A Van Eck Xmas reality check: Cool your jets, it’s a slower economic journey in 2023

Experts

Experts

In this special Christmas special, Van Eck’s very special portfolio manager Cameron McCormack takes his investment performance analytics and applies it to 2023’s biggest trade execution decisions for equity and fixed income ETFs.

Enjoy!

What a year 2022 has been.

From skyrocketing inflation and heightened geo-political tensions to global talent shortages and an energy crisis. But as the year draws to a close, and fears of a global recession mount, investors are wondering what 2023 might have in store and how they should be positioning their portfolios.

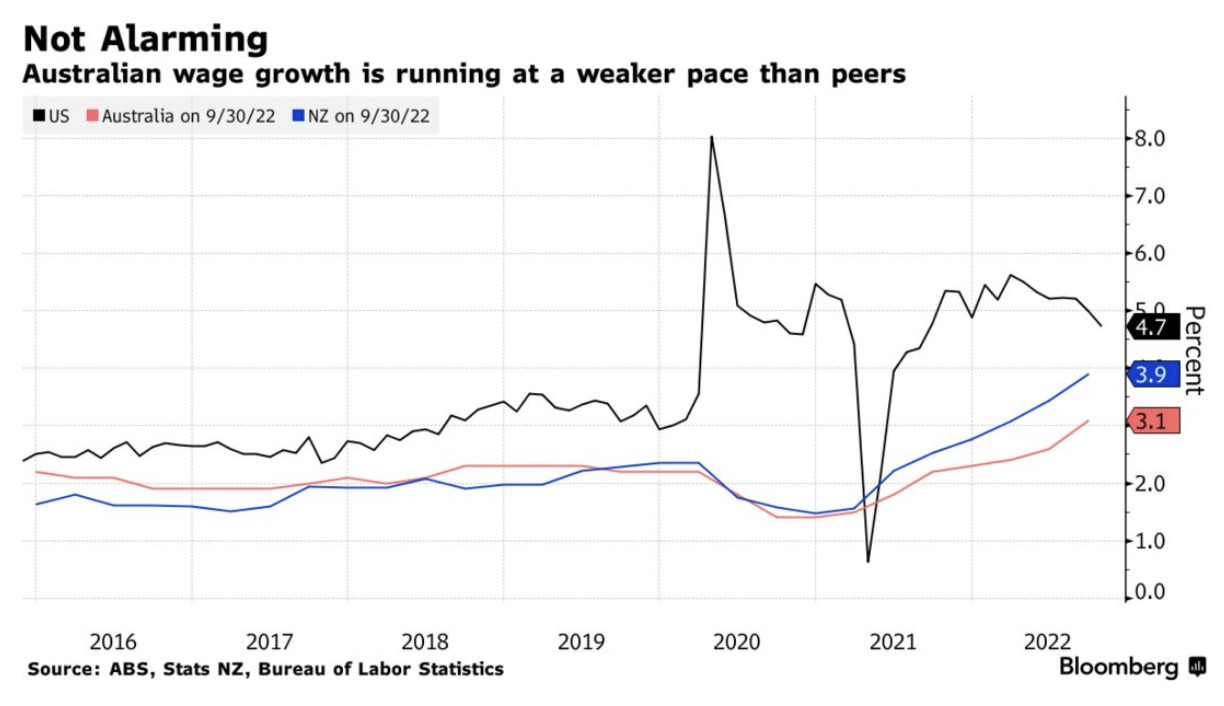

Australia on balance, is much better positioned than most countries to deal with economic challenges in 2023. Wage growth has been relatively modest, and, the return of migration over the next 12 months will likely ease the labor market tightness.

Our soft landing?

Reserve Bank Governor Phillip Lowe recently said Australia has a stronger probability of bringing its economy in for a “soft landing” than almost any other developed-world counterpart, citing the nation’s still-contained wage growth. Furthermore, with a higher percentage of variable mortgage rates among property owners relative to other developed nations means there is a faster transmission of monetary policy to the economy.

Australia is a major commodities exporter with abundant natural resources relative to its own needs. And meantime, the ASX has held up relatively well compared to other global benchmarks, in the year to December the S&P/ASX 200 increased by 2.20% versus a 5.78% fall by the S&P 500 and a 19.42% fall by the Nasdaq 100.

