertake a pre-IPO raise in the coming months (up to $25 million) which is anticipated to generate the cash flow for manufacture and launch of the remaining constellations.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.