IPO Wrap: There’s one more new listee hitting the bourse before Xmas and after that it gets outright festive

Pic: via Getty Images.

- Desoto Resources lists with a focus on its Fenix lithium and gold project in Pine Creek

- Taiton Resources has 3 x gold and polymetallic projects in SA and WA

- And one more merry company sneaks in to list before Christmas

A couple of fresh listees sneaked their way into 2022 by listing this month, so lets see how they’re tracking.

This company listed on Friday, IPOing at $12m at $0.20, and, as Stockhead’s Josh Chiat reported the DES chairman Paul Roberts has genuine cache n the sector already, as founder and CEO of prospect generator Predictive Discovery (ASX:PDI) from 2007 to 2021.

Roberts closed his stint with the discovery of the world class 4.2Moz Bankan gold project in Guinea.

Now, Roberts is aiming to recapture that success, with a focus on the 345km2 Fenix lithium and gold project in the Pine Creek pegmatite field, located near Core Lithium’s (ASX:CXO) 110,000tpa spodumene mine Finniss.

“If you look at the Predictive story after they commercialised their public research cooperative technology, what their approach showed is that when applied correctly, they made discoveries all over West Africa”, MD (and former PDI CDO) Chris Swallow said.

“They made a discovery in Burkina Faso, they made a couple in Cote d’Ivoire, and then finally, the one that everyone knows about, which is the one in Guinea, Bankan, which is currently 4.2 million ounces and I think when all is said and done will be the better part of 10-15 million ounces.

“So that approach is really differentiated and it’s something that the team has brought over to DeSoto and it’s pretty unusual for a junior exploration company to have that level of technical expertise driving the company.”

Desoto also owns the Fenton gold project, which sits in the 17Moz Pine Creek field near the Cosmo Howley deposit, with wide gold hits from limited drilling of 55m at 0.88g/t gold from 418m including 20m at 1.74g/t gold from 423m.

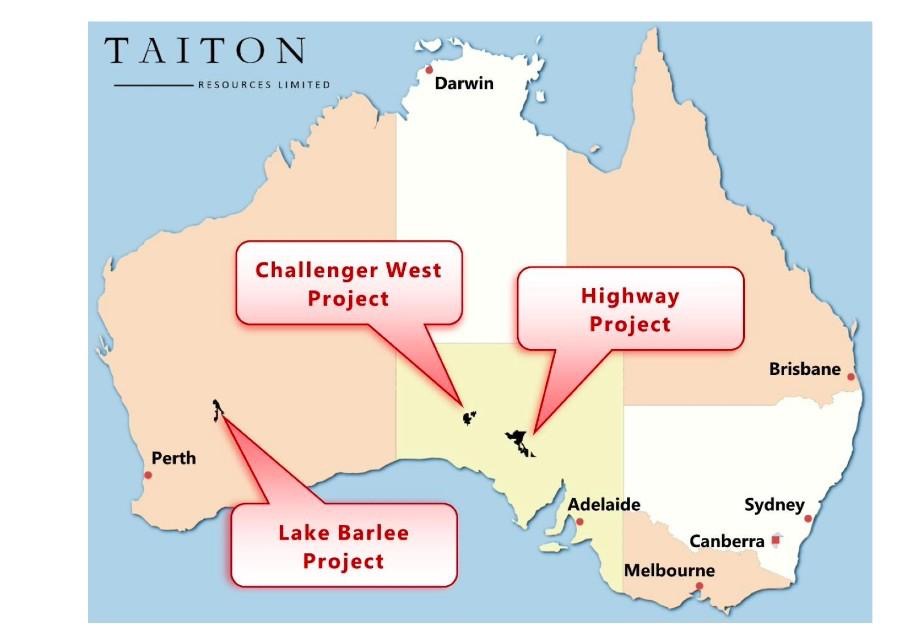

This explorer listed on Monday with its fully underwritten IPO raising $7 million to conduct exploration activities for its three projects.

The company is focused predominantly on gold and polymetallic, and has three projects including the Highway and Challenger Westin projects in South Australia and Lake Barlee in Western Australia.

“Our exploration plans have started, and we are wasting no time in getting the planning ready for more intense exploration activities in the coming 2023,” MD Noel Ong said.

“We have completed our Heritage Agreement on the Highway project and in doing that, it has allowed the company to fast-track exploration activities in preparation for a drilling program in 2023. “

Exploration activities have kicked off on the Highway project and the company has initiated the request for heritage surveys for impending field mapping, surface sampling and geophysical surveys.

A contractor has been selected to conduct and complete an induced polarisation (IP), resistivity and magnetotelluric (MT) surveys for the Merino and Angus prospects, within the Highway project.

The Highway hosts major IOCG (iron oxide copper gold) deposits including Olympic Dam, Carrapateena and Prominent Hill.

The Olympic Dam deposit, discovered by Western Mining back in 1975, is considered one of the world’s largest iron-oxide-copper-gold (IOCG) deposits and the fourth largest copper deposit globally. It’s located roughly 350m below the surface.