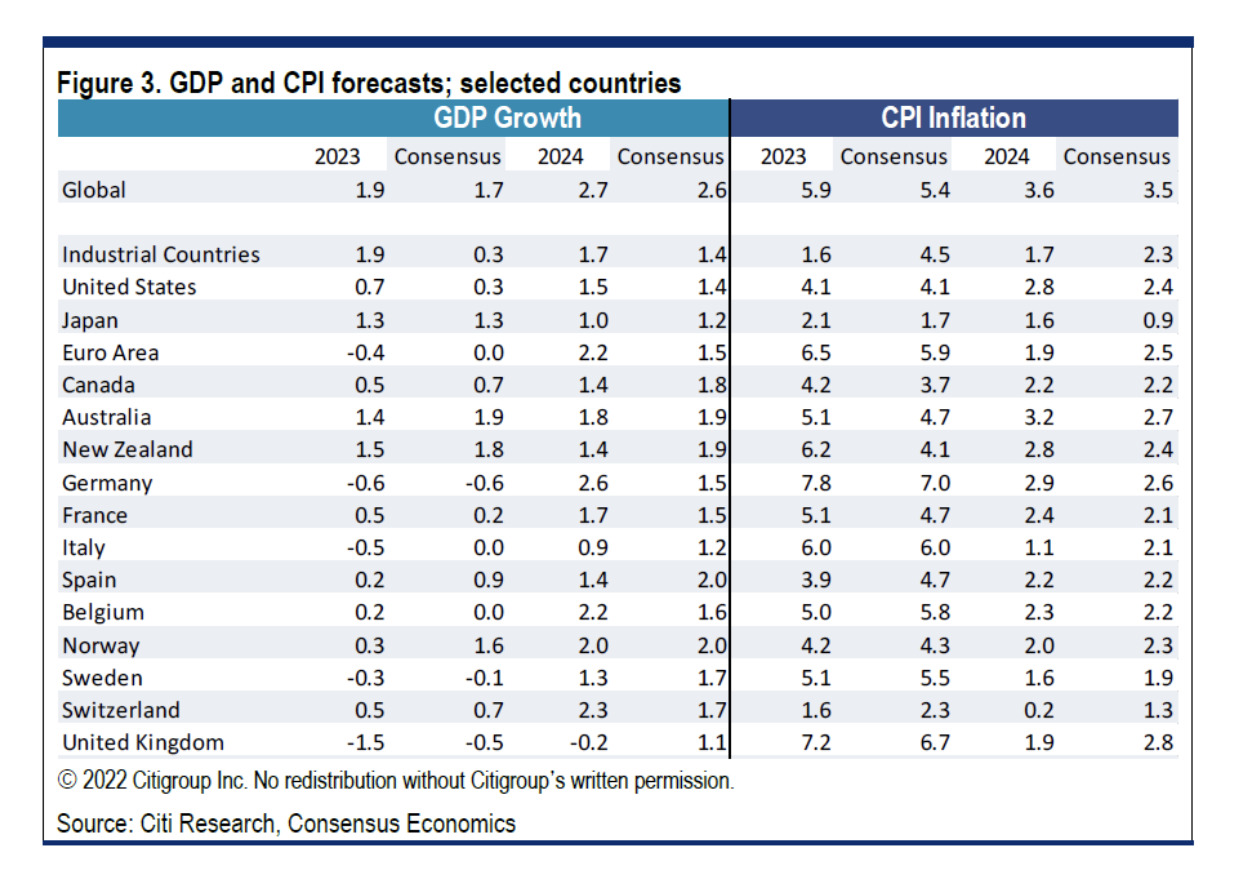

Citi Bank forecasts 1.4% Australian GDP growth in 2023, above forecasts for the US, Japan, Europe, Canada and the UK.

In the US, the picture is somewhat different, the central bank is sounding alarm bells, Fed Chair Powell has reiterated that there is “more pain to come” and cautioned that monetary policy is likely to stay restrictive for some time until real signs of progress emerge on inflation, despite the US Funds Rate already jumping to 2008 levels with another 1% increase forecast by the futures market in 2023.

