Nasdaq Wrap: US bull market hits two years, will it keep charging ahead?

US bull market hits two years, will it keep charging ahead? Pic: Getty Images

Nasdaq Wrap is our weekly look at the highly influential, tech-heavy Nasdaq 100 index – movers and shakers over the past seven days or so, talking points and a brief look at what’s ahead.

- US bull market marks two years with strong index gains

- China’s lack of stimulus disappoints investors

- Tesla shares drop 8pc on Musk’s robotaxi plans

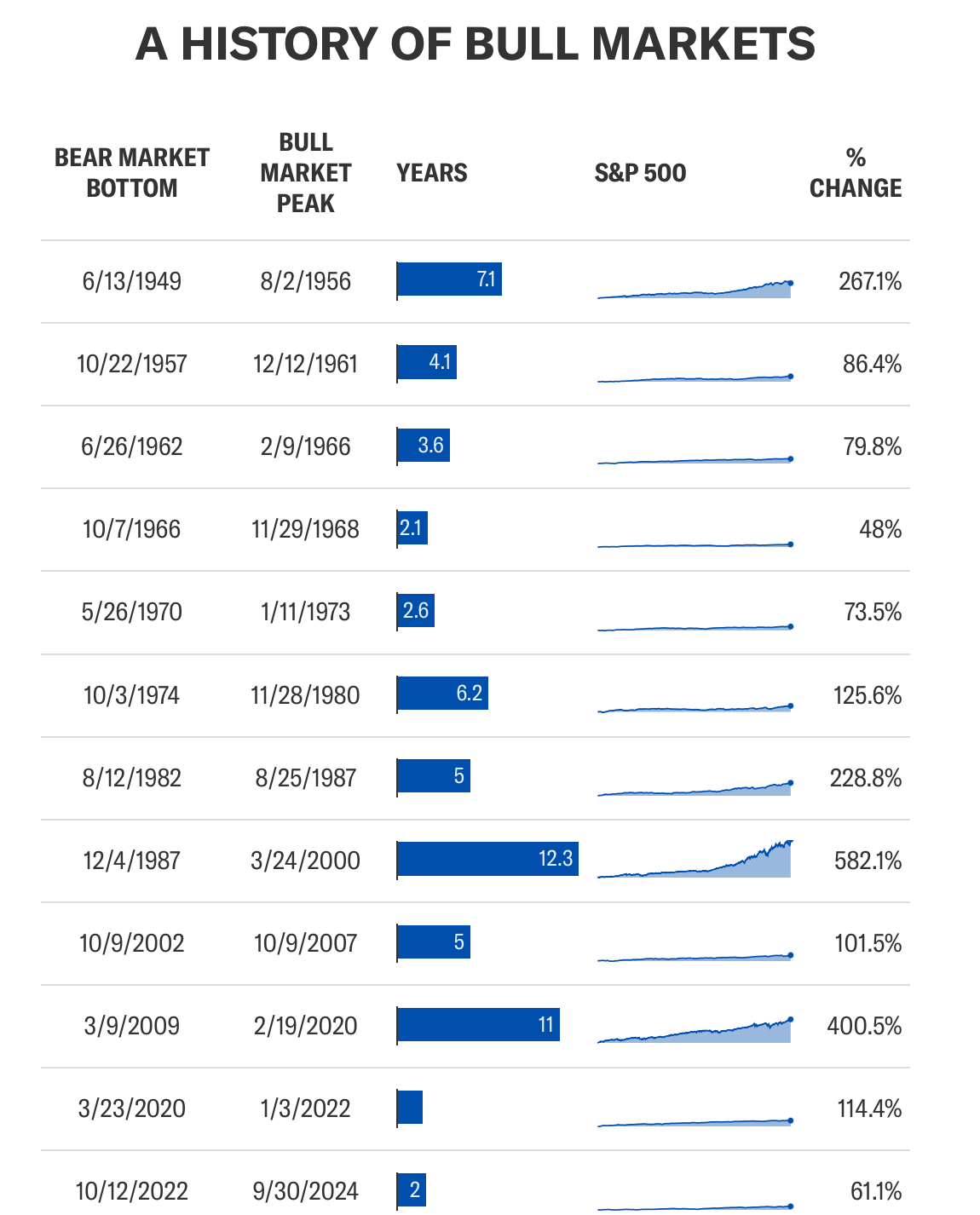

We’ve just celebrated two years of the current bull market. Over this period, the markets have seen an impressive run – the S&P 500 jumping about 60% since October 2022, while the ASX has climbed around 25%.

