Nasdaq Wrap: Reddit notches first ever profit; while an Aussie company leads Nasdaq’s winners

One Nasdaq-listed Aussie firm is sizzling hot. Picture via Getty Images

Nasdaq Wrap is our weekly look at the highly influential, tech-heavy Nasdaq 100 index – movers and shakers over the past seven days or so, talking points and a brief look at what’s ahead.

- Election week brings market jitters while tech earnings reveal mixed results

- Reddit celebrates first-ever profit amidst market volatility

- And one Nasdaq-listed Aussie company is sizzling hot on Wall Street right now

The week that was

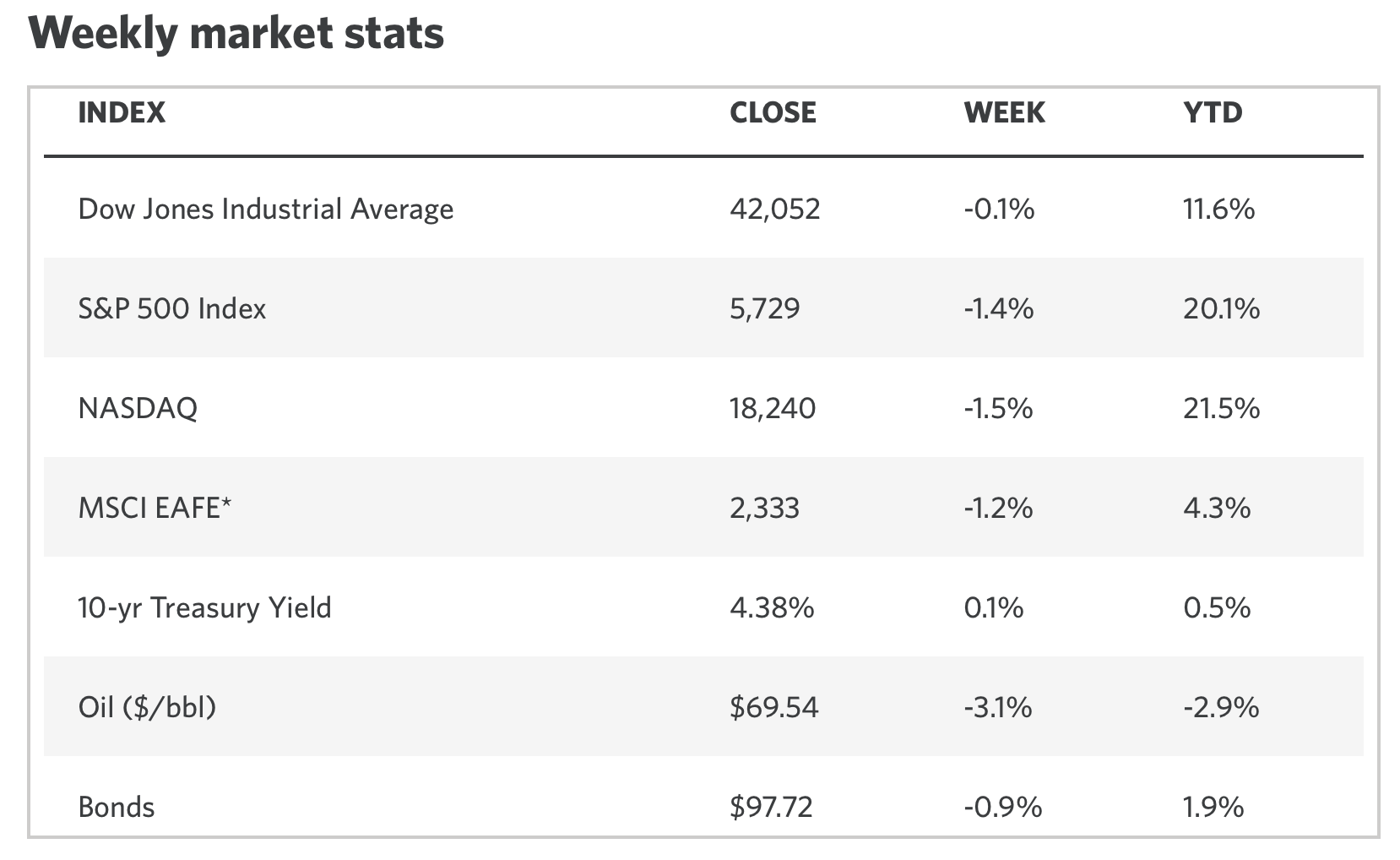

Wall Street saw some fluctuations last week, driven by earnings reports from major tech companies.