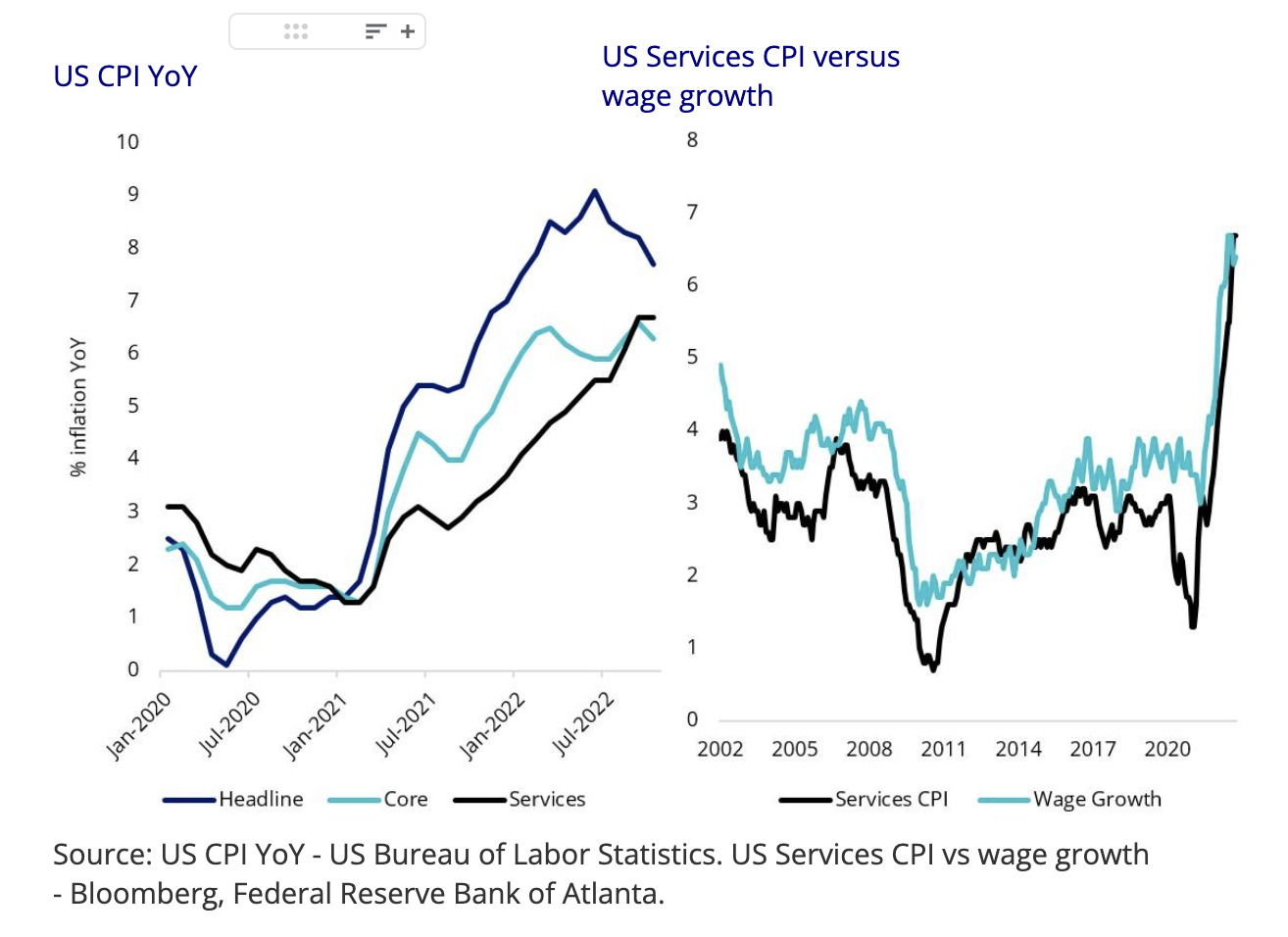

The Fed is determined to contain inflation quickly, despite the high risk of triggering a US recession in 2023. Of most concern to the Fed is high services inflation.

The latest CPI print showed that services inflation remains sticky despite core and headline inflation showing early signs of cooling.

Services inflation contributes 60% to total CPI and high accelerating year on year growth is a function of high wage growth and record low unemployment.