Rigorous geophysics programs have provided compelling evidence for not only an extension to the OME Domain, but also that Merino Prospect itself is likely a shallow hydrothermal system, i.e. by way of the zircon isotope analyses.

Notably, the evaluation of the data shows that Merino is potentially tapping the source rocks that feed the Olympic Dam IOCG Belt.

And then there was one…

SOCO CORPORATION (ASX:SOC)

Listing: 23 December

IPO: $5m at $0.20

One lonely IPO is left before Christmas in SOCO Corporation, an Australian based IT consultancy, specialising in the delivery of cloud solutions, business applications and integration projects – with a particular focus on Microsoft solutions.

The company’s key target markets include federal government, local and state government, along with large corporates.

Who’s listing in the New Year?

DYNAMIC METALS (ASX:DYM)

Listing: 6 January

IPO: $7m at $0.20

The specialist metals suppliers are one of the UK’s largest independent stockists of aerospace high-grade metals supplying materials to many industry sectors across the UK, mainland Europe and globally.

In addition to cutting and supplying from their extensive stock of titanium, stainless steels, nickel alloys, alloy steels and aluminium, the company have the necessary relationships to enable us to source more exotic ‘hard to find’ metals and the equipment and skills to process them on site – plus there’s no minimum order quantities required.

VHM LIMITED (ASX:VHM)

Listing: 9 January

IPO: $30m at $1.35

The Company’s flagship project is the Goschen Project which has a substantial rare earth deposit of 413,107 tonnes of total rare earth oxide (TREO), with an accompanying mineral sands resource, located in the premier mineral sands province in North-West Victoria, Australia.

Goschen has a current Proved and Probable Ore Reserve of 198.7Mt.

And the scalability of the project is underpinned by a Mineral Resource inventory of 629Mt, comprising measured, indicated, and inferred resources with further resource expansion potential, the company says.

HIGH-TECH METALS (ASX:HTM)

Listing: 10 January

IPO: $5.5m at $0.20

On listing, the company will acquire the Werner Lake Cobalt Project in north-western Ontario, within the Kenora Mining District.

Initial plans include reviewing the existing exploration and geological data, drill targets not previously drilled and establish new drill targets at the Project.

New drill targets will then be established using electromagnetic techniques to consider targets outside of the existing orebody, after which an RC and/or diamond drilling program will be conducted.

ACUSENSUS (ASX:ACE)

Listing: 12 January

IPO: $20m at $4

This company develops and sells AI-based traffic enforcement solutions, including the world’s first illegal mobile phone use enforcement camera program, deployed in New South Wales.

ACE’s patent pending technology also includes a windshield penetrating imaging system and high-performance artificial intelligence to detect illegal mobile phone use – which has been demonstrated in partnership with Tasmanian Police.

Listing: 13 January

IPO: $8m at $0.20

We’ve all heard of the Lithium Triangle, the famous salars in Argentina and Chile where brines deliver around 40% of the world’s lithium materials.

Patagonia is coming to market with a slew of projects covering 23km2 across the Salta and Jujuy Provinces of Argentina, in close proximity to established producers and developers like Ganfeng, Allkem (ASX:AKE), Lake Resources (ASX:LKE), Power Minerals (ASX:PNN) and Lithium Energy (ASX:LEL).

Patagonia was due to exercise its option by yesterday on the Tomas III project, having exercised options to acquire Formentera and Cilon in April and October respectively.

The company plans to undertake follow-up exploration on the sites, with funds raised to pay vendor costs, provide working capital and IPO expenses, and cover around $1.725m of exploration expenditure including drilling at Tomas III.

GOLD HYDROGEN (ASX:GHY)

Listing: 13 January

IPO: $20m at $0.50

This company is focused on gold hydrogen, which is hydrogen that occurs naturally, generated by geological processes, and offers significant cost and emissions advantages relative to other means of hydrogen production.

Gold Hydrogen holds one granted Petroleum Exploration Licence in South Australia (PEL 687) that covers approximately 7,820 km2 on the Yorke Peninsula and Kangaroo Island in South Australia.

On PEL 687, the company is planning to confirm historic occurrences of natural hydrogen of up to 89% purity, at its flagship Ramsay Project.

They also have seven other tenements in application before the South Australian Government, across a further approximately 67,512 km2.

That’s the largest tenure position over naturally occurring hydrogen prospective acreage in Australia.

SOUTH-EAST QUEENSLAND EXPLORATION (ASX:SQX)

Listing: 19 January

IPO: $5m at $0.20

SQX’s current focus is on copper and gold mineralisation at its Ollenburgs and Scrub Paddock Prospects, in the underexplored Esk Basin in southeast Queensland and situated near major regional infrastructure and population centres.

Scrub Paddock has been identified as a potential gold-copper porphyry, and features more than 20 mine workings and an area of comparable scale to Cadia/Ridgeway.

The company intends to drill high priority targets immediately upon listing, with the aim of defining an economic mineral resource.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.