Historically, bull markets tend to continue into their third year, so the question remains: will the trend hold true this time?

While the fundamentals of the current economy remain strong, they are beginning to show signs of slowing.

Valuations appear to have limited room for growth, meaning that earnings will need to to do the heavy lifting if we want to see further gains from here.

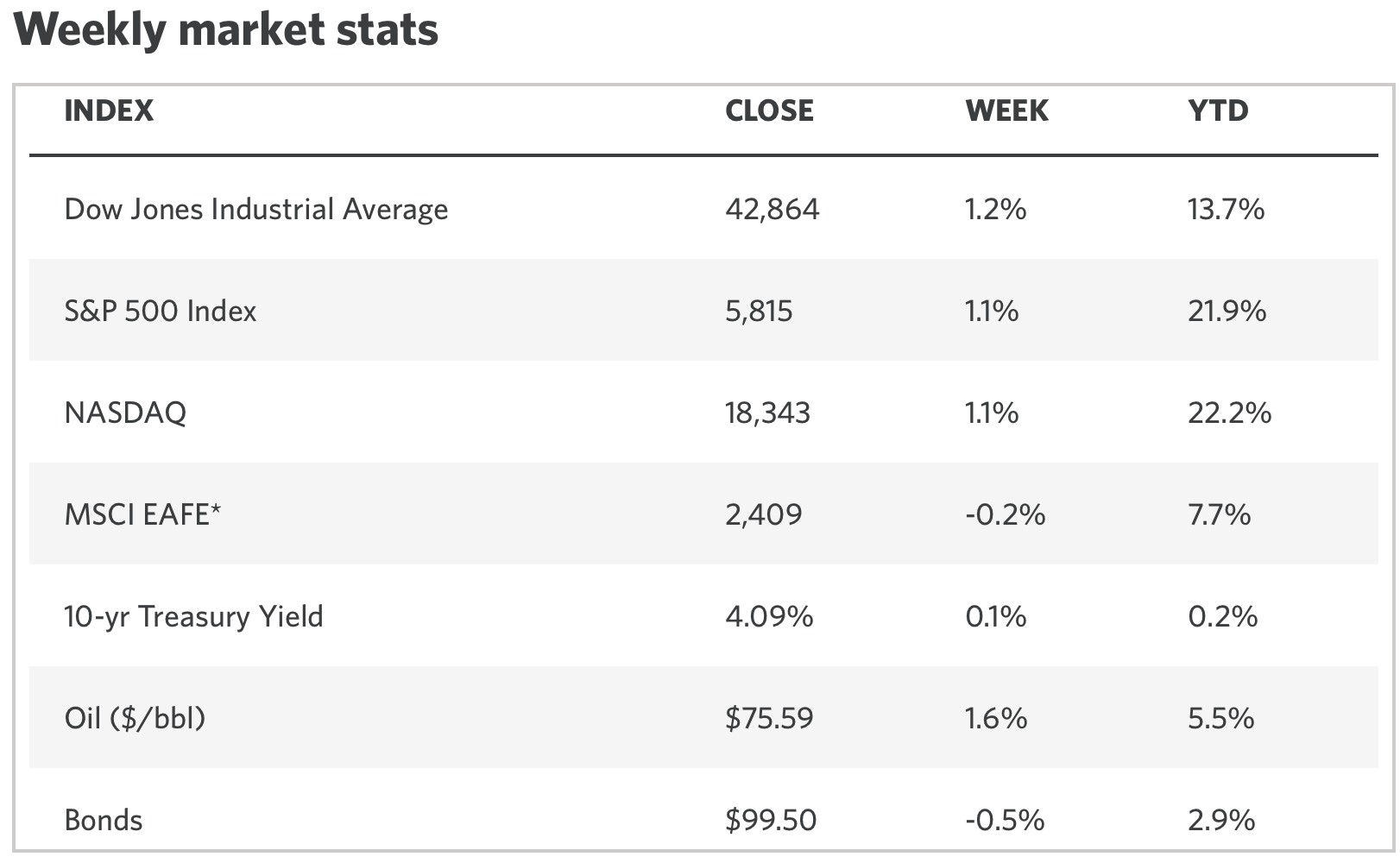

Goldman Sachs, however, maintains a bullish outlook, predicting that the S&P 500 could rise to 6,300 over the next year, up from its current level of 5,815.

Meanwhile, UBS anticipates several rate cuts from the Federal Reserve in the coming months, which could help push the S&P 500 to 6,200 by June 2025.

As investment strategist Angelo Kourkafas notes, “Bull markets don’t die of old age; they typically end due to a recession, overly tight Fed policy, or an external shock.”

The week that was

With these factors in play, investors are watching closely to see how the market unfolds.

The major US indexes finished around 1% higher last week, with the S&P 500 notching its 45th record in 2024.

The key takeaways from last week’s trading include:

China taking investors on wild ride

Investor disappointment deepened when China failed to announce any new stimulus measures.

Hopes had been high for a robust package, but the National Development and Reform Commission’s announcement fell flat, leaving a sour sentiment in the markets.

Following a 30% rally in September, Chinese stocks dropped heavily on Wednesday as Beijing didn’t announce major new stimulus.

On Saturday, the Chinese Ministry of Finance announced another round of modest stimulus measures.

While the Ministry didn’t specify the scale of the new measures, the announcement has somewhat dampened hopes for a massive ‘bazooka’ package.

“So the overall sentiment for investors is negative,” said Shen Meng at Chanson & Co.

Milton strikes