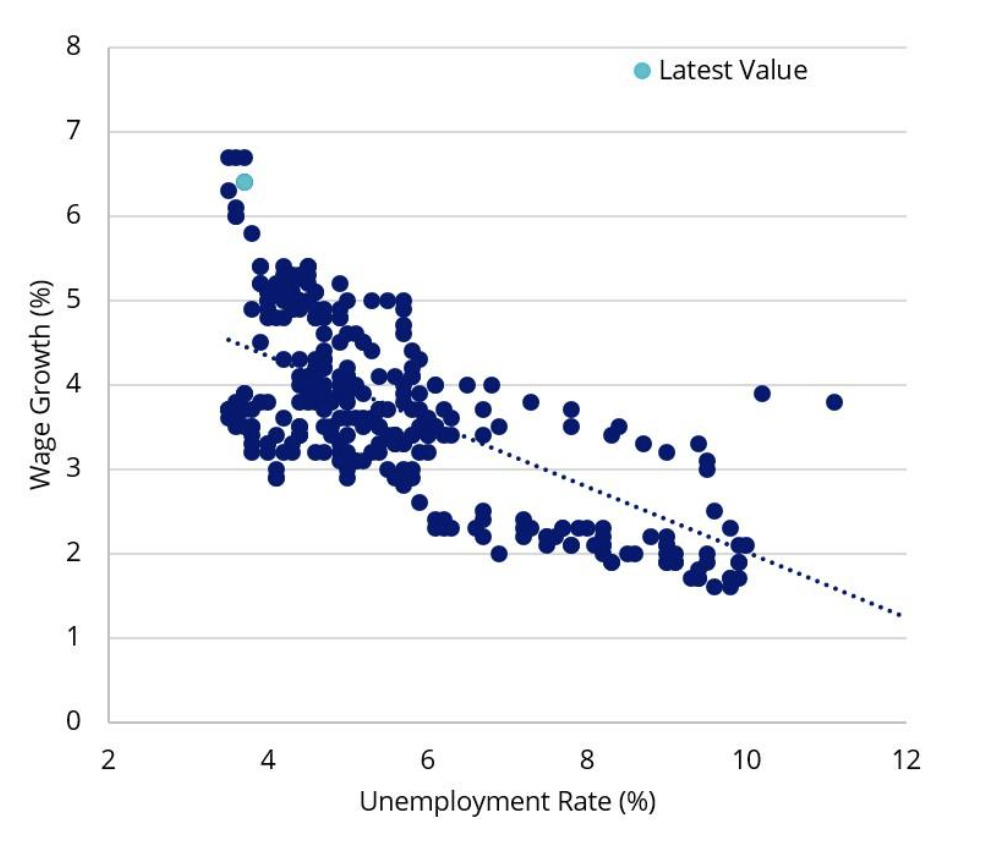

You may have heard of the Phillips curve which describes the negative relationship between inflation and unemployment. Another relationship to observe is the relationship between wage growth and unemployment as shown below. Labour market retrenchment is required (aka increase in the unemployment rate) to slow spending and cost inflationary pressures to lower wage growth.

The challenge for the Fed is that every time the US unemployment rate has increased by more than 0.50% it has triggered a recession.

US wage growth versus unemployment

Source: Bloomberg, Federal Reserve Bank of Atlanta

The question front of mind for investors is how to position for the uncertainty ahead?

Based on the current inversion of the curve, as reflected by the 10- and 2-year yields, a US recession is priced in as a likely scenario in late 2023 given the rapid succession of central bank policy rate hikes and hawkish tone from the Fed.

A slowing economy with falling inflation could see a return back to quality.

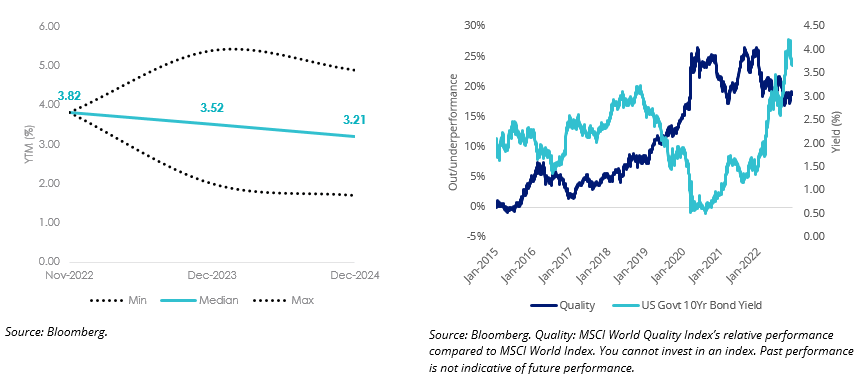

The US treasury 10-year bond yield is likely at the peak. The interest rate curve has priced for a Fed that is expected to cut the Funds Rate in H2 2023 as the economy slows.

The US treasury 10-year bond yield could be near the peak. Brokers forecast US treasury yields to fall in 2023 and 2024 as the global economy slows in the face of managing higher interest rates. The Futures market also expect the Fed Funds Rate to be cut in H2 2023. Falling yields would be a tailwind for quality companies.

Quality companies typically trade at a valuation premium relative to the benchmark (i.e price to earnings) which means that prices are more sensitive to interest rate movements.

