Nasdaq Wrap: Global tensions steal headlines; and how Wall Street predicts US election results

Wall Street could predict the US election result. Read how. Pic via Getty Images

Nasdaq Wrap is our weekly look at the highly influential, tech-heavy Nasdaq 100 index – movers and shakers over the past seven days or so, talking points and a brief look at what’s ahead.

- Wall Street ends week flat after rocky start

- Friday’s jobs report boosts market amid geopolitical tensions

- Elections are closely tied to stock performance

The week that was

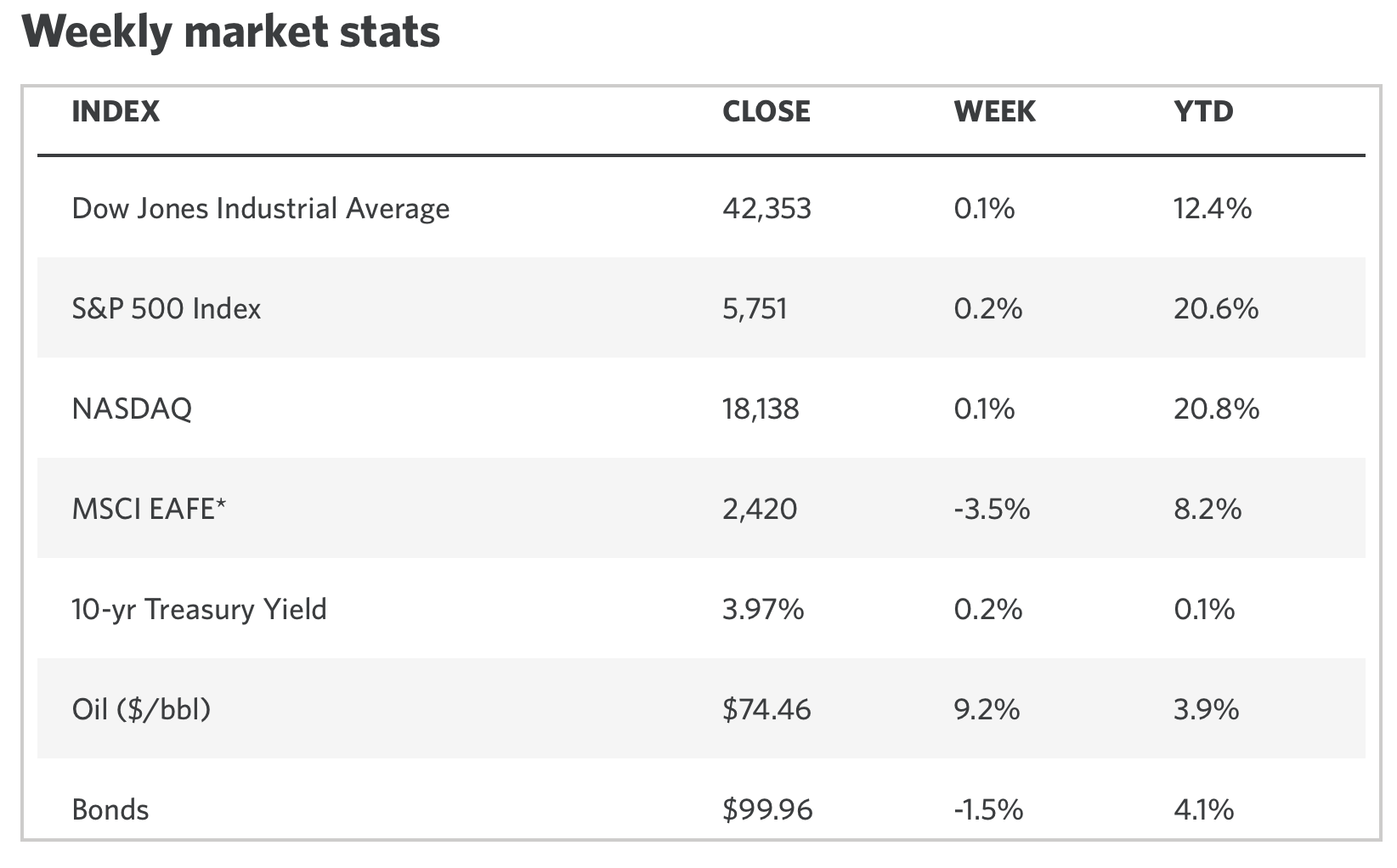

After a cracking first three quarters of the year, where the S&P 500 was up over 19%, Wall Street kicked off the fourth quarter on a shaky note.

But things improved by the end of the week, with major indexes closing mostly flat.

The volatility was linked to several factors: ongoing port strikes on the US East Coast, geopolitical tensions in the Middle East, and the approaching US presidential election.

However, a blowout jobs report on Friday boosted stocks, showcasing the resilience of the US labour market.

The report showed the US added 254,000 jobs in September, far exceeding expectations by more than 100,000. Also, the unemployment rate unexpectedly fell to 4.1%.

“This report should give the Fed more flexibility as it looks to continue lowering rates, and it should help counter arguments that the Fed acted too late,” said Eric Merlis at Citizens.