Hurricane Milton struck Florida on Thursday, resulting in at least 16 fatalities and leaving more than 3.5 million people without power.

The hurricane unleashed destructive tornadoes, with towering waves reaching up to 7 metres tall, fierce winds of up to 230km/hour, torrential rain, and a menacing storm.

President Biden called Milton “the storm of the century”.

The hurricane has pushed oil prices higher in a market where the prices have been rallying because of the conflict in the Middle East.

“Investors are evaluating how hurricane damage might impact the U.S. economy and oil demand,” said oil trader Hiroyuki Kikukawa at NS Trading.

Thursday’s big data dump

Thursday’s US inflation came in slightly higher than expected – at 2.4% versus 2.3% forecasted.

“Inflation is dying, but not dead,” said Olu Sonola at Fitch Ratings. “The likely path is still a quarter point rate cut in November, but a December cut should not be taken for granted.”

“We expect the FOMC to cut rates by 25 basis points at the Nov. 6-7 meeting,” added Anna Wong at Bloomberg Economics.

Sentiment however began to improve after the release of the Fed’s September meeting minutes, which revealed that a “substantial majority” of officials supported the 50 basis point cut implemented in September.

“The bottom line is that Powell might have the market’s back heading into year-end,” noted David Russell at TradeStation.

US bank earnings

The Q3 earnings season kicked off last Friday, and we saw some of the big US banks report results that beat expectations – with strong results from JP Morgan, Wells Fargo, and BNY Mellon.

Analysts are projecting a 4% growth in earnings this quarter, marking the fifth consecutive quarter of growth.

JP Morgan reported a solid increase in Net Interest Income, and both BNY Mellon and Wells Fargo also beat profit forecasts.

“Although the macro picture is arguably the more important driver over the coming weeks, it is positive for equity markets to get earnings season off to a good start,” said a note from Saxobank.