US Treasury 10 Yr Gov Yield broker consensus Quality performance relative to MSCI World vs US 10 Yr Gov Bond Yield

2. Stable earnings throughout economic cycle

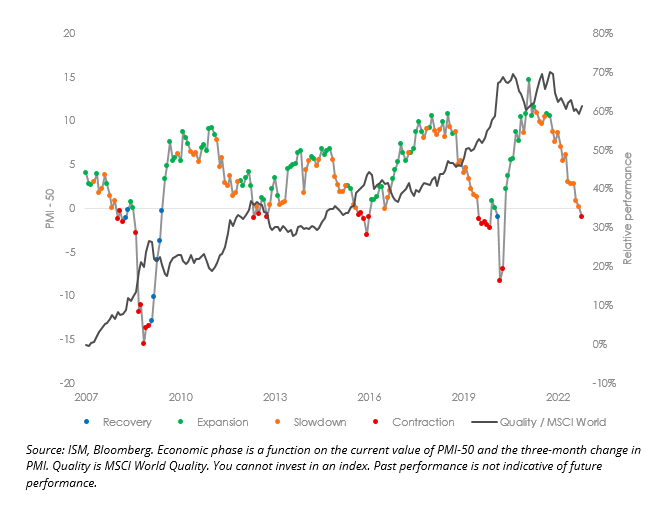

Quality companies typically outperform in a late cycle environment as they are rewarded for their ability to generate sustainable earnings amid a backdrop of stagnate economic growth. The graph below highlights that quality companies historically outperform when manufacturing activity (proxy for economic activity) slows or contracts (orange or red).

US manufacturing is already in a contractionary phrase.

US ISM Manufacturing PMI Index and quality versus MSCI World performance

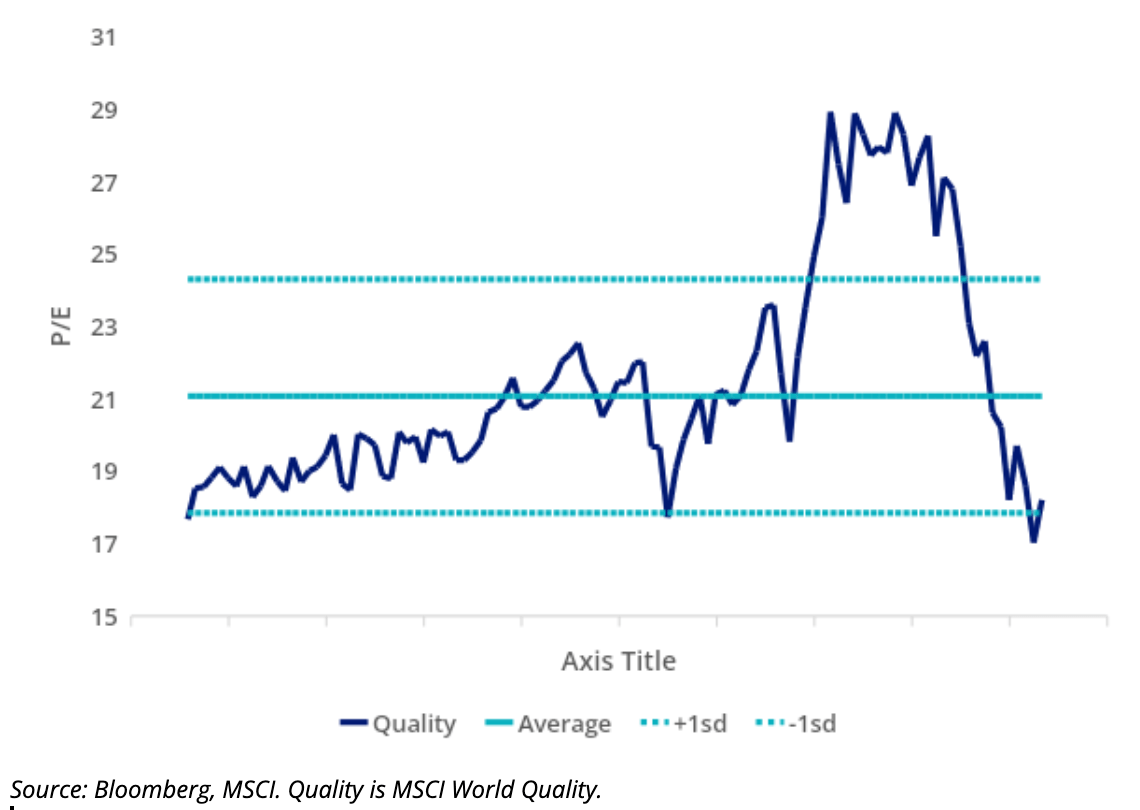

3. Valuations attractive

Quality companies are trading at one standard deviation below the price to earnings 9 year average

MSCI World Quality Price to Earnings

Quality was the standout factor between the global financial crisis and emergence of COVID-19 during an era of falling inflation and stagnate economic growth.

The stage is set for a repeat of this environment in 2023.

Until then investors, it’s a Merry Christmas from all of us here at Van Eck.

Cameron McCormack, December 2022

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.