Rapid HIV & COVID-19 test maker Atomo Diagnostics is set to be the first IPO in 6 weeks

No company has attempted to make an ASX debut in the past six weeks amid volatile markets as the COVID-19 pandemic took hold.

But tomorrow rapid disease test maker Atomo Diagnostics (ASX:AT1) will be the first company to list on the bourse since February 27, having successfully raised $30m.

Since its founding in 2010 the company’s bread and butter has been in HIV testing. Its solutions, which include a self-test kit and professional-use kit, are approved in Australia and Europe.

Since 2015 it has sold 550,000 rapid diagnostic tests (RDTs) direct to medical professionals and consumers as well as another 430,000 to other RDT manufacturers for sub-assembly.

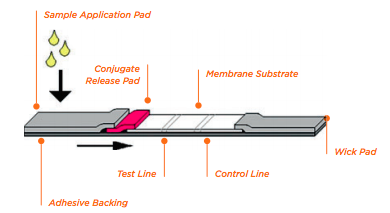

These work similar to a pregnancy test — a liquid sample, such as blood is applied to the test strip and if the target substance is present two lines will appear.

In recent weeks, however, Atomo has been working on self-testing kits for COVID-19. The company says that it can deliver results in as little as 15 minutes.

Atomo has reported substantial demand for the test, which screens the blood for anti-bodies generated in response to the virus. The company has set aside an initial 300,000 units in inventory to be made available for COVID-19.

CEO John Kelly told Stockhead demand had also been high for a piece of his company as it goes public.

“We’d been marketing the offer for a while, we had a good level of support before the market dropped,” he said.

“We saw a restructuring of the register, some went off but others came in because of our ability to help with COVID-19. We raised a good amount of money, sufficient enough to get the deal done.”

Is it the end of an IPO drought?

The only players being truly appreciated by the market at the moment is anyone announcing COVID-19 related advancements — or those in the gold space.

It’s unlikely this is the end of the IPO drought, with the ASX’s calendar of upcoming listings (very) light on. In fact, there are no other IPOs with a fixed listing date in the near future.

Companies that have completed their raises, such as ArmNet (ASX:AR1) and AML3D (ASX:AML), have held off listing, although the latter said three weeks ago it would list “mid-April”.

Some already listed companies have had success in raising capital in recent weeks, particularly larger firms. Recent deals include Cochlear (ASX:COH) and Flight Centre (ASX:FLT).

But the picture looks bleaker for companies not yet listed. Adam Davey, a Canaccord analyst, said in a webinar last week about the IPO market: “Just forget it for the time being.”

However, he did note Canaccord was still doing private capital raising deals and would look to help take them public once the market recovered.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.