Last week’s Nasdaq stock highlights

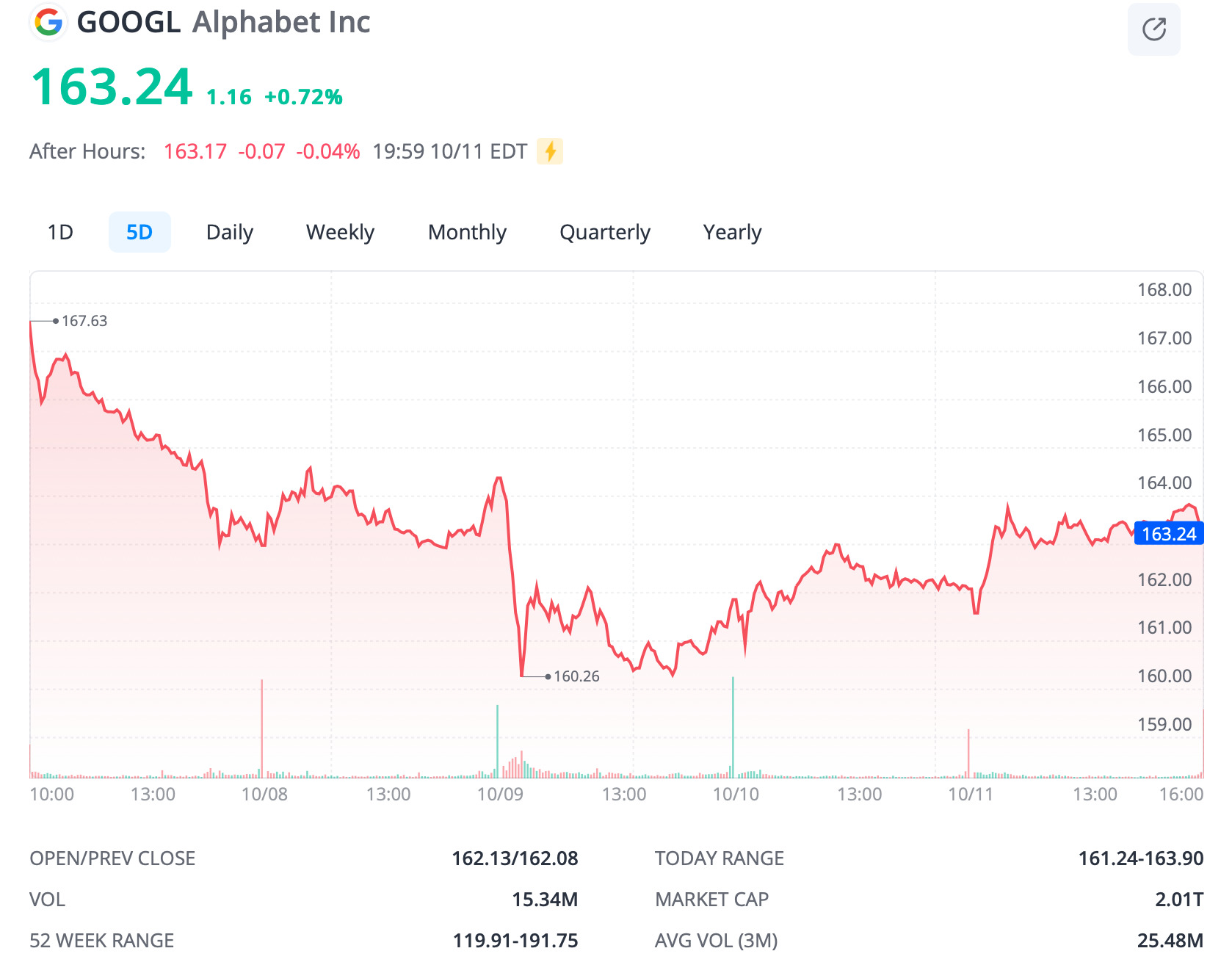

Alphabet (NASDAQ:GOOG)

The US Department of Justice (DoJ) is exploring the possibility of breaking up Google to tackle its monopoly of its search engine.