Elsewhere, the paralysing East Coast port strike has reached a tentative resolution during the week, with the International Longshoremen’s Association and the United States Maritime Alliance almost agreeing on wages.

Fed Reserve Chair Jerome Powell also gave a boost to markets after describing the US economy as “strong overall,” noting that the job market is solid and inflation appears to be settling towards the 2% target.

However, he remained non-committal about any upcoming rate cuts, stating, “We’re not locked into any plan just yet. There are risks on both sides, and we’ll be making decisions as we go.”

Meanwhile, the crude market stole the headlines as prices spiked to their highest in over a year after Iran launched 200 missiles at Israel.

President Biden stirred concerns when he hinted the US might consider striking Iranian oil assets in response.

“First of all, we don’t ‘allow’ Israel; we advise Israel. And there is nothing going to happen today,” he clarified late last week.

Experts warn that a major attack on Iran’s oil facilities could reduce supply by 1.5 million barrels per day, while smaller strikes might take out between 300,000 and 450,000 barrels.

But overall, the sentiment last week was that of a shift away from safe-haven assets – with Treasury bonds, gold, and the VIX index all declining.

Stock markets predict election results

The US presidential election continues to be a key focus for the market, with less than four weeks until Election Day on November 5.

While last week saw limited news on the election – apart from a relatively inconclusive vice-presidential debate – the presidential and Congressional races are still very close, with tight margins expected in key states.

And as we approach D-day, the stock market emerges as a crucial predictor of potential outcomes.

For over 90 years, the S&P 500 has demonstrated a remarkable correlation with who ultimately occupies the White House, accurately predicting election winners 83% of the time.

The trend shows that when the market performs well in the three months leading up to an election, the incumbent party tends to retain power, having done so in 12 out of 15 instances since 1928.

Research from LPL Financial indicates that when the S&P 500 is positive during this critical period, the incumbent party is favoured. Conversely, when market returns decline, the incumbents have lost eight out of the last nine elections.

Over the last 90 days, the return on Wall Street has been volatile. After reaching an all-time high in mid-July, the S&P 500 had a sell-off, dropping over 8%.

However, recent months have seen a rebound, with the index finishing August up 3.7% and posting a 4.2% gain in September– historically the weakest month for the market.

Looking back, however, the S&P 500’s track record isn’t without exceptions.

In some cases, like the 2020 election influenced by the pandemic, the outcomes defied market predictions.

Last week’s Nasdaq stock highlights

Tesla (NASDAQ:TSLA)

Tesla shares fell last week after the company reported a smaller-than-expected increase in Q3 deliveries, rising just 6.4% year-over-year to 462,890 vehicles.

The figure fell short of analysts’ expectations and raises concerns about Tesla’s potential for its first annual drop in deliveries after years of rapid growth,

Demand in the US and Europe remains low as the company faces rising competition, but China is becoming a crucial market and now accounts for one third of Tesla’s sales.

Dan Ives, a well-regarded bullish analyst of Tesla, said Tesla is the most undervalued player in the AI space.

“We continue to believe Tesla is the most undervalued AI name in the market, and we expect Musk & Co. to unveil some ‘game changing’ autonomous technology at this event,” said Ives.

Nvdia (NASDAQ:NVDA)

Nvidia was up 5% last week after CEO Jensen Huang called the demand for its new Blackwell chips “insane”.

These highly anticipated chips are now in full production. On October 2, Oracle revealed plans to acquire 131,072 Blackwell GPUs to support its AI push.

The cost of Blackwell is expected to range between US$30,000 and US$40,000 per unit.

Nvidia’s Blackwell chips are poised to transform AI computing, delivering revolutionary performance with up to 4x faster training and 30x faster inference than their predecessor, the Hopper H100.

Just a side note: Vistra (NYSE:VST), a retail electricity and power generation company based in Irving, Texas, has taken the lead as the best-performing stock on the S&P 500 this year, surpassing Nvidia.

Shares in Vistra have tripled year-to-date on the back of growing investor interest in the increased power demands for artificial intelligence (AI) and electrification.