Initially, there was optimism in the market ahead of the reports, but as earnings were released, the sentiment shifted, with major indices on Wall Street closing mostly lower.

The reports underscored what we already know: that there continues to be ongoing volatility in the tech sector, with strong performances from some companies and weaker results from others.

A standout performer last week was Alphabet, Google’s parent company, which surpassed Wall Street forecasts.

Alphabet is making great progress, with over a quarter of its new code now generated by AI – contributing to its solid 35% increase in Q3 cloud revenues.

Microsoft and Meta Platform, on the other hand, weighed down the market with losses after their disappointing results.

So, what did we learn about AI from last week’s filings, and how is this trade shaping up for investors?

Well, big tech companies are indeed ramping up spending to meet skyrocketing demand for AI and cloud computing.

In Q3 alone, Microsoft, Alphabet, Amazon, and Meta collectively spent US$60 billion on AI infrastructure, a 60% increase from last year. Despite this surge, most said they’re still struggling to keep up with demand.

Microsoft and Amazon already acknowledged that their cloud services can’t keep up, citing a shortage of advanced semiconductors.

Microsoft said it expects its AI division to hit a US$10 billion annual revenue run rate, while Amazon’s AI business is expanding much faster than its cloud computing business did during its early stages.

Alphabet, meanwhile, is optimistic that its AI investments will quickly translate into revenue; and Meta said it was seeing user engagement rise due to AI-driven recommendations on its platforms.

Investors are now looking forward to Nvidia’s upcoming earnings report on November 20, as its stock has already surged on expectations of strong demand for AI chips.

Another notable performer last week was gold prices, which reached new highs amid rising economic uncertainty and the US election.

Gold is expected to maintain its positive momentum regardless of the election outcome as historically gold has thrived during periods of instability.

Forget the election, make tech your long-term play

The future of the tech sector is looking uncertain, no matter who ends up in the White House. Recent court decisions, like the ruling against Google, highlight this ongoing concern.

Both Kamala Harris and Donald Trump have expressed their support for boosting domestic chip manufacturing, with Harris now backing the bipartisan Chips Act.

Historically, though, tech stocks have performed well under both administrations.

So as an investor, it’s wise not to overreact to the election noise; because tech stocks can still be a strong long-term play.

“Investing for the long term, keeping cash on hand for opportunities when stocks are discounted, and being selective about stock purchases are wise strategies, no matter who is in the White House,” said Bershire’s Keith Speights.

Last week’s Nasdaq stock highlights

Please note all dollar figures below are in USD.