Alphabet’s stock price fell 3% last week, and analysts believe the uncertainty surrounding this decision could weigh on the company until a final decision is made.

The DoJ has suggested measures to stop Google from using its products like Chrome, Android, and Play to gain an unfair edge over competitors.

The regulator is also considering blocking Google from paying to have its search engine set as the default on devices.

This comes after a court ruled in August that Google violated antitrust laws, controlling 90% of the global search market.

Tesla (NASDAQ:TSLA)

Elon Musk introduced Tesla’s new Cybercab robotaxi at a much anticipated event on Thursday

Musk said Tesla is aiming for production by 2026 at a price of under US$30,000. He also unveiled a new 20-passenger Robovan concept at the event.

Musk claimed these new vehicles could transform cities by turning car parks into parks. He also tweeted that all transport will be fully autonomous in 50 years.

However, investors were disappointed by the lack of details on these plans, sending Tesla’s stock tumbling by 8% on Friday.

“They seemed focused on branding and marketing Tesla’s vision, rather than giving concrete numbers for us to model out,” said Tom Narayan at Royal Bank of Canada.

Techies also said one proposed feature of the futuristic two-seater stood out.

The company’s plan for the robotaxi to be charged wirelessly through road coils faces challenges, including slow charging technology, the need for new road infrastructure, and regulatory hurdles.

Without clear details on how it will work, many questions about its practicality remain.

Trump Media & Technology Group (NASDAQ:DJT)

DJT was one of the best performing Nasdaq-listed stocks last week, jumping by over 50% after a surprise appearance by Elon Musk at Donald Trump’s rally in Butler, PA, last weekend.

Musk is one of Trump’s most prominent supporters, frequently expressing his backing for the former president on his plaftorm, X.

During the rally on Saturday, Trump called the Tesla CEO “a truly incredible guy,” praising him for “saving free speech” and creating his numerous ventures.

“I’m going to have Elon Musk — he is dying to do this… We’ll have a new position: secretary of cost-cutting, OK? Elon wants to do that,” the former president said.

Trump maintains a roughly 57% stake in DJT.