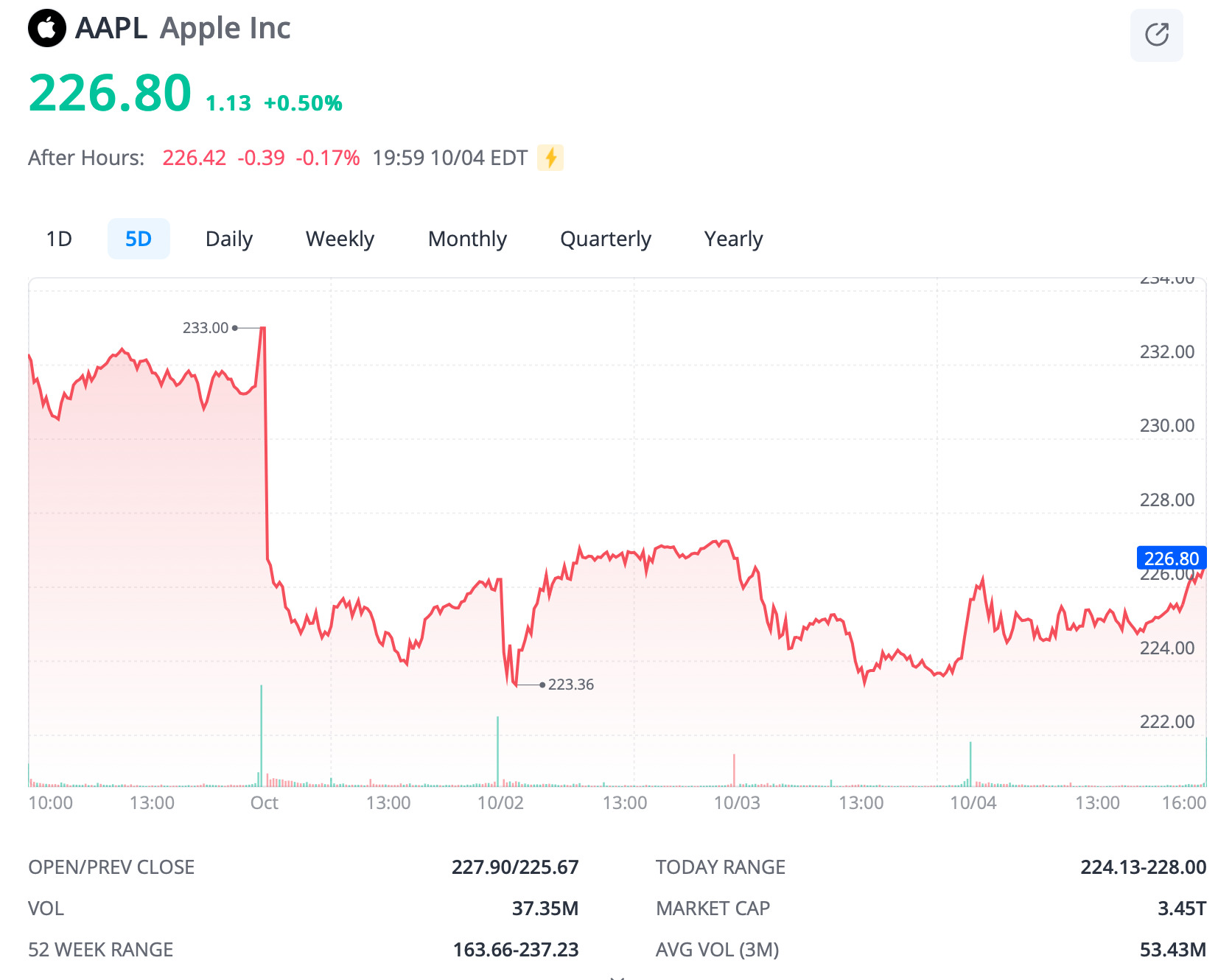

Apple (NASDAQ:APPL)

Apple fell 1% for the week after Barclays analyst Tim Long raised concerns about weak demand for the newly released iPhone 16, suggesting Apple may have to cut production by around 3 million units for the December quarter.

Long has maintained his Underweight rating on Apple, signalling it might be time to sell.

Later in the week, a JPMorgan survey found that more people want to buy iPhones compared to last year, but it’s not due to the new AI features.

The report showed that 68% of about 500 surveyed consumers are interested in getting a new iPhone, and they wanted a faster device with 5G connectivity not AI features.

Meanwhile, CEO Tim Cook has just been awarded an additional 219,502 shares of Apple as part of his remuneration package.

Out of these, 54,876 shares will vest in one-third increments in April 2027, 2028, and 2029. The remaining are performance-based and will vest on October 1, 2027.

Capricor Therapeutics (NASDAQ: CAPR)

Here’s one stock you may never have heard about.

Capricor Therapeutics rose over 100% last week after the biotech company announced plans to seek full FDA approval for its main drug, deramiocel (CAP-1002), later this year.

Capricor says it aims to file a biologics license application (BLA) with the FDA to treat all patients with cardiomyopathy associated with DMD (Duchenne muscular dystrophy).

DMD is a rare genetic disorder affecting around 300,000 people worldwide, primarily boys, which causes muscle degeneration and weakness.

The total addressable market for treatments is projected to reach approximately US$5.5 billion by 2032.

Capricor competes with established players like Sarepta Therapeutics (NASDAQ: SRPT) and PepGen (NASDAQ: PEPG) in this space.

The week ahead

This week, the markets will focus on key economic reports from the US, including the Consumer Price Index (CPI) for September, which will provide insights into inflation trends.

Investors will also expect the release of the University of Michigan’s consumer sentiment survey, which could offer clues about consumer confidence.

Also, corporate earnings reports will start rolling in, with major companies like JPMorgan Chase and Delta Air Lines set to share their results.

But the most anticipated event will be Tesla’s Robotaxi Event on October 10 (US time).

The views, information, or opinions expressed by the experts quoted in this article are solely those of the experts and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.