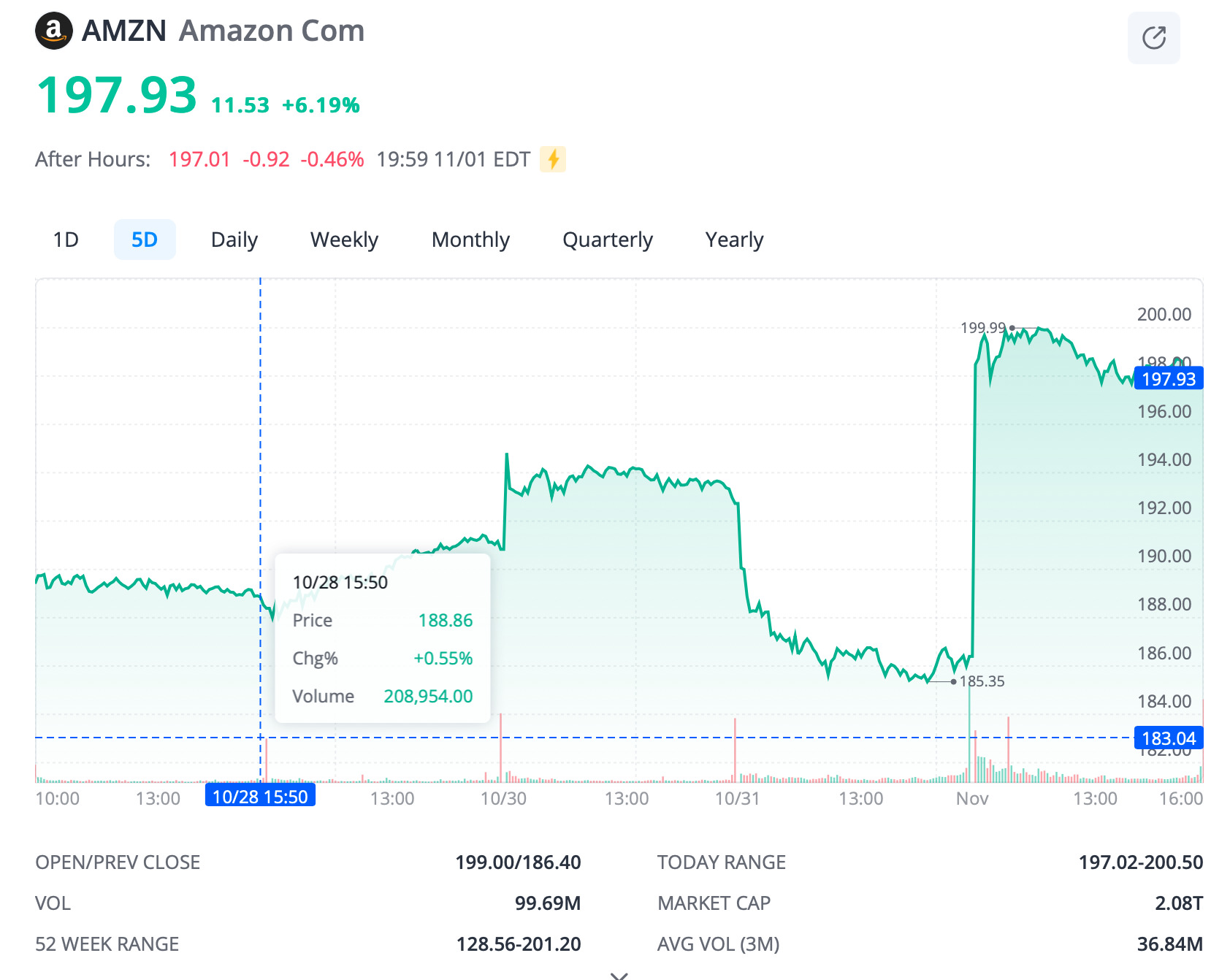

Amazon (NASDAQ: AMZN)

Amazon pulled in $158.9 billion in revenue for the quarter, exceeding Wall Street’s expectations of $157.2 billion, and reported earnings of $1.43 per share, beating forecasts of $1.16.

The cloud division alone raked in $27.5 billion, a 19% increase from the previous year, which has investors feeling optimistic.

Analysts are keenly watching how AI monetisation spreads across the tech landscape, with many seeing this period as critical for confirming its impact.

Beyond the cloud, Amazon’s traditional retail business is also thriving as consumer spending rebounds. With the easing of the cost of living crisis, more shoppers are engaging with events like Prime Day and Black Friday.

Plus, Amazon is making progress with Project Kuiper, aiming to compete with Elon Musk’s satellite internet service by launching over 3,200 satellites for global broadband access.

Reddit (NYSE: RDDT)

Reddit has just announced its first-ever profit after 19 years in the game.

In its latest earnings report, the platform revealed a 68% revenue increase from last year, hitting $348.4 million.