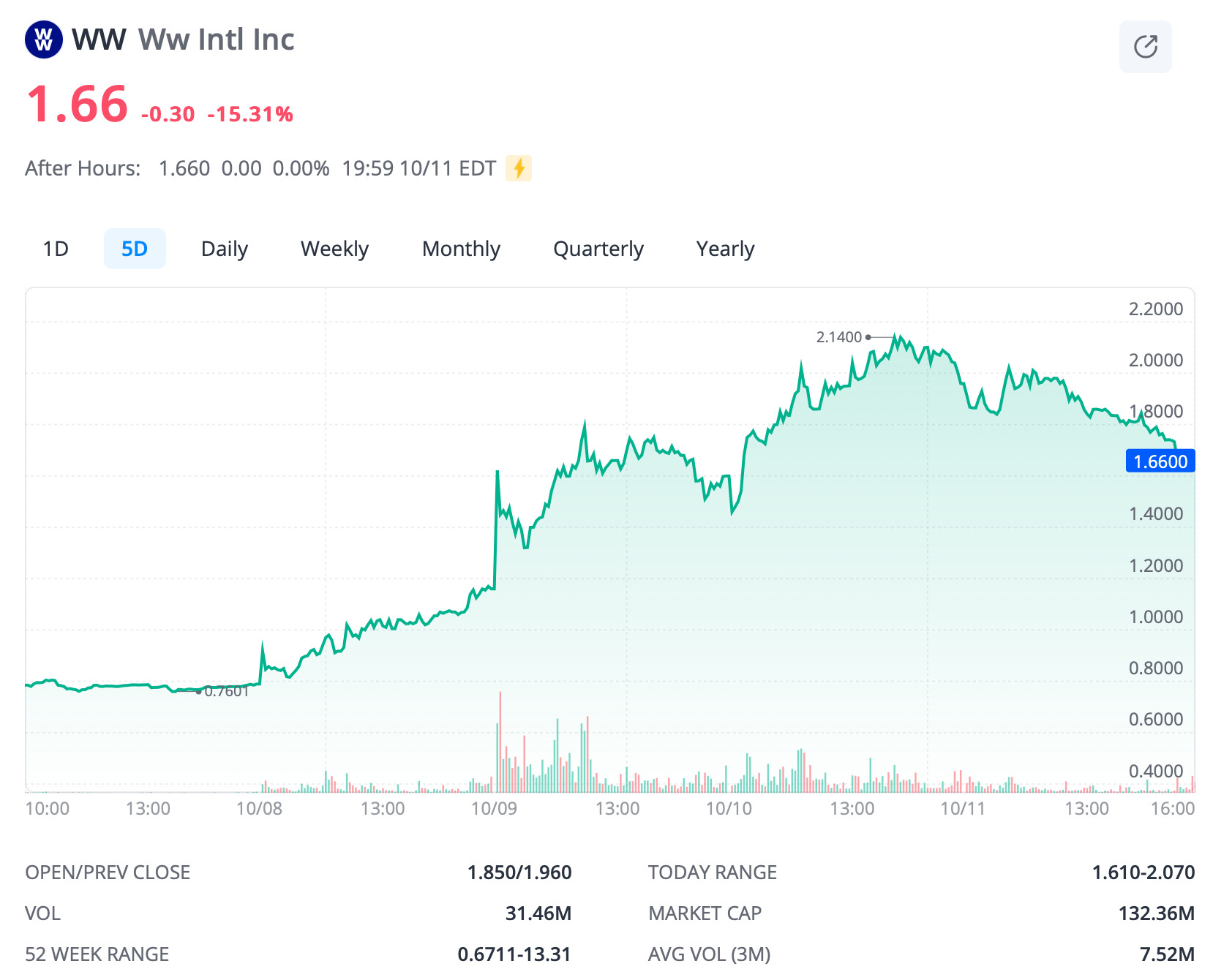

WeightWatchers International (NASDAQ:WW)

Here’s one Nasdaq-listed stock you may not have heard of.

WeightWatchers’ shares surged nearly 47% on Wednesday after the company announced it will offer a compounded version of Novo Nordisk’s popular weight-loss drug, Wegovy, as part of its weight-management programs.

With the popularity of drugs like Wegovy and Eli Lilly’s Zepbound, which can help patients lose up to 20% of their body weight, shortages have created an opportunity for compounding pharmacies.

A compounding version of a drug can involve combining, mixing, or altering ingredients to form a medication that is not commercially available. Compounded drugs can be made in different strengths, forms (like creams or liquids), or flavours to suit a patient’s preferences or medical requirements.

“Given the ongoing shortages of branded medications such as Ozempic and Wegovy, WeightWatchers is committed to ensuring our members have access to effective alternatives,” said WW’s CEO, Tara Comonte.

What to expect this week

As the earnings season kicks off in the US, sentiment will be in the spotlight this week with investors keen to see strong corporate earnings.

Key data from the US to land this week include retail sales, which will come out on October 17. Expectations here are growing that the economy is steering clear of a downturn, even with high interest rates hanging around for a while.

After the latest blowout non-farm payroll report, Goldman Sachs has cut the likelihood of a US recession in the next year by 5%, bringing it down to 15%.

The market will also get a look at US initial jobless claims, industrial production for September, China’s GDP for Q3, and UK CPI inflation figures this week.

Analysts will also be keeping an eye on geopolitical events, particularly what they will do to oil prices.

Gulf states are urging Washington to convince Israel not to target Iranian oil sites, fearing it could lead to retaliation against their own oil infrastructure.

A Saudi analyst noted that if the Gulf opens its airspace to Israel, it would be seen as an act of war by Iran, leading the whole region to the conflict and potentially driving up oil prices dramatically.

The views, information, or opinions expressed by the experts quoted in this article are solely those of the experts and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.