Ad revenue rose by 56%, bringing in $315.1 million, while other revenue sources skyrocketed by 547% to $33.2 million. The company’s net income reached $29.9 million, a big turnaround from a loss of $7.4 million this time last year.

CEO Steve Huffman said he was excited about the record user traffic and revenue growth. He noted that Reddit remains a highly trusted site with unique opportunities that set it apart from other companies.

Reddit’s journey hasn’t been smooth sailing.

Recent changes, like charging for API access, disrupted many popular third-party apps, sparking protests that saw numerous subreddits going private.

While some communities have since reopened, others shifted to rival platforms.

Super Micro Computer (NASDAQ: SMCI)

SMCI has had a dramatic fall from grace this year, going from one of the biggest market winners to the S&P 500’s biggest loser.

After a shocking 33% drop in one day due to auditor Ernst & Young resigning over concerns about the board’s integrity, Super Micro’s stock fell nearly 45% for the week.

The company, which makes AI servers, was once riding high, hitting record highs earlier this year and joining the S&P 500 after a massive 295% surge.

But since then, things have gone downhill, especially after accounting issues came to light, including a short-seller Hinderberg report and a n investigation by the Justice Department.

As of November 1, Super Micro’s stock has plummeted 75% since its S&P 500 debut. Meanwhile, Nvidia, a partner of Super Micro, has seen its stock soar by 173% this year.

Coinbase (NASDAQ: COIN)

Despite Bitcoin hovering near its all-time highs, crypto exchange Coinbase had a tough week, notching its biggest drop in over two years as its stock fell 15%.

The sell-off came after the company’s latest earnings report missed analysts’ expectations, but despite this, many traders are optimistic about Coinbase’s earnings prospects for 2025.

Many crypto traders are bullish, predicting strong earnings in the first half of next year. They believe the current dip is just a reaction to a quieter summer in the markets and that Coinbase could potentially reach $600 soon.

Interestingly, amid the market chaos, another crypto play (specifically Bitcoin), MicroStrategy, has overtaken Coinbase in market cap, now valued at $49.5 billion compared to Coinbase’s $44.5 billion.

Analysts are watching closely, especially with the upcoming US election,which could stir up volatility in this market.

Vast Renewables (NASDAQ: VSTE)

Here’s one Nasdaq stock you might have never heard about.

Vast Renewables is actually based in Australia, focusing on developing renewable energy projects, particularly on concentrated solar thermal power (CSP) technology.

Recently, Vast Renewables announced an agreement with Mabanaft to advance its Solar Methanol 1 (SM1) project in Port Augusta, South Australia.

This initiative aims to produce 7,500 tonnes of green methanol annually, which can significantly decarbonise industries like shipping and aviation.

The company said its CSP system could cut green fuel production costs by up to 40%, potentially positioning Australia as a key player in the green fuels market, with an eye on exporting to countries like Germany.

The stock price jumped 140% last week – the best performer on Nasdaq – after securing around $27 million in funding for the SM1 project, including significant contributions from the Australian Renewable Energy Agency and the German government.

What to expect this week

This week is packed with key events that could shape the markets.

The 2024 US presidential election is on Tuesday, November 5 (US time).

Following that, the Federal Reserve will announce its interest rate decision on Thursday, November 7, which investors are watching closely after a previous cut in September.

Fed Chair Jerome Powell’s press conference on the same day will also provide insights into future monetary policy.

In terms of earnings reports, several major companies are set to share their results.

Palantir, Novo Nordisk, and Toyota are among those reporting. Investors will also be keeping an eye on other tech firms like Microchip Technology and Arm Holdings, as well as pharmaceutical giants like Gilead Sciences and Vertex Pharmaceuticals.

Also, updates on economic indicators like the US trade deficit and consumer sentiment will be released throughout the week, adding to the overall market excitement.

Now read: Nvidia overtakes Apple as world’s most valuable, as investors brace for election volatility

The views, information, or opinions expressed by any experts quoted in this article are solely those of the experts and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.